ADHD's Impact on Options Trading Outcomes and Risk Management Strategies

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

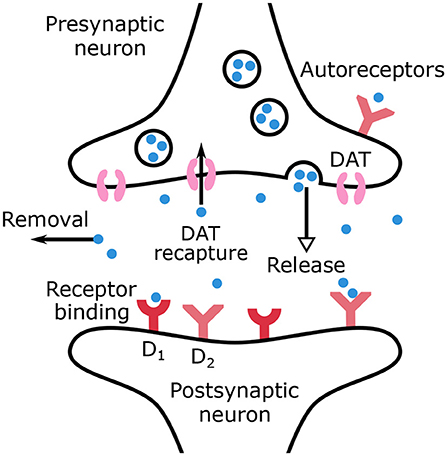

ADHD’s neurobiological (altered dopamine pathways) and psychological (executive function deficits) traits significantly elevate options trading risks. Altered dopamine pathways reduce inhibitory control and amplify reward-seeking behavior [2], leading to patterns like overtrading and disregard for risk limits. Executive function deficits (inattention, poor emotional regulation) impair adherence to structured strategies, monitoring of complex options details (e.g., expiration dates, leverage), and avoidance of cognitive biases [3]. Options trading’s inherent leverage (1 contract controls 100 shares) amplifies the impact of impulsive decisions, while time decay (theta) and volatility sensitivity (vega) require sustained attention—challenges for ADHD traders [0]. The $1 million loss described in the case study aligns with these risks: impulsivity and dopamine-seeking led to overexposure to high-leverage options and failure to monitor positions [0].

- ADHD traits are disproportionately harmful in options trading due to its leverage and complexity [0].

- General trading rules are insufficient; strategies must address ADHD’s root neurobiological and psychological causes [1, 3].

- Automation and external safeguards can reduce the impact of real-time impulsive decisions, a critical ADHD-related vulnerability [1].

- Unmanaged ADHD traits can result in catastrophic losses, as seen in the case study [0].

- Individual responses to ADHD treatments (medication, CBT) vary, requiring personalized approaches [3].

- Trading platform limitations on automation features may restrict strategy implementation [0].

- External market volatility remains a risk despite structured strategies [0].

- Pre-Trade Rule-Setting: Create strict plans with entry/exit criteria, position sizing limits (≤5% of capital per trade), and expiration guidelines [1].

- Automation: Use trading platforms to automate stop-loss/take-profit orders and position limits [1].

- Structured Environment: Minimize distractions and set specific trading times to avoid overtrading [3].

- Account Safeguards: Limit trading capital access and use broker restrictions (no margin trading, daily trade limits) [0].

- Cognitive/Medical Support: Use CBT for impulse control and consult psychiatrists about ADHD medication [3].

ADHD’s impact on dopamine and executive function increases options trading risks, as demonstrated by the $1 million loss case. Tailored risk management strategies addressing ADHD-specific traits—rather than generic trading rules—are critical to prevent catastrophic losses. These strategies include automation, structured routines, account safeguards, and medical/cognitive support.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。