Roche’s Swiss Drug Pricing Shift: Global Revenue and Industry Implications

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

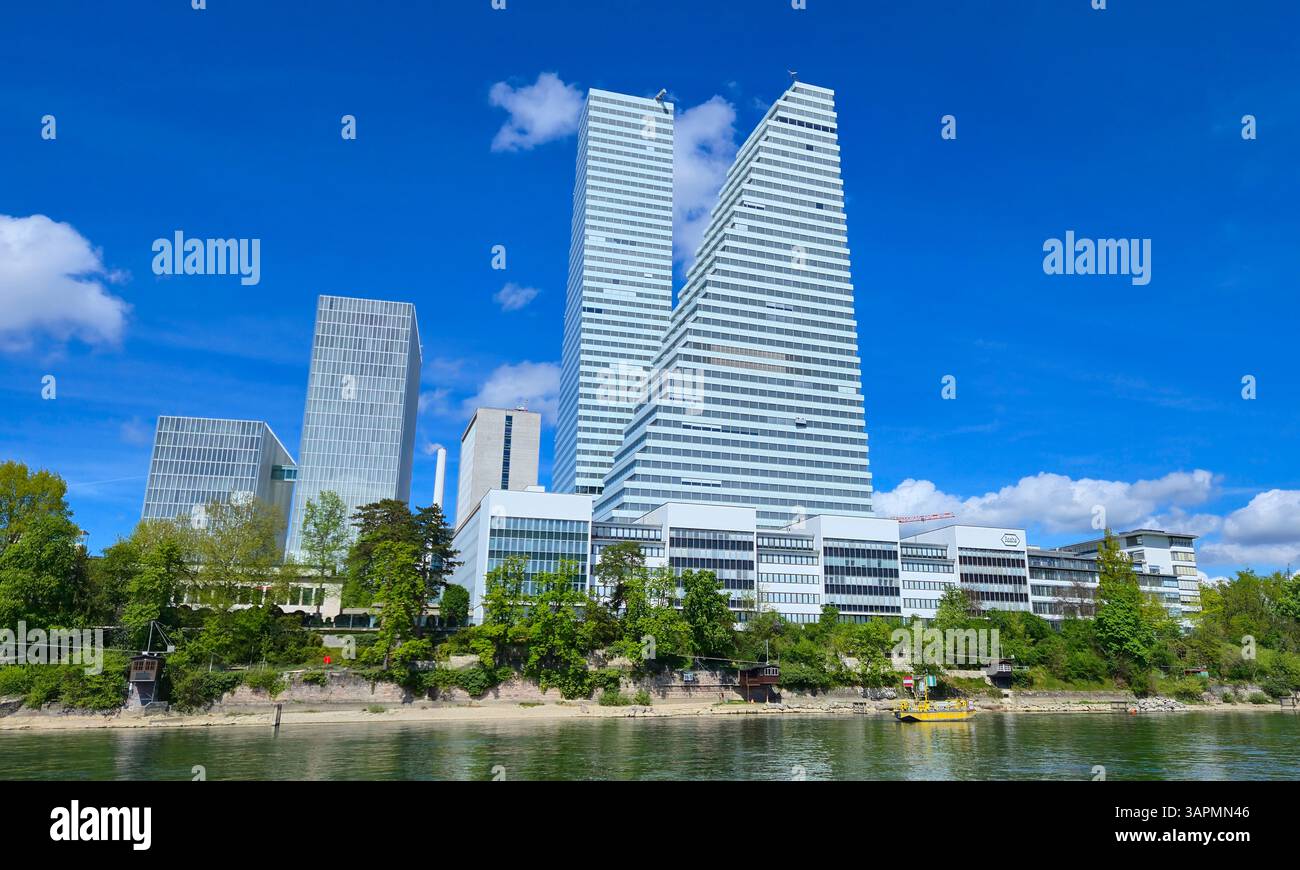

Roche’s pricing strategy shift—higher drug prices in Switzerland following a US pricing agreement—responds to the White House’s effort to end “free-riding” by wealthy nations on US drug prices [1]. The US is Roche’s largest market, generating ~48% of 2024 sales (CHF ~29.0 billion) [0]. In 2024, Roche reported total sales of CHF 60.5 billion (7% growth) and Pharmaceuticals Division sales of CHF 46.2 billion (8% growth), driven by Vabysmo, Phesgo, Ocrevus, and Hemlibra [0].

The strategy’s global revenue impact is dual: potential downside from US price adjustments (affecting nearly half of sales) and upside from price hikes in Switzerland and other targeted wealthy nations (Denmark, Germany, France, etc.). The net effect hinges on price change magnitudes, market sales volumes, and demand elasticity [2]. As of December 24, 2025, Roche’s US-listed stock (RHHBY) trades at $52.59 with a $335.1 billion market cap [2].

- US Regulatory Influence: The White House’s targeting of 8 wealthy nations as pricing references signals a broader shift in global pharma pricing dynamics, with the US pressuring for aligned prices across high-income countries [1].

- Strategic Risk-Reward: Roche balances US revenue risks (its largest market) by tapping into underpriced markets like Switzerland, but success depends on minimal regulatory/political pushback in those regions.

- Industry Precedent: This move demonstrates a potential framework for peers facing US price pressures, highlighting the need for market-differentiated pricing strategies.

- Risks: Political/regulatory resistance in targeted nations could limit effectiveness; uncertainty around price change magnitudes adds revenue volatility [2].

- Opportunities: Successful revenue offsetting could maintain margins and shareholder returns; the strategy may serve as a viable model for the broader pharma industry [1].

Roche’s Swiss price hike decision reflects a strategic response to global pricing disparities. The US market’s dominance (48% of 2024 sales) makes dual pricing critical for revenue stability, while sustainability relies on targeted nations’ responses. For the pharma industry, the move shows a potential way to balance US price pressures via differentiated pricing, though regulatory risks persist.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。