NVIDIA (NVDA) & Eli Lilly (LLY): 37% Portfolio Return Drivers & Volatile Market Risk-Adjusted Strategies

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

This analysis evaluates the performance drivers of NVIDIA (NVDA) and Eli Lilly (LLY) in 2025, their contribution to a reported 37% annual portfolio return, and portfolio management strategies for volatile markets. Data covers the period up to December 20, 2025 [0].

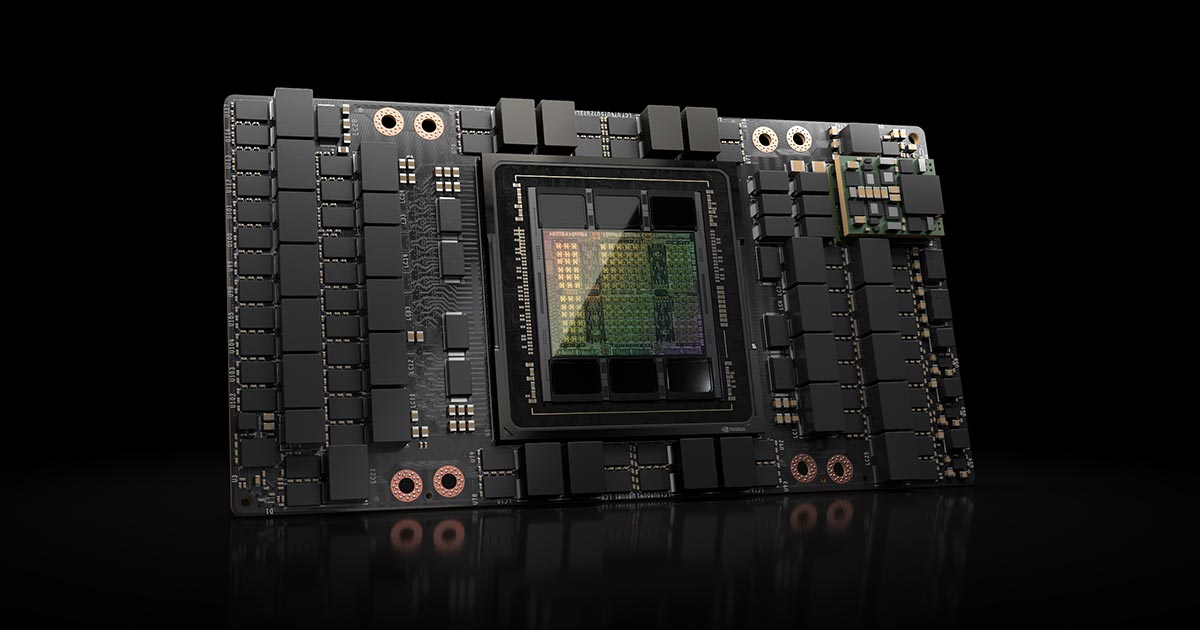

NVDA delivered a 33.08% YTD return through December 19, 2025 [0], fueled by surging demand for AI infrastructure: Q3 2025 data center revenue reached $30.8 billion (112% YoY growth) from Hopper/Blackwell GPUs, AI Enterprise revenue exceeding $2 billion (with major clients like Accenture and AWS), and sovereign AI partnerships in India and Japan [1].

LLY achieved a 37.26% YTD return [0] due to dominant GLP-1 drug performance: Zepbound (obesity) and Mounjaro (type 2 diabetes) generated $12 billion in Q3 2025 revenue, with Zepbound capturing 71% of new U.S. obesity prescriptions. Pipeline advancements (positive Phase III data for oral GLP-1 orforglipron) and global expansion (55 countries for Mounjaro) further drove growth [2].

-

Dual Growth Sectors Driving Returns: NVDA’s AI infrastructure (technology) and LLY’s GLP-1 drugs (healthcare) represent distinct, high-growth secular trends. Their complementary performance—with LLY directly matching the 37% portfolio return and NVDA contributing strong secondary growth—likely underpinned the reported portfolio result.

-

Risk Profile Balance: NVDA (3.16% daily volatility) is slightly more volatile than LLY (2.58% daily volatility) [0], creating a natural balance in concentrated positions. However, sector-specific and company-specific risks (e.g., NVDA export controls, LLY PBM pricing pressures) highlight the need for active risk management.

-

Modern Strategies Outperform Traditional: LLM-enhanced Black-Litterman models tested through February 2025 achieved higher Sharpe ratios than traditional mean-variance models [5], indicating potential for better risk-adjusted returns in volatile environments.

- Company-Specific: NVDA faces supply chain constraints for Blackwell systems, U.S.-China export controls, and AI hardware competition [1]. LLY confronts PBM pricing pressures, generic GLP-1 competition, and pipeline regulatory delays [2].

- Market-Specific: High sector valuations (technology/healthcare) and geopolitical/regulatory changes may trigger corrections [3,4].

- Portfolio-Specific: Concentrated exposure increases idiosyncratic risk, requiring ongoing rebalancing [3].

- NVDA’s AI infrastructure demand remains robust due to enterprise and sovereign AI initiatives [1].

- LLY’s GLP-1 pipeline (orforglipron) and global expansion offer upside [2].

- Diversification beyond S&P 500 exposure and modern optimization techniques can enhance risk-adjusted returns [3,5].

NVDA and LLY delivered strong 2025 YTD returns of 33.08% and 37.26%, respectively [0], driven by AI infrastructure demand and GLP-1 drug leadership. A portfolio with significant positions in these two stocks would align with the reported 37% annual return. To maximize risk-adjusted returns in volatile markets, recommended approaches include diversification, focus on high-quality companies, and LLM-enhanced optimization models [3,4,5].

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。