Impact of Big Tech Custom AI Chips on AMD and Broadcom: Investment Thesis Analysis with Debt & Valuation Context

#AI_chips #AMD #Broadcom #investment_thesis #debt_profile #valuation #big_tech #semiconductors

混合

美股市场

2026年1月2日

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

AMD

--

AMD

--

AVGO

--

AVGO

--

Integrated Analysis

The growing trend of big tech companies developing in-house AI chips (e.g., Google’s TPU) creates divergent impacts on AMD and Broadcom, rooted in their distinct business models, debt profiles, and valuations.

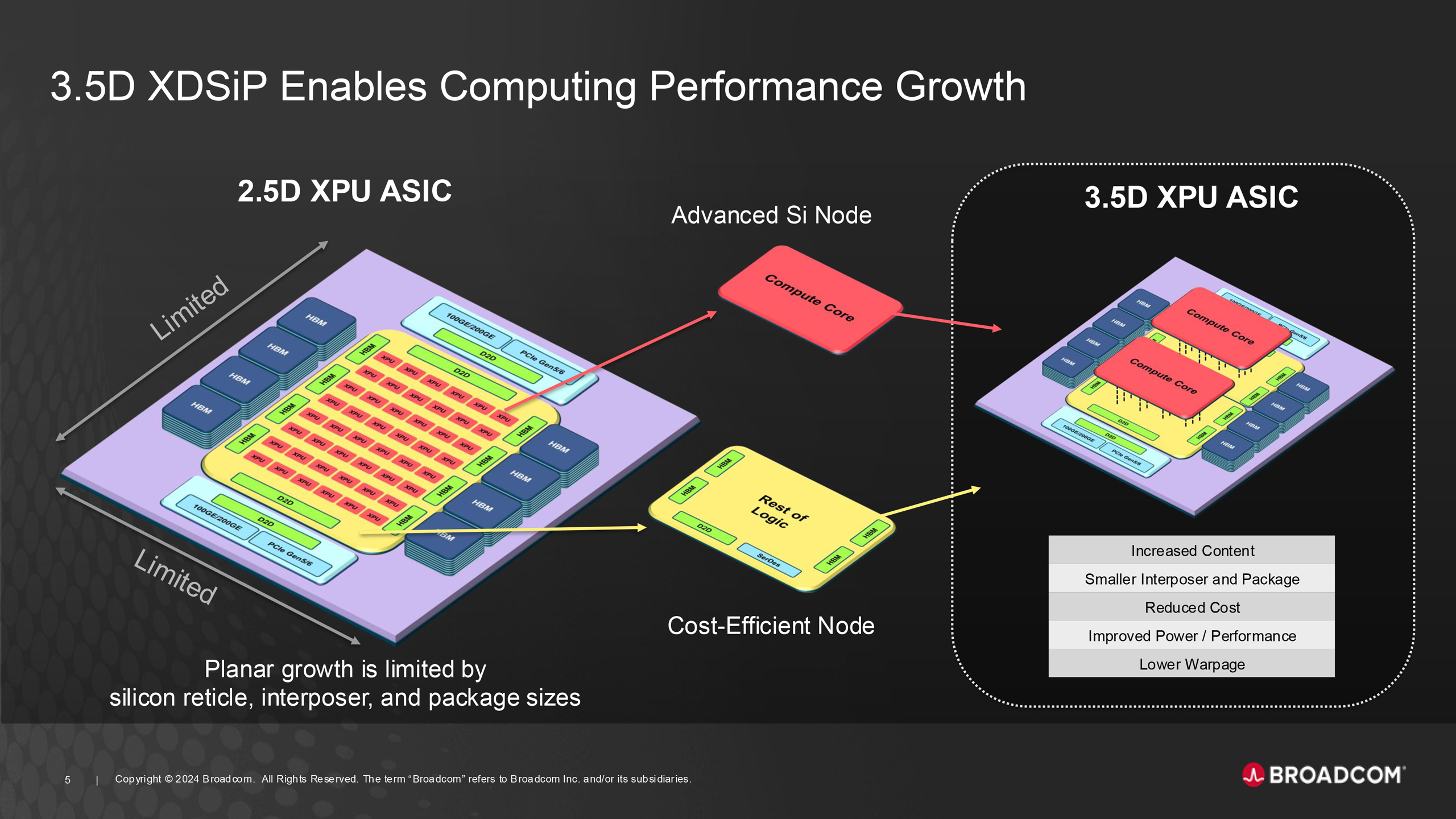

- Broadcom (AVGO)is a leader in designing custom AI ASICs for hyperscalers like Google, Meta, and OpenAI, holding a ~70% share of the 2024 custom AI chip market [1]. This positions it as a direct beneficiary of the trend: Broadcom reported 220% YoY AI-related revenue growth in FY2024 [1], with Q4 2025 AI revenue guided to $6.2 billion [1]. A recent $10 billion custom chip order from OpenAI (September 2025) further validates its strong client relationships [2]. CEO Hock Tan projects a $60–$90 billion AI semiconductor total addressable market (TAM) by FY2027 [4].

- AMD (AMD)competes with Nvidia in supplying GPUs (Instinct series) for AI applications. While it secured a partnership with OpenAI (October 2025) [12], it faces pressure from big tech’s in-house chips, which could reduce demand for third-party GPUs [12]. Susquehanna projects AMD’s AI market share to remain modest (~4% by 2030) [4], though it achieved 57% YoY revenue growth in the data center segment in Q1 2025 [11].

Debt profiles contrast sharply: AMD holds ~$4 billion in net cash (Q3 2025: $7.2 billion in cash/short-term investments, $3.2 billion in total debt) [7][8], while Broadcom carries ~$48.3 billion in net debt (2024) [3]. Valuations reflect growth expectations: AMD trades at ~112.5x TTM P/E, compared to Broadcom’s ~72.9x [0].

Key Insights

- Broadcom’s investment thesis is strengthenedby its alignment with the custom AI chip trend. Its dominant ASIC position drives high-margin revenue growth, mitigating concerns about its significant net debt through robust free cash flow (FY2025 FCF: $26.9 billion) [0].

- AMD’s investment thesis faces mixed risksfrom in-house chip competition, but its net cash position provides financial flexibility. Its high P/E ratio relies on delivering sustained AI GPU market share gains amid competition from both big tech’s internal chips and Nvidia’s ~80% market lead [4].

- Divergent strategies determine exposure: Broadcom’s focus on custom ASICs makes it a direct beneficiary of the trend, while AMD’s GPU-centric model exposes it to potential demand displacement.

Risks & Opportunities

- Opportunities:

- Broadcom’s leadership in custom AI chips positions it for continued revenue growth within the expanding AI TAM.

- AMD can leverage partnerships (like OpenAI) to expand its GPU market share in data centers.

- Risks:

- Execution risk (yield issues, design errors) for both companies in delivering high-performance AI chips [1].

- AMD faces regulatory risks from export controls on advanced chips to China [9].

- Broadcom’s high net debt requires stable cash flow to service obligations, though its FCF is currently strong [0].

- Nvidia’s market dominance limits AMD’s AI GPU growth potential [4].

Key Information Summary

- Market cap: AMD ($348.79 billion), Broadcom ($1.65 trillion) [0]

- Current prices: AMD ($214.90), Broadcom ($349.32) [0]

- Broadcom’s FY2024 AI revenue growth: 220% YoY [1]

- AMD’s Q1 2025 data center revenue growth: 57% YoY [11]

- This analysis provides market context and risk/opportunity assessment without prescriptive investment recommendations.

参考来源

相关阅读推荐

暂无推荐文章

基于这条新闻提问,进行深度分析...

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

AMD

--

AMD

--

AVGO

--

AVGO

--