Tesla Shareholders Approve Musk's $1 Trillion Pay Package: Analysis of Market Impact and Governance Concerns

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

This analysis is based on the CNBC report [1] published on November 6, 2025, which reported that Tesla shareholders approved Elon Musk’s $1 trillion pay package with over 75% voting in favor. The vote took place at Tesla’s annual shareholder meeting in Austin, Texas, where Musk characterized this as “not merely a new chapter of future of Tesla but a whole new book” [2].

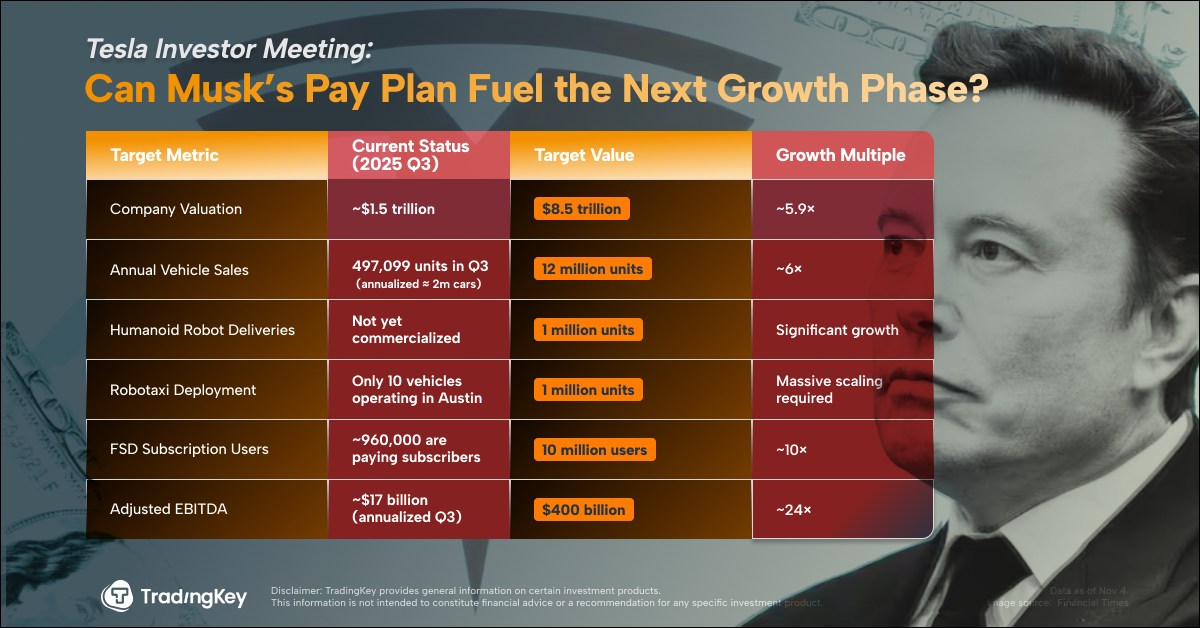

The pay package represents an unprecedented compensation structure consisting of 12 tranches of stock options potentially granting Musk up to 423.7 million additional shares, increasing his ownership from approximately 13% to 25% and boosting his voting power to about 25% [1][3]. The package is structured around extremely ambitious market capitalization and operational milestones that must be achieved over the next decade [1].

Despite the shareholder approval, Tesla’s stock exhibited negative price action, closing at $445.91 on November 6 (down 3.47% on high volume of 109.6 million shares) and declining further to $429.52 on November 7 (-3.68%) [0]. The current market cap stands at $1.38 trillion with shares trading at $429.52 [0].

This negative reaction suggests investor concerns about several factors:

- Dilution concerns: The potential issuance of 423.7 million new shares

- Governance issues: Major proxy advisors ISS and Glass Lewis opposed the plan [1]

- Execution risk: The extremely ambitious targets required for full payout

The pay package requires Tesla to achieve extraordinary targets [1]:

- First tranche: $2 trillion (current: $1.38 trillion)

- Final tranche: $8.5 trillion

- Incremental increases of $500 billion to $6.5 trillion, then $1 trillion increments

- 20 million vehicle deliveries (current cumulative: ~8 million)

- 10 million active FSD subscriptions

- 1 million Optimus humanoid robots delivered

- 1 million robotaxis in commercial operation

- Annual adjusted profit targets from $50 billion to $400 billion (Q3 2025 adjusted EBITDA: $4.2 billion) [1]

Current financial metrics show Tesla trading at a premium valuation with a P/E ratio of 226.06x, net profit margin of 5.55%, and ROE of 6.97% [0]. The revenue breakdown consists of Automotive (78.9%), Services (10.8%), and Energy (10.3%) [0].

A significant aspect of the pay package is the broad “covered events” clause, which allows Musk to earn shares even if targets are missed due to “natural disasters, wars, pandemics, and changes to international, federal, state and local law, regulations or other governmental action” [1]. Reuters reported that Musk could still earn “tens of billions” by hitting just a handful of more attainable goals [1].

The vote follows a Delaware Court ruling voiding Musk’s 2018 pay package, which is currently under appeal [1]. The plan places no limits on Musk’s political activities or minimum time commitment to Tesla, raising additional governance concerns [1].

Current analyst consensus shows a target price of $422.50 (1.6% below current price) with a rating distribution of 40% Buy, 38.8% Hold, and 21.2% Sell [0]. Wedbush analyst Dan Ives expressed positive sentiment, stating “AI valuation is getting unlocked” and expects “AI driven valuation for TSLA over next 6-9 months” [2].

-

Execution Risk: The targets require Tesla to grow from $1.38T to $8.5T market cap (517% increase) while scaling production from ~8M to 20M vehicles and building entirely new product categories from scratch [0][1].

-

Governance Risk: The broad “covered events” clauses could allow substantial payouts even with missed targets, creating moral hazard concerns [1].

-

Concentration Risk: Increasing Musk’s voting power to 25% raises concerns about board independence and shareholder rights [1].

-

Competitive Pressure: Traditional automakers and tech companies are investing heavily in EVs and autonomous driving, potentially eroding Tesla’s first-mover advantages.

- AI and Robotics Potential: Success in FSD subscriptions and Optimus robot deployment could justify higher multiples

- CEO Alignment: Increased alignment of CEO incentives with long-term shareholder value creation

- Market Leadership: Continued innovation could maintain Tesla’s premium valuation

- Progress toward $2T market cap milestone (first tranche trigger)

- Optimus robot production timeline and capabilities

- FSD subscription growth and regulatory approvals

- Robotaxi deployment in announced cities (Miami, Dallas, Phoenix, Las Vegas)

- Delaware Supreme Court ruling on 2018 pay package appeal

- Capital expenditure requirements and financing strategy

The shareholder approval of Musk’s $1 trillion pay package represents a significant corporate governance event with substantial implications for Tesla’s future. The plan’s unprecedented scale and ambitious targets reflect both the potential upside of Tesla’s AI and robotics ambitions and the substantial execution risks involved.

The negative market reaction despite shareholder approval suggests investors are weighing the potential for transformative growth against concerns about dilution, governance, and the feasibility of achieving targets that would require Tesla to become one of the most valuable companies in history while simultaneously building entirely new business categories.

The broad “covered events” exemptions and lack of restrictions on Musk’s other activities present governance challenges that may continue to weigh on investor sentiment, particularly as the company works toward achieving the first tranche milestones that would trigger initial payouts.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。