Potential Shift From Mega-Cap Tech Leadership in 2026: Market Trends and Alternatives

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

This analysis is based on a YouTube video and Yahoo Finance article titled “Why 2026 Won’t Be a Big Tech Year - and What Replaces It” [4], published on 2025-12-22, which discusses a potential shift in market leadership away from mega-cap tech stocks. The same day’s market data [0] provides early evidence supporting this thesis:

- Mega-cap tech stocks (AAPL: -0.69%, MSFT: -0.25%, GOOGL: -0.03%, AMZN: -0.08%, META: -0.02%, TSLA: -0.23%) declined slightly [0].

- Tech-heavy indices/ETFs underperformed: QQQ (NASDAQ 100): -0.34%, XLK (Technology sector): -0.58%, XLC (Communication Services): -0.02%, NASDAQ Composite: -0.09% [0].

- Broader market and alternative sectors outperformed: S&P 500: +0.19%, Russell 2000 (small-caps): +0.79%, XLF (Financial sector): +1.04% [0].

Key contextual factors include:

- Valuation concerns: Investors are demanding evidence that tech’s AI investments are driving sustainable sales/margin growth, pressuring tech valuations [2].

- Interest rate impact: Federal Reserve rate cuts have shifted sentiment toward small-caps and financials, which typically benefit more from lower rates [2].

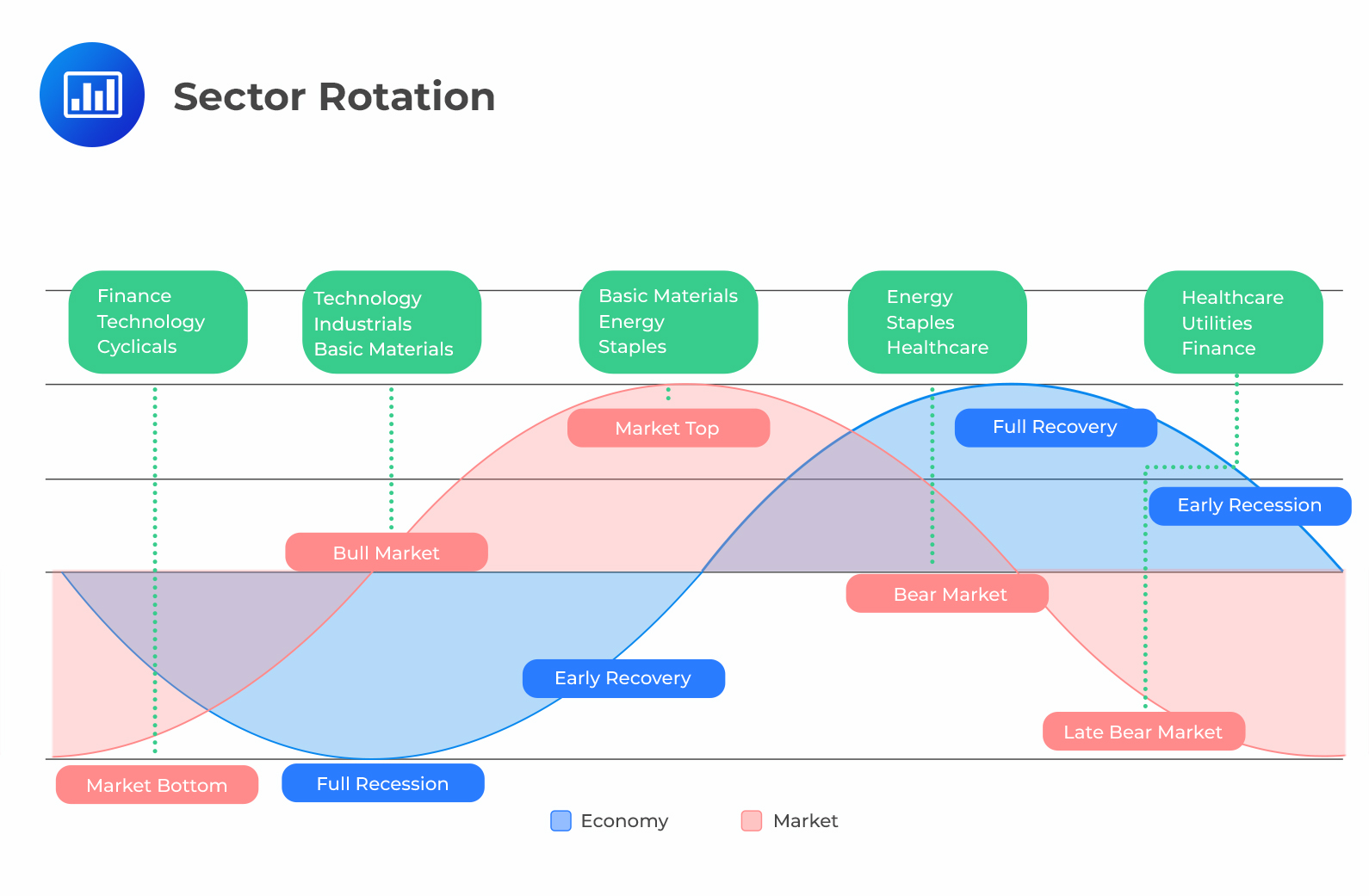

- Sector rotation: Financial stocks are up over 6% in the past month, indicating rotation out of tech [2].

- Market concentration: TheStreet Pro analysts noted divergence in the “Magnificent Seven” mega-cap stocks since summer, highlighting concentration risks [5].

- Analyst sentiment: Morgan Stanley removed tech from its 2026 buy list, except AI chip leaders NVDA and AVGO [6].

- Early shift signs: The 2025-12-22 market moves align with the video’s prediction, showing immediate investor response to sector rotation narratives.

- Multi-factor driver: The potential shift is not isolated but driven by valuation concerns, rate policy, and concentration worries, making it a structural rather than temporary trend.

- AI chip exception: While broad tech is out of favor, AI chip leaders (NVDA, AVGO) are still favored by analysts, indicating nuance in the tech sector outlook [6].

- “Other 493” implication: The video’s reference to “the other 493” suggests opportunities in non-mega-cap stocks, broadening the market beyond the dominant “Magnificent Seven”.

- Tech rebound: Mega-cap tech could rebound if companies report strong AI-driven growth in upcoming earnings [2].

- Rate policy reversal: A change in Federal Reserve rate cut plans could reverse the shift toward small-caps and financials [2].

- Concentration impact: The “Magnificent Seven’s” high weighting in major indices means a sharp tech decline could affect the broader market [5].

- Regulatory risk: Ongoing regulatory scrutiny of tech companies could further pressure valuations [2].

- Small-cap stocks: The Russell 2000’s 2025-12-22 +0.79% gain reflects growing investor interest [0].

- Financial sector: XLF’s +1.04% performance and 6% month-to-date gain highlight opportunities in this rate-sensitive sector [0, 2].

- Non-mega-cap tech: AI chip leaders (NVDA, AVGO) remain favored, suggesting niche opportunities within tech [6].

The 2025-12-22 event highlights a potential 2026 shift from mega-cap tech leadership, supported by concurrent market data showing tech underperformance and strength in small-caps/financials. Key drivers include AI investment ROI concerns, Fed rate cuts, and market concentration worries. Decision-makers should monitor:

- Quarterly earnings reports to assess tech’s AI-driven growth.

- Federal Reserve policy announcements.

- Sector performance trends to confirm ongoing rotation.

- Analyst updates on market concentration risks and alternative investment opportunities.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。