AI Bubble Debate: Seeking Alpha Analysis and Market Reaction

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

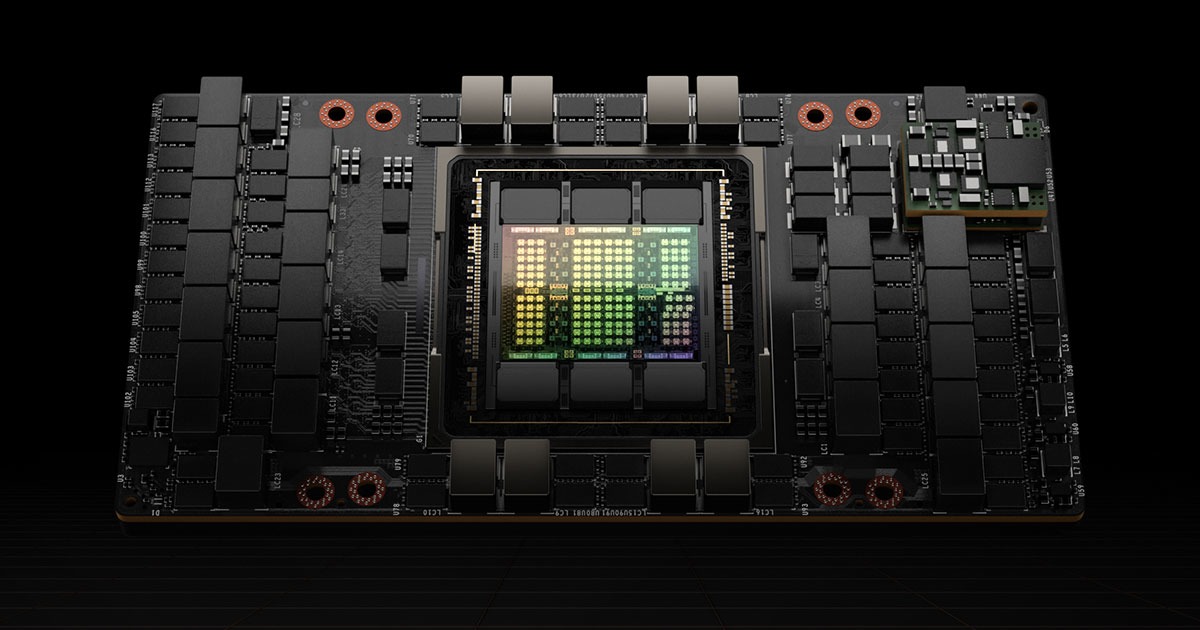

This analysis examines the Seeking Alpha article “Forget The AI Bubble, Follow These 3 Signals” [1], published on December 22, 2025, which contends that current AI-driven market enthusiasm is underpinned by structural investment, earnings growth, and disciplined capital allocation—differentiating it from past destructive bubbles. On the article’s publication day, market indices showed mixed performance: S&P 500 (+0.19%), Dow Jones (+0.31%), and NASDAQ Composite (-0.09%) [0]. However, the technology sector outperformed most sectors with a 1.0187% gain, ranking second only to utilities [0]. Leading AI stocks (NVIDIA, Microsoft, Alphabet) posted modest declines on December 22, but rebounded the following day, with NVIDIA (NVDA) rising 3.01% amid separate reports of potential H200 chip shipments to China [2].

- Market Reaction Dynamics: The muted initial response on December 22 may be attributed to the article’s early morning publication, while the subsequent gains on December 23 likely reflect both delayed market digestion and concurrent positive news (e.g., NVDA’s chip plans) [0][2].

- Valuation Justification: Leading AI stocks maintain high but defensible valuations: NVIDIA P/E (TTM) 46.72, Microsoft P/E (TTM) 34.60, Alphabet P/E (TTM) 31.03—supported by robust earnings growth [0].

- Sector Resilience: The technology sector’s outperformance on December 22 indicates sustained investor confidence despite ongoing bubble debates [0].

- Risks: Regulatory scrutiny of AI companies, NVDA’s geopolitical exposure to China, and potential valuation corrections if earnings growth slows [0][2].

- Opportunities: Structural AI investment and earnings growth present long-term opportunities for leading tech names, particularly those with disciplined capital allocation [1].

The article challenges the AI bubble narrative, citing structural fundamentals over speculative exuberance. Market data shows tech sector strength amid mixed index reactions, with NVIDIA posting notable gains the following day due to separate chip news. Valuations remain elevated but justified by growth, while regulatory and geopolitical risks warrant monitoring.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。