Potential 2026 Market Rotation: Impact on Tech Dominance and Portfolio Strategy

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

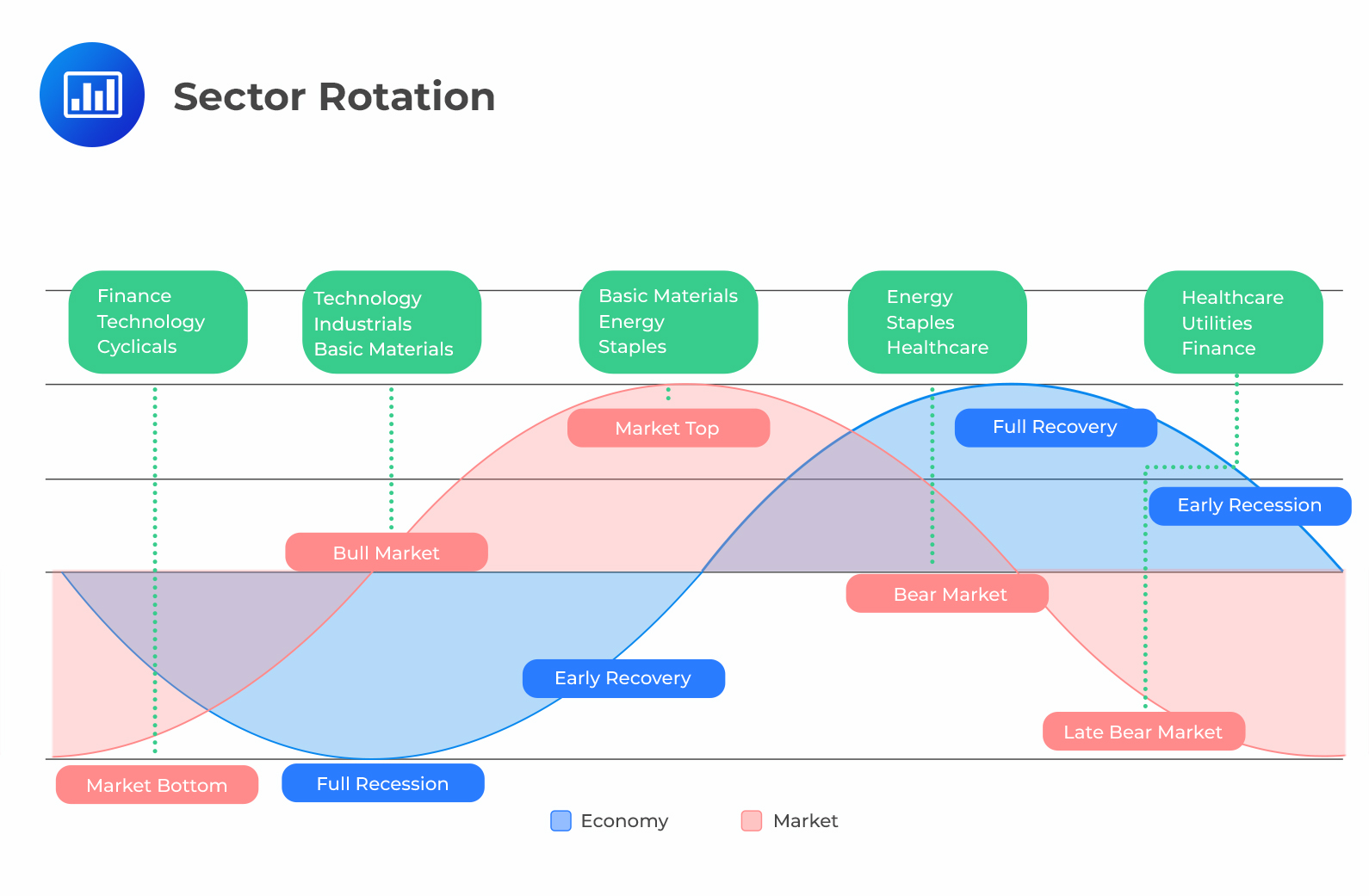

This analysis centers on the December 23, 2025 Seeking Alpha article [1] highlighting a potential 2026 market rotation away from the tech sector, which has dominated recent S&P 500 gains. The author, Samuel Smith, disclosed a long position in Enterprise Products Partners (EPD), a midstream energy company, as part of his portfolio reshuffle. Market data [0] shows the tech sector ETF (XLK) delivered a 19.21% 6-month return, while the small/mid-cap Russell 2000 ETF (IWM) gained 18.18%—a narrowing gap indicating early capital flow toward non-tech segments. Short-term (as of 2025-12-24) sector performance further underscores this shift: utilities (+1.67%) and consumer defensive (+1.01%) led, with tech (+0.21%) ranking mid-table [0]. Valuation disparities are a key driver: NVIDIA (NVDA) has a high P/E ratio of 45.82x, compared to EPD’s 12.13x [0]. Related analyses [3] predict rotation into value/cyclical sectors (financials, utilities) and gold, with tech expected to underperform due to stretched valuations and AI capital expenditure return uncertainties. Small/mid-caps [2] may benefit from better risk-adjusted returns as market breadth expands beyond the “Magnificent 7” tech stocks.

- Early rotation signals in market breadth: Small/mid-cap (IWM) returns have nearly matched tech (XLK) returns over 6 months, indicating growing investor interest in non-tech segments [0].

- Valuation gaps drive shift: High-P/E tech stocks (e.g., NVDA: 45.82x) contrast with low-P/E value stocks (e.g., EPD: 12.13x), creating incentives for portfolio diversification [0][1].

- Maturing tech rally sentiment: The article contributes to growing consensus that the long-dominant tech rally is slowing, prompting investors to seek exposure to underperforming sectors [1][3].

- Mixed outlook for EPD: Despite a buy consensus, recent analyst downgrades (Morgan Stanley, JPMorgan) for EPD require monitoring of its earnings and pipeline projects [0].

-

Risks:

- Tech valuation vulnerability: High P/E ratios (NVDA: 45.82x) increase risk of underperformance amid rotation [0].

- Cyclical sector sensitivity: Energy and financial sectors are exposed to interest rate changes and GDP growth, requiring monitoring of Fed policy and economic forecasts [3].

- Market breadth uncertainty: Sustained rotation depends on continued small/mid-cap outperformance relative to large-cap tech [0][2].

- Company-specific risk for EPD: Analyst downgrades warrant attention to EPD’s operational and financial performance [0].

-

Opportunities:

- Small/mid-cap growth: Expanding market breadth may drive better risk-adjusted returns for the Russell 2000 (IWM) [2][0].

- Value sector appeal: Utilities, financials, and energy (e.g., EPD) offer attractive valuations amid rotation narratives [3].

- Diversification benefits: Shifting exposure from overvalued tech may reduce portfolio concentration risk [1][3].

The potential 2026 market rotation from tech to non-tech sectors is supported by early market breadth trends, valuation disparities, and growing sentiment. Data shows IWM’s 6-month return nearing XLK’s, with short-term momentum shifting to defensive sectors. NVDA’s high valuation (45.82x P/E) contrasts with EPD’s low valuation (12.13x), highlighting opportunities for reallocation. While analyses predict rotation into value/cyclical sectors, conflicting projections of 20% tech upside in 2026 [4] require multi-perspective evaluation. Decision-makers should monitor volume changes between tech and non-tech sectors, economic indicators, and EPD’s performance to confirm rotation signals.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。