2026 Market Rotation Outlook: Gold, Financials, and Utilities

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

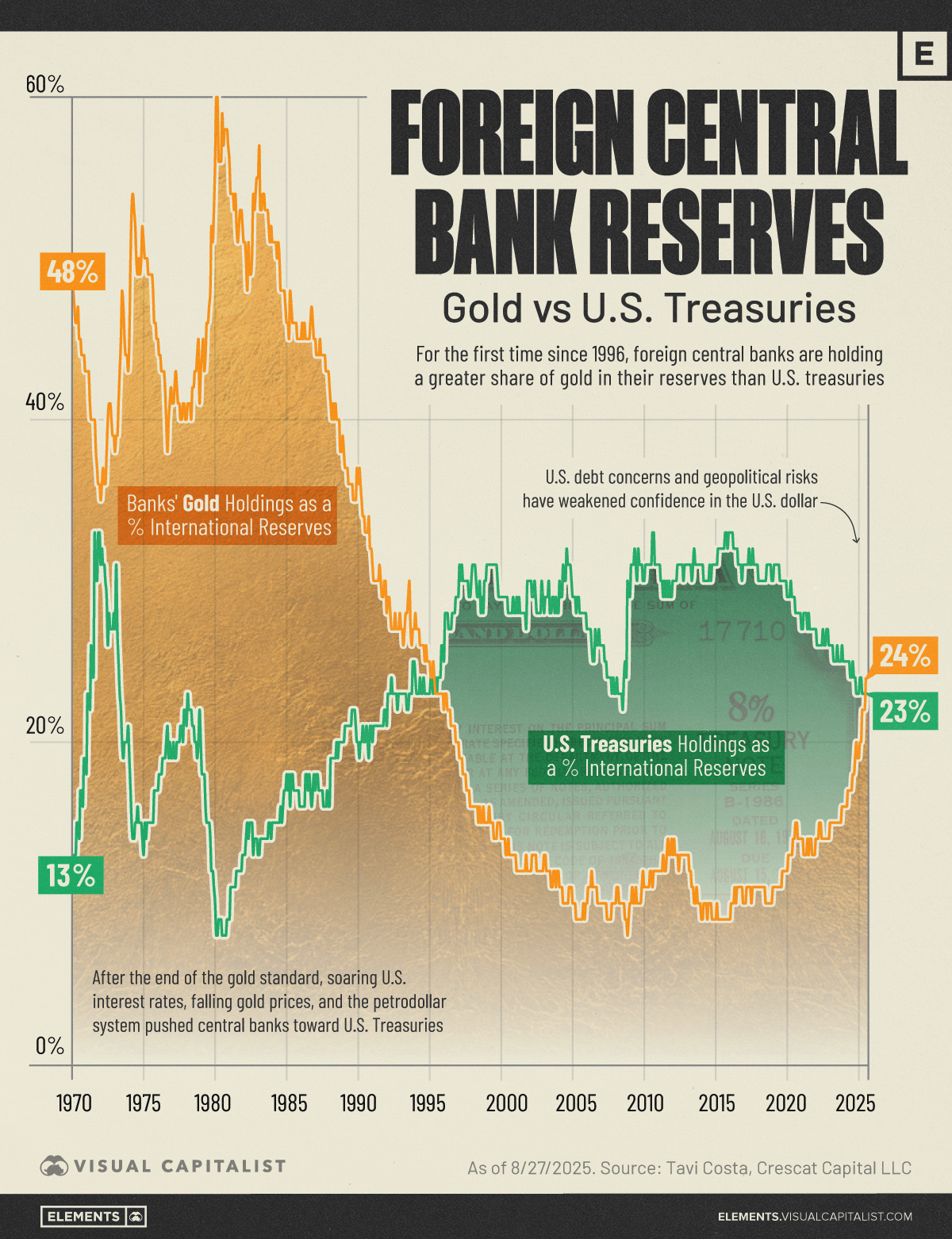

The analysis is anchored in a Seeking Alpha article [1] forecasting outperformance for Gold (GLD), Financials (XLF), and Utilities (XLU) in 2026. Gold’s outlook is underpinned by persistent geopolitical tensions (U.S.-Venezuela, Iran-Israel, Russia-Ukraine), structural de-dollarization trends, and a weak USD environment [1]. Short-term market data shows GLD rose 2.3% from 2025-12-19 to 2025-12-22, closing at $408.23 [0], supported by record central bank gold purchases (1,200 tons in 2025) [2]. Financials (XLF) gained 1.04% on 2025-12-22 (closing at $55.32) following the Federal Reserve’s 25-basis point rate cut, cessation of quantitative tightening, and liquidity injections [0][4]. Utilities (XLU) saw a sector-level gain of 1.49% the same day, driven by rotation out of high-growth tech stocks into defensive value assets with steady dividends [0][3]. The USD Index (UUP) fell 3.7% over the period, reflecting Fed easing policies [0].

- Cross-market dynamics link Fed policy to multiple asset classes: rate cuts and liquidity injections weaken the USD (benefiting gold) while improving financials’ margins and lending demand [0][4].

- Utilities’ defensive appeal amid rotation away from AI hype to tangible earnings aligns with both short-term sector gains and long-term drivers like data center demand and infrastructure upgrades [3][5].

- Record 2025 central bank gold purchases (a core de-dollarization indicator) reinforce gold’s long-term upward momentum beyond short-term geopolitical shocks [2].

- Gold (GLD): Opportunities include ongoing de-dollarization and geopolitical uncertainty [1][2]; risks involve unexpected USD strengthening from Fed policy shifts or geopolitical de-escalation [0][1].

- Financials (XLF): Opportunities stem from easing financial conditions and rising demand for banking services [4]; risks include slowing economic growth reducing loan demand [0].

- Utilities (XLU): Opportunities come from infrastructure spending and defensive investor demand [5]; risks involve regulatory changes or rising energy costs compressing margins [0].

- 2025-12-22 performance: GLD +2.3%, XLF +1.04%, utilities sector +1.49%, UUP -3.7% [0].

- Fed actions (2025-12): 25 bps rate cut, end of quantitative tightening, and liquidity injections [4].

- Central bank gold purchases: 1,200 tons (record 2025) [2].

- Market sentiment: Shift from tech hype to value-oriented, dividend-paying assets [3].

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。