U.S. Consumer Confidence Declines for Fifth Month, Sparking Recession Concerns

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

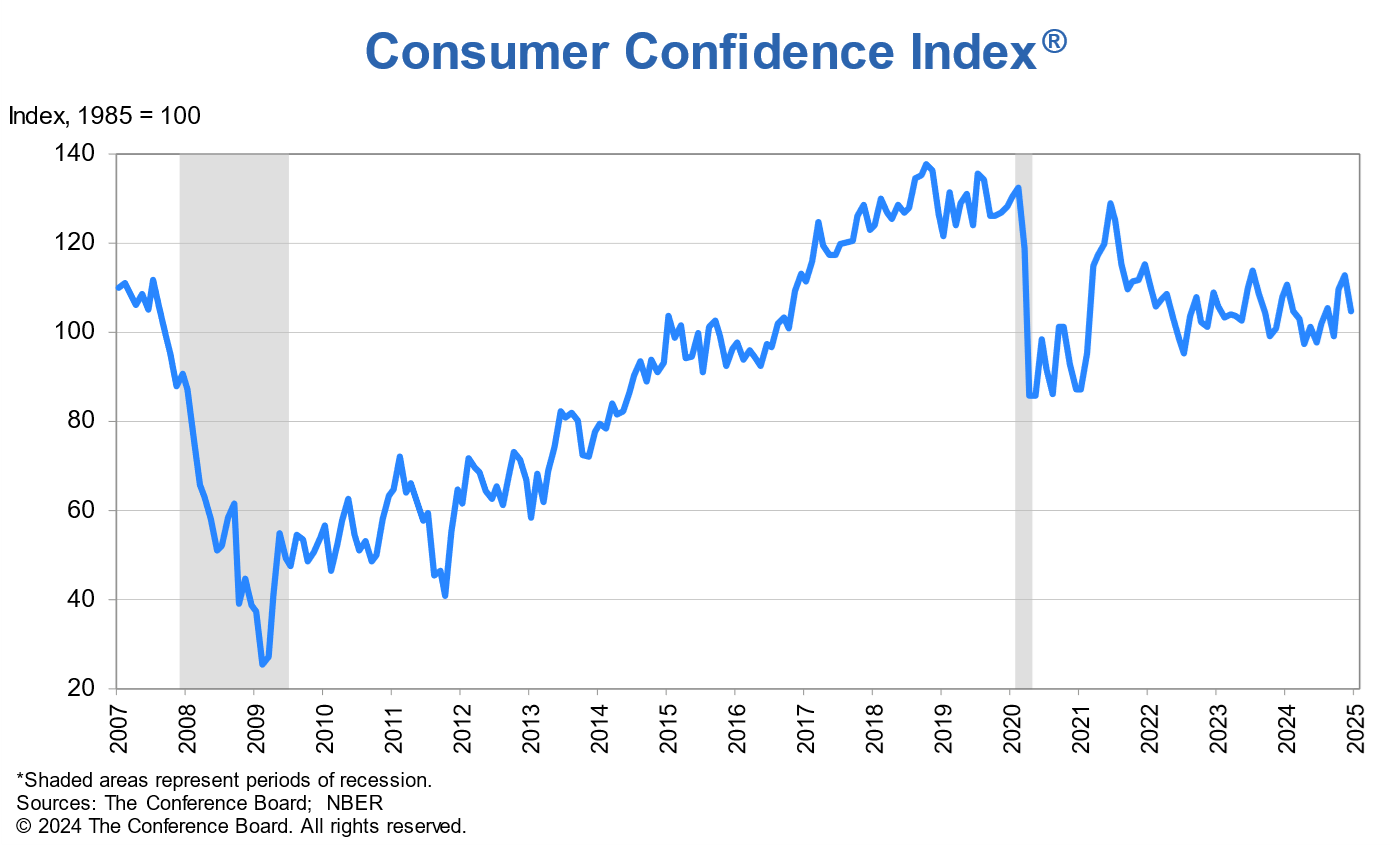

This analysis is based on The Wall Street Journal report [1] published on December 23, 2025, detailing the fifth consecutive monthly decline in U.S. consumer confidence. The Conference Board’s Consumer Confidence Index fell to 89.1 in December from November’s upwardly revised 92.9, missing economists’ expectations [1].

Key index components:

- Present Situation Index: Dropped 9.5 points to 116.8, with views on current business conditions turning negative for the first time since September 2024 [1].

- Expectations Index: Remained stable at 70.7 but stayed below the 80 threshold that historically signals recession risk for the 11th consecutive month [2].

Labor market context shows a slowdown: job creation averaged 35,000 monthly since March 2025 (down from 71,000 monthly in the prior year), with unemployment rising to 4.6% in November [2].

Despite the disappointing sentiment data, major U.S. stock indices closed slightly higher on December 23: S&P 500 (+0.54%), NASDAQ Composite (+0.66%), and Dow Jones Industrial Average (+0.25%) [0]. However, sector performance revealed clear divergence reflecting economic uncertainty:

- Consumer Cyclical (discretionary): -0.29895% (worst performing sector) [0]

- Consumer Defensive (staples/utilities): +1.01489% (top performing sector) [0]

This aligns with historical patterns where defensive stocks outperform during economic uncertainty, while cyclicals are sensitive to consumer sentiment shifts.

- Investor Flight to Safety: The divergence between underperforming cyclicals and strong defensives indicates a shift toward resilient assets amid uncertainty [0].

- Recession Warning Signal: The 11-month streak of the Expectations Index below 80 is a historically reliable indicator of potential recession within 12-18 months [2].

- GDP Vulnerability: With consumer spending driving ~70% of U.S. GDP, prolonged low confidence could reduce economic growth [3].

- Negative Feedback Loop: Slowing job growth and rising unemployment likely contribute to persistent sentiment decline, creating a self-reinforcing cycle [4].

- Consumer Spending Slowdown: Prolonged weak confidence could reduce discretionary spending, weighing on overall economic growth [3].

- Elevated Recession Probability: The extended Expectations Index below 80 increases near-to-medium term recession risk [2].

- Labor Market Deterioration: Further job growth slowdowns or rising unemployment could exacerbate sentiment decline and economic weakness [4].

- Defensive Sector Resilience: The outperformance of Consumer Defensive stocks suggests potential relative stability in these sectors amid uncertainty [0]. This is not an investment recommendation.

- U.S. Consumer Confidence Index: 89.1 (Dec 2025) vs. 92.9 (Nov 2025) [1]

- Present Situation Index: 116.8 (Dec 2025), down 9.5 points [1]

- Expectations Index: 70.7 (Dec 2025), below 80 recession threshold for 11 months [2]

- Market Indices (Dec 23 close): S&P 500 (+0.54%), NASDAQ (+0.66%), Dow (+0.25%) [0]

- Sector Performance: Consumer Cyclical (-0.29895%), Consumer Defensive (+1.01489%) [0]

- Labor Market: 35k monthly job creation (Mar-Dec 2025), 4.6% unemployment rate (Nov 2025) [2]

This summary provides objective data and context for decision-making without prescriptive investment advice.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。