Stock Market vs Consumer Spending Disconnect Analysis: K-Shaped Recovery and Wealth Concentration

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

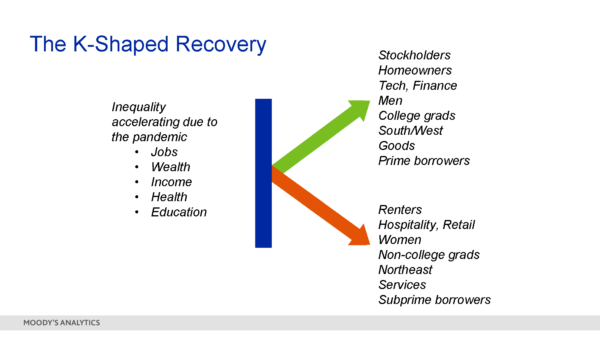

This analysis examines the Reddit poster’s observation about the disconnect between strong stock market performance and reduced consumer spending. The phenomenon is not a market bubble but rather a manifestation of increasing economic inequality and wealth concentration in the U.S. economy.

Major U.S. indices have shown remarkable resilience with the S&P 500 up 0.75%, NASDAQ up 1.45%, and Dow Jones up 1.24% over the past 30 days [0]. However, this market strength exists alongside a severe consumer sentiment crisis, with the University of Michigan Consumer Sentiment Index plummeting to 50.3 in early November - the lowest level since June 2022 [1]. This represents a significant drop from 53.6 in October and marks near 3-1/2-year lows across all political affiliations, age groups, and income levels [1].

The core explanation lies in the bifurcated nature of the current economic recovery. According to the University of Michigan survey, sentiment actually increased among consumers with the largest stock holdings, attributed to “continued strength in stock markets” [1]. This creates a structural divide where wealthier households with significant stock portfolios benefit from market gains while lower-income households face economic pressures. The data shows that the top 20% of households by income drive 40% of consumer spending [1], meaning market gains concentrated among wealthy households can sustain overall spending levels even as the broader consumer base struggles.

The stock market’s resilience is significantly underpinned by corporate buyback activity rather than broad-based economic fundamentals. U.S. stock buybacks are projected to exceed $1 trillion in 2025, a record level [2]. Q1 2025 set a quarterly record at $293 billion, up 20.6% year-over-year [3]. These buybacks act as “silent catalysts” in the recent stock rally [4], directly boosting stock prices and earnings per share while creating artificial market support independent of underlying economic conditions.

The ongoing government shutdown (38+ days as of November 7, 2025) has created a unique economic shock that disproportionately affects lower-income households. The shutdown has disrupted food stamp payments affecting millions, grounded flights, and left federal workers furloughed or working without pay [1]. The CBO estimates Q4 GDP could be reduced by 1.0-2.0 percentage points, with $7-14 billion permanently lost [1]. This disruption amplifies the economic divide by removing essential support systems for vulnerable populations while leaving wealthier households largely unaffected.

- Market Vulnerability:The stock market’s reliance on corporate buybacks rather than broad economic participation creates significant vulnerability. If buyback activity slows or economic conditions deteriorate further, markets could face substantial corrections.

- Consumer Spending Sustainability:While overall personal spending showed resilience (up 0.6% in August 2025) [5], this appears increasingly concentrated among higher-income households. Retail sectors dependent on discretionary spending from lower and middle-income consumers may face continued pressure.

- Social and Political Stability:The growing economic divide and government shutdown impacts could lead to increased social tensions and political instability, potentially affecting business confidence and investment decisions.

- Debt Sustainability:Lower-income households facing reduced government benefits and job insecurity may struggle with debt service, potentially leading to broader financial stability concerns.

- Targeted Consumer Segments:Businesses focusing on higher-income consumers may continue to see strong demand, while those serving lower-income segments may need to adjust value propositions.

- Policy Response Potential:The current economic challenges may create opportunities for policy interventions aimed at reducing wealth inequality and supporting broader economic participation.

- Market Correction Opportunities:If the market does correct due to reduced buyback activity or other factors, it may present opportunities for long-term investors at more reasonable valuations.

The analysis reveals that the Reddit poster’s observation about the disconnect between stock market performance and consumer spending reflects a deeper structural shift in the U.S. economy. The apparent paradox is explained by three key factors:

-

Wealth Concentration:Stock market gains primarily benefit wealthy households who own the majority of equities and drive disproportionate consumer spending [1].

-

Corporate Buybacks:Record $1+ trillion in stock buybacks for 2025 [2] provide artificial market support independent of underlying economic conditions.

-

Economic Bifurcation:A K-shaped recovery where higher-income households thrive while lower-income households face pressures from government shutdown disruptions, job insecurity, and reduced benefits [1].

The current situation suggests markets may indeed be disconnected from the real economy experienced by most Americans, though this disconnection is structural rather than cyclical. While the market strength appears sustainable in the short term due to continued buyback activity and wealth effect concentration, the underlying economic fragility and growing inequality pose significant risks to long-term economic stability and market sustainability.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。