Tesla's Strategic Pivot: Reassessing Valuation from EV to AI/Robotics Platform

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Tesla is undergoing a fundamental transformation from an electric vehicle manufacturer to an AI and robotics company. With its market capitalization at $1.53 trillion[0] and stock up 90% over the past two years[0], investors are already pricing in this strategic shift. However, the current valuation presents a complex challenge: Tesla’s P/E ratio of 291x[0] reflects extraordinary growth expectations, yet 78.9% of revenue still comes from automotive sales[0].

This analysis examines how investors should reassess Tesla’s valuation framework as the company pivots toward robotaxis and Optimus humanoid robots.

Metric |

Value |

Analysis |

|---|---|---|

| Market Cap | $1.53 trillion | Among “Magnificent Seven” tech giants |

| Current Price | $475.19 | Near 52-week high of $498.83 |

| P/E Ratio | 291.09x | Extremely high vs traditional automakers (5-15x) |

| P/B Ratio | 19.18x | Reflects intangible value expectations |

| Revenue (FY2024) | ~$95B | 75% from EV sales, declining for second year[2] |

| Net Margin | 5.51% | Constrained by heavy R&D investment |

| Free Cash Flow | $3.58B | Limited by capex for AI/robotics infrastructure |

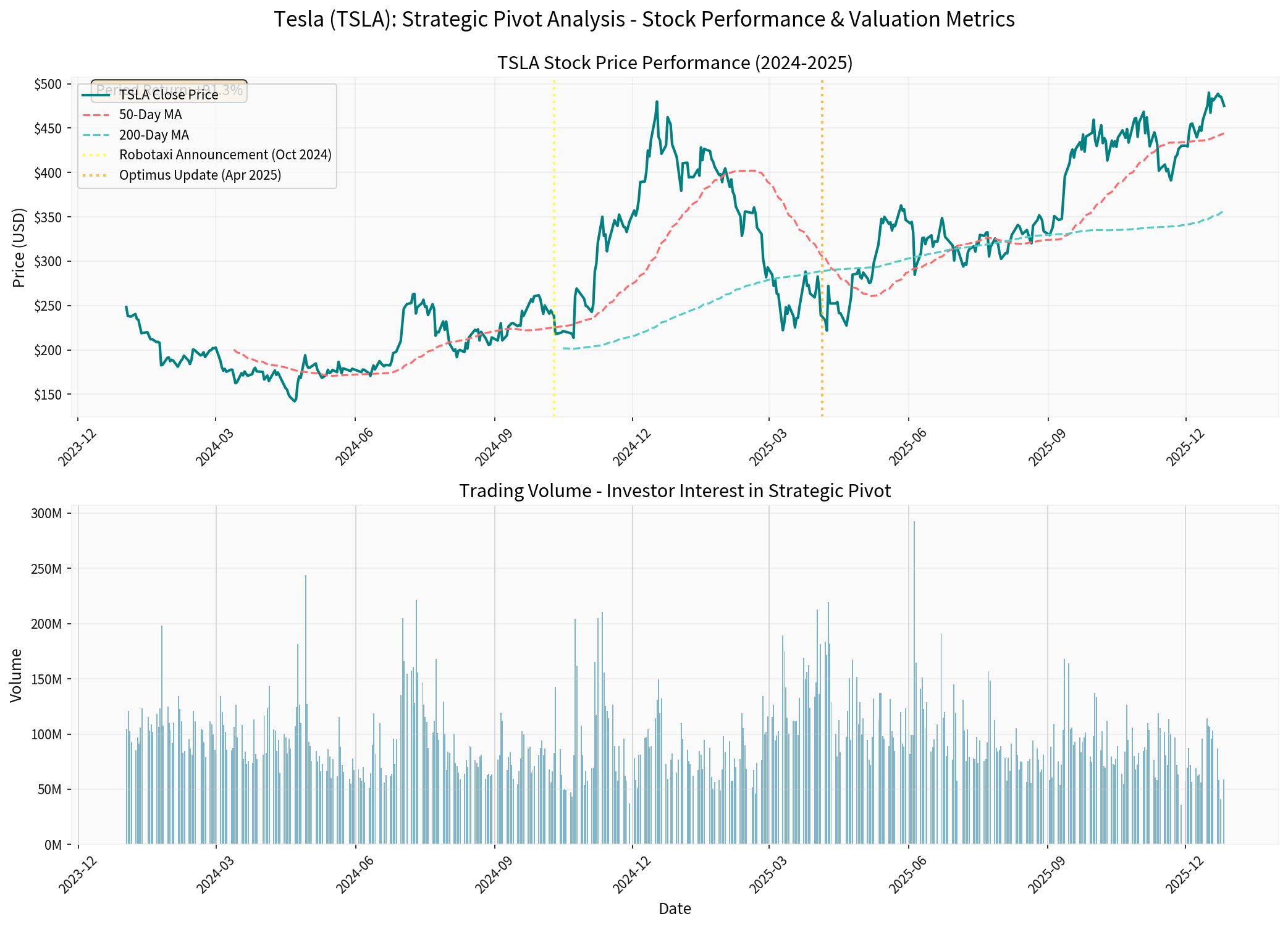

- 2-Year Return:+90.02% (significantly outperforming S&P 500)

- YTD 2025:+25.29%

- 52-Week Range:$214.25 - $498.83 (132% range)

- Volatility:4.00% daily standard deviation

The stock’s dramatic 2024-2025 rally coincides with Tesla’s increased emphasis on AI and robotics initiatives, suggesting investors have already begun repricing the company as a technology platform rather than a traditional automaker[1].

- EV sales declining for second consecutive year in 2025[2]

- Intense competition from Chinese manufacturers (69% market share)[3]

- Margin pressure from price wars

- Still generates ~75% of current revenue[2]

- If valued solely as EV maker: Worth roughly $150-200B

- Implied AI/Robotics Premium:$1.3+ trillion

- Operating in Austin without human safety monitors (as of late 2025)[1]

- Analysts expect fleet to grow from low-hundreds to ~1,000 vehicles by 2026[1]

- Targeting expansion to 30+ U.S. cities in 2026[2]

- Wedbush analyst Dan Ives projects robotaxis could become a “mega-product” eclipsing Tesla’s entire automotive segment[1]

- Bull case scenario: Could drive Tesla to $2-3 trillion market cap by 2026[2]

- Revenue model: Per-mile fees vs vehicle ownership (higher margins than manufacturing)

- Waymo (Alphabet):Only operator providing fully driverless service across multiple U.S. cities; ~150,000 weekly paid rides by late 2024; targeting 1M weekly rides[4]

- GM Cruise & Amazon Zoox:Limited fare-free trials, smaller scale[4]

- Tesla’s Advantage:Lower sensor costs (~$400 vs Waymo’s $12,650 per vehicle)[4]; massive existing fleet for data collection

- Tesla’s Challenge:Still reliant on human supervision in many deployments; Waymo already fully unsupervised[4]

- If robotaxis generate $10-20B in high-margin revenue by 2027: Worth $200-400B

- In development/testing phase

- Elon Musk predicts it could make Tesla “the most valuable company in the world”[1]

- Morgan Stanley added $60/share in equity value from humanoid robotics in sum-of-the-parts analysis[3]

- Humanoid robotics market potentially worth hundreds of billions by 2030s

- Industrial automation, manufacturing, logistics applications

- Competitors: Figure AI, Unitree (Chinese company), Boston Dynamics (less commercial focus)[5]

- Limited production/testing in 2025-2026

- Volume manufacturing unlikely before 2027-2028

- Meaningful revenue contribution post-2028

- Current valuation assumes 100% success in commercialization

- Realistically worth $100-300B in optimistic scenario, $0-50B in base/bear case

Metric Traditional Auto Multiple Tesla Current (Dec 2025)

---------------- ------------------------- ------------------------

P/E Ratio 5-15x 291x

Price/Sales 0.5-2x ~16x

EV/Revenue 0.5-2x ~16x

EV/EBITDA 6-12x ~97x

Implied Market Cap $100-200B $1.53T

Morgan Stanley’s recent analysis adopted this approach[3]:

Business Segment |

Base Case Value |

Bull Case |

Bear Case |

Multiple Type |

|---|---|---|---|---|

| Legacy Auto/EV | $100-150B | $200B | $50-75B | 5-10x EBITDA |

| Energy Storage | $30-50B | $80B | $15-20B | 10-15x EBITDA |

| Robotaxis (FSD) | $300-500B | $800B-1T | $100-200B | Platform multiple |

| Optimus (Humanoid) | $150-250B | $500B | $0-50B | Option value |

TOTAL SOTP |

$580-950B |

$1.58-2.8T |

$165-345B |

|

Current Market Cap |

$1.53T |

|||

Upside/Downside |

+60% to -85% |

+0% to +83% |

-89% to -77% |

If valued as an AI/robotics platform company (comparable to Nvidia, Alphabet, cloud platforms):

Metric Platform Company Tesla Current

Range (Dec 2025)

---------------- ---------------- -------------

Price/Sales (Forward) 8-15x (hypergrowth) TBD (dependent on new revenue streams)

EV/Revenue 10-20x ~16x current

Growth Rate Required 30-50% CAGR Unclear transition period

- Robotaxi fleet reaches 50,000+ vehicles by 2027

- $15-25B in high-margin robotaxi revenue (80%+ gross margin)

- Optimus enters limited production, $5-10B revenue by 2028

- EV business stabilizes at $80-90B revenue

- Total revenue: $120-140B by 2028, 30%+ CAGR

- Margins expand to 15-20% on software/platform revenue

- Robotaxi deployment proceeds but slower: 5,000-10,000 vehicles by 2027

- $3-5B in robotaxi revenue by 2027

- Optimus still pre-revenue or minimal commercialization

- EV business declines modestly to $70-80B

- Total revenue: $90-100B by 2028, flat vs current

- Margins compressed by continued investment

- Robotaxi commercialization delayed or fails to achieve scale

- Optimus remains experimental/limited

- EV business continues declining to $60-70B

- Revenue: $80-90B, declining

- Margin pressure from price wars, high R&D

- Autonomous Driving:Tesla’s vision-based approach vs Waymo’s LiDAR/map-based strategy; Tesla behind in fully unsupervised deployment[4]

- Regulatory Hurdles:Robotaxi approvals city-by-city; safety incidents could derail expansion

- Liability Issues:Accident liability framework still evolving

- Waymo:Technologically ahead, fully operational in multiple cities, backed by Alphabet’s resources[4]

- Chinese Competitors:BYD, others in EVs; Chinese humanoid robotics companies emerging[5]

- Tech Giants:Alphabet, Meta, Amazon investing heavily in AI/robotics

- Capital Intensity:Robotaxi fleet requires massive capex

- Manufacturing Complexity:Optimus mass production at scale unproven

- Management Bandwidth:Elon Musk distracted by X (Twitter), SpaceX, other ventures

- Already Priced to Perfection:At 291x P/E, limited margin for error

- Execution Gaps:Any delay in robotaxi/Optimus could trigger 30-50% correction

- EV Decline:Core business deterioration not fully priced in

-

Is Tesla an AI company or an automaker?

- Current reality: 75% automaker, 25% option value on future

- Market pricing: Treating as AI/platform company

- Gap:Misalignment between current fundamentals and valuation

-

What probability of success is priced in?

- At $1.53T, implies 60-70%+ probability of robotaxi success AND 40-50%+ probability of Optimus success

- Historical tech platform success rates: <20% achieve expectations

- Verdict:Expectations likely too high

-

What are the catalysts and timeline?

- Near-term (2026):Robotaxi fleet expansion to 30 cities, production volume ramp[2]

- Mid-term (2027):Proof of robotaxi unit economics (profitability per vehicle)

- Long-term (2028+):Optimus commercialization

- Risk:Long investment horizon with limited near-term catalysts

-

How to monitor progress?

- Robotaxi Metrics:Fleet size, rides/week, utilization rates, revenue/vehicle

- FSD Take Rate:Percentage of Tesla owners subscribing to FSD software

- Optimus:Production prototypes, pilot deployments, commercial agreements

- EV Business:Stabilization of deliveries and margins

-

Take Profits on Partial Position:At $475, stock prices in significant success across all new initiatives. Consider trimming 20-30% of holdings to lock in gains and reduce exposure to execution risk.

-

Monitor Key Catalysts:

- Q1 2026: Update on 30-city robotaxi expansion progress[2]

- Q2 2026: Initial robotaxi fleet economics data

- Q4 2026: Optimus commercialization timeline

-

Set Stop-Loss Levels:Given 132% 52-week range[0] and high volatility, consider protective stops at $380-400 to limit downside to 15-20%.

-

Wait for Better Entry Point:At 291x P/E, risk/reward unfavorable. Wait for:

- Pullback to $350-400 range (more reasonable valuation)

- Concrete robotaxi revenue data (Q2 2026+)

- Stabilization of core EV business

-

If Buying Now:

- Treat as venture capital investment in AI/robotics

- Expect 3-5 year holding period

- Position size: 2-5% of portfolio maximum

Hedge with Put Options:Given volatility, consider protective puts or buy-write strategies

-

Adopt Sum-of-the-Parts Valuation:Model robotaxis, Optimus, and EV as separate businesses with distinct multiples[3]

-

Scenario Analysis:Assign probabilities to bull/base/bear cases; expected value calculation at current price suggests modest downside risk (-10% to -20% if using reasonable probability weights)

-

Peer Group Comparison:Compare to:

- Traditional Auto:GM, Ford (5-8x P/E)

- EV Pure Plays:Rivian, Lucid (pre-profit, growth multiples)

- AI/Platforms:Alphabet, Nvidia (25-35x P/E on high growth)

- Ride-Hailing:Uber, Lyft (2-3x revenue, negative earnings)

Conclusion:Tesla trades at premium to all comparables

Tesla faces a fundamental

- If valued as automaker:Worth $150-200B (85-90% downside)

- If valued as AI/platform company:Needs to prove hypergrowth from new segments

- Current reality:Market pricing it as AI company before new businesses have generated material revenue

Timeline |

Milestone |

Current Status |

Confidence |

|---|---|---|---|

| Q1 2026 | Robotaxi expansion to 30 cities announced | Planning stage | Medium |

| Q2 2026 | Fleet grows to 1,000+ vehicles | ~500 currently | Medium |

| Q3 2026 | First positive unit economics data | Unproven | Low |

| Q4 2026 | $1B+ robotaxi revenue run rate | ~$0 currently | Low |

| 2027 | Optimus enters limited production | Testing phase | Very Low |

| 2028 | Robotaxi revenue >$10B | Speculative | Very Low |

[0]

[1]

https://finance.yahoo.com/news/800-tesla-stock-could-reality-143002634.html

[2]

https://finance.yahoo.com/news/golden-goose-could-tesla-3-023056178.html

[3]

https://finance.yahoo.com/news/tesla-sky-high-valuation-prompts-160032022.html

[4]

https://www.forbes.com/sites/greatspeculations/2025

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。