Comprehensive Analysis: Winter Storm Impact on U.S. Airline Operations and Stock Performance

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Winter Storm “Devin” struck the U.S. Northeast on December 26-27, 2025, causing significant operational disruptions across major airlines during peak post-holiday travel. While the storm created immediate operational challenges and modest stock price declines, historical data indicates that weather-related disruptions typically have

- 1,800+ flights canceledacross the U.S. on December 26, 2025

- 22,000+ flights delayedduring the peak holiday travel period

- 1,650 flightscanceled within, into, or out of the U.S. specifically

- Northeast airports hit hardest:JFK, LaGuardia, and Newark Liberty International issued travel advisories

| Airline | Cancellations | Percentage of Schedule |

|---|---|---|

| JetBlue (JBLU) | 225+ | ~22% of operations |

| Delta (DAL) | 186 | ~5% of mainline schedule |

| Republic Airways | 153 | N/A |

| American (AAL) | Not specified but | significant impact |

| United (UAL) | Not specified but | significant impact |

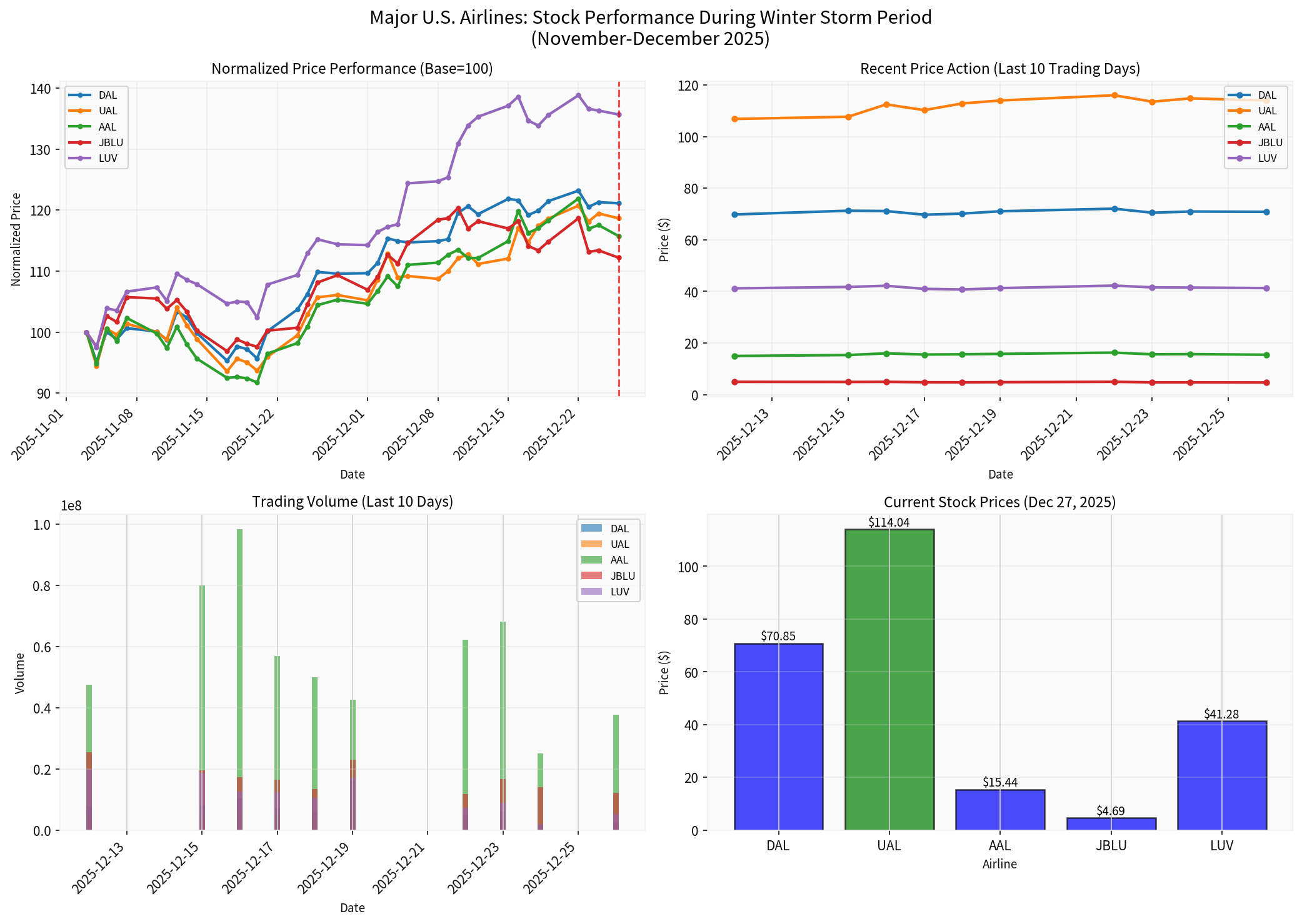

The winter storm caused modest declines across major airline stocks on December 27, 2025, reflecting short-term investor concerns about operational costs and revenue disruption:

| Airline | Current Price | Daily Change | 52-Week Range |

|---|---|---|---|

American (AAL) |

$15.44 | -1.53% ⬇️ |

$8.50 - $19.10 |

JetBlue (JBLU) |

$4.69 | -1.05% ⬇️ |

$3.34 - $8.31 |

United (UAL) |

$114.04 | -0.67% ⬇️ |

$52.00 - $116.32 |

Southwest (LUV) |

$41.28 | -0.48% ⬇️ |

$23.82 - $43.54 |

Delta (DAL) |

$70.85 | -0.16% ⬇️ |

$34.74 - $72.34 |

Alaska (ALK) |

$51.49 | +0.21% ⬆️ |

$37.63 - $78.08 |

- American Airlines experienced the largest decline (-1.53%), despite having fewer cancellations than JetBlue

- JetBlue’s -1.05% decline reflects its operational vulnerability as a Northeast-focused carrier

- Delta demonstrated relative resilience (-0.16%), consistent with its strong operational performance

- Market reaction was measured, suggesting investors view this as a temporary disruption

Despite the winter storm disruptions, major airlines have demonstrated

Figure: Normalized price performance showing major U.S. airlines from November to December 2025. The red dashed line indicates when Winter Storm Devin struck (December 26).

| Airline | Period Return | Volatility | 20-Day MA | Analysis |

|---|---|---|---|---|

Southwest (LUV) |

+36.87% |

2.32% | $39.28 | Strongest performer |

Delta (DAL) |

+23.67% |

2.37% | $68.89 | Consistent gains |

United (UAL) |

+21.32% |

2.71% | $108.72 | Solid upward trend |

American (AAL) |

+17.95% |

2.68% | $15.11 | Moderate gains |

JetBlue (JBLU) |

+13.01% |

2.41% | $4.79 | Lagging peers |

- Market Cap:$46.26B

- P/E Ratio:9.99x (attractive valuation)

- Net Profit Margin:7.36%

- ROE:27.64% (excellent)

- Analyst Consensus:BUY with target price of $74.00 (+4.4% upside)

- YTD Performance:+19.94%

- 5-Year Performance:+76.46%

- Market Cap:$36.92B

- P/E Ratio:11.43x

- Net Profit Margin:5.64%

- ROE:24.87%

- Analyst Consensus:BUY with target price of $132.50 (+16.2% upside)

- YTD Performance:+19.50%

- 5-Year Performance:+159.65%

- Market Cap:$1.71B (significantly smaller)

- P/E Ratio:Negative (-3.64x)

- Net Profit Margin:-5.16% (loss-making)

- ROE:-19.21%

- Analyst Consensus:HOLD with target price of $5.00 (+6.6% upside)

- YTD Performance:-37.30% (struggling)

- 5-Year Performance:-68.33% (severe underperformance)

The most significant recent winter storm event occurred in December 2022, when Southwest Airlines experienced a

- Thousands of flights canceledstarting December 21, 2022, continuing through Christmas

- Contributing factors:Winter storm + inadequate staffing + outdated scheduling systems

- Industry impact:Highlighted operational vulnerabilities at capacity-constrained hubs during winter weather

- Stock impact:Significant short-term decline but eventual recovery

The NOAA documented multiple billion-dollar winter storms in early 2024:

- January 12-14, 2024:Northwest Winter Storm affecting Western Washington and Oregon

- January 14-18, 2024:Central, Southern, Northeastern Winter Storm and Cold Wave

- Operational impact:Widespread disruptions across multiple carriers

- Market reaction:Temporary stock declines followed by recovery

- Geographic concentration in affected regions (e.g., JetBlue in Northeast)

- Weaker financial positions

- Operational vulnerabilities (staffing, technology)

- S&P 500:+1.52%

- NASDAQ:+1.42%

- Dow Jones:+1.11%

- Russell 2000:+3.80%

The

- Operational costsincrease due to de-icing, crew accommodation, and repositioning

- Revenue lossfrom canceled flights (partially offset by rebookings)

- Customer compensationcosts and potential brand damage

- Recovery timeof 3-7 days to normalize operations after weather clears

- Additional 1-2% declinepossible if disruptions persist

- Quick recoverylikely once operations stabilize (historical pattern)

- Delta and Unitedexpected to recover fastest due to strong balance sheets

- JetBluefaces extended pressure if Northeast operations remain disrupted

- Holiday travel demandremains robust despite disruptions

- Analyst optimism:Citi initiated coverage on American Airlines with BUY rating in December 2025, citing stronger demand cycle expected in 2026

- Pricing power:Airlines maintaining fare discipline amid high demand

- Cost management:Carriers have improved operational resilience since 2022 Southwest crisis

- Additional winter stormscould compound operational challenges

- JetBlue financial stress:Ongoing losses (-5.16% margin) limit recovery capacity

- Fuel price volatilitycould pressure margins if costs rise

- Post-pandemic travel normalizationcontinuing into 2026

- Capacity disciplinemaintained by major carriers

- Technology investmentsimproving operational resilience (e.g., United’s Starlink IFE integration, cloud-based systems)

- Strategic partnershipsevolving (note: JAL-JetBlue partnership ending March 31, 2026, may impact JBLU)

- Buy on weakness:Consider accumulating positions in DAL and UAL on any weather-related pullbacks

- Focus on quality:Prioritize financially strong carriers (DAL, UAL) over financially stressed peers (JBLU)

- Short-term trading:Swing trade opportunities as stocks overreact to weather news

- Wait for clarity:Allow 5-7 days for operations to normalize before adding positions

- Diversify:Consider airline ETF exposure rather than single-stock picks

- Monitor earnings:Q4 2025 earnings (late January 2026) will quantify storm impact

- Avoid JetBlue (JBLU):Carrier faces fundamental challenges beyond weather (loss-making, -37.3% YTD)

- Consider alternatives:Other transportation/logistics stocks with less weather exposure

- Wait for seasonal pattern:February-March historically better for airline stocks

Winter Storm Devin’s impact on U.S. airline operations and stocks demonstrates a

-

Operational disruption is significant but temporary- 1,800+ flights canceled, but historically airlines normalize within 3-7 days

-

Stock market reaction is measured- 1-2% declines reflect investor understanding that weather events are episodic rather than structural

-

Financial strength determines resilience- Delta (-0.16%) and United (-0.67%) showed smaller declines than American (-1.53%) and JetBlue (-1.05%) due to stronger fundamentals

-

Long-term trends remain positive- Despite the storm, major airlines significantly outperformed the market over the past two months

-

Historical precedents suggest recovery- Similar winter storms in 2022 and 2024 caused temporary disruptions followed by stock price recovery

[0] 金灵AI Financial Data API - Real-time quotes, company overviews, and historical price data for DAL, UAL, AAL, LUV, JBLU, ALK (retrieved December 27, 2025)

[1] Reuters via U.S. News & World Report - “Winter Storm Bears Down on U.S. Northeast, Disrupting Airline Travel” (December 27, 2025) - https://www.usnews.com/news/top-news/articles/2025-12-27/winter-storm-bears-down-on-u-s-northeast-disrupting-airline-travel

[2] Benzinga - “Holiday Travel Chaos: JetBlue, Delta, American, United Flights Cancelled As Winter Storm Devin Strikes Northeast US” (December 27, 2025) - https://www.benzinga.com/news/travel/25/12/49600176/holiday-travel-chaos-jetblue-delta-american-united-flights-cancelled-as-winter-storm-devin-strikes-no

[3] CNBC - “Airlines cancel more than 1500 flights for winter storm” (December 26, 2025) - https://www.cnbc.com/2025/12/26/winter-storm-flight-cancellations.html

[4] Patch.com - “Hundreds Of JetBlue, Delta Flights Canceled As Winter Weather Disrupts Travel: Report” (December 26, 2025) - https://patch.com/new-york/longisland/hundreds-jetblue-delta-flights-canceled-winter-weather-disrupts-travel-report

[5] Economic Times - “Winter storm Devin grounds over 1,800 US flights amid holiday chaos” (December 26, 2025) - https://m.economictimes.com/us/news/winter-storm-devin-grounds-over-1800-us-flights-amid-holiday-chaos-and-coastal-storms/articleshow/126200416.cms

[6] StockTwits - “American Airlines Stock Slides As Winter Storm Chaos Cancels Over 1,500 Flights During Holiday Rush” (December 26, 2025) - https://stocktwits.com/news-articles/markets/equity/american-airlines-stock-slides-as-winter-storm-chaos-cancels-over-1-500-flights-during-holiday-rush/cLeU0kXREDd

[7] NOAA National Centers for Environmental Information - “Billion-Dollar Weather and Climate Disasters: United States Summary” - https://www.ncei.noaa.gov/access/billions/state-summary/US

[8] Wikipedia - “Southwest Airlines - December 2022 holiday meltdown” - https://en.wikipedia.org/wiki/Southwest_Airlines

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。