Activist Investor Stake-Building in Target: Strategic Changes & Investment Implications

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

| Company | Stake Size | Outcome |

|---|---|---|

Kenvue (KVUE) |

Significant | Acquired by Kimberly-Clark for $40B (Nov 2025) |

Kellanova |

Strategic stake | Pushed for operational changes at Pringles maker |

US Steel |

Active position | Advocated for strategic alternatives amid acquisition interest |

According to

- Net sales declined -1.5%year-over-year

- Comparable sales fell -2.7%

- Three consecutive quarters of declining comparable sales[1]

| Metric | Value |

|---|---|

| 52-Week High | $145.08 |

| Current Price | $99.55 |

| YTD Decline | -27.4% |

| 3-Year Decline | -31.6% |

| 5-Year Decline | -43.6%[0] |

| Metric | Value | Assessment |

|---|---|---|

| P/E Ratio (TTM) | 12.02x | Below historical average |

| Market Cap | $45.2B | Down significantly from highs |

| P/B Ratio | 2.92x | Reasonable for retail |

| ROE | 24.87% | Strong profitability[0] |

Based on TCIM’s historical approach and typical retail activist campaigns, the following strategic changes are likely:

- Further corporate workforce reductions (Target already cut 1,800 roles in October 2025)

- Supply chain optimization and inventory management improvements

- Store footprint rationalization

- Administrative expense reductions

- Addition of activist-nominated directors with retail expertise

- Potential removal of long-tenured directors

- Enhanced board diversity and independence

The Accountability Board has already filed a shareholder proposal urging Target to appoint an

- Real estate monetization (Target owns significant store properties)

- Non-core business divestitures

- Strategic alternatives for underperforming segments

- Increased share buybacks

- Dividend policy review

- Rebalancing capital expenditures

- Debt optimization

- Accelerated management transitions

- Enhanced accountability for performance

- Possible addition of turnaround specialists

- Upside Potential:DCF analysis suggests significant upside with:

- Conservative fair value: $296.23(+197.6%)

- Base case fair value: $375.58(+277.3%)

- Probability-weighted value: $412.23(+314.1%)[0]

- Conservative fair value:

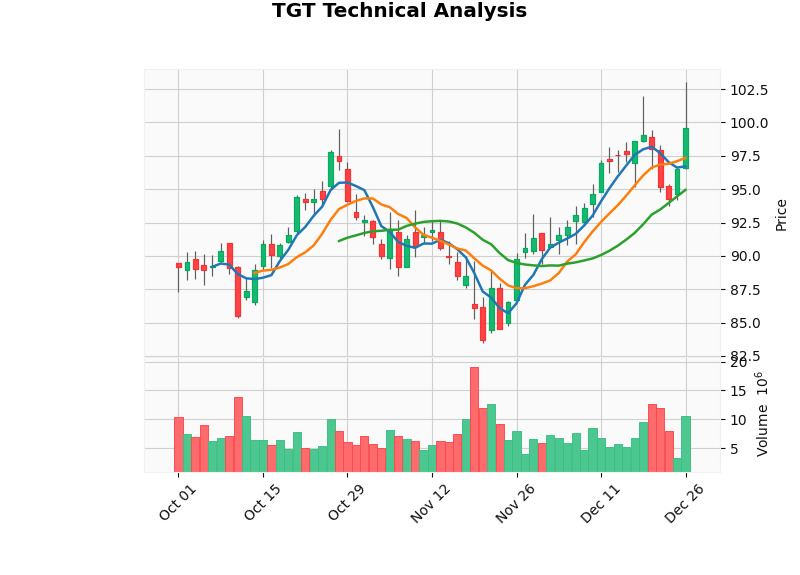

- Technical Position:Stock currently trades in sideways range ($94.95 - $100.96) with potential for breakout[0]

- Analyst Sentiment:Consensus rating of HOLD with 44.8% Buy ratings; price target $92.00[0]

- Volatility during activist campaign

- Potential public disagreements between TCIM and management

- Execution risk on operational changes

- Consumer spending weakness and tariff headwinds[1]

| Scenario | Probability | Shareholder Impact |

|---|---|---|

Cooperative Engagement |

50% | Gradual operational improvements, 20-40% upside |

Aggressive Campaign |

30% | More radical changes, higher volatility, 30-60% upside |

Resistance & Stalemate |

15% | Limited progress, stock remains range-bound |

Full Proxy Contest |

5% | Significant disruption, binary outcome |

- Digital/e-commerce accelerationto compete with Amazon and Walmart

- Private label expansion(Target’s owned brands account for ~30% of sales)

- Same-day delivery and fulfillment optimization

- Loyalty program enhancement

- Format innovation(small-format stores, urban locations)

| Company | Activist | Outcome | Shareholder Return |

|---|---|---|---|

Kohl’s (2022) |

Ancora/Legion/Macellum | CEO replacement, board refresh | Mixed - operational focus, but sales challenges persisted |

Bed Bath & Beyond |

Ancora/Legion | Board overhaul | Negative - bankruptcy (2023) |

JCPenney |

Various (2010s) | Multiple campaigns | Negative - bankruptcy (2020) |

Target (2009) |

Pershing Square | Real estate spin-off rejected | Mixed - shareholder vote supported management[1][3] |

- Activism does not guarantee success; execution and market conditions matter

- Retail turnarounds are particularly challenging in e-commerce era

- Governance changes alone cannot offset secular headwinds

- Cooperate engagement typically yields better outcomes than proxy fights

- Trend:Sideways/no clear trend

- Support:$94.95 (20-day moving average)

- Resistance:$100.96 (recent highs)

- Volume:Elevated on activist news (10.47M vs. 7.66M average)

- Beta:1.12 (higher volatility than market)

- Break above $105 would signal bullish momentum

- Support at $90 (November 2024 lows)

- Major support at $83.44 (52-week low)

- Strong ROE:24.87% indicates efficient capital use

- Reasonable valuation:P/E of 12.02x below 5-year average

- Established brand:Target remains a destination for value-conscious consumers

- Free cash flow:$4.48B (latest) provides flexibility

- Debt risk classified as HIGHby financial analysis

- Current ratio:0.97 (slightly below 1.0, indicates liquidity pressure)

- Quick ratio:0.27 (very low, indicates short-term liquidity concerns)

- 12 consecutive quartersof sales decline

- Significant undervaluation according to DCF analysis (up to 314% upside potential)[0]

- Activist involvement creates catalyst for value realization

- Target’s core franchise remains strong with owned brands and experiential retail

- New CEO (Fiddelke) may bring fresh perspective

- Consumer spending weakness in 2026

- Potential escalation costs if TCIM pursues proxy contest

- Competitive pressure from Walmart and Amazon

- Tariff and inflation headwinds

| Strategy | Entry Price | Target | Rationale |

|---|---|---|---|

Conservative |

<$90 | $110-125 | Attractive risk/reward if activist campaign succeeds |

Moderate |

$95-100 | $130-160 | Fair value considering activist catalyst |

Aggressive |

Current | $175+ | Assumes successful turnaround and multiple expansion |

- January-February 2026: TCIM may file 13DorSchedule 13Gdisclosing stake size

- February 1, 2026: CEO transition (Cornell → Fiddelke)

- Q4 2025 earnings release: First quarterly results under activist scrutiny

- Potential board refresh announcements

- Strategic review announcements

- Possible restructuring initiatives

- Shareholder meeting season (May-June 2026) - potential proxy contest if demands not met

The entry of

- DCF analysis indicates fair value potentially 3x-5x current price[0]

- TCIM’s track record shows ability to unlock value (Kenvue sale, Kellanova improvements)

- Target’s strong brand and owned-portfolio provide turnaround potential

- Retail sector faces structural challenges from e-commerce and discounters

- Consumer spending headwinds in 2026

- Target already initiated restructuring (1,800 job cuts announced October 2025)

- Cooperation vs. confrontation dynamic remains uncertain

- Current shareholders:Hold with position sizing appropriate for turnaround risk

- New investors:Opportunistic entry on weakness with clear exit strategy

- Risk tolerance:Moderate-High given execution and sector risks

The activist stake creates a

[0] 金灵API Data (Stock quotes, technical analysis, financial analysis, DCF valuation, and price data)

[1] PYMNTS.com - “Activist Investor TCIM Makes ‘Significant’ Investment in Target” (https://www.pymnts.com/news/2025/activist-investor-tcim-makes-significant-investment-in-target/)

[2] Financial Times via 13D Monitor - “Pressure Grows on Target as Activist Investor Builds Stake” (https://www.13dmonitor.com/DefaultUS.aspx)

[3] Harvard Law School Forum on Corporate Governance - “The Recent Evolution of Shareholder Activism in the United States” (https://corpgov.law.harvard.edu/2025/12/24/the-recent-evolution-of-shareholder-activism-in-the-united-states/)

[4] AOL/Reuters - “Embattled Target Feeling Heat from Hedge Fund Investor Toms Capital” (https://www.aol.com/articles/embattled-target-feeling-heat-hedge-165142817.html)

[5] Yahoo Finance - “Target Shares Gain as Activist Investor Reportedly Builds Big Stake” (https://finance.yahoo.com/news/target-shares-gain-activist-investor-154111204.html)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。