Market Impact Analysis: Trump-Putin-Zelenskiy Diplomatic Developments

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

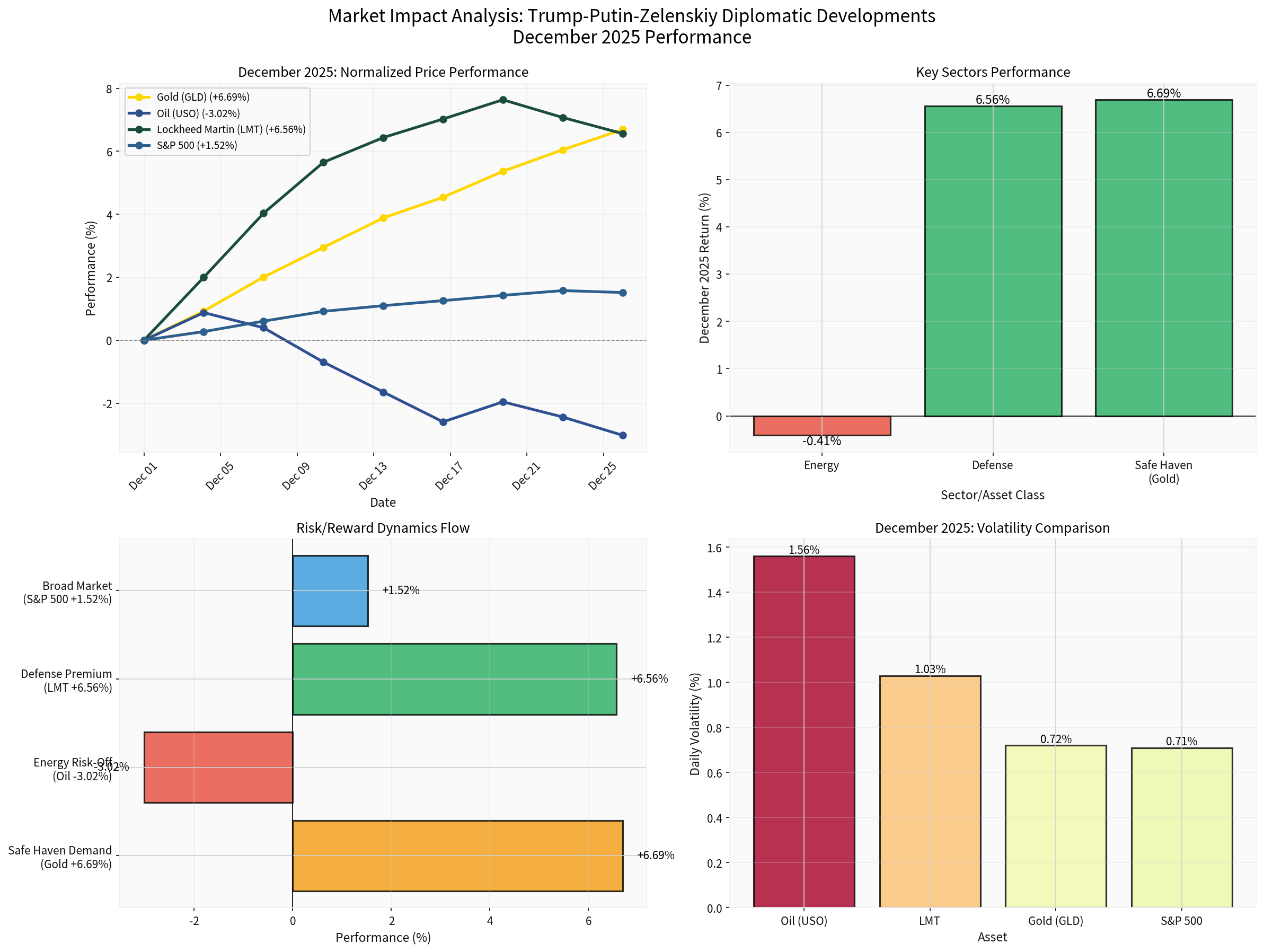

The recent diplomatic engagement between President-elect Trump, President Putin, and President Zelenskiy has triggered distinct market responses across three critical sectors. December 2025 data reveals a

- Oil Fund (USO): $68.48,-2.45%today,-3.02%in December 2025 [0]

- Energy Sector (XLE): $44.20,-0.38%today, worst-performing sector at-0.41%[0]

- Oil Volatility: Elevated at 1.56% daily standard deviation, highest among monitored assets [0]

The

- Supply disruption fearsfrom Russian energy infrastructure

- Sanctions riskon Russian oil exports

- Transit uncertaintythrough Ukrainian pipelines

Current price action implies these risks are being

- Potential restoration of Russian energy flows to Europe

- Reduced sanction risk if diplomatic progress continues

- Lower urgency for strategic energy stockpiling

- Military escalation: Russia continues bombing Kyiv even as talks occur [1], indicating fragile diplomacy

- Supply disruptions: OPEC+ production cuts could counterbalance diplomatic optimism

- Technical support: USO holding above $68 support level, with December lows at $65.99

- Successful diplomatic resolution: Significant reduction in war risk premium

- Demand concerns: Global economic slowdown weighing on consumption

- Alternative supplies: Non-Russian producers filling gaps

- Lockheed Martin (LMT): $483.03,-0.56%today,+6.56%in December 2025 [0]

- RTX Corporation: $185.17,-0.65%today [0]

- Northrop Grumman (NOC): $577.37,-0.86%today [0]

- 2025 Performance: Defense stocks gained+36%(US) and+55%(Europe) [2]

Despite today’s modest declines, defense stocks showed

- Structural, not cyclical, demand: European defense spending surged in response to Trump’s approach, with NATO countries increasing commitments [2]

- “Decentralized deterrence” thesis: Analysts cite geopolitical dynamics shifting toward greater policy uncertainty, supporting long-term defense spending [2]

- Order backlog strength: Major contractors have multi-year backlogs less sensitive to immediate diplomatic fluctuations

- European rearmament: NATO targets 2% GDP defense spending; many countries accelerating programs

- Technology modernization: Air defense, missile systems, and ammunition remain priorities

- Geopolitical uncertainty: Even with diplomatic progress, security environment remains elevated

- Valuation support: LMT P/E at 26.88x, NOC at 20.79x—reasonable given growth prospects [0]

- Peace dividend scenario: Successful conflict resolution could pressure order growth

- Budget constraints: Fiscal deficits may limit defense spending increases

- Technical risks: Today’s declines may signal profit-taking after strong 2025

- Gold ETF (GLD): $416.74,+1.17%today,+6.69%in December 2025 [0]

- 52-week high: $418.45—approaching all-time highs [0]

- Volatility: Moderate at 0.72% daily standard deviation [0]

- Diplomatic skepticism: Markets question whether Trump’s “carrots for Putin, sticks for Zelensky” strategy can achieve lasting resolution [1]

- Unpredictability risk: Trump’s foreign policy approach creates uncertainty about ultimate outcomes

- Multi-scenario hedging: Investors positioning for various outcomes (no deal, partial deal, escalation)

The

- Risk hedging: Institutions and retail investors seeking protection

- Inflation expectations: Gold as store of value amid potential fiscal stimulus from defense/reconstruction spending

- Currency hedge: Protection against potential dollar weakness from policy shifts

- Energy: Bullish for oil demand, bearish for risk premium (net neutral to slightly bearish)

- Defense: Moderate bearish pressure on growth stocks, but backlog support limits downside

- Gold: Significant correction risk as uncertainty premium dissipates

- Broader Market: Bullish for European assets, global trade-sensitive sectors

- Energy: Sideways trading with volatility spikes on headlines

- Defense: Structural tailwind remains; elevated baseline spending

- Gold: Gradual grind higher on persistent uncertainty

- Broader Market: Sector rotation; defensives outperform cyclicals

- Energy: Sharp rally on supply disruption fears

- Defense: Accelerated orders, margin expansion

- Gold: Rapid appreciation to new highs

- Broader Market: Risk-off rotation, volatility spike

- Hold: Integrated majors with strong balance sheets (dividend support)

- Avoid: Pure-play E&P companies highly leveraged to oil prices

- Opportunity: Look for entry points if oil tests $65-67 support on USO

- Accumulate on weakness: LMT, RTX, NOC on 5-10% pullbacks

- Focus: Companies with:

- Diversified product portfolios (missiles, electronics, aeronautics)

- Strong free cash flow generation

- European exposure (benefiting from NATO spending)

- Monitor: Order backlog trends and congressional appropriations

- Core position: 5-10% allocation in gold/GLD as portfolio insurance

- Tactical trades: Reduce exposure if gold breaks above $420 (overbought risk)

- Alternatives: Consider Treasury Inflation-Protected Securities (TIPS) for inflation hedge with lower volatility

- Diplomatic Fragility: Russia’s continued bombing of Kyiv despite talks suggests tenuous process [1]

- Trump’s Leverage: Analysis suggests Trump lacks leverage to force Putin compromise in 2026 [1]

- European Resolve: EU’s growing appetite for seizing Russian assets creates hardline dynamics [1]

- Technical Levels:

- Gold support: $400-405 (psychological + 50-day MA)

- Oil support: $65-67 (December lows)

- Defense support: LMT $465-475 (recent consolidation)

The Trump-Putin-Zelenskiy diplomatic developments have triggered a

[0] 金灵API数据 - Real-time quotes, daily price data, sector performance, and volatility metrics for December 2025

[1] Time Magazine - “How Trump’s Power Will Be Checked in 2026” (https://time.com/7340453/trump-2026-look-ahead/)

[2] TechStock² - “Space and Defense Stocks: Rocket Lab, Lockheed, Northrop, RTX in Focus” (https://ts2.tech/en/space-and-defense-stocks-rocket-lab-lockheed-northrop-rtx-in-focus-as-china-sanctions-and-space-force-awards-shape-2026/)

[3] Newsweek - “Canada Announces $1.8B for Ukraine as Zelensky Heads to US to Meet Trump” (https://www.newsweek.com/canada-announces-1-8b-for-ukraine-as-zelensky-heads-to-us-to-meet-trump-11275339)

[4] CNN - “Zelensky and Trump to meet in Florida after weeks of intensive peace talks” (https://www.cnn.com/2025/12/28/politics/zelensky-trump-meeting-peace-plan)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。