Fed Rate Cut Expectations: Impact on Asian Equities and Precious Metals

#fed_rate_cuts #asian_equities #precious_metals #market_analysis #asset_valuation

混合

A股市场

2026年1月2日

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

Fed Rate Cut Expectations: Impact Analysis on Asian Equities and Precious Metals

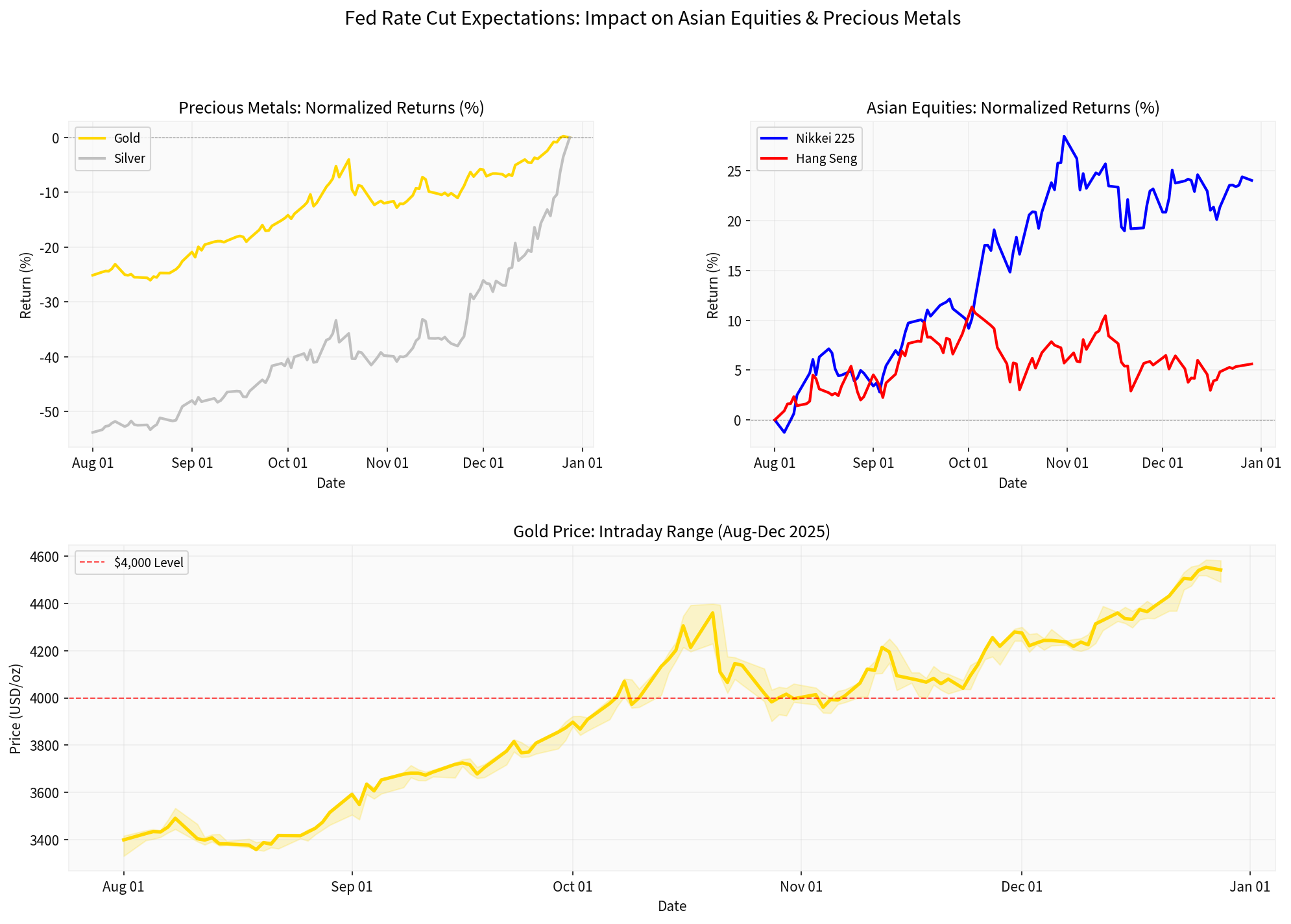

Based on comprehensive market data and current policy expectations, here is a detailed analysis of how Federal Reserve rate cut expectations are influencing asset valuations across Asian markets and precious metals.

1. Current Market Environment Overview

Market Performance Summary (Q4 2025)

| Asset Class | Current Level | Period High | Q4 Return | Daily Volatility |

|---|---|---|---|---|

Gold |

$4,014 | $4,584 | -11.61% | 0.91% |

Silver |

$48.05 | $82.67 | -39.94% | 2.49% |

Japan Nikkei 225 |

50,604 | N/A | -1.74% | 1.35% |

Hong Kong Hang Seng |

25,885 | N/A | -1.05% | 1.06% |

China Shanghai Composite |

3,976 | N/A | -0.02% | N/A |

Data: Nov-Dec 2025 period [0]

Key Pattern:

Precious metals hit record highs earlier in Q4 (gold above $4,500/oz)[0] but have since experienced profit-taking, while Asian equities demonstrate greater relative stability despite recent modest declines.

2. Fed Rate Cut Expectations Landscape

Current Market Pricing:

- 90% probabilitythe Fed will hold rates steady at the next FOMC meeting[1]

- Traders are betting on one quarter-point cut by mid-2026and potentially another later in the year[1]

- Fed has delivered three consecutive rate cuts in 2025, with markets highly anticipating each move (up to 90% probability priced-in prior to meetings)[2]

- The Fed’s final 2025 rate cut catalyzed gold’s surge above $4,300/oz[2]

Policy Context:

- US Q3 GDP grew at a robust 4.3% annualized rate, suggesting the economy remains resilient despite falling consumer confidence[1]

- Strong economic data has been trimming rate-cut expectations, creating a delicate balance between growth and accommodation needs[1]

3. Impact on Asian Equity Valuations

Valuation Mechanisms

1. Discount Rate Effect

- Lower US rates reduce the discount rate applied to future cash flows, supporting higher equity valuations

- Asian exporters benefit from improved US consumer spendingsupported by lower rates

- Technology and growth stocks see the greatest valuation expansiondue to their longer-duration cash flows

2. Currency Dynamics

- Fed rate cuts typically weaken the US dollar, making Asian exports more competitive

- USD weakeningimproves the translation of overseas earnings back to local currencies for Asian multinationals

- However, this is being partially offset by the Bank of Japan’s rate hike expectations(to 0.75% by December 2025)[3], which supports the yen and creates competitive headwinds for Japanese exporters

3. Capital Flow Considerations

- Lower US yields historically drive capital flows toward higher-yielding Asian markets

- Asian dividend stocksare gaining attention, with well-covered payouts (29-43% payout ratios, 3.14% yields)[4]

- Japan remains attractive despite BOJ tightening as even after hikes, rates would sit at just 0.75% versus 3.75% in the US[3], maintaining yield differentials favorable to carry trades

Current Valuation Status

- Asian markets are showing resilience with lower volatilitycompared to precious metals (0.91-2.49% for metals vs. 1.06-1.35% for equities)[0]

- Recent modest declines (-0.02% to -1.74%) reflect profit-taking rather than structural concerns

- Valuations remain supported by the anticipation of continued Fed accommodationin 2026

4. Impact on Precious Metal Prices

Primary Drivers

1. Opportunity Cost Reduction

- Rate cuts reduce the opportunity cost of holding non-yielding assetslike gold

- Lower real yields make precious metals more attractive relative to bonds

- This was evident as gold surged to record highs above $4,300/ozafter the Fed’s final 2025 rate cut[2]

2. Safe-Haven Demand

- Geopolitical tensions (Venezuela blockade, US conflicts)[2] have driven safe-haven buying

- Gold and silver climbed to fresh records alongside geopolitical risk escalation[2]

- This creates a dual support mechanism: monetary accommodation + risk hedging

3. De-dollarization Trend

- Central banks continue diversifying reserves away from the US dollar, with gold as a primary alternative

- Expectations of further Fed rate cuts in 2026reinforce this de-dollarization trend[1]

- Long-term structural demand supports higher price floors

Current Price Dynamics

- Gold’s record high of $4,584represents the peak of rate-cut anticipation[0]

- Recent pullback (-11.61% in Q4)reflects profit-taking as some rate cuts become priced-in

- Silver’s extreme volatility(down 40% from Q4 start, hitting $82.67 high)[0] reflects its dual role as monetary and industrial metal

- Daily volatility analysisshows silver at 2.49% vs. gold at 0.91%, indicating silver’s higher risk/reward profile[0]

5. Capital Flows and Risk Sentiment Analysis

Shifting Dynamics

1. Risk-On Rotation

- Lower Fed rates typically encourage risk-on behavior, benefiting equities over defensive assets

- However, the current environment shows a decoupling pattern: commodities peaked earlier while stocks show more stability[0]

- This suggests markets are transitioning from speculative positioning to fundamental valuation

2. Carry Trade Considerations

- Japanese yen carry traderemains a factor, with investors borrowing in low-yielding yen to invest in higher-yielding assets[3]

- BOJ rate hike to 0.75% would be the highest since 1995, but still far below US rates[3]

- This maintains structural support for risk assetsbut with reduced leverage

3. Regional Divergence

- US markets outperforming: S&P 500 +3.86%, NASDAQ +4.65%, Russell 2000 +7.43% (Nov 14 - Dec 26)[0]

- Asian markets lagging: -0.02% to -1.74% over similar period[0]

- This reflects regional growth differentialsand the stronger US dollar’s impact on emerging market capital flows

6. Forward-Looking Assessment

Scenario Analysis

Base Case (60% probability):

- One more 25bp Fed cut in mid-2026, with markets pricing this gradually

- Asian equities: Modest upside (5-10%) as earnings growth and lower discount rates support valuations

- Precious metals: Range-bound with upward bias ($3,800-$4,300 gold) as rate cut anticipation moderates

- Currency: Gradual USD weakening, supporting Asian exporters

Bullish Case (25% probability):

- Two or more Fed cuts in 2026due to economic slowdown

- Asian equities: Strong upside (10-20%) as capital flows aggressively toward growth markets

- Precious metals: Breakout to new highs (gold $4,500+)

- Trigger: Weaker-than-expected US data, aggressive Fed easing, geopolitical escalation

Bearish Case (15% probability):

- No further Fed cuts or rate hikesdue to sticky inflation

- Asian equities: Consolidation with potential downside (-5% to -15%)

- Precious metals: Profit-taking accelerates (gold retesting $3,500)

- Trigger: Stronger US data, inflation resurgence, risk aversion

Key Risks to Monitor

- US Data Surprises: Stronger jobs/inflation could delay Fed cuts

- BOJ Policy: Faster Japanese tightening could trigger carry trade unwinding[3]

- Geopolitical Escalation: Venezuela tensions, Middle East conflicts could spike safe-haven demand[2]

- Chinese Economic Recovery: Slower rebound would weigh on regional exports

- US Dollar Strength: Persistent dollar strength would pressure emerging market valuations

7. Strategic Implications for Investors

Portfolio Positioning Considerations

Asian Equities:

- Overweight export beneficiaries(technology, autos, electronics) from weaker USD and stronger US demand

- Focus on quality dividend payerswith strong balance sheets to navigate volatility[4]

- Japanese markets: Monitor BOJ policy trajectory; gradual normalization should be manageable

- Chinese exposure: Selective approach focusing on policy beneficiaries and domestic consumption

Precious Metals:

- Strategic allocationto gold (5-10% of portfolio) as hedge against monetary uncertainty and geopolitical risk

- Silver trading opportunity: Higher volatility offers attractive entry points on dips for risk-tolerant investors

- Timing consideration: Wait for post-rate-cut consolidation before adding aggressively

Risk Management:

- Diversification across regionsto mitigate currency and policy risk

- Hedging USD exposurefor international investors

- Staggered entryrather than all-in positioning given elevated volatility

Conclusion

Fed rate cut expectations are creating a

complex but constructive environment

for both Asian equities and precious metals, albeit through different transmission mechanisms and with different timing dynamics.

-

Asian equitiesare benefiting from valuation support through lower discount rates and improved export competitiveness, though gains are moderated by regional headwinds and the lag effects of policy transmission

-

Precious metalshave already priced in significant rate cut expectations, hitting record highs, and are now experiencing a period of consolidation and profit-taking

The current market reflects a

transition from speculative positioning to fundamental valuation

, with capital flows increasingly discriminating between quality and speculative assets. Investors should focus on identifying companies and assets with strong fundamentals, attractive valuations, and catalyst visibility

while maintaining defensive positioning through precious metals and diversified regional exposure.

The key will be monitoring the pace and magnitude of Fed actions in 2026

, as this will determine whether current trends accelerate, reverse, or stabilize across both asset classes.

References

[0]

金灵API数据

- Market indices, precious metals pricing, Asian equities data, volatility analysis (Dec 29, 2025)

[1]

Bloomberg

- “Dollar Set for Worst Week Since June With Focus on Data Ahead” (Dec 26, 2025) - https://www.bloomberg.com/news/articles/2025-12-26/dollar-set-for-worst-week-since-june-with-focus-on-data-ahead

[2]

Yahoo Finance

- “Gold Rockets to Fresh Record Highs After Fed’s Final 2025 Rate Cut” (Dec 2025) - https://finance.yahoo.com/news/gold-rockets-fresh-record-highs-185534489.html

[3]

Yahoo Finance

- “Bitcoin Faces Japan Rate Hike: Debunking The Yen Carry Trade Unwind Alarms” (Dec 2025) - https://au.finance.yahoo.com/news/bitcoin-faces-japan-rate-hike-053627549.html

[4]

Yahoo Finance

- “Asian Dividend Stocks To Consider In December 2025” (Dec 4, 2025) - https://finance.yahoo.com/news/asian-dividend-stocks-consider-december-043144517.html

相关阅读推荐

暂无推荐文章

基于这条新闻提问,进行深度分析...

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

暂无相关个股数据