Reddit Investor Sells AI Stocks Amid Bubble Fears vs Strong Fundamentals Analysis

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

This analysis examines a Reddit investor’s decision to liquidate all holdings in NVIDIA (NVDA), Broadcom (AVGO), Alphabet (GOOGL), and Johnson & Johnson (JNJ) after achieving approximately 12% gains, citing fears of an AI bubble [1]. The investor, influenced by Michael Burry’s perspectives, purchased these stocks at April 2025 lows and now awaits a market correction back to those levels.

The decision contrasts sharply with the underlying fundamental performance of these companies. Recent market data [0] reveals that NVDA has gained 36% year-to-date, AVGO shows 22% revenue growth, GOOGL achieved record Q3 revenue of $102.3 billion, and JNJ provides defensive stability with a 2.79% dividend yield. The AI sector continues to demonstrate robust growth, with NVIDIA securing $500 billion in Blackwell GPU orders and Broadcom establishing a $10 billion partnership with OpenAI [1][4].

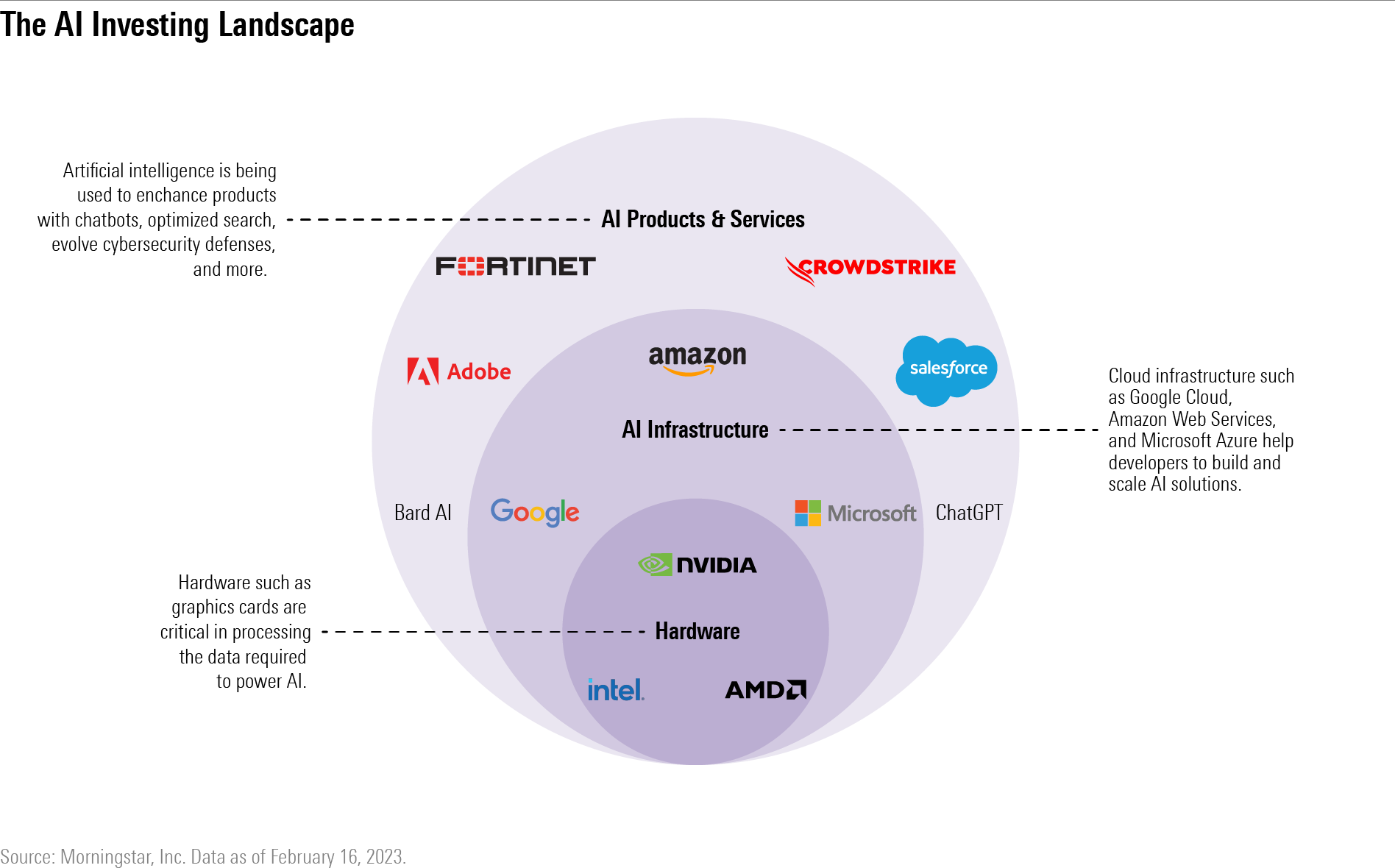

The timing of this liquidation appears particularly questionable given current market dynamics. The five major US technology companies have announced capital expenditures exceeding $470 billion for 2026, with plans to purchase over 3 million AI chips [11]. Cloud computing backlogs at Microsoft and Amazon total $600 billion, indicating sustained demand for AI infrastructure [12].

- Valuation Concerns: High P/E ratios in AI stocks could lead to corrections if growth expectations aren’t met [1]

- Macroeconomic Headwinds: Inflation, tariffs, and unemployment concerns cited by the investor remain valid considerations [1]

- Market Timing Risk: Attempting to time market re-entry to April lows may result in missing continued upside potential

- AI Infrastructure Expansion: The massive capital expenditure commitments from tech giants suggest sustained demand [11]

- Custom Chip Growth: Broadcom’s position in custom AI chips presents significant growth potential through 2027 [4]

- Cloud Computing Growth: Google’s 34% cloud revenue growth indicates expanding market opportunities [7]

The Reddit investor’s liquidation decision appears driven by psychological factors and bubble concerns rather than fundamental analysis. The sold companies demonstrate strong operational performance: NVIDIA’s Blackwell GPU architecture has secured $500 billion in orders, Broadcom’s custom AI chip business is growing 40% annually, Google’s cloud revenue expansion of 34% supports sustained growth, and Johnson & Johnson provides defensive stability through consistent dividends [1][4][7][10].

Market data indicates continued AI sector expansion, with US tech giants planning $470 billion in 2026 capital expenditures and the global Cloud AI market projected to reach $4.63 trillion by 2030 [11][12]. The semiconductor industry, particularly AI-focused companies, shows strong growth prospects with Broadcom’s AI revenue expected to reach $10 billion by 2027 [4].

The decision to exit positions after 12% gains, while the stocks have delivered 30-36% year-to-date performance, suggests potential opportunity cost. However, the investor’s concerns about macroeconomic factors including inflation and tariffs reflect legitimate market risks that should be monitored [1].

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。