Novo Nordisk Executive Fainting Incident During White House Drug Pricing Announcement

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

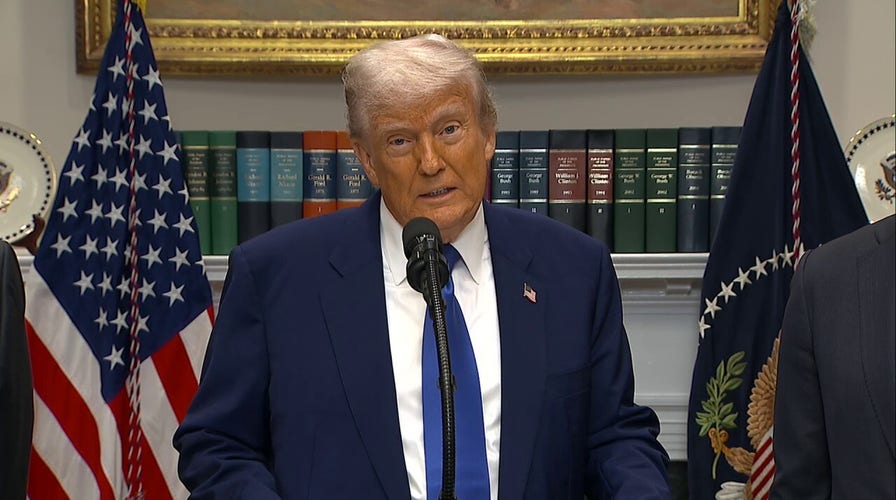

This analysis is based on news reports [1][2] about a White House press conference on November 6, 2025, where President Donald Trump announced a major drug pricing agreement with pharmaceutical companies.

During a White House Oval Office press conference on November 6, 2025, a healthcare executive collapsed behind President Trump while he was announcing a significant drug pricing agreement [1][2]. The incident occurred around 1:00 PM EST during Eli Lilly CEO David Ricks’ remarks about new price reductions for weight loss drugs [2]. The individual was assisted by Dr. Mehmet Oz and others, with White House Press Secretary Karoline Leavitt confirming the person “fainted” but was “expected to recover” [1].

Novo Nordisk (NVO) experienced substantial market movement on November 6, closing at $46.51, down 4.02% (-$1.95) on trading volume of 43.12 million shares—nearly 3x the average daily volume of 15.16 million shares [0]. The stock traded in a wide intraday range of $46.28 - $49.56, indicating significant volatility [0].

Initial reports identified the individual who fainted as Gordon Findlay, described as a Novo Nordisk healthcare executive [1]. However, Novo Nordisk later clarified that Gordon Findlay was NOT present at the event, stating that only CEO Mike Doustdar and EVP of US Operations Dave Moore represented the company at the press conference [3]. This discrepancy raises questions about the accuracy of initial reporting and the actual identity of the individual who experienced the medical incident.

The press conference was announcing a landmark agreement where Novo Nordisk and Eli Lilly agreed to reduce prices for GLP-1 drugs (Ozempic, Wegovy) to approximately $150/month for Medicare/Medicaid patients [1][2]. This represents the first time these weight loss drugs would be available through federal programs, providing tariff relief and expanded market access in exchange for price concessions [2].

Several factors suggest the stock decline was driven more by the pricing agreement than the medical incident:

- Sector Performance: The healthcare sector actually performed positively on November 6, up 0.43%, indicating company-specific factors rather than sector-wide issues [0]

- Pre-Event Momentum: NVO had gained 3.15% on November 5, suggesting positive momentum ahead of the White House announcement [0]

- Competitive Dynamics: Eli Lilly was also part of the agreement, suggesting sector-wide pricing pressures rather than company-specific issues

Despite the daily decline, NVO maintains robust financial metrics with a P/E ratio of 12.29x and net profit margin of 35.61% [0]. The current analyst consensus remains “BUY” with 66.7% of analysts rating the stock as Buy [0], suggesting professional investors view the fundamentals as intact.

Novo Nordisk has been experiencing significant volatility, with YTD performance down 46.86% through November 6, 2025, trading near the low end of its $45.05 - $112.52 52-week range [0]. However, the stock is up 32.21% over 5 years, indicating long-term value creation despite recent challenges [0].

- Margin Compression: The significant price reductions to approximately $150/month could impact profitability despite increased volume [1][2]

- Regulatory Scrutiny: The agreement may signal increased government pressure on pharmaceutical pricing moving forward

- Information Uncertainty: The conflicting reports about the executive’s identity create uncertainty about the incident’s implications

- Market Expansion: Medicare/Medicaid access represents a significant new patient population for GLP-1 drugs

- Competitive Positioning: Being part of the first federal agreement for weight loss drugs could establish market leadership

- Volume Growth: Lower prices could drive substantial volume increases that offset margin pressure

- Q4 2025 Earnings: Watch for guidance on how the pricing agreement will impact 2026 financial performance

- Competitive Response: Monitor how Eli Lilly and other GLP-1 competitors respond to the pricing structure

- Regulatory Developments: Track any additional government actions on drug pricing that could affect the broader pharmaceutical sector

The November 6, 2025 incident at the White House occurred during a strategically important announcement about drug pricing agreements. While the medical emergency created immediate market attention, the more significant business development was the pricing agreement that expands Medicare/Medicaid access for GLP-1 drugs. The stock’s 4.02% decline on triple normal volume [0] reflects investor concerns about margin compression from the price reductions, though the company’s strong fundamentals (35.61% net profit margin, 12.29x P/E) [0] and continued analyst Buy ratings [0] suggest confidence in long-term value creation. The conflicting reports about the executive’s identity [1][3] highlight the importance of verifying information during breaking news events, particularly when market reactions are involved.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。