Wood Group's UK T&D Business Sale: Strategic and Valuation Impact Analysis

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

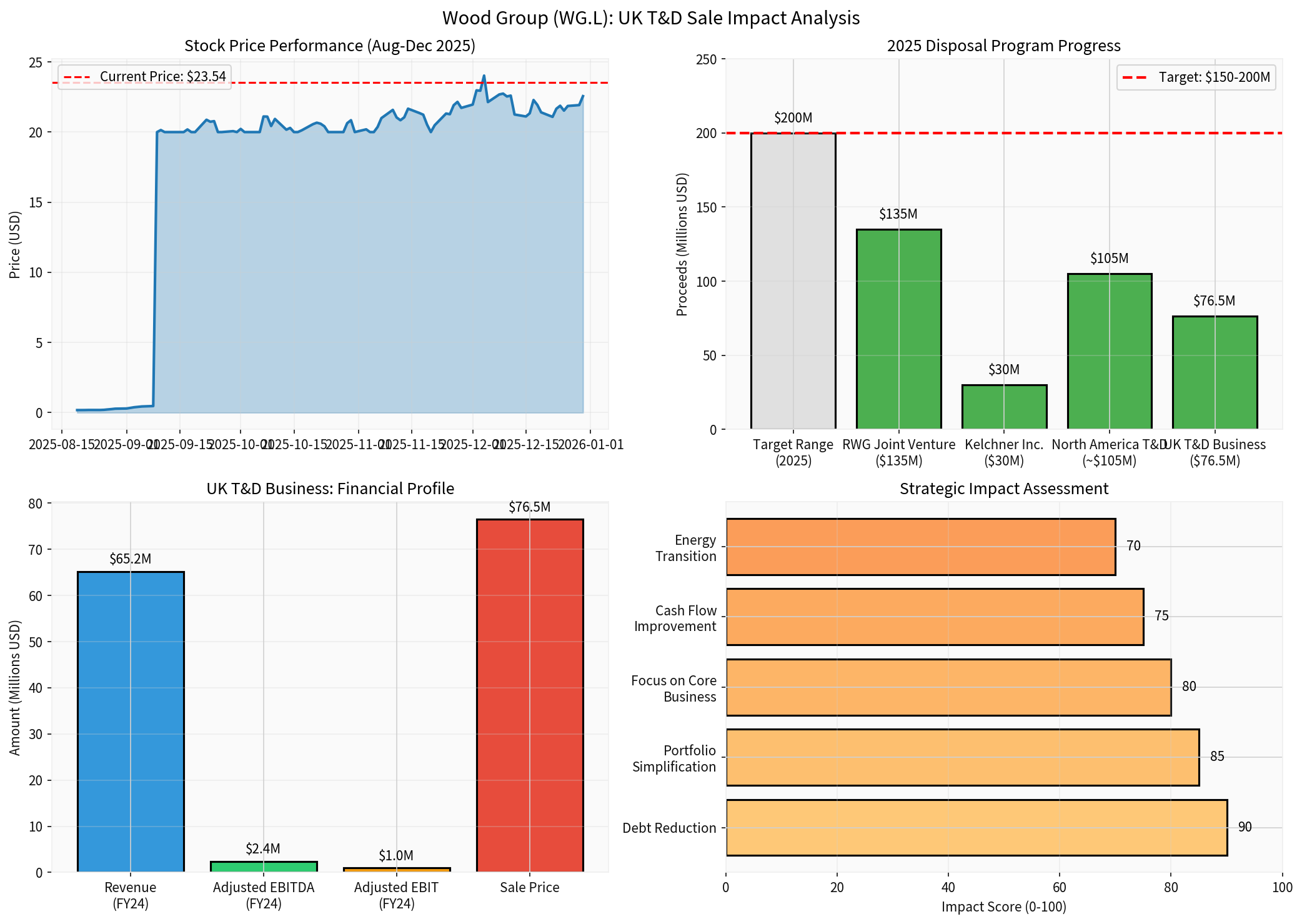

Wood Group’s sale of its UK Transmission & Distribution (T&D) business to United Infrastructure for £57.5 million ($76.5 million) represents a significant milestone in the company’s broader portfolio transformation strategy[1]. This transaction, combined with other disposals in 2025, has generated approximately $345 million in total proceeds—substantially exceeding the original target range of $150-200 million[2]. The strategic divestment is designed to strengthen Wood’s financial position, simplify its business portfolio, and accelerate its focus on core high-margin services within the energy transition theme.

Parameter |

Value |

|---|---|

Buyer |

UI Telecoms & Power Holdco Limited (United Infrastructure) |

Sale Price |

£57.5 million (~$76.5 million) |

Expected Completion |

December 31, 2025 |

FY24 Revenue |

$65.2 million |

FY24 Adjusted EBITDA |

$2.4 million |

FY24 Adjusted EBIT |

$1.0 million |

Net Assets (FY24) |

$(1.6) million |

Source: Company disclosures[1]

The UK T&D business provided engineering, procurement, construction, and installation services for overhead line and underground cable projects in the UK, serving Distribution Network Operators (DNOs)[3].

The UK T&D sale is part of Wood Group’s comprehensive disposal program targeting non-core businesses. In 2025 alone, the company has agreed to four major transactions:

- RWG Joint Venture:$135 million (sale to Siemens Energy)

- Kelchner Inc.:$30 million (U.S. civil construction services)

- North America T&D:~$105 million (sale to Qualus)

- UK T&D Business:$76.5 million (sale to United Infrastructure)[2]

The disposal program aligns with Wood’s strategy to:

- Exit lower-margin infrastructure services(T&D operations historically generated thin margins)

- Concentrate on core high-margin servicesin energy consulting, project management, and technical solutions

- Enhance exposure to energy transition marketsincluding renewables, carbon capture, hydrogen, and decarbonization[4]

- Reduce reliance on large-scale lump sum turnkey (LSTK) contractswhich carry higher execution risk[4]

By divesting UK and North American T&D assets, Wood is strategically reallocating capital to higher-growth regions, particularly:

- Middle East:Strong demand in Iraq and wider region (contracts up nearly 20% in 2025)[5]

- Emerging energy transition marketsacross 60+ countries globally[4]

- Current Net Debt:~$1.1 billion (as of 2024)[2]

- 2025 Expected Free Cash Flow:Negative $(150) million to $(200) million[2]

- Debt Classification:High risk per financial analysis[0]

- Immediate cash infusionof $76.5 million to reduce net debt by approximately 7%

- Proceeds utilization:Specifically earmarked for debt reduction and general corporate purposes[6]

- Debt-to-equity improvement:Supports deleveraging efforts amid challenging capital structure

With ~$345 million in total disposal proceeds (vs. $150-200 million target), Wood is positioned to:

- Offset the 2025 negative free cash flow entirely

- Maintain net debt at 2024 levels of ~$1.1 billion

- Create liquidity buffer for operational improvements[2]

- Annual revenue reduction:~$65.2 million (UK T&D contribution)[1]

- EBITDA reduction:~$2.4 million (minimal impact on consolidated profitability)[1]

- Capital structure:Sale of a business with negative net assets (-$1.6 million) improves balance sheet quality[1]

- Exit low-margin T&D services:Historically thin margins in infrastructure construction

- Portfolio mix improvement:Shift toward higher-margin consulting and technical services

- Simplification benefits:Reduced complexity, overhead, and working capital requirements

The UK T&D business generated

Metric |

Value |

Interpretation |

|---|---|---|

Market Cap |

$162.57 million | Severely depressed valuation |

Current Price |

$23.54 | Post-restructuring recovery from $0.18 low[0] |

P/E Ratio |

-1.97x | Negative earnings (loss-making) |

P/B Ratio |

0.06x | Trading at deep discount to book value |

ROE |

-3.01% | Negative return on equity[0] |

- Debt reduction of ~7%improves financial stability during restructuring

- Strategic clarityfrom accelerated portfolio simplification

- Focus on higher-growth, higher-margin segmentsmay justify improved multiple

- Cash generationfrom disposals exceeds expectations, demonstrating execution capability

- Loss of $65.2M revenue(though low-margin) reduces top-line

- Continued negative earningsuntil turnaround materializes

- High leverage persistsdespite disposals (net debt still ~$1B+)

- Execution riskin transitioning business model

The disposals, including UK T&D, support Wood’s target of

- Stabilization of legacy claims liabilities (~$150M over 3 years)

- Working capital normalization

- Margin expansion from portfolio simplification (~$60M annual savings from 2025)[4]

If successful, this turnaround could justify a significant valuation re-rating from current distressed levels.

The UK T&D sale accelerates Wood’s transformation into a

-

Core Business Concentration:

- Energy consulting and advisory services

- Project management for energy transition projects

- Technical solutions for decarbonization

- Digital and innovation-led services[4]

-

Geographic Prioritization:

- Middle East expansion:Strong growth in Iraq (contracts up nearly 20% in 2025)[5]

- Energy transition hubs:Renewables, hydrogen, carbon capture globally

- Selective presence:Maintaining operations only in high-return markets

-

Business Model Evolution:

- Reduced LSTK exposure:Lower risk, higher predictability

- Fee-based services:More stable, asset-light revenue streams

- Partnership-led growth:Collaborating rather than owning entire project lifecycle

Proceeds from disposals (including UK T&D) will support:

- Debt reduction(primary priority)

- Investment in digital solutionsand energy transition capabilities[4]

- Selective strategic acquisitionsin core focus areas

- Working capital stabilizationduring transition

- Transition disruption:Divesting multiple businesses simultaneously creates operational complexity

- Talent retention:Key employee departures during organizational restructuring

- Client relationships:Potential revenue attrition from dispositions

- Insufficient proceeds:Even with ~$345M in disposals, net debt remains elevated at ~$1.1B

- Cash flow pressure:Negative FCF in 2025 requires careful liquidity management

- Legacy liabilities:~$150M in claim costs over 3 years continues to strain cash flow[2]

- Energy transition timing:Pace of renewable energy adoption affects growth opportunities

- Competitive pressure:Established competitors in core consulting segments

- Macro volatility:Oil & gas price volatility impacts traditional client base

- Debt reduction remains criticalto stabilize balance sheet

- Focus on cash generationto achieve positive FCF in 2026 (as targeted)[2]

- Monitor executionof portfolio transition and margin improvement

- Successful delivery of positive FCFcould trigger valuation re-rating

- Proof of strategic transformationthrough revenue mix shift to energy transition

- Potential strategic alternativesincluding partnership or M&A if standalone execution falters

- Current valuation(P/B 0.06x) prices in significant distress, creating potential upside if turnaround succeeds

- Disposal executionhas exceeded expectations, demonstrating management credibility

- Key catalystsinclude 2026 positive FCF delivery and sustained margin expansion

- Employees:Focus on core segments offers clearer career path in high-growth areas

- Clients:Simplified portfolio may enable deeper expertise in energy transition

- Counterparties:Reduced leverage from disposals improves credit profile (though still high-risk)

Wood Group’s sale of its UK T&D business to United Infrastructure for $76.5 million represents a strategically prudent step in an ambitious portfolio transformation. The transaction, combined with other 2025 disposals totaling ~$345 million, provides immediate financial relief through debt reduction while positioning the company for sustainable growth in higher-margin energy transition services.

The

Ultimately, the UK T&D sale is a necessary component of Wood’s broader reinvention from a diversified energy services conglomerate to a focused, high-margin advisor in the global energy transition. The success of this strategy will determine whether current valuations represent a compelling opportunity or a value trap.

https://www.woodplc.com/news/latest-press-releases/2025/sale-of-uk-t-and-d-busines

https://www.woodplc.com/news/latest-press-releases/2025/business-update

https://unitedinfrastructure.com/news/acquisition-of-woods-uk-transmission-and-distribution-business/

https://matrixbcg.com/blogs/growth-strategy/woodplc

https://www.iraqinews.com/iraq/wood-sees-strong-iraq-demand-as-middle-east-awards-jump-nearly-20/

https://www.woodplc.com/news/latest-press-releases/2025/sale-of-north-america-t-and-d-to-qualus

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。