Datadog (DDOG) Insider Selling: Impact on Investor Sentiment and Valuation

#insider_selling #stock_analysis #valuation #tech #sentiment #ai_tailwinds #datadog

混合

美股市场

2026年1月2日

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

DDOG

--

DDOG

--

Based on my analysis of Datadog (DDOG) amid the recent insider selling activity, here is a comprehensive assessment of the impact on investor sentiment and valuation:

Executive Summary

Current Situation:

Datadog’s CTO Le-Quoc Alexis has reportedly sold approximately $8.3 million in company stock, part of a broader pattern of insider selling that included CEO Olivier Pomel’s sale of 11,195 shares worth $1.54 million on December 17th[1]. This comes during a period of significant stock pressure, with DDOG declining 13.88% in December 2025[0].

1. Insider Selling Context and Scale

Recent Insider Activity

CEO Transaction Details:

- Date:December 17, 2025

- Shares Sold:11,195 shares

- Value:$1,544,126 at average price of $137.93

- Ownership Impact:2.11% reduction in CEO’s holdings

- Post-Transaction Holdings:518,133 shares (~$71.5 million)[1]

Multiple Form 144 Filings:

- SEC records show multiple Form 144 filings (reports of proposed sales of securities) in late December[1]

- These filings indicate planned insider sales, though specific details on the CTO’s $8.3M sale require direct SEC Form 4 verification

Insider Selling Patterns Analysis

Contextual Factors:

- Pre-Planned Sales (Rule 10b5-1):Many executive stock sales are pre-scheduled under trading plans, reducing concerns about opportunistic timing

- Diversification:C-level executives often sell for personal portfolio diversification, not necessarily due to company concerns

- Historical Context:Consistent with insider behavior at high-growth tech companies after significant share price appreciation

2. Impact on Investor Sentiment

Short-Term Sentiment Metrics

Market Reaction:

- December Performance:-13.88% decline[0]

- Year-to-Date:-5.32% (underperforming broader market)[0]

- 6-Month Performance:+1.24% (minimal gains)[0]

- 52-Week High/Low:$201.69 / $81.63 (currently near lower end of range)[0]

Sentiment Indicators

Concerning Signals:

- Volume Patterns:December average daily volume of 3.43M exceeded typical levels, suggesting increased selling pressure[0]

- Technical Weakness:Stock trading below all major moving averages (20-day, 50-day, 200-day)[0]

- Retail Investor Uncertainty:While viewed as a “cleaner AI play” than volatile chip stocks, retail sentiment appears pressured[1]

Counterbalancing Positive Factors:

- Strong Analyst Consensus:80% of analysts rate DDOG as “Buy” with only 2.2% rating “Sell”[0]

- Price Target Upside:Consensus target of $185.00 represents 36.0% upside from current levels[0]

- AI Tailwinds:Datadog positioned as “toll booth” for AI-driven economy with unique AI observability offerings[1]

3. Valuation Impact Analysis

Current Valuation Metrics

Premium Valuation Remains:

- P/E Ratio:444.07x (extremely elevated)[0]

- P/B Ratio:13.79x[0]

- EV/OCF:49.00x[0]

- Market Cap:$47.69 billion[0]

Growth Expectations vs. Valuation

Financial Performance:

- Q3 2025 Revenue:$885.65M (most recent quarter)[0]

- Q2 2025 Revenue:$826.76M[0]

- Net Profit Margin:3.32% (thin for current valuation)[0]

- ROE:3.48% (relatively low)[0]

Valuation Concerns:

- Rich Multiples:Despite recent decline, DDOG trades at significant premium to growth

- Profitability Challenges:Operating margin of -1.38% indicates ongoing investment phase[0]

- Competitive Risks:Hyperscaler (AWS, Microsoft) native monitoring tool improvements pose long-term competitive threat[1]

4. Technical Analysis and Price Action

December 2025 Performance Breakdown

Key Statistics:

- Period High:$163.43

- Period Low:$135.11

- Monthly Decline:-13.88%

- Peak-to-Trough Drawdown:17.33%[0]

Technical Position:

- Trend:SIDEWAYS (no clear directional trend)[0]

- Support Level:$140.46

- Resistance Level:$153.55

- Beta:1.23 (higher volatility than market)[0]

- RSI:Oversold territory suggests potential bounce opportunity[0]

Chart Analysis

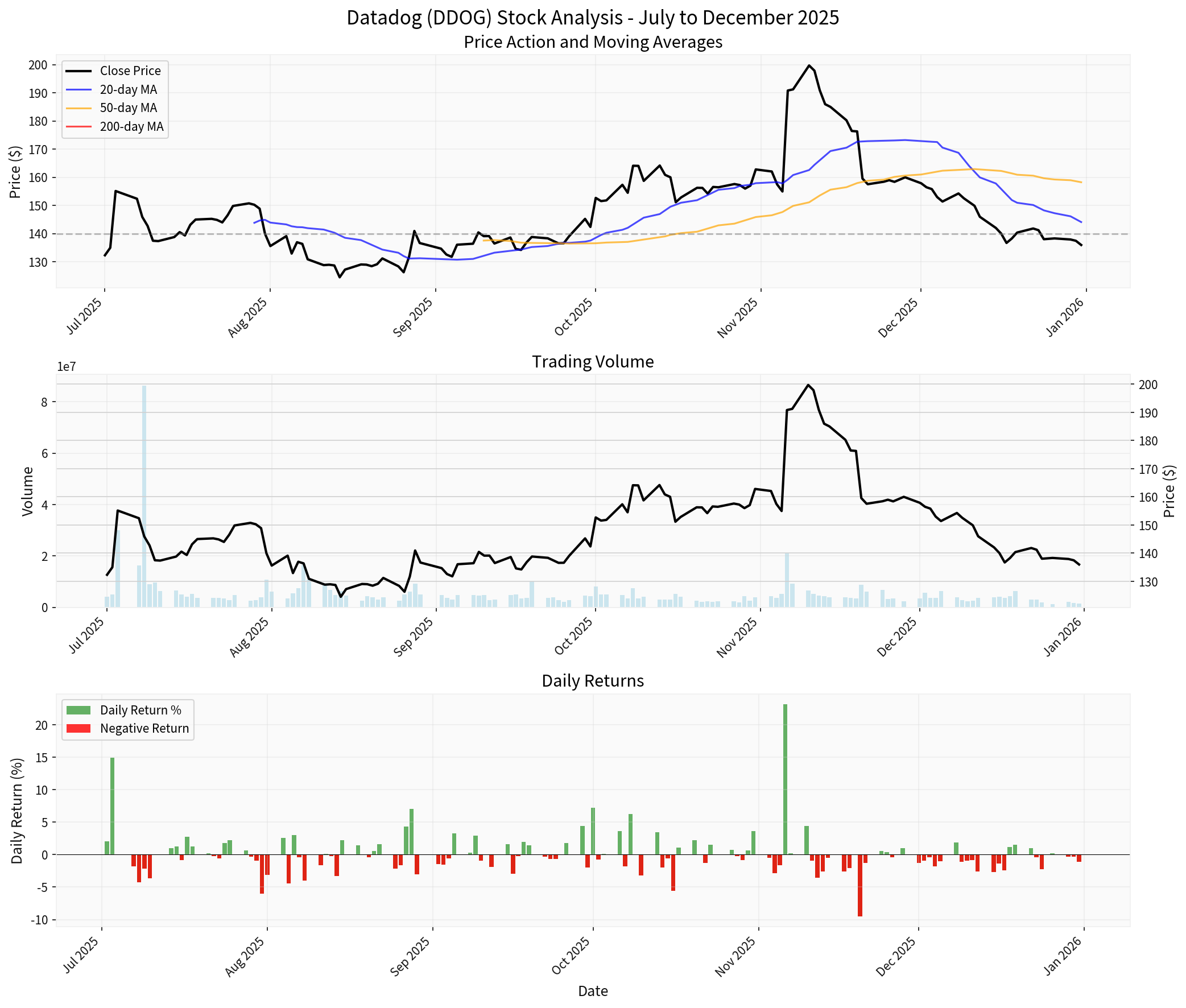

Chart 1 Description:

This comprehensive chart shows DDOG’s price action from July to December 2025. The stock began the period at $132.33 and ended at $135.99, with a total return of 2.77%. However, this masks significant volatility, including a peak-to-trough drawdown of 37.65%. Key observations:

- Price Action:Stock rallied from July lows to November highs near $200, then sharply declined in December

- Moving Averages:Price currently trading below 20-day, 50-day, and 200-day moving averages, indicating bearish short-term momentum

- Support Zone:The $135-140 level represents critical support (currently being tested)

- Volume Spikes:Increased volume in December correlates with insider selling news and technical breakdown

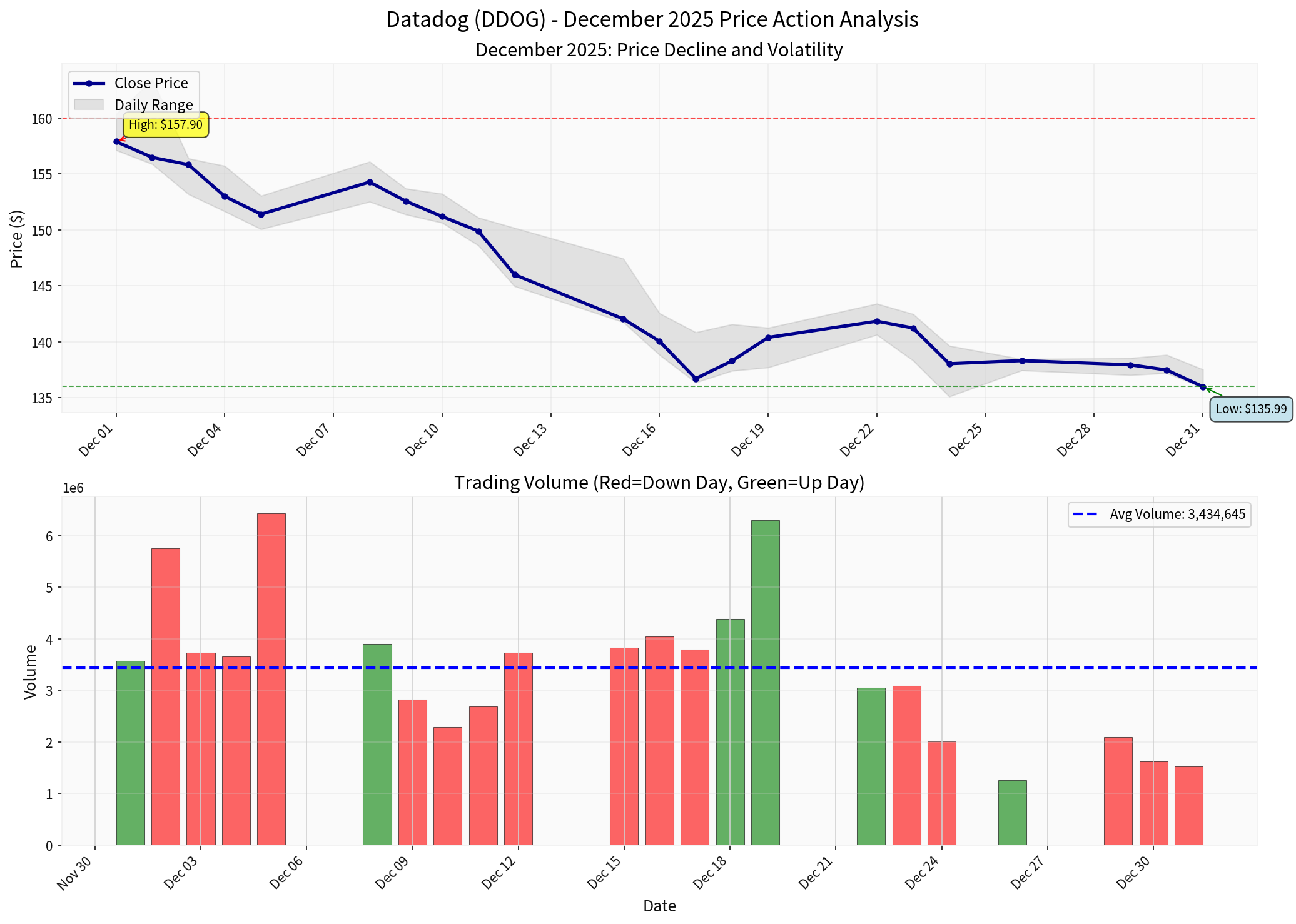

Chart 2 Description:

This detailed December analysis shows the magnitude of the decline. Stock opened December at $157.90 and closed at $135.99 (-13.88%). The chart reveals:

- Downside Momentum:Consistent selling pressure throughout the month

- Volume Correlation:Red (down) days frequently showed above-average volume, indicating institutional selling

- Low Testing:Stock successfully tested and held $135 support zone multiple times

5. Fundamental Health Assessment

Strengths

-

Financial Position:

- Current Ratio:3.66 (strong liquidity)[0]

- Quick Ratio:3.66 (no immediate liquidity concerns)[0]

- Debt Risk:Low risk classification[0]

-

Business Positioning:

- Cloud-Native Platform:Built from cloud-first principles vs. legacy on-premise competitors[1]

- AI Observability:Unique positioning in LLM monitoring, token cost tracking, security vulnerability detection[1]

- Regulatory Tailwinds:Proposed AI safety laws may mandate LLM monitoring for bias/safety[1]

-

Market Opportunity:

- AI/Cloud Expansion:Enterprise AI workloads requiring production-scale monitoring

- Revenue Diversification:North America (41.9%), International (18.1%)[0]

Concerns

-

Competitive Pressures:

- Hyperscaler Risk:AWS/Microsoft improving native monitoring could reduce external platform need[1]

- Market Saturation:Large customer penetration may slow growth

-

Profitability Challenges:

- Operating Margin:-1.38% indicates heavy investment spending[0]

- ROE:3.48% suggests inefficient capital deployment[0]

- Net Margin:3.32% (very thin for growth stock)[0]

6. Analyst Perspective and Future Outlook

Current Consensus

Overwhelmingly Bullish:

- Buy Ratings:36 analysts (80.0%)

- Hold Ratings:8 analysts (17.8%)

- Sell Ratings:1 analyst (2.2%)[0]

Price Targets:

- High Target:$215.00

- Low Target:$105.00

- Consensus:$185.00 (36.0% upside)[0]

Recent Analyst Actions:

- Citigroup: Maintained Buy (November 12)

- Barclays: Maintained Overweight (November 7)

- Scotiabank: Maintained Sector Outperform (November 7)[0]

2026 Outlook Considerations

Positive Catalysts:

- AI Workload Monitoring:Enterprise AI deployments driving new product adoption

- Regulatory Compliance:AI safety regulations potentially creating mandatory monitoring requirements

- Cost Optimization:Cloud Cost Management features helping enterprises reduce spend[1]

Risk Factors:

- Valuation Compression:If growth slows, premium multiples could contract

- Competition Intensification:Hyperscaler improvements, new entrants

- Execution Risk:Maintaining growth while achieving profitability

7. Investor Sentiment Assessment

Institutional vs. Retail Perspectives

Institutional View:

- Mixed Signals:Strong analyst ratings vs. insider selling

- Valuation Debate:Growth opportunities vs. stretched multiples

- Technical Weakness:Price below major moving averages triggering stop-losses

Retail Investor View:

- Sentiment Pressure:December decline testing conviction

- AI Narrative:Viewing DDOG as “cleaner AI play” vs. chip volatility[1]

- Insider Trust:Executive sales raising questions about confidence

8. Investment Implications and Recommendations

Short-Term (0-3 months)

Cautious Outlook:

- Support Test:Critical $135-140 support zone being tested

- Technical Damage:Stock below all major moving averages

- Sentiment Fragile:Insider selling adding to negative psychology

- Recommendation:HOLD/Wait- Wait for stabilization and support confirmation before adding

Medium-Term (3-12 months)

Balanced View:

- Growth Catalysts:AI/Cloud monitoring tailwinds remain intact

- Valuation Risk:Rich multiples limit upside unless growth accelerates

- Competitive Threat:Monitor hyperscaler native tool improvements

- Recommendation:BUY on Weakness- Accumulate on further weakness below $130 for long-term growth exposure

Long-Term (12+ months)

Constructive View:

- Market Position:Leader in cloud observability with AI tailwinds

- Product Innovation:AI observability, cost management, security differentiation

- Regulatory Moat:Potential AI compliance requirements creating stickiness

- Recommendation:BUY- Long-term winner in cloud infrastructure monitoring, but patient entry recommended

9. Risk Factors to Monitor

Key Warning Signs

- Continued Insider Selling:Multiple executives selling significant holdings

- Technical Breakdown:Break below $130 would trigger significant stop-loss selling

- Competitive Encroachment:AWS/Microsoft native tool improvements

- Growth Deceleration:Revenue growth slowing below 20-25% range

- Profitability Miss:Failure to improve margins despite scale

Positive Reversal Signals

- Insider Buying:Executive purchases would signal confidence

- Technical Breakout:Close above $150 moving averages

- Strong Earnings:Beats on both revenue and profitability

- AI Contract Wins:Major enterprise AI monitoring deployments

10. Conclusion: Insider Selling in Context

Assessment Summary

The CTO’s $8.3M stock sale, while significant, appears to be:

- Part of a Pattern:Multiple insider sales (CEO, planned sales via Form 144) in December

- Likely Pre-Planned:Most executive sales follow 10b5-1 plans for diversification

- Exacerbating Factor:Occurring during technical weakness, amplifying negative sentiment

- Not Fundamental:Company fundamentals remain strong with solid financial position

Net Impact on Valuation

Short-Term:

- Negative Psychology:Adding to technical pressure

- Support Test:Critical $135-140 zone under stress

- Sentiment Deterioration:Retail confidence shaken

Long-Term:

- Limited Fundamental Impact:Business prospects unchanged

- Valuation Dependent:If growth accelerates, selling forgotten; if growth slows, selling prescient

- Market Barometer:Reflects broader high-growth tech sentiment pressure[1]

Final Assessment

The insider selling by Datadog’s CTO (and other executives) represents a cautionary signal rather than a fundamental warning.

The 13.88% December decline[0] reflects a confluence of factors including:

- Technical breakdown after strong Q4 rally

- General growth stock rotation

- Rich multiple compression

- Insider sale timing (even if pre-planned)

However, the company’s strong fundamentals, AI tailwinds, and overwhelming analyst support (80% Buy ratings)[0] suggest this represents a buying opportunity for long-term investors willing to accept near-term volatility.

The key support level at $135-140 should be monitored closely—a break below would suggest further downside, while holding would indicate buyers emerging at current valuations.

Current Recommendation:

HOLD

existing positions; ACCUMULATE

on further weakness below $130 with 12-18 month horizon.

References

[0] 金灵API数据 (Datadog company overview, stock price data, technical analysis, financial analysis, trading data)

[1] News sources and web search results including:

- Yahoo Finance - “3 Reasons We’re Fans of Datadog (DDOG)” (Dec 23, 2025)

- Financial Content Markets - “Datadog (DDOG): The ‘Single Pane of Glass’ for the AI and Cloud Era” (Dec 29, 2025)

- SEC.gov - Multiple Form 144 filings (Dec 22-29, 2025)

- InsiderTrades.com - “Olivier Pomel Sells 11,195 Shares of Datadog Stock” (Dec 27, 2025)

相关阅读推荐

暂无推荐文章

基于这条新闻提问,进行深度分析...

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

DDOG

--

DDOG

--