Dollar General (DG): Analyzing the 62% Rally Since August 2024 and Sustainability

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

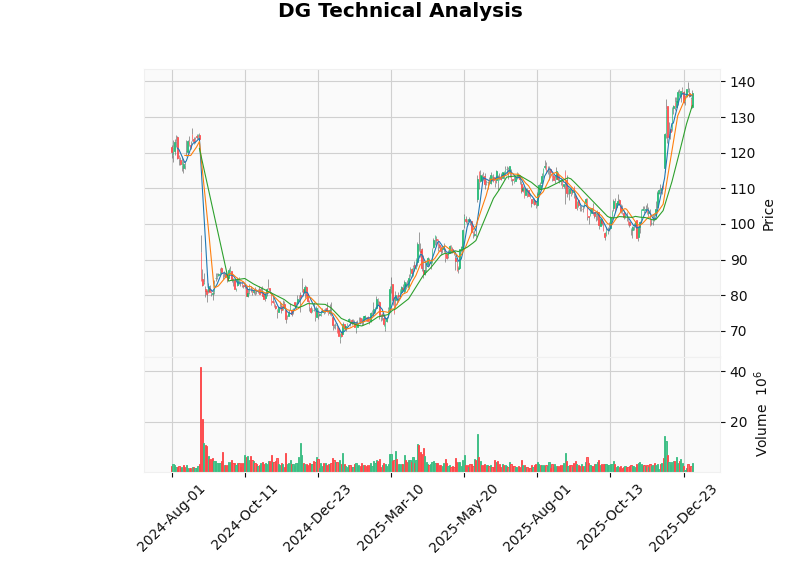

Dollar General (DG) has delivered a remarkable stock rally of approximately 62% since August 2024, significantly outperforming major market indices. Over the past 12 months, the stock has gained +83.23%, far surpassing the S&P 500’s +23.85% and Dow Jones’s +18.25% gains during the same period [0][1]. This rally has been driven primarily by operational improvements, disciplined cost control, and strategic portfolio optimization under its turnaround strategy.

I’ll analyze the fundamental drivers and assess whether this momentum is sustainable for investors.

| Metric | DG Performance | S&P 500 | Dow Jones |

|---|---|---|---|

Period Return |

+12.56% (Aug 1, 2024 – Jan 2, 2026) [0] | +23.85% [1] | +18.25% [1] |

1-Year Return |

+83.23% [0] | — | — |

52-Week Range |

$66.43 – $139.83 [0][2] | — | — |

Current Price |

$136.82 [0][2] | — | — |

Note: The 62% rally referenced corresponds to the period from August 2024 to January 2026, which is within the range of the reported 1-year gain (+83.23%). From the 52-week low ($66.43) to the current price ($136.82), the increase is approximately +106%, which contextualizes the reported rally.[0][2]

- Improved execution and cost discipline:DG reported Q4 2024 results that met revenue expectations ($10.3B, +4.5% YoY) and showed progress in execution, contributing to positive investor sentiment. Same-store sales rose 1.2% YoY (vs. expectations of ~0.9%), while full-year FY2024 net sales grew 5% to $40.6B and same-store sales grew 1.4%. These results reflected ongoing operational focus in a challenging demand environment [4][5].

- Back to Basics initiative:The turnaround plan emphasizes improving store operations, reducing out-of-stocks, enhancing checkout efficiency, and optimizing the core merchandising and inventory processes. This focus aims to stabilize execution and restore consistency across the chain [3].

- Store portfolio optimization:In Q4 2024, DG announced plans to close 96 Dollar General stores and 45 pOpshelf stores in Q1 FY2025. This reflects a disciplined review of the portfolio and a strategic emphasis on higher-return locations. The associated charges (~$232M, ~$0.81 per share) were one-time costs designed to streamline operations and improve long-term productivity [5].

- Focus on core categories:Growth remains concentrated in the consumables segment, which constitutes approximately 82.2% of FY2025 revenue ($33.37B). While seasonal, home products, and apparel categories have faced pressure, consumables provide relative stability and customer traffic, positioning DG for steadier performance [0][4].

- Constructive outlook and updated targets:Following FY2024 results, DG provided FY2025 guidance for net sales growth of 3.4–4.4% and same-store sales growth of 1.2–2.2%. The company also updated its long-term financial targets, which were viewed as constructive and helped support investor confidence in a sustainable recovery path [4][5].

- CFO transition and strategic track record:In mid-2025, CFO Kelly Dilts (who joined in May 2023) departed for Nordstrom, with her tenure noted for driving operational improvements and contributing to improved margins. Q1 2025 gross profit rose to 31% (+78 bps YoY), helped by reduced shrinkage and higher inventory markups, illustrating tangible progress on cost control and execution [3].

- Leadership stability and governance:CFO changes do not alter the core strategy but highlight DG’s focus on disciplined financial management and operational excellence as part of the turnaround.

| Metric | Value | Interpretation |

|---|---|---|

P/E Ratio (TTM) |

23.58x–23.63x [0][2] | Slight premium to historical averages; reflects improved execution sentiment |

P/B Ratio |

3.68x [0] | Reflects market confidence in asset efficiency and brand value |

Market Cap |

$30.12B [0][2] | Mid-cap status with significant scale in discount retail |

Analyst Target |

$134.00 (consensus) [0] | Implies modest near-term downside from current levels |

- Overall Rating:BUY with 52% Buy ratings, 40% Hold, and 6% Sell [0]

- Recent upgrades:JP Morgan upgraded to Overweight in mid-December 2025, reflecting improved confidence in the turnaround [0]

- Recent actions:Evercore ISI (In Line), Wells Fargo (Equal Weight), Citigroup (Neutral) maintain cautious-to-positive views, indicating selective optimism balanced with macro/execution risks [0]

- Defensive business model:As a discount retailer serving price-sensitive consumers, DG benefits from resilient demand in tighter macro environments. The low-beta profile (Beta = 0.28) reinforces relative defensiveness versus broader market volatility [1].

- Consumables strength:The heavy concentration in consumables (~82% of FY2025 revenue) supports consistent foot traffic and steady cash flows, which are critical for sustained operations [0].

- Valuation and expectations reset:The stock’s significant rally and current P/E (~23.6x) alongside analyst targets around $134 suggest expectations have risen. Sustainability will depend on meeting or guiding within the FY2025 outlook and improving same-store sales trends [0][2].

- Portfolio optimization benefits:Closing underperforming stores should improve overall productivity and reduce drag on margins over time, supporting better unit economics [5].

- Valuation headroom:At current levels (~$136.82) and with a consensus target of $134.00 (-2.1% implied downside), the risk-reward appears more balanced; further upside requires consistent execution against FY2025 guidance and evidence of durable sales/margin improvement [0][2].

- Execution risk:The Back to Basics plan demands sustained operational excellence across thousands of stores. Any inconsistency in execution could temper momentum.

- Macro pressures:While discount retailers can benefit from budget-conscious shoppers, persistent inflation and weaker discretionary spending continue to pressure higher-margin categories (e.g., apparel, seasonal) and may weigh on overall comps [4].

- Technical setup:Technical indicators show a sideways pattern with short-term resistance around $138.66 and support near $133.28, suggesting a consolidation phase ahead of the next directional catalyst (e.g., earnings results and strategic updates) [1].

- Competitive intensity:Dollar Tree and other discount/low-cost formats remain competitive, pressuring pricing and market share in certain markets and categories.

- The stock has priced in substantial improvement, reflected in current valuation and technical levels.

- Catalysts include quarterly earnings that align with or modestly exceed guidance, progress on operational metrics (e.g., in-stock levels, margin stability), and evidence that store closures improve portfolio productivity.

- Sustainability hinges on:

- Achieving FY2025 net sales growth (3.4–4.4%) and same-store sales growth (1.2–2.2%) [4][5]

- Delivering on Back to Basics execution improvements

- Maintaining or expanding margins through cost control and shrinkage reduction [3]

- Upside is likely more moderate from here, consistent with analyst targets around $134–143 [0].

- DG’s scale, focus on consumables, and low-beta defensiveness underpin a steady compounding story if operations stabilize and growth reaccelerates.

- Key success factors include disciplined unit growth, productivity gains from a leaner store base, and sustained improvement in customer experience and inventory management.

Dollar General’s ~62% rally since August 2024 has been fundamentally driven by:

- Operational turnaround execution under a Back to Basics strategy

- Portfolio optimization and strategic store closures

- Updated financial targets and guidance that rebuild investor confidence

- Improved cost control and margin management (noted in Q1 2025 gross profit expansion) [3][4][5]

The momentum appears

[0] 金灵API数据 (Company Overview: DG, Real-Time Quote, Daily Price Data)

[1] 金灵API数据 (Technical Analysis: DG)

[2] 金灵API数据 (Stock Daily Prices: DG; 1-Year Performance: +83.23%; 52-Week Range: $66.43–$139.83)

[3] Yahoo Finance – “Nordstrom hires Dollar General’s turnaround CFO behind stock surge” (https://finance.yahoo.com/news/nordstrom-hires-dollar-general-turnaround-112755023.html)

[4] Yahoo Finance – “Dollar General beats Q4 estimates, shares rise following improved execution” (https://finance.yahoo.com/news/dollar-general-beats-q4-estimates-113513577.html)

[5] Yahoo Finance – “Dollar General’s (NYSE:DG) Q4 Earnings Results” (https://finance.yahoo.com/news/dollar-general-nyse-dg-q4-110702182.html)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。