Phoenix Motor Inc. Reverse Stock Split Analysis

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Based on my comprehensive analysis of Phoenix Motor Inc. (PEV), here’s a detailed examination of the reverse stock split decision and its implications:

Phoenix Motor Inc. implemented a reverse stock split as a strategic maneuver to address critical market positioning challenges, primarily driven by NASDAQ compliance requirements and extremely low stock price levels. The company’s stock has declined by

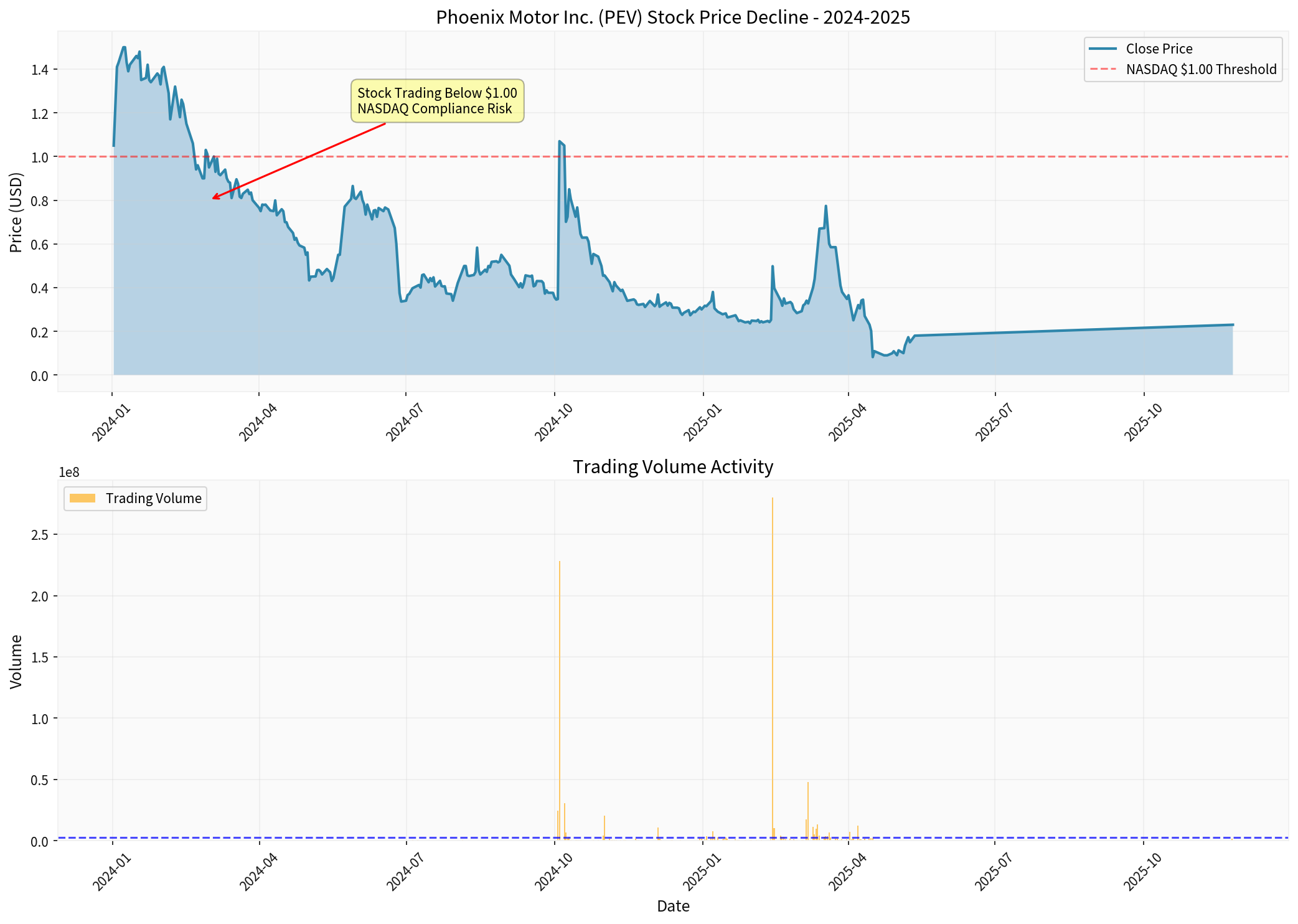

Chart illustrates PEV’s dramatic stock price decline throughout 2024-2025, showing the stock consistently trading below the $1.00 NASDAQ minimum threshold, with significant trading volume volatility.

The primary catalyst for the reverse stock split appears to be

- Current Price:$0.23 per share (as of January 3, 2026)[0]

- NASDAQ Minimum Bid:$1.00 per share requirement for continued listing

- 52-Week Range:$0.20 - $1.39[0]

- Market Cap:$10.70 million (micro-cap status)[0]

The stock has been trading below the $1.00 threshold for an extended period, placing the company at risk of

The company has experienced catastrophic value destruction over recent periods:

| Time Period | Return |

|---|---|

| YTD 2025 | -27.44%[0] |

| 1 Year | -20.69%[0] |

| 3 Years | -77.67%[0] |

| 5 Years | -94.33%[0] |

| Jan 2024 - Nov 2025 | -77.45%[0] |

The stock opened 2024 at $1.02 and has since collapsed to $0.23, representing a loss of approximately

The company’s fundamental metrics indicate significant financial distress:

- Net Profit Margin:-98.09%[0]

- Operating Margin:-101.32%[0]

- Return on Equity (ROE):-155.91%[0]

- P/E Ratio:-1.17x (negative earnings)[0]

- Latest Quarterly Revenue:$2.74M (declining from prior quarters)[0]

The company has reported

-

No Fundamental Value Creation

- A reverse split is a purely mechanical adjustment that does not address underlying business challenges

- Total market capitalization remains unchanged in the immediate term

- The company’s fundamental problems (negative margins, declining revenue, operational losses) persist[0][3]

-

Increased Trading Volatility

- Reduced float can lead to higher volatility and wider bid-ask spreads

- Micro-cap stocks with higher per-share prices often experience reduced liquidity

- Historical data shows average daily volume of 2.65M shares, which may contract post-split[3]

-

Psychological Market Perception

- Reverse splits are often viewed negatively by investors as signals of distress

- Academic research consistently shows reverse-split stocks tend to underperform in subsequent periods

- The stock has already demonstrated extreme volatility with a 15.31% daily standard deviation[3]

-

Exchange Compliance Restoration

- Successful implementation should bring the share price above $1.00 threshold

- Prevents forced delisting which would further damage liquidity and access to capital markets

-

Institutional Investor Eligibility

- Many institutional funds have minimum share price requirements

- Higher price point may expand the potential investor base (though fundamental issues remain a barrier)

| Metric | Current Status | Implication |

|---|---|---|

| Market Cap | $10.70M | Extreme micro-cap status limits institutional interest |

| Stock Price | $0.23 | Below $1.00 NASDAQ minimum; retail-dominated trading |

| Profitability | -98.09% margin | Severe operational losses |

| Cash Position | Negative FCF | Capital raising pressure |

The company faces significant competitive challenges in the electric vehicle market:

- Sector Headwinds:The EV industry has experienced intensified competition, pricing pressures, and waning investor sentiment

- Scale Disadvantages:With sub-$11M market cap, PEV lacks resources to compete with larger players like Tesla, Rivian, or Lucid

- Limited Access to Capital:Reverse split alone doesn’t solve underlying capital structure challenges

- Brand Perception:Trading at sub-$1 levels severely damages credibility with customers, suppliers, and partners

The reverse split was approved alongside

- Management and board recognition of the urgency of the situation

- Potential strategic pivot or restructuring underway

- Governance changes may accompany operational restructuring efforts

Recent SEC filings show multiple Form 8-Ks and 10-Qs, indicating active management disclosure and potentially significant corporate developments[2].

- NASDAQ Compliance:The immediate catalyst is preventing delisting due to sub-$1.00 trading price

- Value Destruction:77%+ stock price decline over 2 years necessitated action

- Market Access:Maintaining exchange listing preserves access to capital markets

- Institutional Barriers:Attempting to meet minimum share price requirements for broader investor participation

The reverse split represents a

- Continued operational losses (-101% operating margin)

- Declining revenue trajectory

- Negative free cash flow generation

- Extreme competitive pressures in the EV sector

Post-reverse split, Phoenix Motor Inc. will likely trade at a higher nominal price but remain a

Shareholders should view this action as a

[0] 金灵API数据 - Company Overview, Real-Time Quote, and Historical Price Data for PEV (Retrieved January 3, 2026)

[1] Investing.com - “Phoenix Motor Inc. shareholders approve board election and reverse stock split” (https://www.investing.com/news/sec-filings/phoenix-motor-inc-shareholders-approve-board-election-and-reverse-stock-split-93CH-4428504)

[2] SEC.gov - Form 25-NSE, Form 8-K, and Form DEF 14A filings for Phoenix Motor Inc. (https://www.sec.gov/Archives/edgar/data/1879848)

[3] 金灵API数据 - Financial Analysis and Technical Analysis for PEV (Retrieved January 3, 2026)

[4] Yahoo Finance - PEVM Financial Analysis (https://finance.yahoo.com/quote/PEVM/)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。