Analysis of Stocks That Rose During the Great Recession (2007-2009)

Integrated Analysis

This analysis is based on a Reddit discussion [1] where users investigated which stocks performed well during the Great Recession, noting that most familiar stocks dropped approximately 40% during that period. The investigation reveals that very few stocks actually gained during this severe economic downturn, with cash, short positions, and ultra-defensive sectors being the primary exceptions.

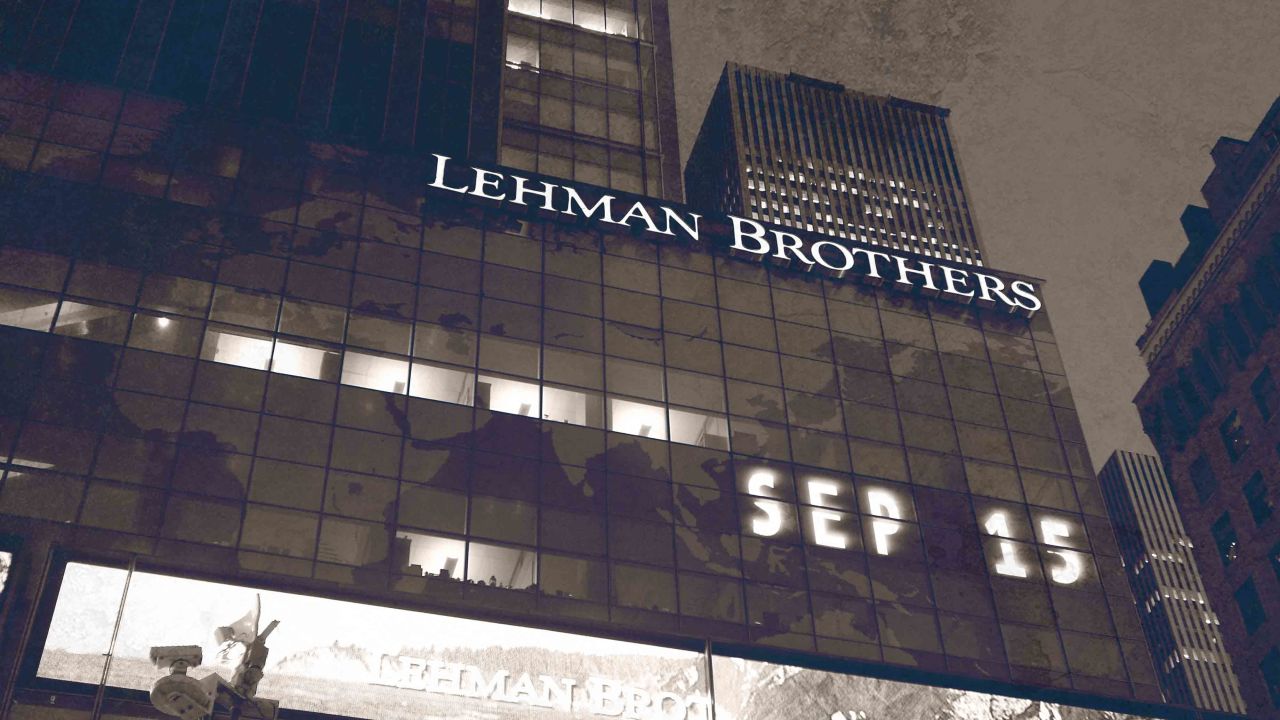

The Great Recession officially lasted from December 2007 to June 2009, during which the S&P 500 index declined by 37.87% [0]. This represented one of the most severe economic downturns since the Great Depression, wiping out a decade of market gains [2].

According to comprehensive analysis of 1,363 U.S. mid-cap and larger stocks, only

32 companies (2%)

had positive total returns during the entire recession period [2]. This extreme selectivity demonstrates the difficulty of finding winning stocks during severe economic downturns.

Key Insights

Sector Performance Patterns

Retail Trade Sector

showed surprising resilience with discount retailers thriving as consumers sought value. Dollar Tree (+28%), Walmart (+4%), Ross Stores (+11%), and Family Dollar all posted gains. Auto parts retailers like AutoZone (+22%) and O’Reilly Automotive also performed well [2].

Healthcare/Medical Sector

demonstrated recession resistance with several pharmaceutical and medical device companies gaining. Myriad Genetics (+49%) and Vertex Pharmaceuticals (+15%) led the sector, benefiting from medical necessity creating recession-resistant demand [2].

Information/Technology

saw Netflix emerge as an early winner (+44%), as consumers sought affordable home entertainment options during the downturn [2].

Counterintuitive Market Dynamics

Budget Travel

: Allegiant Travel Company gained during the recession, benefiting from falling oil prices reducing operational costs and consumers seeking budget travel options with high load factors (90%+ capacity utilization) [4].

Education

: For-profit education companies like Career Education Corporation gained as unemployed workers sought retraining opportunities during high unemployment periods [4].

Critical Risk Considerations

The analysis reveals several important caveats that investors should consider:

Limited Success Rate

: 98% of stocks lost money during the recession [2]. Even among gainers, many underperformed during the subsequent recovery. Notably, 36% of companies from that period no longer exist (acquired, bankrupt, or delisted) [2].

Recovery Performance Warning

: Several companies that gained during the recession actually underperformed during the recovery. Myriad Genetics gained 49% during the recession but lost 13% during recovery, while H&R Block gained 0.4% during recession but lost 1% during recovery [2].

Sector-Specific Risks

: Pharmaceutical gains may not repeat in future recessions due to different regulatory environments. REITs performed poorly during the housing crisis but might fare better in non-housing-related recessions. Financial sector winners were largely government-supported outliers [4].

Risks & Opportunities

Major Risk Points

Non-repeatable anomalies

: Many 2008 winners benefited from unique circumstances including government bailouts and specific market dislocations that are unlikely to recur [2][4].

Structural market changes

: The economy and market dynamics have evolved significantly since 2008, potentially altering which sectors might perform well in future recessions [2].

Survivorship bias

: Focusing only on winners ignores the 98% failure rate among stocks during the recession period [2].

Timing risk

: No investor can perfectly time market bottoms and recoveries, making stock selection during recessions extremely challenging [2].

Opportunity Windows

Defensive positioning

: Historical patterns suggest that defensive positioning and cash reserves typically provide better risk-adjusted returns than attempting to pick individual recession winners [2][4].

Industry selection over stock selection

: Analysis shows that picking the right industry was more important than individual stock selection, as performance varied widely within sectors [2].

Quality and size focus

: Mid-cap and larger companies showed better survival rates, with smaller companies experiencing higher volatility and failure rates [2].

Key Information Summary

The analysis reveals that during the Great Recession (December 2007 to June 2009), the S&P 500 declined 37.87% [0], with only 32 out of 1,363 analyzed U.S. stocks (2%) achieving positive returns [2]. Top performers included Bowles Fluidics Corporation (+58%), Myriad Genetics (+49%), Netflix (+44%), Dollar Tree (+28%), and AutoZone (+22%) [2].

The most successful sectors were discount retail, healthcare/pharmaceuticals, and budget entertainment. However, the analysis strongly suggests that holding cash was actually a superior strategy for most investors, providing capital preservation during the market decline and buying power for undervalued opportunities at market bottom [2][4].

Users should be aware that attempting to replicate Great Recession performance patterns carries significant risks due to non-repeatable anomalies, structural market changes, survivorship bias, and timing challenges. Historical patterns indicate that defensive positioning and cash reserves typically provide better risk-adjusted returns than attempting to pick individual recession winners [2][4].