S&P 500 Q1 2025 Upside Potential Analysis

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

The S&P 500 index has demonstrated remarkable resilience in 2025, delivering its third consecutive year of double-digit gains. As of January 12, 2026, the index trades at

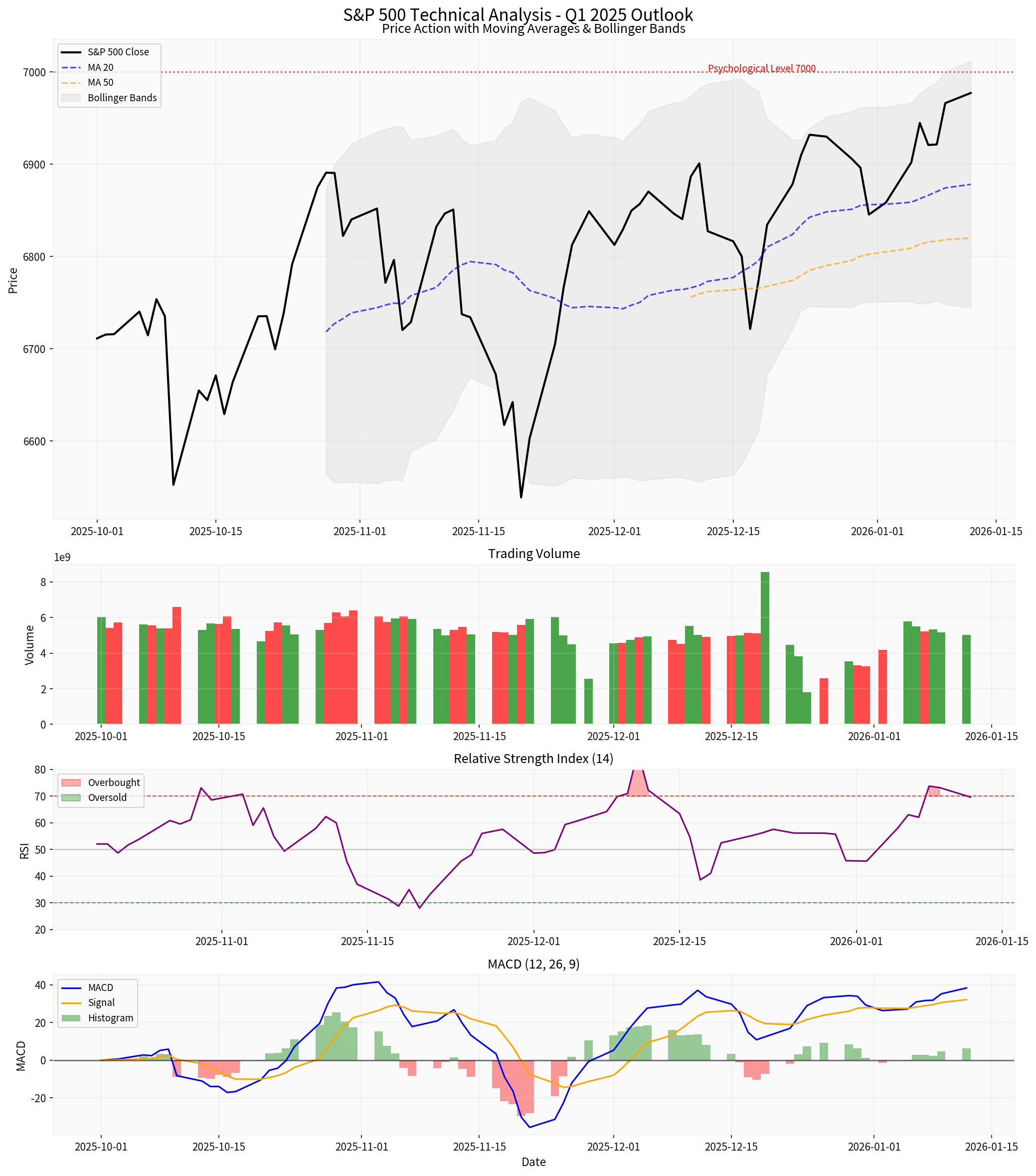

| Moving Average | Current Value | Signal | Price Position |

|---|---|---|---|

| MA 20 | 6,878.19 | Bullish | Price above MA |

| MA 50 | 6,819.94 | Bullish | Price above MA |

| MA 200 | N/A* | Bullish | Price above MA |

Note: MA200 data incomplete due to lookback period

The

- Currently positioned in the neutral-to-overbought territory(below 70 threshold)

- Indicates strong but not extreme momentum

- No immediate divergence signals detected [0][2]

- MACD Line: 38.42

- Signal Line: 32.23

- Histogram: Positive (6.19)

- Signal: BULLISH— MACD trading above signal line with expanding histogram confirms strong upward momentum [0][2]

| Band | Price Level |

|---|---|

| Upper Band | 7,012.00 |

| Middle (MA20) | 6,878.19 |

| Lower Band | 6,744.39 |

The index is trading in the

┌─────────────────────────────────────────────────────────────┐

│ S&P 500 PRICE MATRIX │

├─────────────────────────────────────────────────────────────┤

│ RESISTANCE LEVELS: │

│ R1 (Psychological): 7,000.00 ████████████████████████ │

│ R2: 7,062.18 │

│ R3 (All-time High): 6,986.33 │

├─────────────────────────────────────────────────────────────┤

│ CURRENT PRICE: 6,977.26 │

├─────────────────────────────────────────────────────────────┤

│ SUPPORT LEVELS: │

│ S1: 6,720.43 │

│ S2 (61.8% Fib): 6,863.55 │

│ S3 (50% Fib): 6,825.62 │

│ S4 (38.2% Fib): 6,787.70 │

└─────────────────────────────────────────────────────────────┘

The technology sector has been the primary catalyst for S&P 500 gains, with

- AI Capital Spending Surge: Unanticipated acceleration in AI infrastructure investments has provided unexpected economic tailwinds [3]

- Cloud Computing Expansion: Enterprise cloud adoption continues to accelerate across sectors

- Productivity Gains: Similar to the late 1990s, AI adoption is driving productivity improvements that support earnings growth [4]

The Federal Reserve has implemented

- Lower Borrowing Costs: Enhanced corporate profitability through reduced debt servicing costs

- Valuation Support: Lower discount rates enhance present value of future earnings

- Consumer Spending: Improved disposable income supports consumption

S&P 500 earnings projections remain robust:

| Period | Earnings Growth | Source |

|---|---|---|

| 2025 (Full Year) | +13% | LSEG [4] |

| 2026 (Projected) | +15%+ | Analyst Consensus [4] |

The passage of the

- M&A Activity Expected Surge: Following two years of 20%+ returns, M&A activity correlation (+68% from 1998-2024) suggests increased deal activity in 2025 [5]

- Industrial Production Strengthening: Corporate restocking cycles remain robust, with companies continuing to replenish inventories [5]

Central banks worldwide are in

| Sector | Daily Change | Status |

|---|---|---|

| Consumer Defensive | +1.88% | 🟢 Leading |

| Technology | +0.89% | 🟢 Strong |

| Financial Services | +0.67% | 🟢 Improving |

| Industrials | +0.57% | 🟢 Rising |

| Utilities | +0.45% | 🟢 Stable |

| Basic Materials | +0.28% | 🟢 Flat |

| Energy | +0.05% | 🟢 Neutral |

| Consumer Cyclical | +0.02% | 🟢 Flat |

| Communication Services | +0.02% | 🟢 Stable |

| Healthcare | -0.94% | 🔴 Underperforming |

| Real Estate | -1.53% | 🔴 Weakest |

| Indicator | Current Reading | Action Signal | Monitor For |

|---|---|---|---|

RSI (14) |

69.63 | Neutral → Overbought >70 | Potential short-term pullback if >70 |

MACD |

Above Signal Line | Bullish | Cross below signal line |

Price vs MA50 |

Above | Bullish | Sustained break below |

Volume |

Average ↑ | Confirms trend | Volume dry-up on advances |

Bollinger Band Position |

Upper half | Strong | Touch upper band with rejection |

- VIX Index: Monitor for spikes above 20 indicating尾部风险增加

- Put/Call Ratio: Extreme readings (>1.5) may signal inflection points

- Advance/Decline Line: Breadth deterioration could signal warning

- New Highs/New Lows: Divergences between price and new highs

| Signal | Threshold | Implication |

|---|---|---|

| RSI > 70 for 3+ days | Overbought | Potential correction |

| MACD Death Cross | Signal line crossover | Trend change risk |

| Volume Decline on Up Days | <80% of average | Weak conviction |

| Support Break (MA50) | Close below | Trend in question |

- Entry Points: Monitor pullbacks to MA20 (6,878) or 50% Fibonacci level (6,826)

- Stop Losses: Place below 6,720 (S1 support) or MA50 break

- Take Profits: Target 7,000 psychological level, then 7,062

- Position Sizing: Maintain core exposure; add on significant pullbacks

- Diversification: Consider rotating toward sector breadth (Financials, Industrials)

- Risk Management: Use trailing stops or protective puts for portfolio protection

| Catalyst | Timing | Potential Impact |

|---|---|---|

| Q4 2025 Earnings | January-February | Positive if >13% growth |

| Fed Policy Statement | Ongoing | Rate cut expectations |

| AI Developments | Continuous | Sector leadership |

| Geopolitical Events | Uncertain | Volatility spike risk |

- Price action shows sustained uptrend with higher highs and higher lows

- MA20 and MA50 act as dynamic support levels

- RSI approaching overbought territory but not yet signaling reversal

- MACD histogram expansion confirms bullish momentum

| Target | Probability | Trigger |

|---|---|---|

| 7,000 | High | Sustained momentum, positive catalysts |

| 7,200 | Moderate | Strong earnings, Fed support |

| 7,400 | Lower | Broad earnings acceleration, AI breakthrough |

| Level | Trigger |

|---|---|

| 6,863 (61.8% Fib) | Normal correction |

| 6,720 (S1) | Moderate pullback |

| 6,500 | Technical breakdown |

The S&P 500 demonstrates a

✅

- Price above all key moving averages

- MACD in bullish configuration

- Strong sector breadth (7 of 11 sectors positive)

- Robust earnings growth expectations

⚠️

- RSI approaching overbought territory

- Proximity to psychological 7,000 level

- Potential for short-term consolidation

[0] Market Data - S&P 500 Index (2025-10-01 to 2026-01-13)

[1] Investing.com - S&P 500 Technical Analysis (https://www.investing.com/indices/us-spx-500-technical)

[2] SPDR S&P 500 ETF (SPY) Technical Analysis - SPDR S&P 500 ETF Trust

[3] RBC Wealth Management - U.S. equity returns in 2025: Record-breaking resilience (https://www.rbcwealthmanagement.com/en-us/insights/us-equity-returns-in-2025-record-breaking-resilience)

[4] Reuters - AI spending, strong corporate profits, Fed rate cuts seen as key to 2026 US stock market (https://www.reuters.com/business/ai-spending-strong-corporate-profits-fed-rate-cuts-seen-key-2026-stock-market-2025-12-24/)

[5] Neuberger Berman - Equity Market Outlook 1Q 2025 (https://www.nb.com/en/global/equity-market-outlook/equity-market-outlook-1q2025)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。