Wolfspeed's 300mm SiC Wafer Breakthrough: Strategic Assessment

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Based on comprehensive research and data analysis, I can now provide a detailed assessment of Wolfspeed’s 300mm SiC wafer breakthrough and its potential to reverse the company’s stock decline and competitive position.

Wolfspeed, Inc. (NYSE: WOLF) announced on January 13, 2026, a significant industry milestone: the successful production of a single crystal 300mm (12-inch) silicon carbide wafer [1]. This technological advancement positions the company at the forefront of SiC manufacturing, but faces substantial headwinds from its recent bankruptcy restructuring, competitive pressures, and financial challenges. While the breakthrough represents a genuine technological achievement with long-term strategic value, its ability to immediately reverse Wolfspeed’s stock decline remains uncertain and depends on several critical execution factors.

Wolfspeed has successfully produced a single crystal 300mm silicon carbide wafer, representing a fundamental manufacturing advancement from the current 200mm (8-inch) standard [1][2]. The key technical highlights include:

- Unified Manufacturing Platform: The 300mm technology enables a converged platform combining high-volume SiC power electronics manufacturing with advanced high-purity semi-insulating substrates for optical and RF systems [1]

- Wafer-Scale Integration: Enables integration across optical, photonic, thermal, and power domains at wafer scale [1]

- IP Leadership: Backed by over 2,300 issued and pending patents worldwide, one of the industry’s largest foundational SiC IP portfolios [1]

The breakthrough enables Wolfspeed to address several high-growth markets [1][3]:

| Market Application | Value Proposition |

|---|---|

AI Infrastructure |

Addresses data center power limits by enabling integration of high-voltage power delivery, advanced thermal solutions, and active interconnects at wafer scale |

AR/VR Systems |

Supports compact, lightweight systems with high-brightness displays and effective thermal management |

Advanced Power Devices |

Enables cost-effective scaling for high-voltage grid transmission, next-generation industrial systems, and electrification |

Electric Vehicles |

Powers the expanding EV market requiring high-efficiency power electronics |

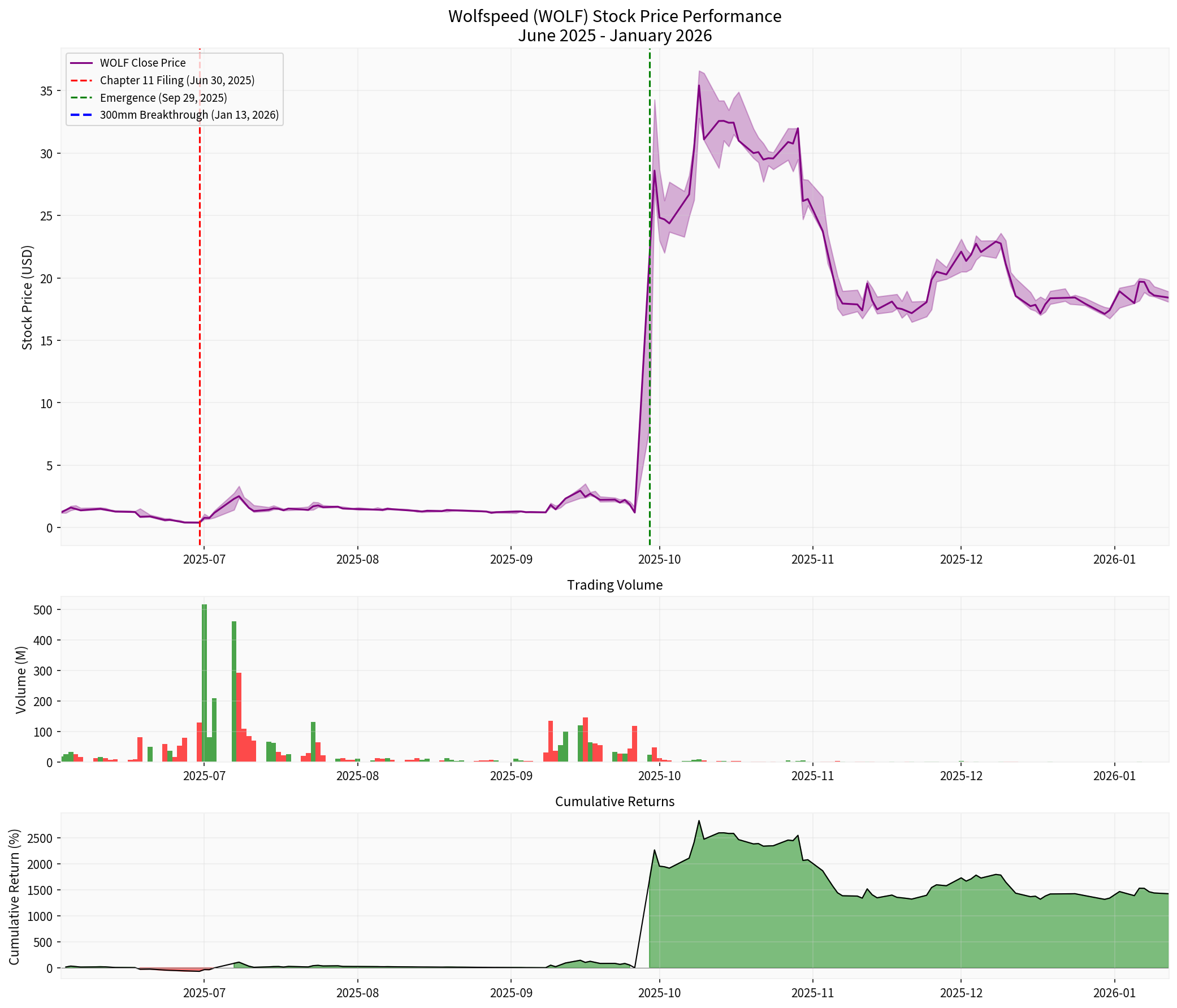

Wolfspeed’s stock has experienced extreme volatility, particularly following its Chapter 11 filing [4]:

| Metric | Value |

|---|---|

| Current Price | $18.42 |

| 52-Week Range | $8.05 - $36.60 |

| Market Cap | $476.94M |

| Average Daily Volume | 29.18M shares |

| Beta (vs S&P 500) | 4.48 [5] |

- Pre-Bankruptcy (June 27, 2025): $0.40 per share

- Chapter 11 Filing (June 30, 2025): Marked the beginning of restructuring

- Post-Emergence (September 30, 2025): $22.10 per share

- Peak (November 2025): $36.60 per share

- Current: $18.42 per share (down 43.44% from 3 months prior) [4]

Wolfspeed filed for Chapter 11 bankruptcy protection on June 30, 2025, and emerged on September 29, 2025, after completing a 91-day prepackaged restructuring [6]:

| Restructuring Metric | Value |

|---|---|

| Pre-Petition Debt | ~$6.7 billion |

| Debt Eliminated | ~$4.6 billion (70% reduction) |

| Post-Emergence Debt | ~$2.0 billion |

| Annual Interest Reduction | ~$240 million (60% reduction) |

| Enterprise Value (Post-Restructuring) | $2.35B - $2.85B |

| Existing Equity Recovery | 3-5% [6] |

The restructuring transferred significant ownership to creditors, resulting in substantial dilution for pre-bankruptcy shareholders [7].

The global silicon carbide market is highly competitive, with Wolfspeed facing pressure from established semiconductor giants [8]:

| Company | Estimated SiC Market Share (2025) |

|---|---|

| STMicroelectronics | ~40% |

| Infineon Technologies | ~22% |

| Wolfspeed | ~14% |

| ROHM | ~10% |

| onsemi | ~7% |

| Others | ~7% |

Wolfspeed has historically maintained leadership in SiC wafer technology, but competitors have been rapidly catching up [8].

The competitive dynamics reveal a race toward larger wafer sizes:

| Company | 200mm Status | 300mm Plans |

|---|---|---|

Wolfspeed |

Only company manufacturing SiC devices on 8-inch platform in high volume | Lab breakthrough achieved; volume commercialization path established |

Infineon |

Products on 200mm SiC from Villach, Austria facility since February 2025 | Actively developing 300mm capability [9] |

STMicroelectronics |

Strong 200mm production | Investment focus on automotive SiC |

onsemi |

Targeting 8-inch transition after 2025 technical verification | Achieved 50%+ self-sufficiency in SiC substrates via GTAT acquisition [8] |

Chinese Players (SICC, TanKeBlue) |

Controlling ~40% of SiC wafer market as of 2025 | Aggressive pricing creating 30% price decrease in 2024 [8] |

- Only company with high-volume 8-inch SiC manufacturing capability [3]

- Largest SiC IP portfolio with 2,300+ patents [1]

- First-mover advantage in 300mm SiC wafer production

- Integrated manufacturing capabilities

- Significant debt burden despite restructuring

- Chinese competitors with aggressive pricing strategies

- Established players (Infineon, STMicroelectronics) with greater financial resources

- Need for $1B+ investment to build 300mm production fab [3]

The 300mm breakthrough demonstrates that Wolfspeed retains its technological edge despite financial difficulties. According to Poshun Chiu, Principal Analyst at Compound Semiconductor, Yole Group: “This 300mm breakthrough is more than a technical milestone — it unlocks new opportunities for silicon carbide as a strategic material. It clearly demonstrates that silicon carbide is advancing to the next level of manufacturing maturity required for the coming decade of electrification, digitalization, and AI.” [1]

The transition to 300mm wafers offers significant cost advantages [3]:

- 300mm wafers provide 2.25x the surface area of 200mm wafers

- Higher chips per wafer spreads fixed costs over greater volume

- Critical for reducing per-device costs in an inherently expensive material system

The SiC market is projected to reach $1.3 trillion by 2035, growing at an 11.3% CAGR [9], with the automotive segment expected to capture 70.6% market share [9]. Wolfspeed’s technological position positions it to capture share in high-growth applications.

The consensus price target stands at $30.00, representing +62.9% upside from current levels, with 6 analysts rating it a Buy [4].

Wolfspeed faces significant challenges in funding the $1B+ 300mm fab investment [3]:

- Still carrying ~$2.0 billion in debt post-emergence

- Reported $864 million net loss for fiscal year 2024

- Limited access to capital markets given recent bankruptcy

The company has only established a “clear path to future volume commercialization” [1] — not immediate production. Competitors like Infineon already have products shipping on 200mm technology [9].

A securities class action lawsuit was recently transferred to North Carolina federal court, alleging misrepresentations about financial projections [7]. This creates ongoing legal and reputational risk.

Short interest has risen to 64.22% of float, indicating significant bearish sentiment [7]. It would take 4.25 days to cover short positions on average volume.

Commercial success hinges on:

- Post-reorganization cost efficiency

- Securing design wins to validate 300mm SiC advantages

- Competing against entrenched 200mm ecosystems [3]

Based on technical indicators as of January 13, 2026 [5]:

| Indicator | Signal | Interpretation |

|---|---|---|

MACD |

No cross (bullish bias) | No clear momentum shift |

KDJ |

Bullish (K:60.6, D:60.6, J:60.7) | Near overbought territory |

RSI |

Normal range | No extreme overbought/oversold conditions |

Trend |

Sideways/No clear trend | Trading range: $17.78 - $19.06 |

- Technological leadership in 300mm SiC positions Wolfspeed for next-generation semiconductor applications

- Massive market growth (11.3% CAGR through 2035) provides long-term tailwinds

- Debt reduction from bankruptcy improves financial flexibility

- Integration opportunities in AI infrastructure and EV supply chains

- 300mm commercialization timeline remains uncertain

- Significant competition from better-capitalized rivals

- Ongoing legal risks from securities litigation

- High short interest and bearish sentiment may limit upside

- Need for $1B+ capital investment in a constrained financial position

The current analyst consensus reflects uncertainty [4]:

- Buy: 6 analysts (31.6%)

- Hold: 9 analysts (47.4%)

- Sell: 4 analysts (21.1%)

Wolfspeed’s 300mm SiC wafer breakthrough represents a genuine technological achievement that validates the company’s innovation capabilities and positions it for long-term success in the expanding SiC market. However,

- Timing Gap: The breakthrough establishes a path to volume commercialization, not immediate revenue

- Financial Constraints: Post-bankruptcy capital structure limits investment capacity

- Competitive Pressure: Rivals like Infineon and STMicroelectronics maintain strong market positions

- Execution Requirements: Success depends on securing design wins and achieving cost targets

The breakthrough is a

- Successfully commercialize 300mm production

- Secure strategic design wins with major customers

- Navigate ongoing legal challenges

- Demonstrate improved financial performance

For investors, the 300mm breakthrough is a

[1] Business Wire - Wolfspeed Achieves 300mm Silicon Carbide (SiC) Technology Breakthrough (https://www.businesswire.com/news/home/20260113487095/en/Wolfspeed-Achieves-300mm-Silicon-Carbide-SiC-Technology-Breakthrough)

[2] StockTitan - Wolfspeed produces 300mm silicon carbide wafer (https://www.stocktitan.net/news/WOLF/wolfspeed-achieves-300mm-silicon-carbide-si-c-technology-w8qq5r5dfrup.html)

[3] AInvest - Wolfspeed’s 300mm SiC Breakthrough: Building the Rails for the Next Power Paradigm (https://www.ainvest.com/news/wolfspeed-300mm-sic-breakthrough-building-rails-power-paradigm-2601/)

[4]金灵API数据 - Company Overview, Real-Time Quote, and Stock Price Data

[5]金灵API数据 - Technical Analysis

[6] ElevenFlo - Wolfspeed: 91-Day Prepack Cuts $4.6B Debt (https://elevenflo.com/blog/wolfspeed-bankruptcy-46b-debt-restructuring)

[7] Benzinga - Looking Into Wolfspeed Inc’s Recent Short Interest (https://www.benzinga.com/insights/short-sellers/26/01/49752862/looking-into-wolfspeed-incs-recent-short-interest)

[8] Pestel Analysis - Competitive Landscape of Wolfspeed Company (https://pestel-analysis.com/blogs/competitors/wolfspeed)

[9] Research Nester - Silicon Carbide (SiC) Wafer Market Size, Growth Report 2035 (https://www.researchnester.com/reports/silicon-carbide-wafer-market/8302)

[10] Wolfspeed Investor Relations - Plan of Reorganization Confirmed (https://investor.wolfspeed.com/news/news-details/2025/Wolfspeeds-Plan-of-Reorganization-Confirmed-Clearing-Path-to-Emerge-from-Restructuring-Process-as-a-Financially-Stronger-Company/default.aspx)

Analysis completed: January 13, 2026

Data sources: 金灵API (market data, financial data, technical analysis), Business Wire, Wolfspeed Investor Relations, Research Nester, ElevenFlo, and other financial news sources

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。