Nexa Resources (NEXA): 52-Week High Analysis and Investment Outlook

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Based on comprehensive analysis of Nexa Resources’ stock performance, zinc market dynamics, and company fundamentals, here is a detailed assessment:

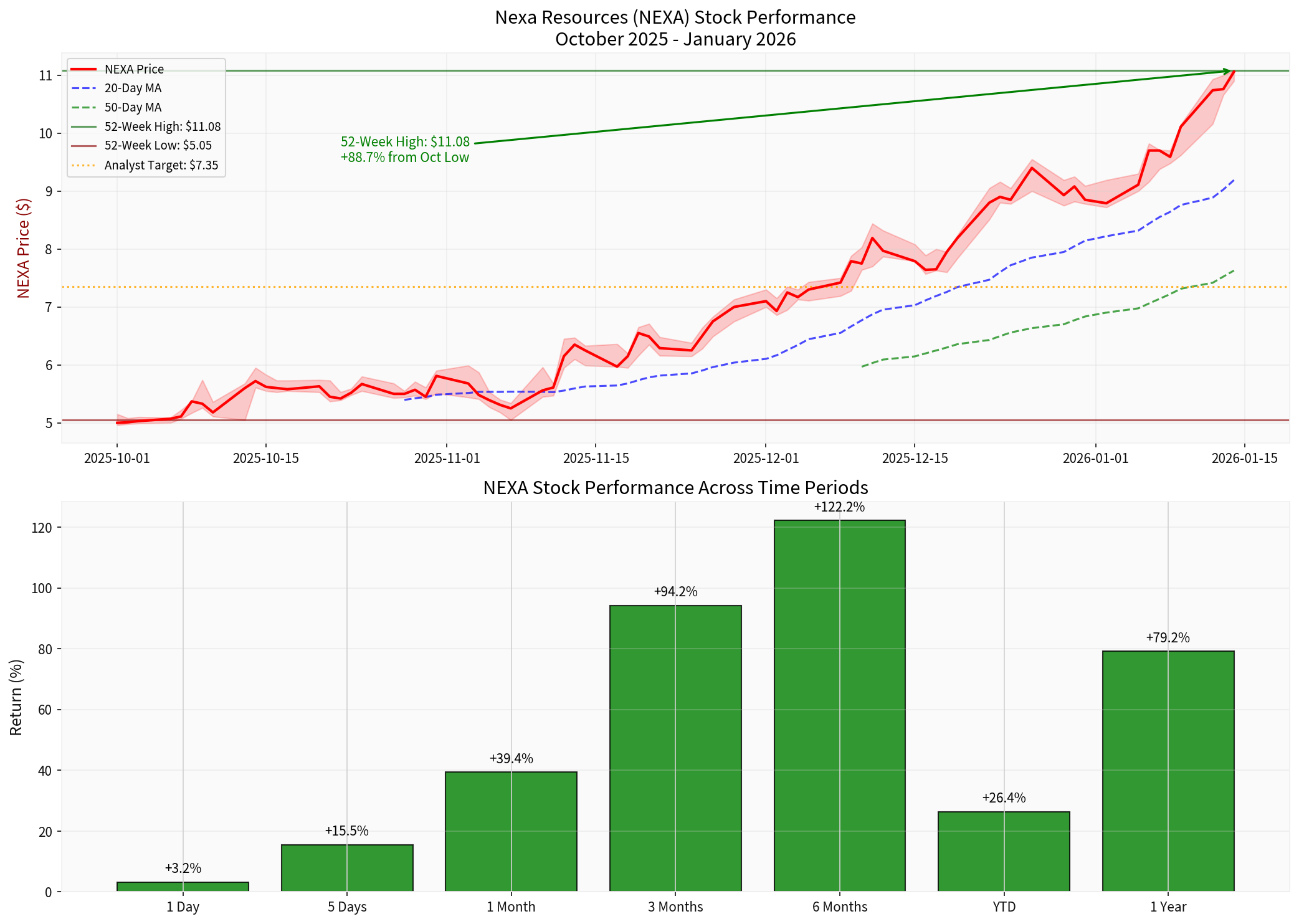

Nexa Resources has achieved a remarkable rally, reaching a 52-week high of $11.08, representing an extraordinary gain from its 52-week low of $5.05 [0]. The stock is currently trading at $11.06, essentially at its peak level (99.8% of 52-week high). Key performance metrics demonstrate exceptional momentum across all timeframes:

| Period | Return |

|---|---|

| 1 Day | +3.25% |

| 5 Days | +15.49% |

| 1 Month | +39.40% |

| 3 Months | +94.23% |

| 6 Months | +122.20% |

| 1 Year | +79.19% |

The company’s Q3 2025 results exceeded market expectations significantly:

- Net revenues: $764 million, up 8% year-over-year [1]

- EPS: $0.52 versus analyst forecast of $0.286 (+81.8% surprise) [1]

- Adjusted EBITDA: $186 million, up 16% from previous quarter [1]

- Net income: $100 million, demonstrating meaningful profitability improvement [1]

The EPS recovery from -$0.03 in Q3 to positive $0.52 represents a dramatic operational turnaround.

Zinc production reached

- Free cash flow generation of $52 million [1]

- Target to reduce net leverage to approximately 1x in coming years [1]

- Strong operational cash flow supporting capital allocation priorities

Scotiabank upgraded Nexa from “Sector Underperform” to “Sector Perform” on October 14, 2025, reflecting improved operational outlook [0]. However, the consensus rating remains “Hold” with a price target of $7.35—approximately

The stock exhibits lower volatility than the broader market, providing defensive characteristics within the materials sector [0]. This lower beta can attract risk-conscious investors during uncertain market conditions.

Zinc prices have demonstrated resilience, trading around

| Factor | Outlook |

|---|---|

| Morgan Stanley 2026 Forecast | $2,900/MT average [3] |

| Trading Economics Q1 2026 | $3,175/MT (end of quarter) [2] |

| 12-Month Forecast | $3,320/MT [2] |

| Global Supply-Demand | Surplus of 271,000 MT expected in 2026 [3] |

Key dynamics shaping zinc prices:

-

Near-Term Support: Upward momentum from 2025 LME average of $3,218 expected to continue through H1 2026 [3]

-

Chinese Demand Concerns: Chinese real estate sector weakness persists, limiting galvanizing steel demand (zinc’s primary end-use) [3]

-

Regional Disparities: Chinese production at surplus while rest of world faces supply shortages [3]

-

Policy Tailwinds: Trump administration policy proposals (December 17) could boost US housing sector and downstream zinc demand [3]

-

European Recovery: European zinc demand expected to grow following predicted 0.7% expansion in 2025 [3]

- Nexa’s integrated mine-smelter model provides margin protection during price volatility

- Production growth (+14% QoQ) amplifies revenue during favorable pricing environments

- Low-carbon operations differentiate Nexa from competitors in ESG-focused investment strategies [1]

- Latin American asset base provides geographic diversification away from Chinese demand concentration

- Long-term zinc surplus (271,000 MT in 2026) could pressure prices [3]

- Morgan Stanley’s 2026 forecast of $2,900/MT suggests potential price decline from current levels

- Chinese property sector weakness may persist through 2027 [3]

- US tariff implementation could impact advanced economy demand [3]

| Indicator | Value | Signal |

|---|---|---|

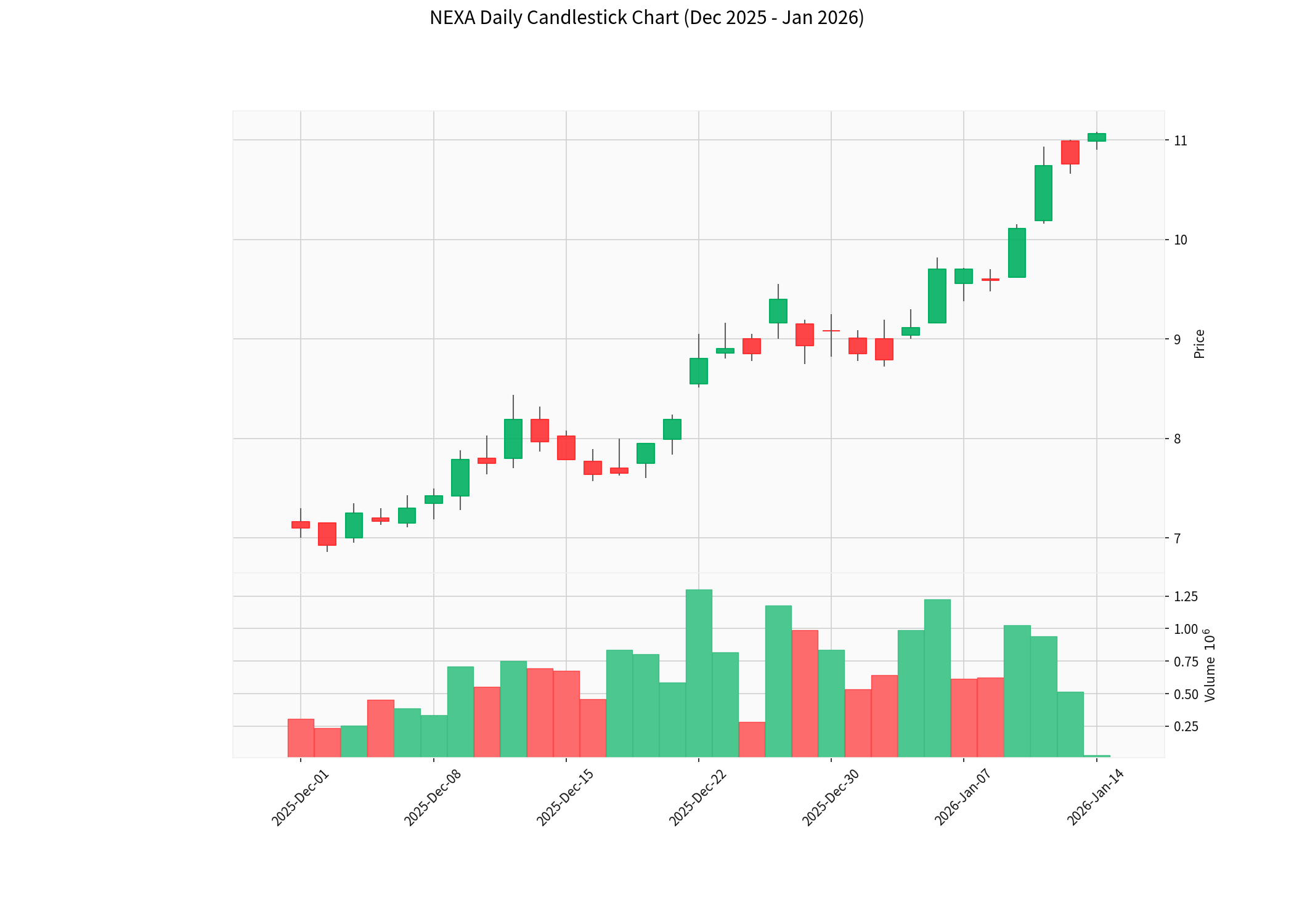

| MACD | No cross | Bullish |

| KDJ | K:91.5, D:86.0, J:102.6 | Overbought warning |

| RSI (14) | Overbought risk | Cautionary |

| 20-Day MA | $9.19 | Above 50-day MA ($7.63) |

| Beta | 0.54 | Defensive |

- Support: $9.84

- Resistance: $11.08 (52-week high)

- Next Target: $11.53

The KDJ indicator showing overbought conditions (J:102.6) and RSI risk suggest potential short-term consolidation or pullback despite the strong momentum [0].

Despite the strong price performance, significant valuation gaps exist:

- Current Price: $11.06

- Analyst Consensus Target: $7.35 (70% Hold, 30% Sell ratings) [0]

- Discount to Target: -33.8%

- P/E Ratio: -16.22x (negative due to prior losses) [0]

- P/S Ratio: 0.53x (potentially attractive if profitability sustains)

- Sustained zinc prices above $3,000/MT supporting revenue growth

- Continued production increases from Peruvian operations

- Potential further analyst upgrades

- Successful deleveraging improves financial flexibility

- US infrastructure spending boosting base metals demand

- Zinc price decline toward $2,900/MT forecast

- Overbought technical conditions triggering correction

- Chinese property sector weakness limiting demand

- Global surplus building in 2026-2027

- Earnings disappointment in upcoming Q4 report (February 19, 2026)

| Factor | Assessment |

|---|---|

Momentum |

Extremely Strong (+122% over 6 months) |

Valuation |

Overvalued relative to analyst targets |

Zinc Outlook |

Near-term constructive, long-term challenged |

Technical |

Overbought with potential consolidation |

Analyst Sentiment |

Cautious (Hold consensus) |

- February 19, 2026: Q4 FY2025 earnings report (EPS estimate: $0.35) [0]

- Zinc price movementsabove $3,200/MT or below $2,800/MT

- Production guidance updatesfor 2026

- Debt reduction progresstoward 1x net leverage target

- US policy developmentsaffecting infrastructure and housing sectors

[0] GoldLink API - Market Data and Technical Analysis

[1] Investing.com - “Earnings call transcript: Nexa Resources Q3 2025 beats revenue expectations” (https://www.investing.com/news/transcripts/earnings-call-transcript-nexa-resources-q3-2025-beats-revenue-expectations-93CH-4324390)

[2] Trading Economics - “Zinc Price - Chart - Historical Data” (https://tradingeconomics.com/commodity/zinc)

[3] Nasdaq - “Zinc Price Forecast: Top Trends for Zinc in 2026” (https://www.nasdaq.com/articles/zinc-price-forecast-top-trends-zinc-2026)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。