TSMC's AI-Driven Growth Trajectory: Impact on Semiconductor Sector Valuations and Investor Allocation Strategies

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Based on my comprehensive analysis of TSMC’s AI-driven growth trajectory and its implications for the semiconductor sector, I will now provide a detailed report.

Taiwan Semiconductor Manufacturing Company (TSMC) has emerged as the pivotal beneficiary of the artificial intelligence revolution, with its stock delivering a remarkable

TSMC has demonstrated exceptional performance metrics across multiple timeframes:

| Timeframe | Performance | Market Context |

|---|---|---|

| 1 Day | +6.80% | Earnings-driven rally |

| 1 Month | +21.41% | Strong AI momentum |

| 3 Months | +14.65% | Sustained uptrend |

| 6 Months | +47.43% | AI boom acceleration |

| 1 Year | +68.93% | Outperforming broader market |

| YTD | +9.30% | Continued strength |

The stock is currently trading at

TSMC’s financial profile reflects its dominant market position and operational excellence:

- P/E Ratio: 27.62x (relative to sector average)

- P/B Ratio: 8.77x

- Net Profit Margin: 43.70%

- Operating Margin: 49.51%

- ROE: 34.52%

- Current Ratio: 2.69 (strong liquidity)

The company’s conservative accounting approach, combined with high depreciation-to-capex ratios, suggests potential earnings upside as investments mature [0]. With a

TSMC’s Q4 2025 results (reported January 15, 2026) exceeded expectations:

| Metric | Actual | Estimate | Surprise |

|---|---|---|---|

| EPS | $3.09 | $2.82 | +9.57% |

| Revenue | $33.11B | — | First $100B annual revenue |

The company achieved its

TSMC has announced a

- Revenue Growth Guidance: ~30% for 2026 (exceeding analyst consensus)

- AI as Primary Growth Driver: Data center AI chip demand remains the dominant catalyst

- Global Capacity Expansion: Accelerating fab construction in the US, Japan, and Germany

CEO C.C. Wei acknowledged investor concerns about capacity overbuild risks: “We’re investing $52 billion to $56 billion in capex. If we don’t do it carefully, that’d be a big disaster for TSMC” [1].

The AI semiconductor demand backdrop remains robust, supported by major customer commentary:

| Company | Executive | Key Comment |

|---|---|---|

| NVIDIA | Jensen Huang | “Demand for AI accelerators continues to run hot” |

| AMD | Lisa Su | “Need for AI computing power and users will surge” |

| Meta | — | Planning $60-65B AI infrastructure spending |

| Amazon | — | Sustained data center investment |

Multiple institutions have upgraded TSMC’s price targets in recent weeks:

| Firm | Price Target (NT$) | Previous | Action | Date |

|---|---|---|---|---|

| Goldman Sachs | 2,600-2,700 | — | Maintain Buy | Jan 2026 |

| JPMorgan | 2,100 | 1,700 | Maintain Overweight | Jan 2026 |

| JPMorgan (Taiwan) | NT$1,852 | — | Strong Buy consensus | Jan 2026 |

| Bernstein | NT$1,800 | — | Maintain Outperform | Dec 2025 |

The

| Rating | Count | Percentage |

|---|---|---|

| Buy/Strong Buy | 16 | 72.7% |

| Hold | 6 | 27.3% |

| Sell | 0 | 0% |

The

TSMC’s performance significantly outpaces broader semiconductor sector averages:

| Company | Market Cap | P/E (TTM) | 1Y Return | Analyst Target | Upside |

|---|---|---|---|---|---|

TSMC (TSM) |

$1.81T | 27.6x | +68.9% | $377.50 | +8.1% |

NVIDIA (NVDA) |

$4.59T | 46.2x | +38.4% | $265.00 | +40.6% |

Broadcom (AVGO) |

$1.64T | 71.1x | +52.5% | $450.00 | +29.4% |

AMD |

$385B | 116.3x | +97.7% | $290.00 | +22.3% |

S&P 500 (SPY) |

— | — | +24.8% | — | — |

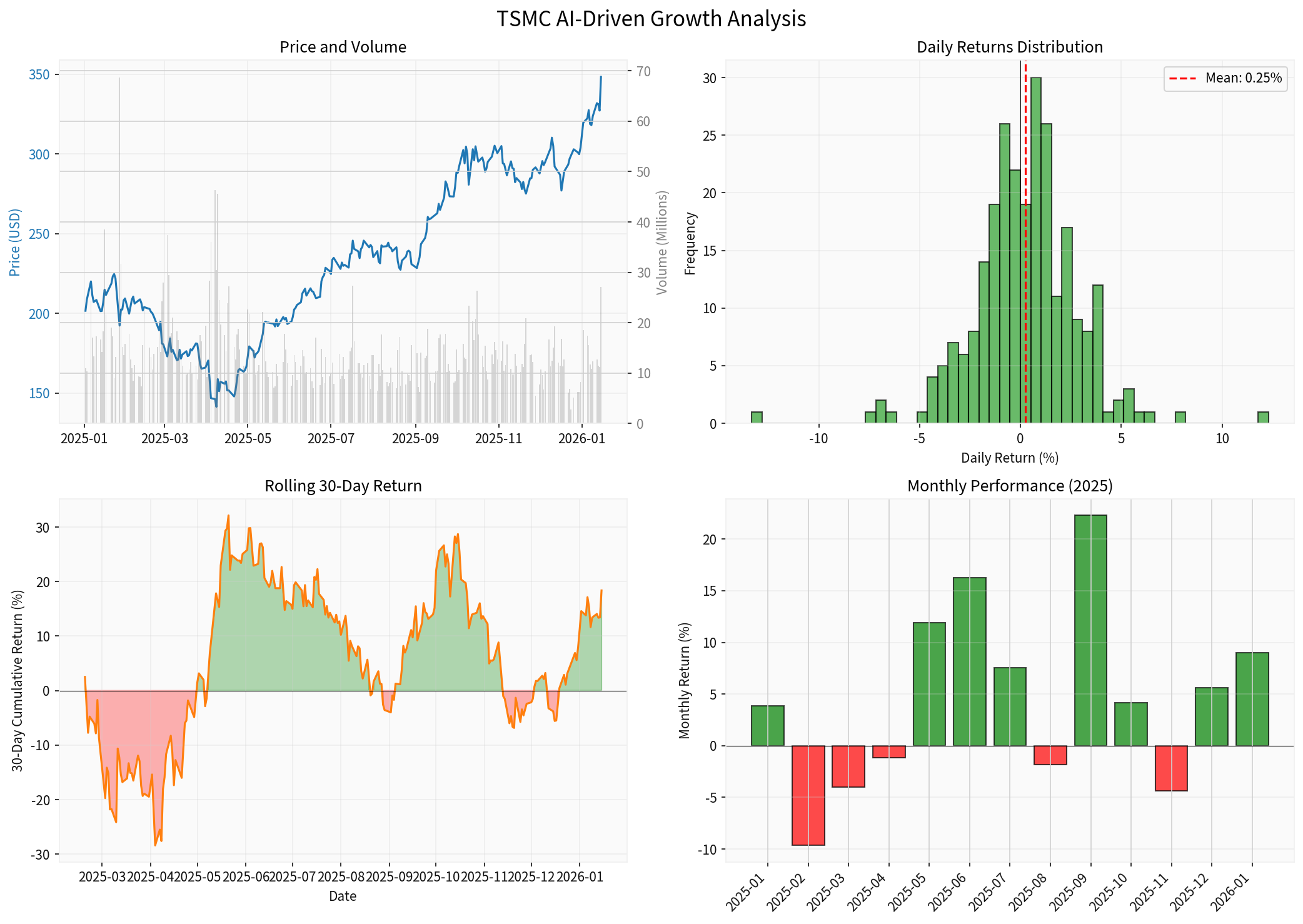

TSMC has dramatically outperformed the S&P 500 on a relative basis:

- TSMC vs SPY YTD: TSMC has outperformed by approximately44 percentage points

- Key Outperformance Period: September 2025 (+22.3% monthly return coinciding with AI infrastructure spending announcements)

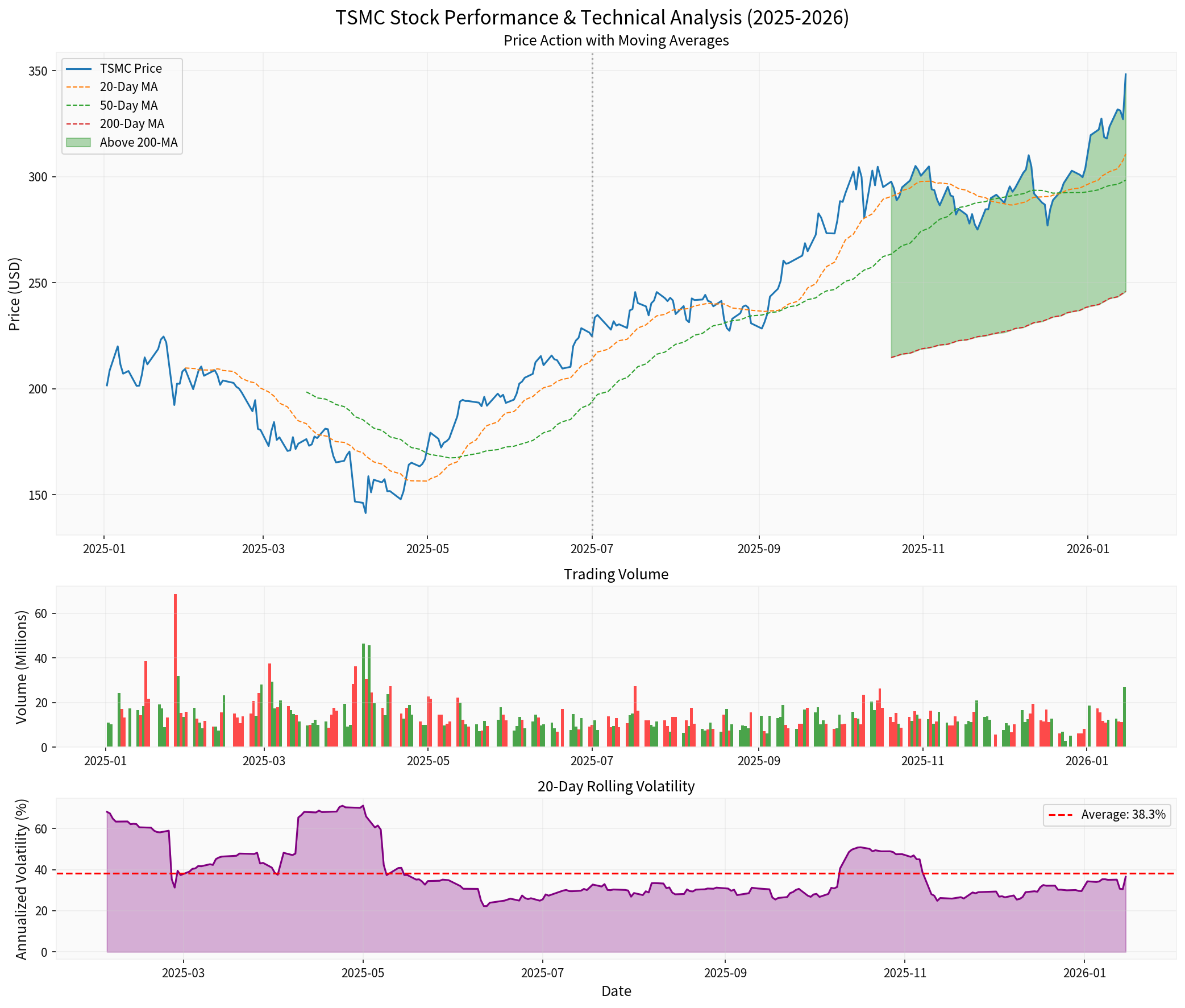

- Technical Position: Trading41.6% above 200-day moving average(strong bullish momentum)

| Metric | TSM | NVDA | AVGO | AMD |

|---|---|---|---|---|

| Sharpe Ratio (est.) | 1.49 | — | — | — |

| Max Drawdown (2025) | -37.1% | — | — | — |

| 20-Day Volatility | 36.5% | — | — | — |

| Beta vs SPY | Elevated | Very High | High | High |

TSMC offers a

TSMC’s AI-driven growth has contributed to sector-wide valuation multiple expansion:

- TSMC P/E Evolution: From ~20x (pre-AI boom) to 27.6x (current)

- Sector Implication: AI premium now priced into leading semiconductor names

- Relative Attractiveness: TSMC trades at a discount to NVIDIA (46.2x) and Broadcom (71.1x)

The semiconductor sector is experiencing a structural re-rating driven by:

- AI Revenue Visibility: TSMC’s 30% 2026 revenue growth guidance provides a floor for sector expectations

- Capital Spending Multiplier: TSMC’s $52-56B capex program signals confidence, benefiting equipment suppliers (ASML, Lam Research)

- Geographic Diversification: TSMC’s global fab expansion reduces concentration risk

- Pricing Power: Advanced node dominance (3nm, upcoming 2nm) supports margin expansion

| Metric | TSM | Semiconductor Avg. | Premium/Discount |

|---|---|---|---|

| P/E (TTM) | 27.6x | 35.2x | -22% (discount) |

| EV/FCF | 19.3x | 24.8x | -22% (discount) |

| ROE | 34.5% | 28.4% | +21% (premium) |

| Profit Margin | 43.7% | 32.1% | +36% (premium) |

TSMC trades at a

Based on the analysis, investors should consider the following allocation framework:

- TSMC as Foundation: 5-10% of semiconductor allocation as a core holding

- Rationale: Dominant market position (~60% foundry market share), AI exposure, and reasonable valuation

- NVIDIA (NVDA): Additional 3-5% for pure AI accelerator exposure

- Broadcom (AVGO): 2-4% for custom chip and networking exposure

- AMD: 1-2% for competitive AI CPU/GPU alternatives

- ASML: +1-2% for lithography equipment exposure

- Lam Research: +1-2% for wafer processing equipment

- Taiwan Semi (TSM): Already captured in core allocation

| Risk Factor | Mitigation Strategy |

|---|---|

| Geopolitical/Taiwan Risk | Geographic diversification (consider US-domiciled alternatives) |

| AI Demand Correction | Focus on companies with diversified revenue bases |

| Valuation Risk | TSMC’s relative discount provides margin of safety |

| Execution Risk | Capex overrun concerns (monitor quarterly guidance) |

| Currency Risk | ADR structure provides some hedging |

| Profile | TSMC Weight | Semiconductors Total | Key Rationale |

|---|---|---|---|

| Growth-Oriented | 8-12% | 15-20% | Maximize AI exposure |

| Balanced | 5-8% | 10-15% | Core holding with sector tilt |

| Defensive | 3-5% | 7-10% | Quality focus with limited AI beta |

| Risk-Averse | 0-3% | 5-8% | Limit concentration risk |

- Pullbacks toward 50-day moving average (~$298)

- Relative strength weakness vs. NVIDIA indicating sector rotation

- Post-earnings volatility compression

- P/E expansion above 35x (full valuation)

- AI demand commentary deterioration from major customers

- Breach of 200-day moving average on sustained basis

The semiconductor sector outlook remains constructive based on:

- TSMC’s 30% Revenue Growth Guidance: Sets the floor for sector expectations

- $1 Trillion+ AI Infrastructure Pipeline: Sustained capital spending visibility

- Productivity Gains from AI: Improving corporate earnings across technology sector

- Geographic Diversification: Reduced concentration risk through global fab expansion

| Risk | Probability | Impact | Mitigation |

|---|---|---|---|

| AI Demand Slowdown | Medium | High | Diversified customer base |

| Geopolitical Escalation | Medium | Very High | Geographic diversification |

| Capex Overbuild | Medium | High | Monitor utilization rates |

| Valuation Compression | Low-Medium | Medium | Strong fundamentals support multiples |

The semiconductor sector is undergoing

- AI as Primary Growth Driver: AI chips now represent the majority of leading foundry revenue

- Geographic Rebalancing: US, Japan, and Europe manufacturing capacity expansion

- Advanced Node Leadership: TSMC’s 2nm development maintains technology moat

- Vertical Integration Trends: Major customers developing custom silicon

- TSMC’s AI-driven growth trajectory remains robustwith 30% 2026 revenue growth guidance and $52-56B capex program

- Analyst price target upgrades are warrantedgiven the sustained AI demand and TSMC’s dominant positioning

- Sector valuations reflect AI premium, but TSMC trades at a discount to peers on earnings multiples

- Risk management is essentialgiven geopolitical concentration and execution risks on capex

- Allocation strategies should reflect investor profile, with core holdings ranging from 3-12% of semiconductor allocation

| Recommendation | Confidence | Timeframe |

|---|---|---|

| Maintain TSMC as core semiconductor holding | High | Medium-term |

| Expect continued multiple expansion | Medium | 6-12 months |

| Monitor AI demand commentary closely | High | Ongoing |

| Consider geographic diversification | Medium | Risk mitigation |

| Selective addition of supply chain beneficiaries | Medium | Tactical |

[0] 金灵AI API数据 (TSMC Company Overview, Financial Analysis, Market Data)

[1] Bloomberg - “TSMC’s Strong Outlook Fires Up Hopes of Sustained AI Boom” (https://www.bloomberg.com/news/articles/2026-01-15/tsmc-profit-beats-estimates-in-fresh-sign-of-ai-demand-strength)

[2] Yahoo Finance - “TSMC’s Strong Outlook Fires Up Hopes of Sustained AI Boom” (https://finance.yahoo.com/news/tsmc-strong-outlook-shores-hopes-072434087.html)

[3] Investing.com - Analyst Price Targets for Taiwan Semiconductor (https://www.investing.com/equities/taiwan-semicon)

[4] The New Indian Express - “Taiwan’s chipmaking giant TSMC logs net profit jump on AI boom” (https://www.newindianexpress.com/business/2026/Jan/15/taiwans-chipmaking-giant-tsmc-logs-net-profit-jump-on-ai-boom)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。