BOJ Policy Acceleration: Impact Analysis on Japanese Equities, Yen, and Global Carry Trades

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Based on comprehensive market data and recent developments, here is a detailed analysis of how earlier-than-expected Bank of Japan (BOJ) rate hikes could affect Japanese equities, the yen currency, and global carry trade strategies.

The BOJ raised its policy rate to

| Asset | Period Performance | Current Level |

|---|---|---|

| Nikkei 225 | +7.03% |

53,855 |

| EWJ (MSCI Japan ETF) | +3.55% |

$85.42 |

| USD/JPY | +2.91% (Yen weakening) |

~156-157 |

Japanese equities have demonstrated remarkable resilience despite rising yields. The Nikkei 225’s

- Corporate Profit Strength: Corporate profits remain at high levels with rising wages and tight labor markets [2]

- Fiscal Support: The Takaichi Cabinet has adopted more accommodative fiscal policy, delaying consolidation [3]

- Structural Reforms: Wage increases and inflation normalization support long-term growth narratives

However, sustained rate hikes could create headwinds:

| Risk Factor | Impact |

|---|---|

| Higher borrowing costs | Reduced corporate profitability for leveraged companies |

| Yen appreciation | Pressures export-oriented manufacturers |

| Valuation compression | Higher discount rates reduce P/E multiples |

| Capital repatriation | Japanese investors may return capital as domestic yields rise |

Despite BOJ tightening, the yen has remained relatively weak, trading around

- Still-wide interest rate differentials with the US (Fed at ~3.75-4.00% vs BOJ at 0.75%)

- Persistent Japanese outbound investment flows (households purchased ~¥9.4 trillion in foreign stocks in 2025)

- Negative real rates in Japan compared to positive real yields in the US [4]

| Scenario | USD/JPY Forecast | Timeline |

|---|---|---|

| Gradual BOJ tightening | 160+ | Through 2026 |

| Moderate convergence | 148 | 12-month horizon |

| Aggressive BOJ | 140-145 | Year-end 2026 |

Analysts at JPMorgan and BNP Paribas project the yen could reach

Morgan Stanley estimates approximately

Borrow Yen (0.75%) → Convert to USD → Invest in US assets (~4-5%)

↓

Net Carry: ~3.25%

| BOJ Policy Rate | Fed Rate (Assumed) | Carry Yield | Yen Risk |

|---|---|---|---|

| 0.75% | 3.50% | 2.75% | Moderate |

| 1.00% | 3.25% | 2.25% | Elevated |

| 1.25% | 3.00% | 1.75% | High |

| 1.50% | 3.00% | 1.50% | Very High |

The market correction during August 2024 demonstrated how rapid yen surges can cascade into liquidations across US equities and cryptocurrencies [1]. Options markets are already pricing elevated volatility for Q1 2026 [2].

CFTC data shows net short yen positions declining

| Scenario | Probability | Equity Impact | Yen Impact | Carry Trade Effect |

|---|---|---|---|---|

Gradual (+25bp every 6-9 months) |

High | Moderate bullish | Gradual appreciation | Slow unwind |

Moderate (+50bp in H1 2026) |

Medium | Volatile, range-bound | 5-8% appreciation | Accelerated unwind |

Aggressive (+75bp+) |

Low | Significant drawdown | 10%+ appreciation | Disorderly unwind |

- Favor: Domestic-focused sectors (utilities, REITs with JGB linkages), companies with strong pricing power

- Hedge: Currency-hedged exposure (DXJ) to protect against yen appreciation

- Avoid: Highly leveraged exporters, interest-rate-sensitive sectors

- Reduce exposureto multi-year carry positions funded by yen

- Hedge FX riskusing options or forward contracts

- Diversify funding currenciesto reduce single-currency dependence

- Monitor BOJ communication closely for policy signal shifts

- Consider reduced beta to yen-sensitive assets (EM bonds, high-yield credit)

- Evaluate liquidity buffer requirements for potential volatility spikes

- Japanese equities remain resilientbut face medium-term headwinds from rising yields and potential yen appreciation

- The yen’s weakness is structural, supported by capital outflows and wide rate differentials, but these are gradually eroding

- Carry trade unwind is already underway, with institutional investors proactively reducing exposure

- Disorderly unwinding risk remains elevated, though smart money positioning suggests better preparedness than in 2024

- Currency-hedged strategiesoffer protection for Japan-focused investors concerned about yen volatility

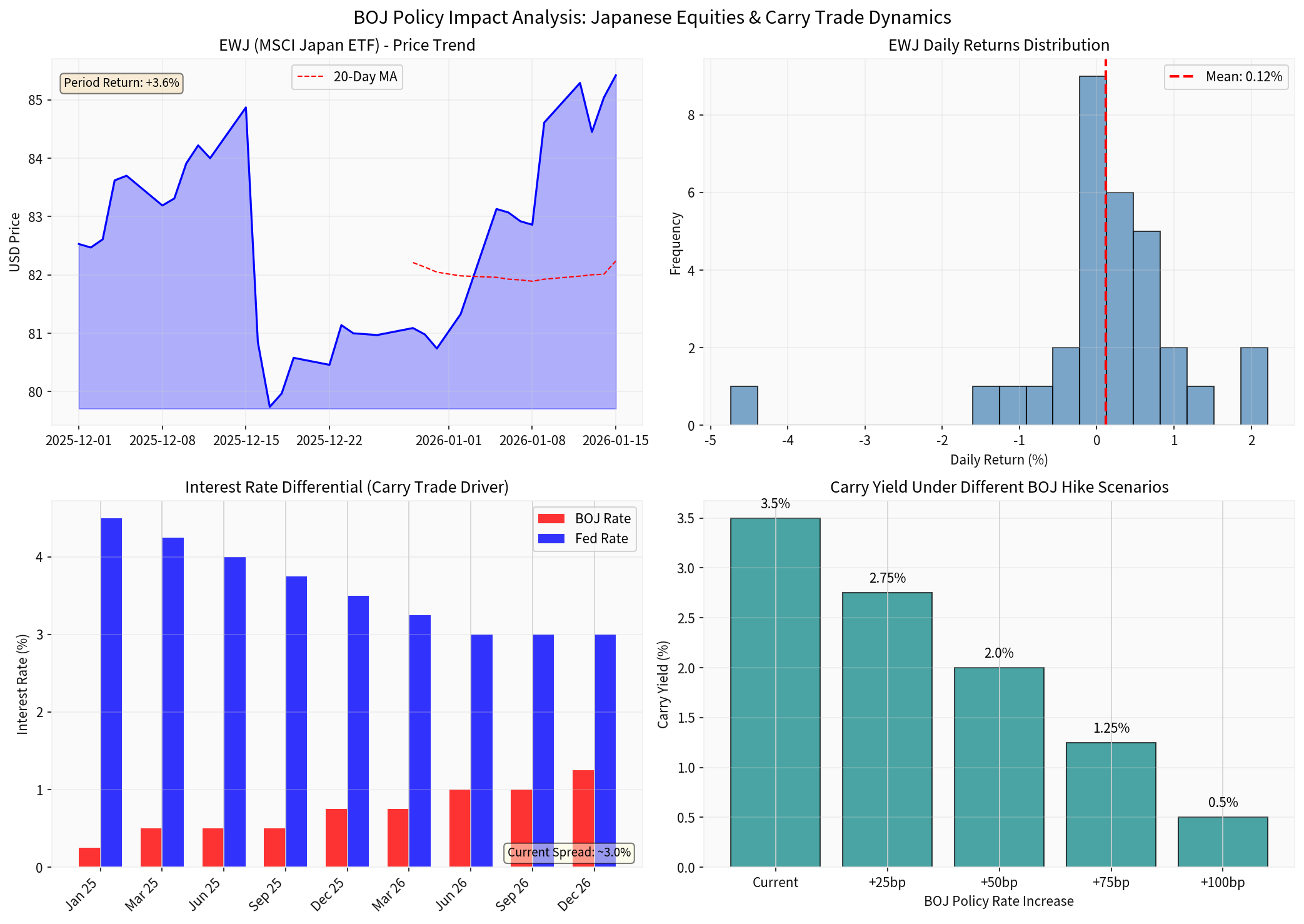

The chart illustrates:

- EWJ price trendwith 20-day moving average support

- Daily returns distributionshowing volatility characteristics

- Interest rate differentialbetween BOJ and Fed (the carry trade driver)

- Carry yield scenariosunder different BOJ policy paths

[1] Investing.com - “The BoJ Just Pulled the Trigger: Markets Brace for Carry Trade Chaos” (https://www.investing.com/analysis/the-boj-just-pulled-the-trigger-markets-brace-for-carry-trade-chaos-200672097)

[2] KPMG - “Central Bank Scanner: Rate Cuts Will Abate in 2026” (https://kpmg.com/us/en/articles/2026/january-2026-central-bank-scanner.html)

[3] Morgan Stanley - “Macro Outlook: Finding Investment Opportunities Across Shifting Global Macro Climates” (https://www.morganstanley.com/im/en-gb/institutional-investor/insights/articles/opportunities-across-shifting-global-macro-climates.html)

[4] Yahoo Finance - “Yen Bearish Voices Build for 2026 on Cautious BOJ Policy” (https://finance.yahoo.com/news/yen-bearish-voices-build-2026-220024517.html)

[5] Kavout - “Japan ETF Outlook 2026: How the Bank of Japan Rate Hike Affects EWJ, DXJ and BBJP” (https://www.kavout.com/market-lens/japan-etf-outlook-2026-how-the-bank-of-japan-rate-hike-affects-ewj-dxj-and-bbjp)

[6] BNP Paribas Wealth Management - “Japan can overcome hurdles” (https://wealthmanagement.bnpparibas/lu/en/insights/video-podcast-hubs/podcasts-hub/japan-can-overcome-hurdles.html)

[7] AInvest - “Japan’s Yield Curve Steepening: A Structural Shift in Borrowing Costs” (https://www.ainvest.com/news/japan-yield-curve-steepening-structural-shift-borrowing-costs-2601/)

[0] Market data retrieved from financial data providers for EWJ, Nikkei 225, and USD/JPY (December 2025 - January 2026)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。