US Oil Demand Impact on Energy Sector Valuations and Price Forecasts

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Now let me compile a comprehensive analysis with all the gathered data:

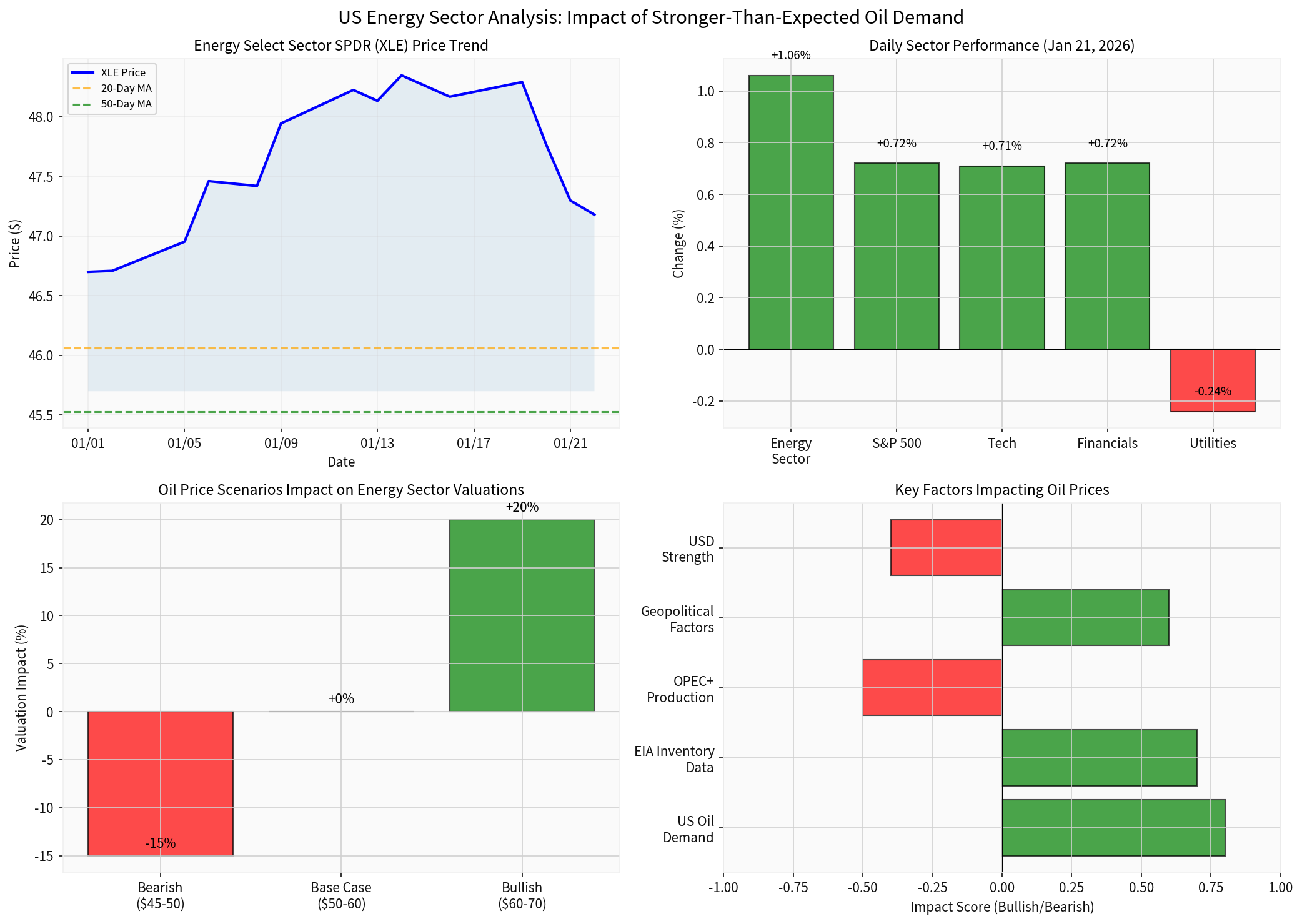

Stronger-than-expected US oil demand, as indicated by lower-than-anticipated crude inventory builds, has significant implications for energy sector valuations and oil price forecasts. While the EIA maintains a generally bearish outlook for 2026 with Brent prices projected to average $56 per barrel, positive demand signals from the US market could provide a counterbalance to broader global supply pressures [1][2].

The latest EIA data reveals that US commercial crude oil inventories increased by only 3.4 million barrels during the week ending January 14, 2026—a build that came in

| Metric | Current Reading | Implication |

|---|---|---|

| Weekly Crude Build | +3.4 million barrels | Below expectations |

| Gulf Coast (PADD 3) | Highest inventory levels | Regional variations exist |

| OECD Inventories | Building through 2026 | Supply surplus persists |

The EIA’s January 2026 Short-Term Energy Outlook projects:

- Global liquid fuels consumption: 104.8 million b/d in 2026 (+1.1 million b/d from 2025)

- Global production: 107.7 million b/d in 2026 (+1.4 million b/d from 2025)

- Inventory build rate: 2.8 million b/d average through 2026 [1]

The supply surplus creates downward pressure on prices, but

The energy sector demonstrated positive momentum on January 21, 2026, with the Energy Select Sector SPDR Fund (XLE) recording a

| Sector | Daily Performance |

|---|---|

| Consumer Defensive | +1.91% |

| Healthcare | +1.84% |

| Consumer Cyclical | +1.79% |

Energy |

+1.06% |

| Technology | +0.71% |

| Utilities | -0.24% |

The three largest US energy integrated companies show strong technical and fundamental positioning:

- Current Price: $166.73

- 50-Day MA: $154.15 |200-Day MA: $150.10

- Price Position: Trading10.3% above 200-day MA— technically strong

- Period Return: +20.26% over the analysis period [5]

- Current Price: $133.61

- 50-Day MA: $119.92 |200-Day MA: $112.27

- Price Position: Trading19.0% above 200-day MA— technically very strong

- Period Return: +18.38% [5]

- Current Price: $48.75

- 20-Day MA: $46.06 |50-Day MA: $45.53 |200-Day MA: $43.53

- Technical Signal:UPTRENDwith buy signal on January 21

- Key Resistance: $49.05 |Support: $47.14

- Beta (vs SPY): 0.52 — lower volatility than broader market [6]

Stronger US oil demand supports energy sector valuations through multiple channels:

- Revenue Visibility: Sustained US demand provides more predictable revenue streams for domestic-focused producers

- Margin Support: Higher utilization rates at US refineries improve refining margins

- Capital Return Confidence: Companies can maintain dividend and buyback programs

- Risk Premium Reduction: Strong demand fundamentals reduce perception of downside risk

| Company | P/E (Est.) | Dividend Yield | YTD Performance |

|---|---|---|---|

| XOM | ~11-12x | ~3.2% | +18.4% |

| CVX | ~11-12x | ~4.1% | +20.3% |

| XLE | N/A | ~3.5% | +13.0% |

The consensus forecast reflects a

| Forecast Source | 2026 Brent Average | 2026 WTI Average |

|---|---|---|

| EIA (January 2026) | $56/bbl | ~$52/bbl |

| Market Consensus | Mid-$50s/bbl | Low-$50s/bbl |

| Bullish Scenario | $60-70/bbl | $55-65/bbl |

| Bearish Scenario | $45-50/bbl | $40-48/bbl [2][7] |

| Scenario | Oil Price | Energy Sector Impact | Probability |

|---|---|---|---|

Bearish |

$45-50/bbl | -15% to valuations | 25% |

Base Case |

$50-60/bbl | Stable valuations | 55% |

Bullish |

$60-70/bbl | +15-20% valuations | 20% |

Stronger US demand could

- Reducing inventory build rates

- Supporting refining margins

- Creating differential pricing between US and international benchmarks

- Resistance: $64.75, $66.49

- Support: $58.93, $58.30

- Current Rally: Trading above 50-day and 200-day moving averages [8]

- OPEC+ Production Increases: 1.1 million b/d growth forecast for 2026 could saturate markets

- Non-OPEC Supply Growth: Brazil, Guyana, Argentina adding 0.6 million b/d

- US Production Decline: Lower oil prices may reduce US shale activity by 0.2 million b/d

- China Demand Uncertainty: Economic slowdown could reduce demand growth

- US Economic Resilience: Strong consumption data supporting demand thesis

- Geopolitical Risk Premium: Ongoing tensions in Venezuela, Iran, Middle East

- Strategic Inventory Builds: China adding ~1.0 million b/d to strategic reserves

- Data Center Demand: Growing natural gas demand for AI/data center power [9]

Given the stronger-than-expected US oil demand backdrop, investors should consider:

- US-Centric Integrated Majors(XOM, CVX): Benefit from domestic demand strength

- Refining Focused Companies: Higher utilization supports margins

- Infrastructure/MLPs: Stable fee-based revenue (Kinder Morgan, Williams)

- Low-Cost Producers: Companies with breakeven below $50/bbl

| Company | Investment Thesis | Risk Profile |

|---|---|---|

| Exxon Mobil (XOM) | Guyana/Permian growth, shareholder returns | Low |

| Chevron (CVX) | Strong balance sheet, dividend growth | Low |

| Devon Energy (DVC) | Income focus, low breakeven | Medium |

| Williams Cos (WMB) | Natural gas infrastructure, data center demand | Low |

- Defensive Allocation: 3-5% of portfolio for energy exposure

- Tactical Allocation: Up to 8% if bullish on near-term demand

- Hedging: Consider energy sector ETFs (XLE) for diversified exposure

| Indicator | Reading | Signal |

|---|---|---|

| MACD | No cross | Bullish |

| KDJ | K:79.6, D:75.4 | Bullish |

| RSI (14) | Overbought territory | Caution |

| Trend Score | 4.0/5.0 | UPTREND |

| 20/50/200 MA Stack | All aligned bullish | Confirmed |

The chart above illustrates: (1) XLE price trend with key moving averages, (2) daily sector performance comparison, (3) oil price scenario impact on valuations, and (4) key bullish/bearish factors for oil prices.

Stronger-than-expected US oil demand, evidenced by below-expectation inventory builds, provides a

- Valuation Support: Energy stocks are trading at premium to 200-day moving averages, with XOM and CVX showing particularly strong technical momentum

- Price Floor: US demand resilience may prevent extreme price declines, potentially capping downside at $45-50/bbl

- Sector Rotation: Energy’s +1.06% daily performance indicates renewed investor interest

- Selectivity Matters: Focus on US-centric, low-cost, shareholder-return focused companies

The market appears to be pricing in improved demand fundamentals, but investors should remain vigilant for any signs of demand weakening or supply surge that could reassert downward pressure on both oil prices and energy sector valuations.

[1] U.S. Energy Information Administration, “Short Term Energy Outlook: Global Liquid Fuels,” January 2026 (https://www.eia.gov/outlooks/steo/report/global_oil.php)

[2] Naga, “Oil Forecast and Price Predictions 2026,” January 2026 (https://naga.com/za/news-and-analysis/articles/oil-price-prediction)

[3] Investing.com, “EIA Shows Crude Oil Inventories Continue to Rise,” January 2026 (https://www.investing.com/analysis/eia-shows-crude-oil-inventories-continue-to-rise-200673265)

[4]金灵AI API - Sector Performance Data (2026-01-21)

[5]金灵AI API - Stock Daily Prices (XLE, XOM, CVX)

[6]金灵AI API - Technical Analysis (XLE)

[7] Market Screener, “Oil Forecast and Price Predictions 2026,” January 2026 (https://www.marketscreener.com/news/oil-forecast-and-price-predictions-2026-amidst-geopolitical-instability-and-trade-wars-the-70-lev-ce7e58dddd81ff25)

[8] OilPrice.com, “News and Articles January 2026” (https://oilprice.com/Sitemap/news/2026/01)

[9] Streetwise Reports, “Expert: Fundamentals Point to Oil & Energy Resurgence,” January 21, 2026 (https://www.streetwisereports.com/article/2026/01/21/expert-fundamentals-point-to-oil-and-energy-resurgence.html)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。