Celanese's Polyamide Price Increase: Chemical Industry Pricing Power and Margin Outlook

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Based on my comprehensive research, I can now provide a detailed analysis of Celanese’s polyamide price increase and its implications for the chemical industry’s pricing power and margin outlook.

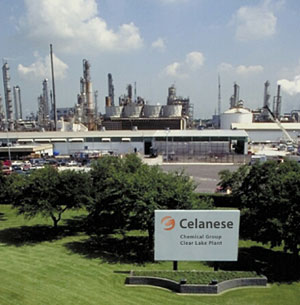

Celanese Corporation’s recent announcement of polyamide price increases—up to $0.25/kg for PA-6 and $0.20/kg for PA-6,6 in the Americas and EMEA regions, effective February 1, 2026—represents a strategic move to offset mounting cost pressures in an industry facing significant margin compression [1][2]. This analysis examines what this price action signals about the broader chemical sector’s pricing dynamics and profit trajectory.

| Product | Americas | EMEA | Effective Date |

|---|---|---|---|

Polyamide-6 (PA-6) |

+$0.25/kg | +€0.25/kg | February 1, 2026 |

Polyamide-6,6 (PA-6,6) |

+$0.20/kg | +€0.20/kg | February 1, 2026 |

- Rising energy costs

- Increased feedstock costs

- General market dynamics driving higher input expenses

The timing of Celanese’s price increase is particularly significant given the challenging macroeconomic environment facing the chemical industry in 2026. According to Deloitte’s 2026 Chemical Industry Outlook, the sector is experiencing a pronounced “downcycle” characterized by:

- Global chemical production growthis projected at a muted 1.9-2.0% for 2026 [3]

- US production volumesare expected to contract by 0.2%, following two years of weak growth

- Persistent overcapacityin basic chemicals continues to pressure operating rates and profit margins [3]

The chemical industry’s profitability has contracted sharply:

| Metric | Trend |

|---|---|

| Net profit margins | Fell sharply after peaking at 5.8% average (2000-2020) |

| Operating margins | Remained under pressure through 2023-2025 H1 |

| Free cash flow | Declined in first half of 2025 after slight improvement in 2024 |

Celanese’s ability to implement price increases—albeit in a difficult market environment—provides important signals about

-

Specialty vs. Commodity Divide: Polyamide (nylon) falls within theengineered materialssegment, where Celanese generated $1.38 billion in Q3 FY2025 revenue (56.6% of total) [4]. This segment retains greater pricing leverage compared to commodity chemicals, which face intense overcapacity pressures.

-

Application-Specific Demand: Polyamides are critical engineering plastics used in:

- Automotive applications (lightweighting, thermal management)

- Electrical & electronics

- Industrial machinery

- Medical devices [1]

This diversified, high-performance application base supports pricing power that commodity chemicals lack.

-

Regional Pricing Differentiation: Celanese’s implementation of both USD and EUR-denominated price increases reflects the company’s ability to manage pricing regionally based on local cost structures and market conditions [2].

Despite this selective pricing success, the broader industry faces significant constraints:

- Overcapacityin basic chemicals (polyethylene, polypropylene, olefins) limits price pass-through

- Weak end-market demandacross key sectors constrains volume and pricing

- Tariff uncertainty(the Global Economic Policy Uncertainty Index reached record highs in April 2025) creates hesitation in the market [3]

| Metric | TTM Value | Industry Context |

|---|---|---|

Operating Margin |

-23.47% | Significantly under pressure |

Net Profit Margin |

-31.85% | Deeply negative |

ROE |

-63.15% | Substantial value destruction |

Current Ratio |

1.63 | Adequate liquidity [4] |

The company’s negative margins highlight the severity of cost pressures. The price increase is thus a

-

Cost Pass-Through Lag: Energy and feedstock costs have risen faster than product prices can adjust, compressing margins

-

Capacity Rationalization: With only 243 M&A deals in H1 2025 (lowest since pre-COVID), industry consolidation sufficient to restore pricing discipline remains limited [3]

-

Capital Expenditure Constraints: Capex fell 8.4% YoY in 2024, with further cuts expected. This limits capacity expansion but also reduces growth investment [3]

| Strategy | Implementation | Expected Impact |

|---|---|---|

| Portfolio shifting | Divesting low-margin commodity assets, focusing on specialty chemicals | Higher aggregate margins |

| Cost efficiency | Flat OPEX, 2.3% SG&A reduction via layoffs and delayed maintenance | Margin improvement |

| AI/digital adoption | Process optimization, waste reduction | 5-10% operational cost savings potential |

| Price increases | Selective pass-through in specialty segments | Direct margin contribution |

- Revenue Impact: At current polyamide volumes, even a partial price pass-through could generate meaningful margin improvement

- Customer Reaction: Contract terms will determine actual implementation; some customers may resist or negotiate

- Competitive Response: Rivals in polyamide production may need to follow with similar increases to maintain margins

-

Specialty Chemicals Retain Pricing Power: Companies with differentiated, application-engineered products can still pass through costs

-

Commodity Chemicals Face Structural Challenges: Basic chemical segments will likely continue to see margin pressure until supply-demand balance improves

-

Profit Prioritization Over Growth: The industry is shifting focus to cash generation and margin protection, evident in reduced capex and M&A activity

- Successful price implementationacross contract and spot markets

- Demand recoveryin automotive and construction end-markets

- Capacity rationalizationthrough closures or consolidation

- AI-driven efficiency gainsreducing operating costs

- Implementation challenges: Customer resistance or volume loss from price increases

- Energy cost escalation: Further cost increases could erode price increase benefits

- Demand weakness: Continued end-market softness could negate pricing actions

- Competitive dynamics: Rival responses could trigger price competition

| Firm | Rating | Price Target |

|---|---|---|

Consensus |

HOLD | $50.00 (+5.2% from current) |

UBS |

Neutral | $50.00 |

Citigroup |

Buy | $70.00 (high target) |

Wells Fargo |

Equal Weight | Lower end of range |

Recent upgrades and the company’s strong Q3 FY2025 earnings surprise (EPS $1.34 vs. $1.27 estimate, Revenue $2.42B vs. $2.25B estimate) suggest improving sentiment [4].

Celanese’s polyamide price increase represents a

- Differential pricing powerremains in specialty/engineered materials segments, even during industry downturns

- Margin recovery will be gradual, requiring successful price implementation, cost discipline, and potential portfolio restructuring

- The industry is in transition, prioritizing profitability and cash generation over growth

- 2026 will be a pivotal yearfor determining whether the chemical sector has bottomed and whether margin recovery can materialize

For investors, Celanese’s price increase announcement represents a

[1] StockTitan - “Celanese Announces Polyamide Price Increase” (https://www.stocktitan.net/news/CE/celanese-announces-polyamide-price-pjxs2mg73g2z.html)

[2] Investing.com - “Celanese to raise polyamide product prices amid higher costs” (https://www.investing.com/news/company-news/celanese-to-raise-polyamide-product-prices-amid-higher-costs-93CH-4463843)

[3] Deloitte - “2026 Chemical Industry Outlook” (https://www.deloitte.com/us/en/insights/industry/chemicals-and-specialty-materials/chemical-industry-outlook.html)

[4] Company Overview Data - Celanese Corporation (CE) Market Analysis

[5] Yahoo Finance - Celanese Stock News and Analysis (https://finance.yahoo.com/)

[6] SEC.gov - Celanese Corporation Form 10-Q Filing (https://www.sec.gov/Archives/edgar/data/1306830/000130683025000225/ce-20250930.htm)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。