US Electric Grid Stress: Investment Implications for Utility Stocks and Energy Infrastructure

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

The United States is currently experiencing a significant Arctic cold blast that has pushed the national electric grid to record winter demand levels, creating substantial implications for utility stocks and energy infrastructure investments. This analysis examines the immediate market impacts, regional variations, and long-term investment opportunities emerging from this infrastructure stress event.

The Arctic blast affecting the US has created unprecedented grid stress across multiple regions [1][2]:

| Region/Operator | Key Metrics | Status |

|---|---|---|

PJM Interconnection (67M people, 13 states) |

Peak demand >130,000 MW for up to 7 days | Critical Alert |

MISO (15 states + Manitoba) |

Minnesota hub at ~$500/MWh | High Alert |

ISO New England (6 states) |

Prices >$300/MWh (double normal) | Elevated Risk |

ERCOT (Texas) |

1.18% controlled blackout probability Jan 31 | Monitored |

The cold weather has triggered dramatic price increases across energy markets [1][2]:

- Natural Gas Futures: Surged approximately63% over three days, reaching a six-week high

- PJM Wholesale Electricity: Jumped from <$200/MWh to nearly$3,000/MWh

- MISO Minnesota Hub: Rose to approximately$500/MWh(from ~$50)

- New England: Exceeded$300/MWh, approximately double Friday’s levels

Real-time market data reveals mixed performance across utility and energy stocks during the current cold event [0]:

| Stock/ETF | Current Price | Daily Change | 52-Week Range |

|---|---|---|---|

XLU (Utilities ETF) |

$42.56 | -0.36% | $35.51 - $46.88 |

XLE (Energy ETF) |

$49.19 | +0.57% | $37.24 - $49.89 |

DUK (Duke Energy) |

$117.43 | -0.24% | $109.43 - $130.03 |

GNRC (Generac) |

$173.01 | -1.33% | $99.50 - $203.25 |

SO (Southern Company) |

$87.54 | +0.03% | $82.69 - $100.84 |

UNG (Natural Gas ETF) |

$13.97 | +4.02% |

$9.95 - $24.33 |

The market is exhibiting classic cold-weather trading patterns [3]:

- Natural Gas ETFs(UNG, BOIL): BOIL has surged approximately70%this week as freeze-offs reduce supply while heating demand spikes

- Backup Power Specialists(Generac): Up over10%on outage fears as consumers and businesses seek backup generation

- Traditional Utilities: Showing modest declines as investors weigh potential infrastructure damage and repair costs

- Natural Gas Exposure: The “freeze-off” phenomenon—where production is curtailed due to frozen wells and pipelines—creates supply shocks that benefit existing gas inventories

- Backup Power Demand: Companies like Generac (GNRC) benefit from immediate outage-related demand surges

- Grid Services: Companies providing emergency response and grid hardening services see increased short-term demand

- Potential for rotating blackouts could damage utility infrastructure

- Higher operational costs may compress margins temporarily

- Regulatory scrutiny during widespread outages

Based on historical patterns during extreme weather events [3]:

| Strategy | Entry Trigger | Exit Trigger |

|---|---|---|

Sector Rotation (XLE/XLU) |

10-day ROC > 0 + Volume > 200% of 20-day average | Close < 50-day SMA or +15% TP / -7% SL |

Natural Gas ETFs |

Storage drawdown confirmation | Price reversal after storm passes |

Generac (GNRC) |

Outage-fueled rally initiation | Restoration reports normalizing |

The energy sector is entering a massive capital investment cycle driven by multiple factors [4]:

| Investment Category | 2025-2030 Allocation | Key Drivers |

|---|---|---|

Grid Modernization |

~$450 billion | Smart grid, AMI, ADMS systems |

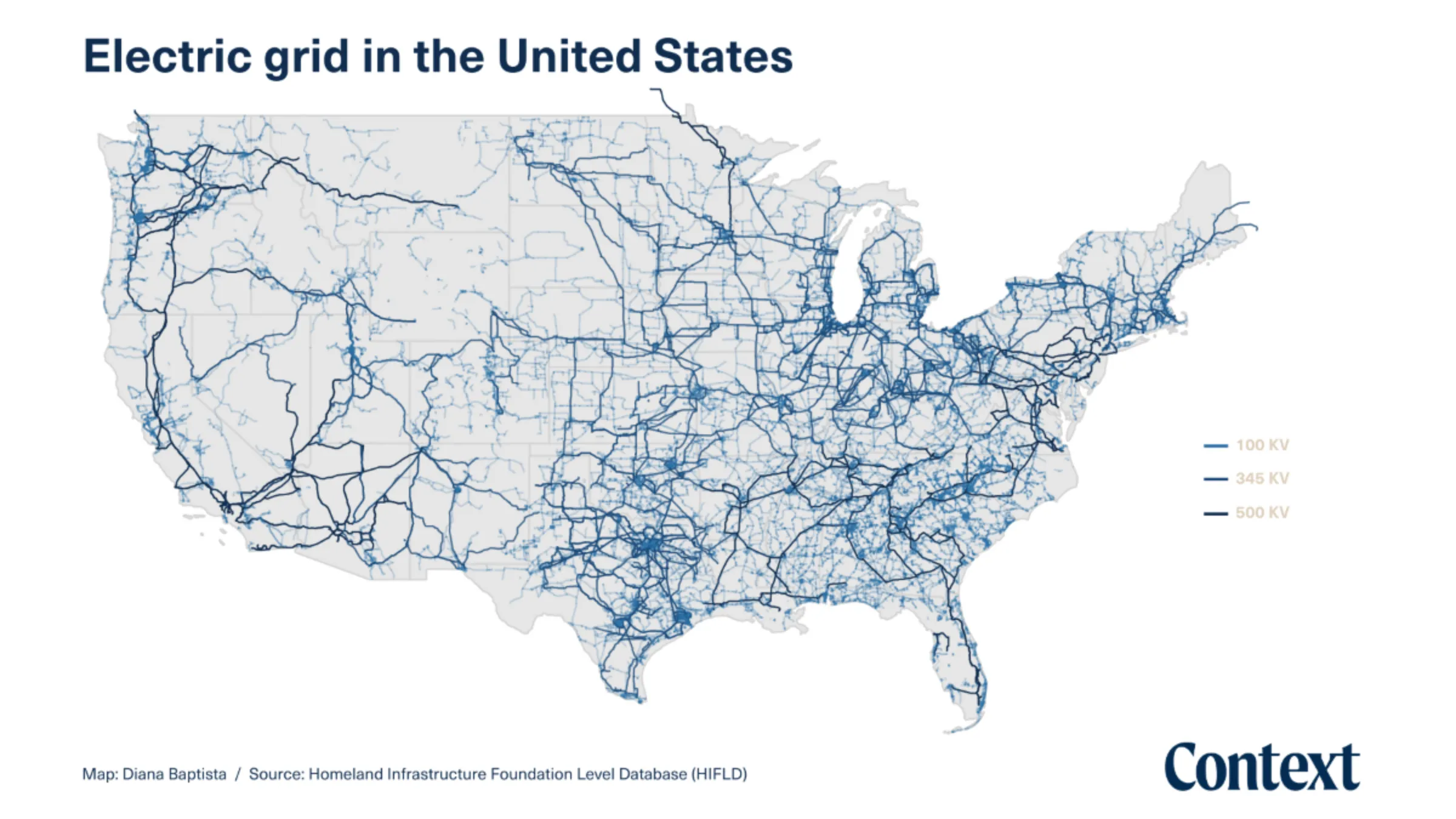

Transmission Expansion |

~$300 billion | 60% capacity increase needed |

Renewables |

~$350 billion | IRA tax incentives, corporate PPA |

Energy Storage |

~$150 billion | Battery installations projected at 18.3 GW in 2025 |

Cybersecurity |

~$100 billion | NERC compliance, AI-driven grid management |

The investment thesis is reinforced by substantial government support [4]:

- Infrastructure Investment and Jobs Act (2022): $65 billion allocated for power infrastructure

- $21.5 billion for grid modernization

- $7.5 billion for EV charging infrastructure

- Inflation Reduction Act: Production Tax Credits (PTCs) and Investment Tax Credits (ITCs) for renewables and storage

| Region | Grid Operator | Investment Focus |

|---|---|---|

Mid-Atlantic/Northeast |

PJM | Transmission interconnections, winter hardening |

Midwest |

MISO | Storage deployment, natural gas infrastructure |

Texas |

ERCOT | Grid reliability, generation capacity |

New England |

ISO-NE | Fuel diversification, renewable integration |

- PJM Coverage: Exelon (EXC), American Electric Power (AEP), Dominion Energy (D)

- MISO Coverage: Xcel Energy (XEL), Ameren (AEE), CMS Energy (CMS)

- ERCOT Coverage: NextEra Energy (NEE), CenterPoint Energy (CNP)

- Monitor Natural Gas Storage Reports: A massive drawdown confirms the rally thesis; a smaller draw could trigger reversals

- Track FCC DIRS Reports: Daily disaster status reports indicate outage severity and duration

- Watch Weather Forecasts: Transition from “dangerously cold” to “mild” is a key exit signal

- Grid Modernization Beneficiaries: Companies providing smart grid technology, grid-scale storage, and cybersecurity solutions

- Transmission Infrastructure: Companies involved in high-voltage line construction and interconnection upgrades

- Regulated Utilities with Rate Base Growth: Entities with approved infrastructure investment programs and constructive regulatory relationships

- Energy Storage Leaders: Battery manufacturers and project developers capitalizing on the fastest-growing clean energy segment

- Regulatory Risk: Potential for punitive regulation following major outages

- Execution Risk: Infrastructure projects face 10-15 year planning cycles for transmission

- Technology Risk: Smart grid investments require ongoing software and security updates

- Climate Risk: Increasing frequency of extreme weather events may exceed infrastructure design parameters

The escalating US electric grid stress during the current Arctic cold blast highlights fundamental vulnerabilities in the nation’s energy infrastructure while simultaneously creating both immediate trading opportunities and long-term investment themes. The approximately

For investors, the cold weather event serves as a reminder of:

- The essential nature of utility investments during supply-demand stress periods

- The growth potential in grid modernization and energy storage sectors

- The increasing importance of backup power solutions for both residential and commercial customers

The

[1] Reuters - “US power grid faces stress test amid arctic chill, data center demand” (https://www.reuters.com/business/energy/largest-us-electric-grid-expects-all-time-record-winter-demand-2026-01-22/)

[2] US News - “US Electric Grid Shows Escalating Stress Amid Cold Blast” (https://www.usnews.com/news/us/articles/2026-01-24/us-electric-grid-shows-escalating-stress-amid-cold-blast)

[3] AInvest - “Winter Storm Trade: Tactical Entry/Exit Triggers for Energy Utilities” (https://www.ainvest.com/news/winter-storm-trade-tactical-entry-exit-triggers-energy-utilities-2601/)

[4] LandGate - “2025-2030: $1.4 Trillion in Energy Infrastructure Opportunities” (https://www.landgate.com/news/2025-2030-1-4-trillion-in-energy-infrastructure-opportunities)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。