Southwest Airlines LUV 2026 Guidance Beat Analysis

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Based on my comprehensive analysis of Southwest Airlines’ 2026 guidance beat and industry outlook, here is a detailed assessment:

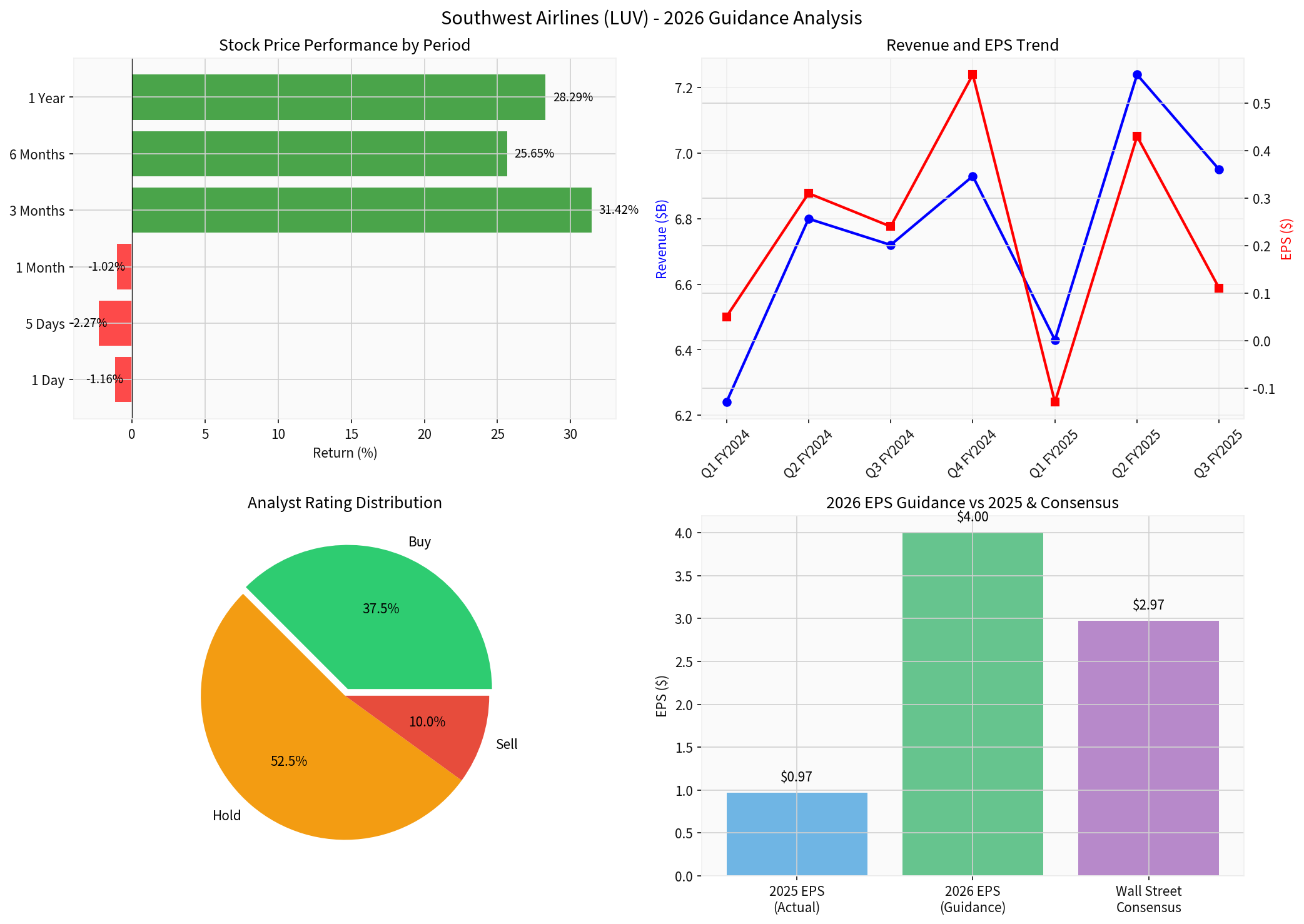

Southwest Airlines reported Q4 FY2025 earnings that exceeded analyst expectations, setting the stage for an ambitious 2026 outlook[0][1]:

| Metric | Actual | Estimate | Surprise |

|---|---|---|---|

| EPS | $0.56 | $0.56 | +4.51% |

| Revenue | $6.93B | $6.92B | -1.01% |

The company achieved record revenue for 2025, supported by

Southwest Airlines issued 2026 EPS guidance of

The company has implemented significant operational changes following pressure from activist investor Elliott Investment Management. These reforms include improved scheduling efficiency, route optimization, and enhanced crew utilization.

Southwest’s transition to assigned seating has begun generating incremental EBIT contribution. This strategic shift, implemented in recent quarters, is expected to provide sustained revenue benefits in 2026.

The company projects Available Seat Miles (ASMs) to increase by

Management expects favorable fuel cost dynamics in 2026, with potential price relief contributing to margin expansion. Aviation fuel market analysis supports this outlook, with prices expected to remain manageable amid stable crude oil markets[4].

Record annual revenue and robust adjusted EBIT provide a solid base for 2026 projections, demonstrating the effectiveness of Southwest’s cost control measures and revenue enhancement initiatives.

Southwest Airlines’ stock has demonstrated strong momentum, with the

| Indicator | Signal | Interpretation |

|---|---|---|

| MACD | No cross (bearish) | Neutral momentum |

| KDJ | Oversold opportunity | Potential bounce |

| RSI | Oversold opportunity | Potential rebound |

| Beta | 1.15 | Higher volatility than market |

| Trend | Sideways | Trading range: $40.28-$42.43 |

The stock is currently trading near key support levels, with the analyst consensus target at

-

Profits Recovery: Global airline industry profits are projected to reach$41 billion in 2026, supported by continued low fuel prices and economic growth[4].

-

Strong Demand: Air travel demand remains robust across both domestic and international markets, with international routes driving 85% of capacity growth in 2025[4].

-

Revenue Growth: The aviation fuel market is expected to grow from $341 billion in 2026 to $548 billion by 2031, indicating sustained air travel expansion[4].

-

Aircraft Delivery Constraints: Airlines face significant challenges with Boeing and Airbus delivery backlogs, potentially limiting capacity growth opportunities.

-

Labor Costs: Rising labor expenses and potential contract negotiations could impact margins.

-

Competitive Dynamics: Low-cost carrier competition remains intense, particularly in domestic routes.

-

Economic Uncertainty: Potential economic slowdown could impact discretionary travel spending.

The analyst community shows a

| Rating | Count | Percentage |

|---|---|---|

| Buy | 15 | 37.5% |

| Hold | 21 | 52.5% |

| Sell | 4 | 10.0% |

- JP Morgan: Upgraded to Overweight from Underweight (January 9, 2026)[0]

- Goldman Sachs: Maintained Sell rating (January 13, 2026)

- Jefferies: Maintained Hold rating (January 26, 2026)

Price targets range from

- Operational improvements from restructuring initiatives

- Incremental benefits from assigned seating

- Favorable fuel cost environment

- Strong demand fundamentals

- Successful integration of new business model initiatives

- Labor cost management

- Fleet renewal and capacity discipline

- Economic conditions affecting travel demand

[0] 金灵API数据 (公司概览、股价数据、财务分析)

[1] GuruFocus - “Southwest Airlines (LUV) Q4 Earnings Beat Expectations” (https://www.gurufocus.com/news/8560635/southwest-airlines-luv-q4-earnings-beat-expectations)

[2] StockTitan - “Southwest Airlines guides 2026 EPS at least $4” (https://www.stocktitan.net/news/LUV/southwest-airlines-reports-fourth-quarter-and-full-year-2025-results-wi75yrwz7zui.html)

[3] Investing.com - “Southwest Airlines shares soar as 2026 guidance exceeds expectations” (https://ng.investing.com/news/earnings/southwest-airlines-shares-soar-as-2026-guidance-exceeds-expectations-93CH-2310908)

[4] Avolon 2026 Outlook - “India, UAE, and Saudi Arabia set to lead global aviation growth” (https://avolon.aero/newsrooms/avolon-2026-outlook-up-next)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。