Uber Earnings Risk Analysis: Restaurant Weakness vs. Business Travel Resilience

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

The original Reddit post raises significant concerns about Uber’s valuation near all-time highs, arguing the stock faces 10-15% downside risk if earnings disappoint. Key Reddit concerns include:

- Restaurant Peer Weakness: Uber is trading near ATH while restaurant stocks have sold off dramatically, with the 25-35 year demographic showing particular consumer weakness

- Delivery Exposure: Uber Eats represents 32% of revenue, making it a leveraged bet on declining restaurant traffic

- High Expectations: Limited upside potential with elevated risk of a correction if delivery growth slows or guidance is cautious

Reddit comments provide counterarguments:

- Some users note many Uber trips are for work/business travel, not comparable to restaurant stocks

- Others argue Uber appears fairly/undervalued with low P/E ratio

- Business travel spending is confirmed as a significant component

- GLP-1 weight loss drugs may reduce restaurant demand but potentially shift to delivery

- Chipotle down 44%, Cava Group down 51%, Sweetgreen down 76% YTD

- Hospitality sector down 2.12%, restaurants specifically down 1.97%

- Consumer weakness driven by inflation, weak labor market, unemployment, increased student loan repayments, and slower real wage growth

The Reddit concerns about restaurant sector weakness are well-founded and validated by research data. However, several factors differentiate Uber from pure-play restaurant stocks:

-

Business Travel Component: Reddit comments correctly identify that Uber’s ride-sharing business has significant business travel exposure, providing insulation from pure consumer discretionary weakness

-

Delivery Market Dynamics: While restaurant traffic is declining, the food delivery market continues to grow, potentially benefiting Uber Eats even as in-person dining weakens

-

Valuation Perspective: Reddit’s bearish view on valuation contrasts with some commenters’ assessment of fair value based on low P/E ratios

The key earnings question is whether Uber’s delivery segment can maintain growth amid restaurant weakness, or if the broader consumer headwinds will impact both segments.

- Delivery growth slowdown if restaurant traffic decline accelerates

- Cautious forward guidance given macro uncertainty

- Potential miss on MAPC growth metrics

- Continued consumer weakness among core 25-35 demographic

- Business travel resilience providing segment stability

- Potential market share gains in delivery if weaker competitors struggle

- Low valuation relative to growth prospects if execution continues

- Shift from in-person dining to delivery could benefit Uber Eats

- Delivery segment growth rate and guidance

- MAPC trends, particularly among younger demographics

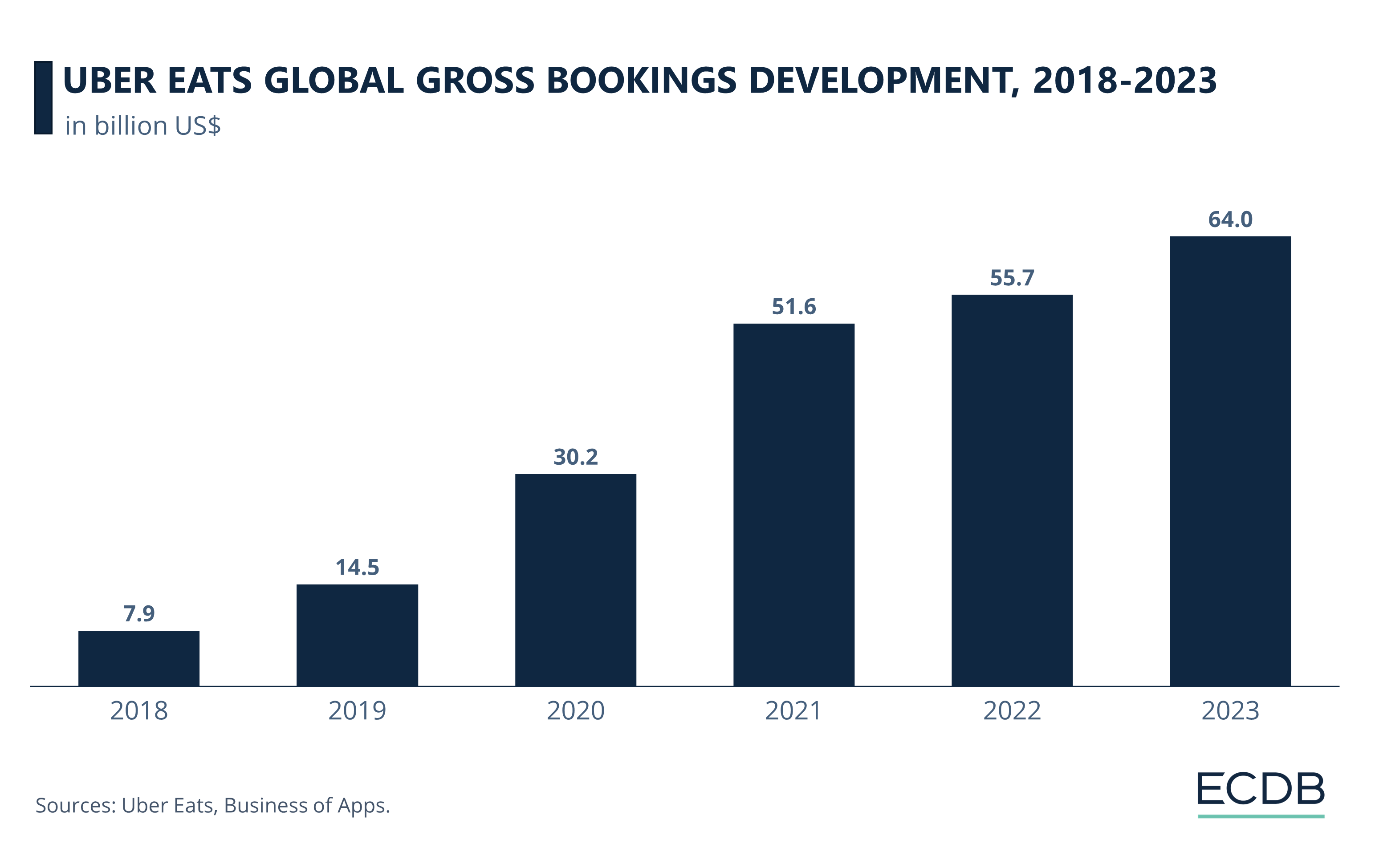

- Gross bookings growth across both segments

- Management commentary on consumer spending trends

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。