Deutsche Bank's Bullish Outlook on Palantir (PLTR): Analysis of the $200 Price Target

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Deutsche Bank’s upgrade of Palantir Technologies (PLTR) from a $160 to $200 price target—representing a 25% increase—is grounded in a confluence of compelling growth drivers. As of February 3, 2026, PLTR trades at $157.99, making Deutsche Bank’s $200 target imply approximately

Deutsche Bank highlighted the

The bank pointed to

Deutsche Bank projected government revenue growth of approximately

The firm cited an ongoing

Palantir maintains

Deutsche Bank referenced Palantir’s

Palantir has demonstrated consistent revenue acceleration:

| Fiscal Period | Revenue | YoY Growth |

|---|---|---|

| Q1 FY2025 | $883.86M | — |

| Q2 FY2025 | $1.00B | — |

| Q3 FY2025 | $1.18B | +62.8% |

| Q4 FY2025 | $1.41B | +70% |

| FY2025 Total | ~$4.4B | +53% |

| FY2026 Target | — | +70-80% [1] |

The Q4 FY2025 results exceeded expectations with revenue of $1.41 billion (4.9% above estimates) and EPS of $0.25 (8.6% above estimates) [2]. Analyst consensus projects FY2026 revenue growth of 70-80%, representing a substantial acceleration from FY2025 levels.

- Net Profit Margin:28.11% (TTM)

- Operating Margin:21.81%

- ROE:19.09%

- Current Ratio:6.43 (strong liquidity)

- Free Cash Flow (2024):$2.1 billion [4]

| Metric | Value | Industry Context |

|---|---|---|

| P/E Ratio (TTM) | 246.85x-338.98x | Extremely elevated |

| P/S Ratio (TTM) | 92.10x | Premium |

| P/B Ratio | 56.34x | High |

| Market Cap | $360.89B | Large-cap software |

| Beta | 1.69 | High volatility |

The DCF model using analyst consensus estimates shows:

- Expected Revenue (FY2028):$14.66B (average estimate)

- Expected EPS (FY2028):$2.50

- WACC:16.3% (reflecting high beta of 1.69)

- Revenue CAGR (5-year):30.5% [5]

-

Growth Justification:70-80% projected revenue growth for FY2026, combined with 121% commercial growth, represents exceptional top-line acceleration. Applying a growth-adjusted multiple supports premium valuations.

-

Margin Expansion:Improving profitability (net margin expanding from single digits to 28%) demonstrates the business model’s operating leverage.

-

AI Positioning:Palantir’s AIP platform positions it favorably within the enterprise AI market—a structural growth opportunity that commands premium multiples.

-

Strong Q4 Results:The recent earnings beat ($1.41B revenue, $0.25 EPS) validates the growth trajectory and provides fundamental support for higher targets.

-

Extreme Multiples:P/E of 246-339x and P/S of 92x far exceed typical software industry norms. Even high-growth companies rarely sustain such multiples.

-

High Beta (1.69):Palantir exhibits significant volatility, making it susceptible to market sentiment swings and risk-off scenarios.

-

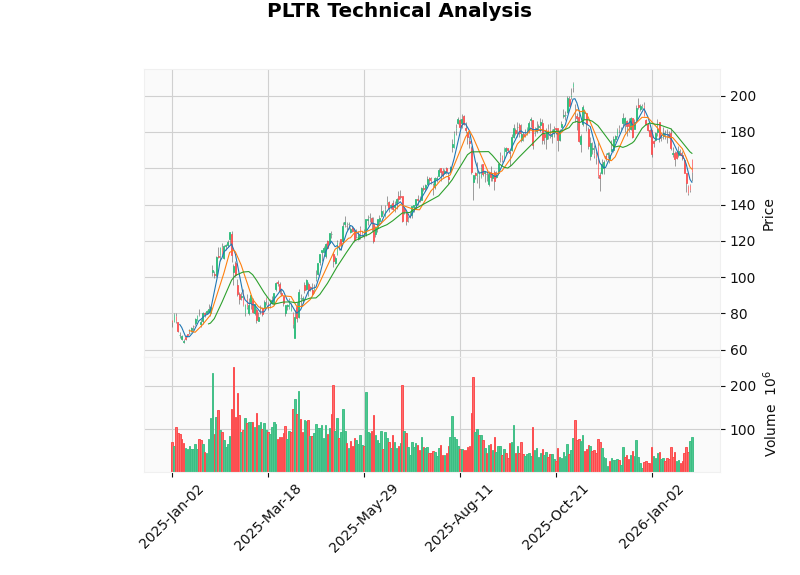

Technical Indicators:The stock is currently in asideways/no clear trendzone (support: $153.99, resistance: $168.22), with MACD showing bearish signals [6].

-

Consensus Rating:The analyst consensus isHold(58.3% of analysts), suggesting the market views the current price as fairly valued relative to fundamentals [2].

- Current Price:$157.81 (as of Feb 3, 2026)

- 50-Day MA:$174.29 (above current price)

- 200-Day MA:$159.49 (above current price)

- 52-Week Range:$66.12 - $207.52

- Trend:Sideways/No clear trend

The stock is trading below both its 50-day and 200-day moving averages, suggesting short-term weakness. However, the strong fundamental backdrop may provide support at current levels.

| Analyst | Rating | Price Target | Date |

|---|---|---|---|

Deutsche Bank |

Hold | $200 | Feb 2026 |

| Citi | Buy | $235 | Jan 2026 |

| DA Davidson | Neutral | $180 | Feb 2026 |

| William Blair | Outperform | $200+ | Recent |

| Morgan Stanley | Equal Weight | — | Nov 2025 |

Consensus Target |

Hold |

$196.50 |

— |

The consensus target of $196.50 aligns closely with Deutsche Bank’s $200 target, suggesting the upgrade is consistent with broader analyst sentiment [2].

Deutsche Bank’s $200 price target for Palantir is

- Genuine growth accelerationin both commercial (121% YoY) and government (51% projected) segments

- Strong margin expansiondemonstrating operating leverage

- Structural AI tailwindsthrough the AIP platform

- Robust deal pipelineproviding revenue visibility

However, the

[1] InsiderFinance - “Palantir Stock Upgrade Boosts 2026 Outlook” (https://www.insiderfinance.io/news/palantir-stock-upgrade-boosts-2026-outlook)

[2]金灵API - Company Overview & Market Data for PLTR (2026-02-03)

[3] Palantir Technologies Inc. - SEC 10-K Filing (2024-12-31) (https://www.sec.gov/Archives/edgar/data/1321655/000132165525000022/pltr-20241231.htm)

[4]金灵API - Financial Analysis for PLTR (2026-02-03)

[5]金灵API - DCF Valuation Analysis for PLTR (2026-02-03)

[6]金灵API - Technical Analysis for PLTR (2026-02-03)

[7] Yahoo Finance - “After a 130% Surge in 2025, Can Palantir Stock Keep Climbing?” (https://finance.yahoo.com/news/130-surge-2025-palantir-stock-182629024.html)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。