Gen Digital (GEN) Investment Analysis: AI-Driven Revenue Recovery Assessment

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Based on comprehensive analysis of Gen Digital’s current position, AI strategy, and market dynamics, here is a detailed assessment:

Gen Digital Inc. (NASDAQ: GEN), the parent company of Norton, LifeLock, Avast, and other cybersecurity brands, faces a critical inflection point as it releases its Q3 FY2026 earnings today. The company’s AI integration strategy represents both its primary opportunity for revenue recovery and its defense against intensifying competition in the consumer cybersecurity market [0][1].

| Metric | Current Value | vs. Industry Benchmark |

|---|---|---|

Current Price |

$22.90 | — |

Market Cap |

$14.12B | — |

P/E Ratio (TTM) |

24.79x | Above software sector avg |

P/B Ratio |

5.75x | — |

YTD Return |

-12.16% | Underperforming S&P 500 (+2.8%) |

1-Year Return |

-16.76% | Significantly underperforming |

The stock has declined approximately

| Fiscal Quarter | Revenue | YoY Growth | EPS | vs. Estimate |

|---|---|---|---|---|

Q3 FY2025 |

$986M | — | $0.56 | +2.2% |

Q4 FY2025 |

$1.01B | — | $0.59 | — |

Q1 FY2026 |

$1.26B | +30% YoY | $0.64 | +8.5% |

Q2 FY2026 |

$1.22B | +25% YoY | $0.62 | +1.6% |

Q3 FY2026 Est. |

$1.23B | — | $0.63 | Consensus |

The company has demonstrated strong year-over-year growth (25-30%) in recent quarters, driven primarily by the post-merger integration of Norton and Avast, as well as expanded premium bundle adoption.

Gen Digital has developed a comprehensive AI infrastructure leveraging

- Real-Time Threat Detection:Machine learning models for malware, phishing, and scam identification

- Generative AI Features:Proactive scam detection, smart phishing alerts, and automated incident response

- Identity Protection Intelligence:Enhanced credit monitoring and fraud prevention capabilities

- Cross-Platform Integration:Unified protection across macOS, Android, and iOS devices [1][3]

- AI Skills Scanner:Diagnostic tool scanning OpenClaw agent skills for unauthorized data access and malicious behavior

- AI Skills Marketplace:Curated repository of vetted agent skills audited by Gen’s security engine

- Positioned as the “trust layer” for autonomous AI systems [3]

This launch demonstrates Gen’s ambition to extend its cybersecurity expertise beyond traditional consumer protection into emerging AI application security—a potentially significant growth vector.

| Advantage | Description | Strategic Value |

|---|---|---|

Data Scale |

One of the largest consumer security sensor networks globally | High – enables superior ML model training |

Brand Portfolio |

Multi-brand ecosystem (free-to-paid conversion funnel) | High – cross-selling opportunities |

Identity Protection |

LifeLock integration with credit monitoring | Differentiation vs. free competitors |

Platform Agnosticism |

Strong coverage across macOS, Android, iOS | Captures broader market share |

Gen Digital faces intensifying competition from multiple vectors:

- Microsoft Defender:Free baseline security creating pricing pressure in entry-level segment

- McAfee:Competes on UX simplicity with newer consumer applications

- Bitdefender:Strong technical capabilities in endpoint protection

- Cloud-Native Vendors:Emerging players with modern architectures

- Superior depth of identity protection where LifeLock is fully integrated

- Variety of entry-level and premium tier offerings

- Strong geographic diversification (Americas 69.9%, EMEA 21.3%, APAC 8.8%)

- 75+ million paid customers providing recurring revenue base [0][1]

- Recent stock price weakness signaling investor skepticism

- Aggressive accounting classification may limit analyst confidence

- Current ratio of 0.51 indicates near-term liquidity constraints [0]

| Scenario | Revenue Impact | Key Drivers |

|---|---|---|

AI Upsell |

+15% revenue | Premium AI feature adoption by existing customer base |

Market Share Expansion |

+25% revenue | Conversion from free Avast/AVG users to paid bundles |

Merger Synergies |

+35% revenue | Full R&D consolidation and cross-brand integration |

AI Agent Security |

New segment | Emerging revenue stream from enterprise/SMB agent security |

- Free-to-Paid Conversion:Expanding paid user base from Avast/AVG’s substantial free installation base

- ARPU Growth:Higher average revenue per user through bundled AI services (VPN, identity protection)

- Churn Reduction:AI-driven proactive protection reducing customer attrition

- SMB Expansion:Leveraging consumer platform for small business security segment

| Rating | Distribution |

|---|---|

Buy |

52.4% (11 analysts) |

Hold |

42.9% (9 analysts) |

Sell |

4.8% (1 analyst) |

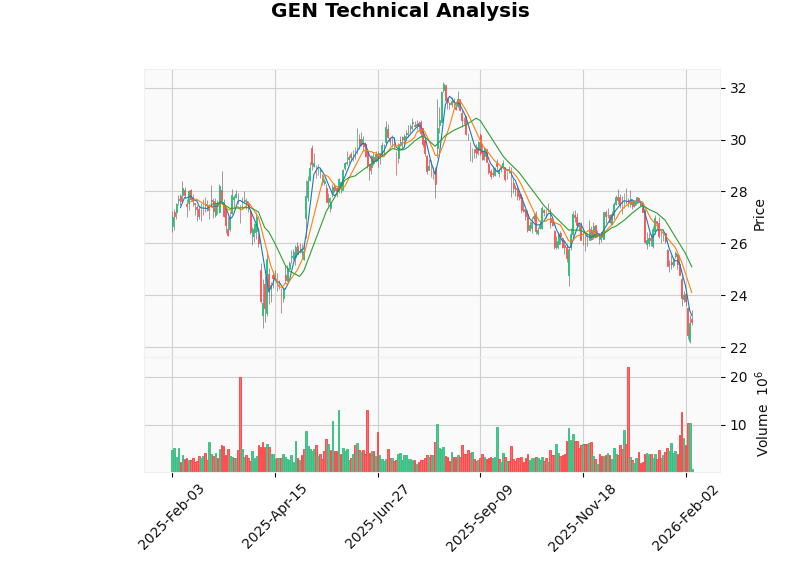

| Indicator | Signal | Interpretation |

|---|---|---|

MACD |

Bearish (no_cross) | No clear upward momentum |

KDJ |

Bullish (K:17.1, D:15.1) | Oversold condition with potential bounce |

RSI (14) |

Oversold | Possible mean reversion opportunity |

Beta |

1.1 | Slightly higher volatility than market |

Trend |

Sideways | Trading range: $22.63 - $25.09 |

- Support:$22.63

- Resistance:$25.09 [0]

The technical picture suggests the stock is in a consolidation phase with oversold conditions that could present a rebound opportunity if AI initiatives deliver positive catalyst.

- Proven Growth Trajectory:25-30% YoY revenue growth in recent quarters demonstrates underlying business momentum

- AI Differentiation:Genuine competitive advantages through data scale and multi-brand ecosystem

- Strategic Positioning:Agent Trust Hub indicates innovation beyond traditional consumer security

- Valuation Headroom:37% upside to consensus target suggests market has priced in near-term challenges

- Competitive Intensity:Free solutions (Microsoft Defender) commoditizing entry-level security

- Accounting Concerns:“Aggressive” classification may limit institutional investor confidence

- Liquidity:Current ratio of 0.51 indicates near-term balance sheet stress

- Execution Risk:AI feature adoption depends on successful customer education and retention

Gen Digital’s AI capabilities represent a

- Positive:Strong AI feature adoption metrics, raised FY2027 guidance, Agent Trust Hub traction

- Negative:Churn increases, margin compression, competitive share losses

The company’s

Gen Digital’s AI features

[0] 金灵API - Gen Digital Company Overview & Technical Analysis

[1] GuruFocus - Gen Digital Q3 2026 Earnings Preview

[2] MarketBeat - Gen Digital 52-Week Low Analysis

[3] Finviz - Gen Digital Agent Trust Hub Launch

[4] Ad-Hoc News - Gen Digital Cybersecurity Analysis

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。