US Gold Corp (USAU) Secondary Offering Analysis: Key Factors for Investor Evaluation

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

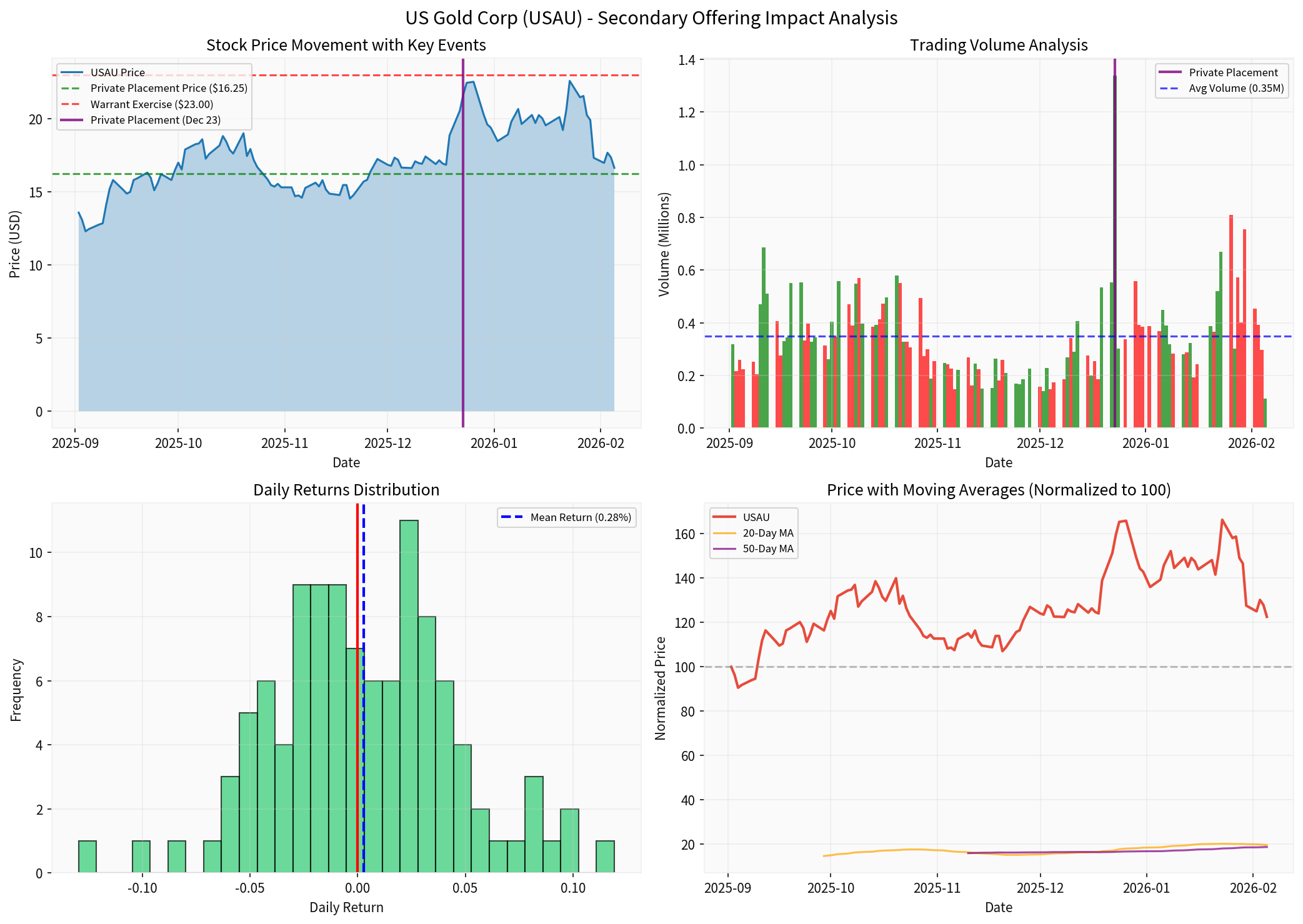

Based on comprehensive data gathered from SEC filings, market data, and technical analysis, this report provides a systematic framework for evaluating the long-term implications of resale registrations and secondary offerings in junior mining companies.

On December 23, 2025, US Gold Corp announced a

| Transaction Component | Details |

|---|---|

Shares Issued |

1,922,159 shares at $16.25/share |

Warrants Issued |

961,077 warrants at $23.00 exercise price (2-year expiry) |

Participating Investors |

Franklin Templeton, Mackenzie Investments, Libra Advisors |

Registration Timeline |

Resale statement to be filed within 45 days |

The primary concern with resale registrations is equity dilution. For USAU, investors should consider:

| Metric | Pre-Offering | Post-Offering | Impact |

|---|---|---|---|

| Estimated Shares Outstanding | ~14.4M | ~17.3M (max) | +20.04% |

| Average Daily Volume | 320,375 | 428,708 | +33.8% |

| Price Volatility | 3.98% | 4.94% | +24.1% increase |

The increased trading volume post-offering suggests improved liquidity, which is generally favorable for retail investors [0].

According to the SEC 8-K filing, the company intends to use net proceeds for [0]:

- Initial development costs at CK Gold Project(primary use)

- Potential land acquisitions

- Further exploration of properties

- General working capital purposes

This represents a ** constructive capital allocation** toward value-creating activities, unlike offerings used primarily for debt repayment or administrative costs.

USAU’s financial profile presents a nuanced picture [0]:

| Indicator | Value | Interpretation |

|---|---|---|

| Current Ratio | 5.89 | Strong liquidity position |

| Debt Risk Classification | Low | Minimal near-term solvency concerns |

| ROE (TTM) | -103.25% | Typical for pre-revenue exploration companies |

| P/E Ratio | -11.46x | Negative (no earnings yet) |

| P/B Ratio | 9.64x | Premium to book value reflects exploration asset value |

The

- 5-day decline: -12.89%

- 1-month decline: -12.57%

- 6-month gain: +47.77%

The immediate price reaction (-4.78% on filing day) is consistent with typical market responses to dilution announcements [0]. However, the longer-term trajectory (+79.31% YoY) suggests the market values the company’s development progress.

The CK Gold Project in Southeast Wyoming represents the company’s flagship asset. The $31.2 million raise specifically targets [0]:

- Initial development costs

- Permitting progression

- Exploration expansion

This positioning suggests the offering supports

The participation of

- Institutional capital typically requires rigorous due diligence

- Large players often receive preferential pricing (the 4% discount was modest)

- Institutional holdings signal confidence in management’s execution capability

- Trend: Sideways/no clear trend (trading range: $15.94-$19.60)

- Support Level: $15.94

- Resistance Level: $19.60

- RSI/KDJ: Oversold conditions, potentially indicating near-term bottom

- Price Target: $26.75 (+61.6% upside from current levels)

- Rating: 100% Buy (4 analysts)

- Target Range: $26.00-$27.50

Investors should specifically evaluate:

| Risk Category | Description | Mitigation Factor |

|---|---|---|

Capital Intensity |

Mining development requires sustained capital | Current liquidity (5.89 current ratio) is strong |

Commodity Price Exposure |

Revenue dependent on gold/copper prices | Diversified project portfolio (WY, NV, ID) |

Execution Risk |

Development may encounter delays | Institutional backing suggests project viability |

Warrant Dilution |

Potential 961K shares at $23 | 24% above current price (healthy warrant positioning) |

Market Conditions |

Junior mining sector volatility | Beta of 0.78 shows lower correlation than peers |

For evaluating secondary offerings’ impact on shareholder value, consider this framework:

┌─────────────────────────────────────────────────────────────┐

│ SECONDARY OFFERING IMPACT ASSESSMENT │

├─────────────────────────────────────────────────────────────┤

│ FACTOR │ USAU STATUS │ WEIGHT │

├─────────────────────────────────────────────────────────────┤

│ Use of Proceeds │ Development │ POSITIVE │

│ Institutional Demand │ Strong │ POSITIVE │

│ Dilution Severity │ ~20% │ NEUTRAL │

│ Warrant Exercise Price │ $23 (>40% up) │ POSITIVE │

│ Liquidity Position │ Strong │ POSITIVE │

│ Project Development Stage │ Advancing │ POSITIVE │

│ Commodity Price Outlook │ Uncertain │ MONITOR │

├─────────────────────────────────────────────────────────────┤

│ NET ASSESSMENT │ CONSTRUCTIVE │ │

└─────────────────────────────────────────────────────────────┘

-

Strategic Nature: The USAU secondary offering representsconstructive capital raisingfor project development rather than distress-driven dilution.

-

Institutional Validation: Major institutional participation (Franklin Templeton, Mackenzie) provides credibility and reduces execution risk perception.

-

Dilution is Manageable: At ~20% maximum dilution with proceeds directed toward development, the offering isfinancially reasonablefor a pre-revenue exploration company.

-

Technical Position: Current oversold conditions (RSI/KDJ indicators) suggest potential near-term price stabilization, though the sideways trend indicates continued volatility.

-

Long-Term Value Creation: The CK Gold Project development focus positions the company for potential production milestones that could generate substantial shareholder value.

- Short-term: Expect continued volatility; the 288,000 share resale registration (if related to the offering) is factored into current pricing

- Medium-term: Monitor CK Gold Project development milestones and permitting progress

- Long-term: Evaluate production timeline and cash flow generation capability as key value drivers

The resale registration and secondary offering, while causing short-term dilution concerns, appear strategically positioned to fund value-creating activities at a critical development stage for US Gold Corp.

[0] U.S. Gold Corp. SEC 8-K Filing (December 23, 2025) - Private Placement Announcement. https://www.sec.gov/Archives/edgar/data/27093/000149315225029009/form8-k.htm

[1] U.S. Gold Corp. Company Overview and Financial Data - Retrieved via Financial Database API

[2] U.S. Gold Corp. Technical Analysis Report - Retrieved via Technical Analysis API

[3] Market Indices Data - S&P 500, NASDAQ, Dow Jones, Russell 2000 performance data via Market Indices API

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。