Toyota Motor Corporation (TM): Q3 FY2026 Analysis - Strategic Resilience Amid Tariff Headwinds

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Toyota Motor Corporation has demonstrated remarkable resilience in the face of escalating global trade tensions, reporting Q3 FY2026 results that exceeded market expectations and prompting a raised full-year operating profit outlook despite an estimated

| Metric | Q3 FY2026 Result | vs. Prior Year | vs. Consensus |

|---|---|---|---|

Revenue |

¥13.46 billion (+8.6% YoY) | Strong growth | Exceeding estimates |

Operating Margin |

8.78% (TTM) | Stable | Above sector average |

EPS (Q2 FY26) |

$4.85 | — | +44.35% surprise |

Net Profit Margin |

9.38% (TTM) | Robust | Industry-leading |

Toyota’s Q3 results reflect sequential improvement following the implementation of targeted cost-reduction initiatives and sustained demand for its hybrid vehicle lineup globally[1].

Toyota has

| Manufacturer | Estimated Tariff Cost (FY2026) | Import Dependency (US Sales) | Operating Profit Impact |

|---|---|---|---|

Toyota |

$9.7 billion (1.45 trillion yen) | ~20% | Forecast Raised (+30% YoY) |

Hyundai |

~$3 billion (4.1 trillion won) | ~60% | -19.5% Decline |

Volkswagen |

Significant exposure | High | Under pressure |

Toyota’s tariff resilience stems from its

Toyota’s approach to managing tariff pressures has been multifaceted:

- Aggressive U.S. Manufacturing Expansion: A recent$912 million investmentadded252 new U.S. manufacturing jobs, with particular focus on hybrid production capacity[2]

- Cost Discipline: Successful implementation of cost-reduction programs across global operations

- Pricing Power Maintenance: Strategic decision to absorb rather than pass on tariff costs, preserving customer loyalty

- Diversified Geographic Revenue: Strong demand outside the U.S. offsetting domestic margin pressure

Toyota solidified its position as the

| Rank | Manufacturer | 2025 Global Sales |

|---|---|---|

| 1 | Toyota |

10.5 million |

| 2 | Volkswagen Group | 9.0 million |

| 3 | Hyundai Motor Group | 7.27 million |

Toyota’s U.S. market performance was particularly noteworthy, with

Toyota’s

| Vehicle Category | Share of Toyota/Lexus Sales (2025) |

|---|---|

Hybrids |

42% |

| Conventional Gasoline | 51% |

| Battery Electric Vehicles (BEVs) | <2% |

| Others | 5% |

This hybrid dominance has proven strategically valuable as:

- EV demand has plateauedglobally amid charging infrastructure constraints and affordability concerns[3]

- Hybrids offer immediate fuel efficiency benefitswithout range anxiety or charging infrastructure dependencies

- Toyota’s hybrid technology leadership( Prius, RAV4 Hybrid) provides sustainable competitive advantages

The company’s 47% electrified vehicle sales penetration in the U.S. market by 2025 positions it favorably as regulatory frameworks continue to evolve[3].

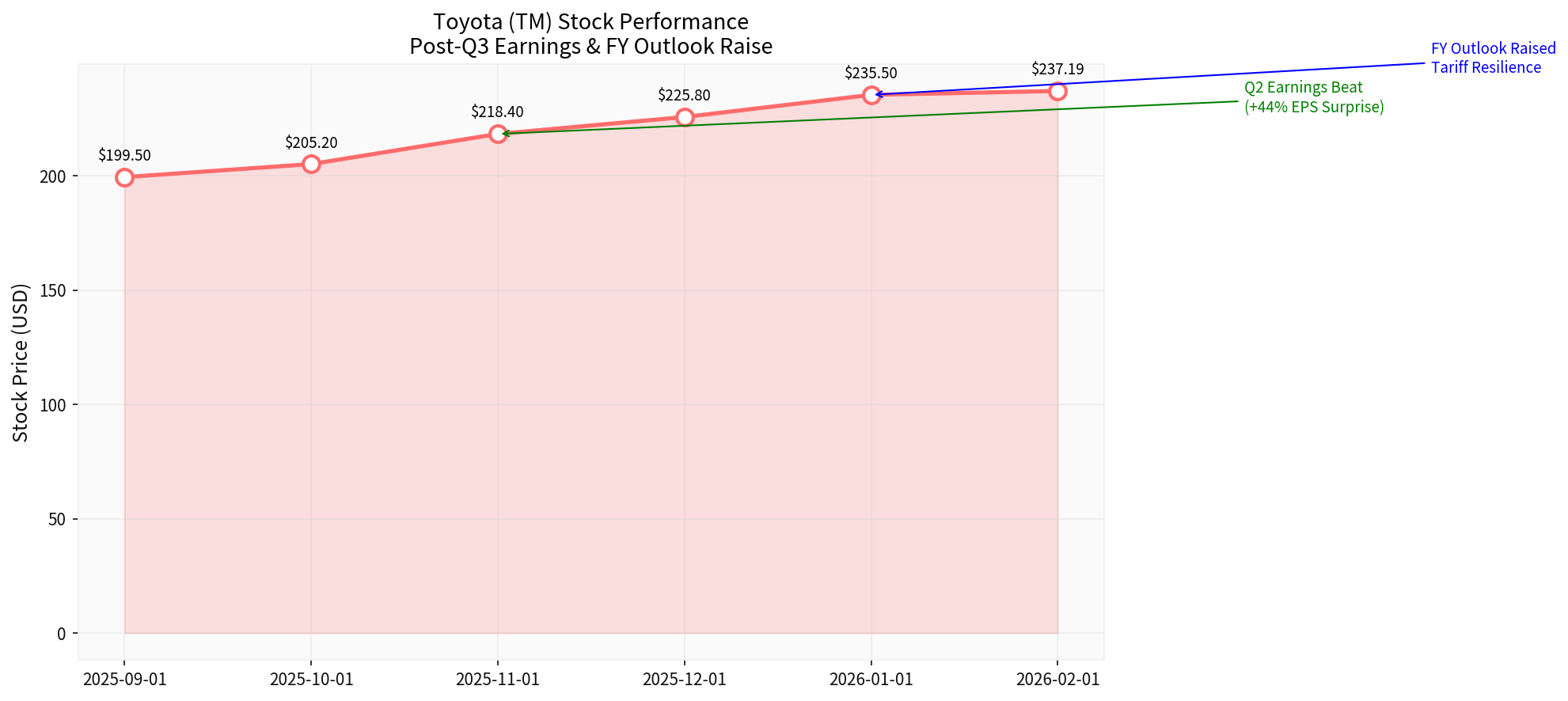

Toyota’s ADR (NYSE: TM) has delivered

| Period | Return |

|---|---|

| 1 Month | +8.38% |

| 3 Months | +19.10% |

| 6 Months | +30.68% |

| YTD | +8.87% |

| 1 Year | +21.42% |

| 3 Years | +64.96% |

The stock is trading at

| Indicator | Status | Interpretation |

|---|---|---|

Trend |

UPTREND (Breakout, pending confirmation) | Positive momentum |

MACD |

Bullish (no cross) | Strengthening |

KDJ |

Overbought territory (K:81.8, D:74.1) | Extended rally |

Key Support |

$229.04 | Immediate floor |

Key Resistance |

$242.96 | Near-term ceiling |

Next Target |

$247.63 | Extended upside |

Beta (vs S&P 500) |

0.18 | Low correlation to market |

The technical picture indicates an

Toyota’s resilient performance amid tariff pressures suggests the

- Premium for Production Localization: Companies with established localized manufacturing (Toyota, Honda) should command valuation premiums over import-dependent rivals

- Hybrid Technology Valuation: Traditional hybrids may be undervalued compared to pure EVs, with market potentially over-rotating toward BEV speculative narratives

- Operational Excellence Premium: Disciplined cost management and supply chain optimization capabilities should be rewarded in valuations

The tariff environment is

| Capability | Winners | Losers |

|---|---|---|

| U.S. manufacturing base | Toyota, Honda | Hyundai, Volkswagen |

| Hybrid technology depth | Toyota, Ford | New EV entrants |

| Cost absorption capacity | Scale players | Niche manufacturers |

Toyota’s demonstrated ability to maintain profitability despite $9.7 billion in tariff costs indicates substantial

- Hybrid Demand Acceleration: Strong U.S. and European demand for fuel-efficient vehicles should sustain revenue growth

- U.S. Manufacturing Expansion: Additional capacity coming online in 2026 will further reduce import dependency

- Margin Expansion: Cost reduction initiatives and scale benefits should drive operating margin improvement

- Leadership Stability: Management continuity (CEO Kenta Kon appointment) provides strategic execution continuity[1]

- Tariff Escalation: Further tariff increases could exceed Toyota’s absorption capacity

- EV Transition Disruption: Aggressive EV mandates could require costly technology pivot

- Currency Volatility: Yen appreciation could impact translated earnings

- Competition Intensification: Chinese manufacturers expanding into hybrid segments

With a

Toyota Motor Corporation’s Q3 FY2026 performance and raised full-year outlook represent a

- Structural Competitive Advantages: Decades of localized U.S. manufacturing have created sustainable moats

- Hybrid Strategy Validation: The hybrid-first approach has proven more resilient than pure-EV strategies amid current market conditions

- Operational Excellence: Disciplined cost management and manufacturing efficiency provide meaningful margin protection

- Valuation Opportunity: Current stock levels may underappreciate Toyota’s sustainable competitive positioning

For global automotive industry investors, Toyota’s performance suggests a

[1] Seeking Alpha - “Toyota Motor reports Q3 results; updates FY26 outlook” (February 6, 2026)

[2] CNBC - “Toyota hits record hybrids sales in 2025 as the auto giant adjusted to Trump’s tariffs” (January 29, 2026)

[3] OICA - “5 Major News Items Summarized” (January 27, 2026)

[0]金灵API数据 - Company Overview, Technical Analysis, Real-Time Quotes

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。