Expedia Group (EXPE): Outperform Rating Analysis & Competitive Positioning

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Evercore ISI has maintained its

Expedia trades at

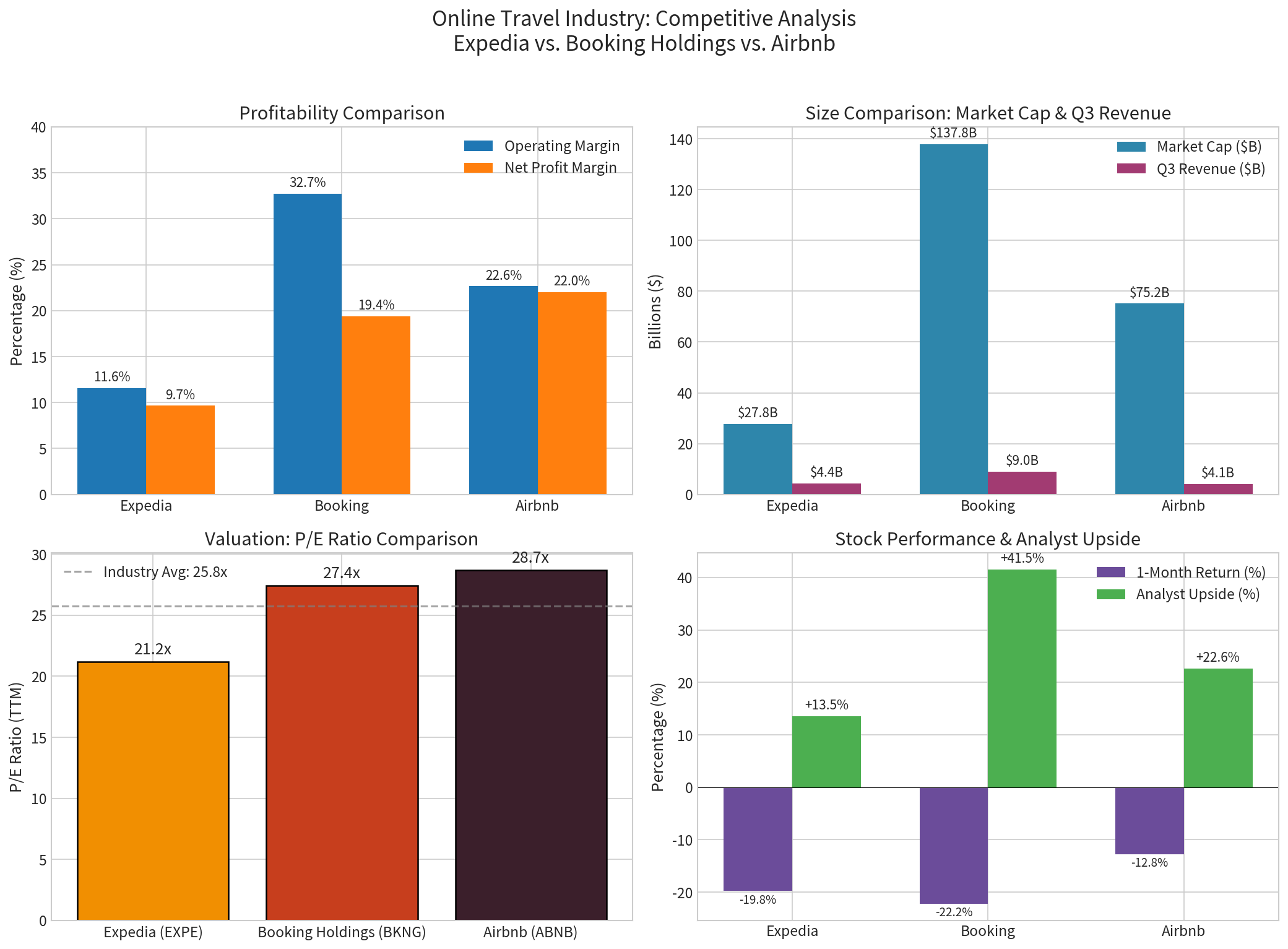

| Company | P/E Ratio | Relative Valuation |

|---|---|---|

Expedia (EXPE) |

21.19x |

Most undervalued |

| Booking Holdings (BKNG) | 27.44x | 29% premium |

| Airbnb (ABNB) | 28.70x | 35% premium |

Evercore notes that Expedia’s valuation remains approximately

Expedia’s new CEO Ariane Gorin has driven meaningful operational improvements in 2025[3]:

- Q3 FY2025 Revenue: $4.41 billion (+3.0% vs. estimates)

- Q3 FY2025 EPS: $7.57 (+8.6% vs. $6.97 estimate)

- Stronger room night growthcompared to prior periods

- Improved marketing efficiencyreducing customer acquisition costs

The company’s 2025 turnaround has demonstrated clear recovery momentum, with the CEO projecting 2026 will be “very big” for U.S. tourism[3][4].

Despite industry-wide challenges, Expedia has delivered superior returns[0]:

| Metric | EXPE | BKNG | ABNB |

|---|---|---|---|

1-Year Return |

+17.14% |

-13.01% | -10.15% |

| 1-Month Return | -19.75% | -22.17% | -12.75% |

| YTD Return | -15.96% | -19.70% | -8.65% |

Expedia’s

- Evercore ISI Target: $350.00 (47% upside from current levels)

- Consensus Target: $270.00 (13.5% upside)

- Target Range: $200.00 - $330.00[0][2]

With 44.6% of analysts rating EXPE a “Buy” and a consensus price target suggesting meaningful upside, the stock offers compelling risk-reward.

The online travel agency (OTA) industry shows clear market leadership dynamics[5][6]:

| Company | Market Share | Position |

|---|---|---|

| Booking Holdings | ~40% | Market Leader |

| Airbnb | ~18-19% | Growing Sharply |

Expedia Group |

~15% | #2 Position Under Pressure |

| Trip.com Group | Regional | Asian Markets |

| Metric | EXPE | BKNG | Implication |

|---|---|---|---|

Market Cap |

$27.82B | $137.78B | BKNG is 5x larger |

Operating Margin |

11.60% | 32.74% | BKNG 2.8x more efficient |

Net Margin |

9.66% | 19.37% | BKNG 2x profitability |

Current Ratio |

0.74 | 1.33 | BKNG better liquidity |

P/E Ratio |

21.19x | 27.44x | EXPE 23% discount |

- Trades at significant discount to market leader

- Stronger presence in North American market

- More diverse brand portfolio (Expedia, Hotels.com, Vrbo)

- Superior profitability and margins

- Better liquidity position

- Dominance in international markets

- Higher ROE (when positive)

| Metric | EXPE | ABNB | Implication |

|---|---|---|---|

Q3 Revenue |

$4.41B | $4.09B | Similar scale |

Operating Margin |

11.60% | 22.65% | ABNB 2x more efficient |

Net Margin |

9.66% | 22.03% | ABNB significantly higher |

ROE |

1.16% | 32.14% | ABNB vastly superior |

Beta |

1.38 | 1.10 | ABNB less volatile |

P/E Ratio |

21.19x | 28.70x | EXPE 26% discount |

- Lower valuation multiple

- Broader service offerings (lodging + air + packages)

- Established brand portfolio

- Superior profitability metrics

- Better return on equity

- Lower volatility profile

- Stronger EMEA presence (48% of revenue)[0]

┌────────────────────────┬──────────┬──────────┬──────────┐

│ Factor │ EXPE │ BKNG │ ABNB │

├────────────────────────┼──────────┼──────────┼──────────┤

│ Valuation Attractiveness│ ★★★ │ ★★ │ ★★ │

│ Margin Profile │ ★★ │ ★★★ │ ★★★ │

│ Market Share │ ★★ │ ★★★ │ ★★★ │

│ Liquidity │ ★ │ ★★★ │ ★★★ │

│ Growth Momentum │ ★★★ │ ★★ │ ★★ │

│ Balance Sheet Strength │ ★★ │ ★★★ │ ★★★ │

│ Analyst Sentiment │ ★★★ │ ★★★ │ ★★ │

├────────────────────────┼──────────┼──────────┼──────────┤

│ OVERALL RATING │ 19/28 │ 23/28 │ 22/28 │

└────────────────────────┴──────────┴──────────┴──────────┘

- Trend: Sideways/No clear trend

- Support Level: $232.11

- Resistance Level: $267.47

- Beta: 1.38 (vs. SPY)

- Trading Range: $232-$267

The stock is currently trading near the bottom of its established range, potentially offering a favorable entry point.

- Market Share Erosion: Expedia continues to lose ground to Booking Holdings and Airbnb[6]

- Margin Pressure: Operating margin (11.6%) significantly lags peers (22-33%)

- Liquidity Concerns: Current ratio of 0.74 indicates potential short-term financial stress

- Marketing Intensity: Heavy advertising spend required to compete with larger rivals

- Google Canvas/SEO Risk: Competition from Google’s travel search features

Evercore ISI’s

- Valuation Arbitrage: Trading at 21.2x P/E (vs. 27-29x for peers) with ~20% upside to consensus

- Turnaround Validation: New leadership delivering earnings beats and improved operational metrics

- Relative Strength: Outperforming peers on a one-year basis despite competitive pressures

- Recovery Catalyst: 2026 expected to be a strong year for travel demand

While Expedia faces margin and market share challenges versus Booking Holdings and Airbnb, its

[0] 金灵API - Expedia Group Company Overview

[1] Intellectia.ai - Evercore ISI Names Amazon and Expedia as Top Long Picks for 2026

[2] Investing.com - Expedia Stock Rating Reiterated at Outperform by Evercore

[3] Hospitality Today - Expedia’s 2025 Turnaround Gains Momentum

[4] Fortune - Expedia Group CEO on 2026 Outlook

[5] CSIMarket - EXPE Market Share vs Competitors Q3 2025

[6] Skift - 10 Biggest Online Travel Agencies

[7] 金灵API - Expedia Technical Analysis

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。