Robinhood (HOOD) Analysis: Reddit Bullishness vs Valuation Reality Ahead of Earnings

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Reddit sentiment is overwhelmingly bullish on HOOD ahead of November 5 earnings, with users citing expansion across brokerage, crypto, tokenization, prediction markets, and upcoming banking services [reddit:1omuse8]. Long-term holders who bought at $25 expect further upside, with price targets ranging from $200 by next summer to as high as $500. Users praise Robinhood’s superior UI/UX and Gold credit card benefits, noting widespread adoption despite past controversies.

However, skepticism exists around valuation fundamentals. Several users compare HOOD’s $130B market cap to established players like Schwab ($171B) and JPMorgan ($846B), questioning whether current multiples are justified. International users note limited options trading in Europe, suggesting expansion opportunities if these restrictions ease. Prediction markets face legal uncertainty with outcomes potentially varying by state political landscape.

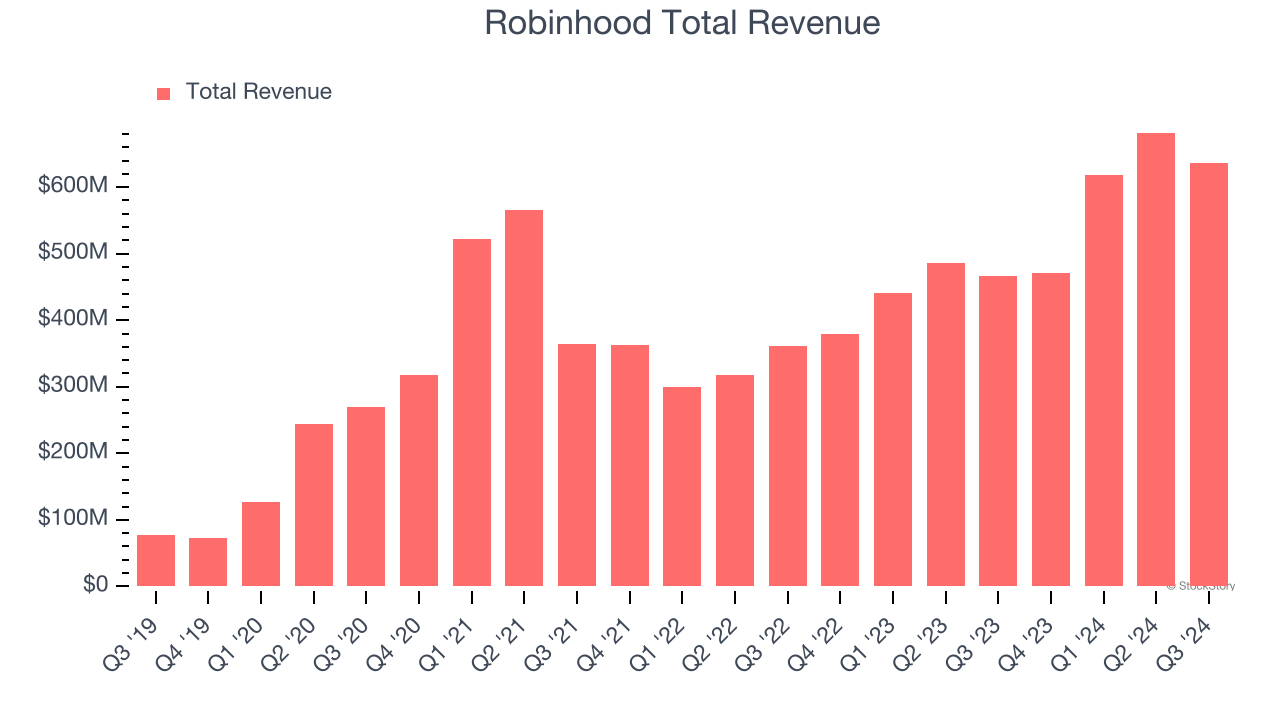

Robinhood has executed a remarkable financial turnaround, achieving profitability in 2024 with $1.4 billion profit versus a $541 million loss in 2023 [citation:1][citation:2]. Current metrics show:

- Market cap: $129-130 billion with trailing P/E of 73.96-74.7

- Q2 2025 net income doubled to $386 million (up 100% YoY)

- Revenue grew 45% YoY to $989 million

- November 5 earnings expected EPS of $0.51 (200% YoY growth)

The company’s multi-vertical expansion strategy includes:

- International: WonderFi acquisition for C$250 million, gaining Canadian crypto market access

- Tokenization: 200+ tokenized US stocks launched for EU customers in June 2025

- Banking: Comprehensive services launching fall 2025 with 4% APY savings accounts

- Prediction Markets: Kalshi partnership offering sports betting contracts

- Crypto: Ethereum and Solana staking services for US users

Analyst consensus remains Moderate Buy with average price target of $122.85, representing 11% downside from current levels [citation:3]. KeyBanc recently raised their target to $155 with Overweight rating [citation:4].

Reddit’s bullish $1T valuation thesis aligns with Robinhood’s aggressive expansion strategy but disconnects from analyst price targets and current valuation metrics. The platform’s strong user engagement and successful pivot to profitability support growth narratives, yet the 74x P/E ratio suggests expectations are already priced in.

Key convergence points:

- Both Reddit and research acknowledge banking services as major catalyst

- International expansion recognized as significant growth driver

- Strong financial performance validates operational improvements

Critical divergence:

- Reddit’s price optimism ($200-$500 targets) vs analyst caution ($122.85 average)

- Reddit’s focus on user experience vs analyst emphasis on valuation multiples

- Reddit’s underestimation of regulatory risks in prediction markets

- Banking Launch: Fall 2025 debut with 4% APY savings could drive deposit growth and fee income

- International Expansion: European tokenization and Canadian crypto access address saturated US market

- Earnings Catalyst: 200% YoY EPS growth expected November 5 could trigger rally

- Network Effects: Superior UI/UX could maintain user base despite higher fees

- Valuation Stretch: 74x P/E ratio leaves little room for disappointment

- Regulatory Uncertainty: Prediction markets face state-by-state legal challenges

- Competition: Established banks entering fintech space with greater resources

- Execution Risk: Simultaneous expansion across multiple verticals may strain resources

- Market Saturation: Core brokerage business faces intense competition and fee compression

The November 5 earnings report will be crucial - meeting or beating the $0.51 EPS expectation could validate the expansion strategy, while any disappointment could trigger significant downside given the premium valuation.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。