BRK.B Investment Analysis: Underperformance vs. Opportunity

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Reddit discussions reveal mixed sentiment about BRK.B’s investment appeal:

-

Performance Frustration: Many users express disappointment with BRK.B’s 5-6% YTD performance versus SPY’s 16-17%, feeling they’ve missed tech gains while holding a “slow and steady” position Reddit

-

Defensive Hedge Perception: Users commonly treat BRK.B as a bubble hedge or defensive position, particularly valuable during market uncertainty

-

Cash Hoard Debate: The $380B cash position is viewed by some as a powerful opportunity for deployment during market crashes, while others criticize it as poor capital allocation with insufficient buybacks

-

Succession Concerns: Buffett’s age is highlighted as a potential trigger for temporary dips, though some believe successor Abel might deploy cash effectively

-

Unique Advantages: Reddit users emphasize BRK’s access to exclusive deals and leverage that retail investors cannot replicate

The Reddit narrative and research data align on BRK.B’s underperformance but differ on the cash position magnitude. While Reddit discussions reference the $380B figure (actually Q3 2025 data), the 2024 reality of $157B still represents significant firepower.

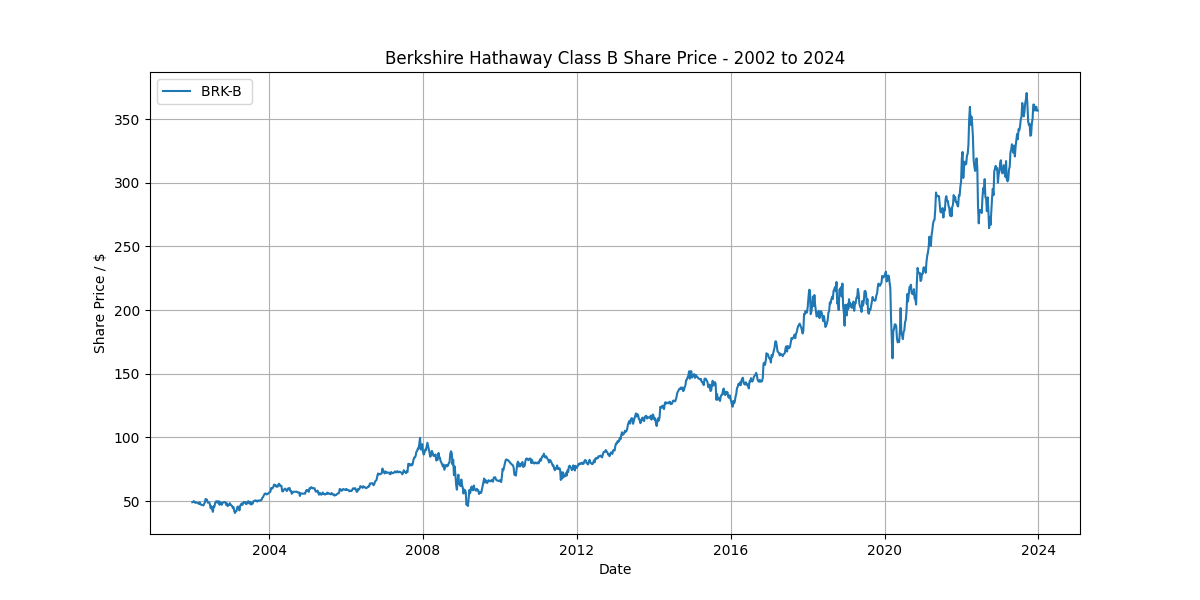

The historical context matters: Berkshire’s book value has grown 18.3% CAGR (1965-2024) versus the S&P 500’s 10.4%, suggesting current underperformance may be temporary Morningstar.

- Market Crash Catalyst: The $157B cash position provides significant capital for opportunistic acquisitions during market downturns

- Succession Deployment: New leadership under Abel may accelerate capital deployment more aggressively than Buffett’s cautious approach

- Valuation Support: Strong operating earnings (+34% YoY) provide fundamental support despite stock underperformance

- Historical Mean Reversion: Long-term outperformance suggests current underperformance may reverse

- Opportunity Cost: Continued underperformance versus growth indices and tech stocks

- Succession Uncertainty: Leadership transition could trigger temporary volatility

- Cash Drag: Large cash position may continue weighing on returns if deployment opportunities don’t materialize

- Market Timing Risk: Defensive positioning may underperform in continued bull markets

BRK.B presents a compelling risk-adjusted opportunity for defensive, long-term investors, particularly those concerned about market corrections. The substantial cash position and strong fundamentals provide downside protection, though investors should be prepared for potential continued underperformance in strong bull markets. The investment thesis hinges on either market downturns creating deployment opportunities or improved capital allocation under new leadership.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。