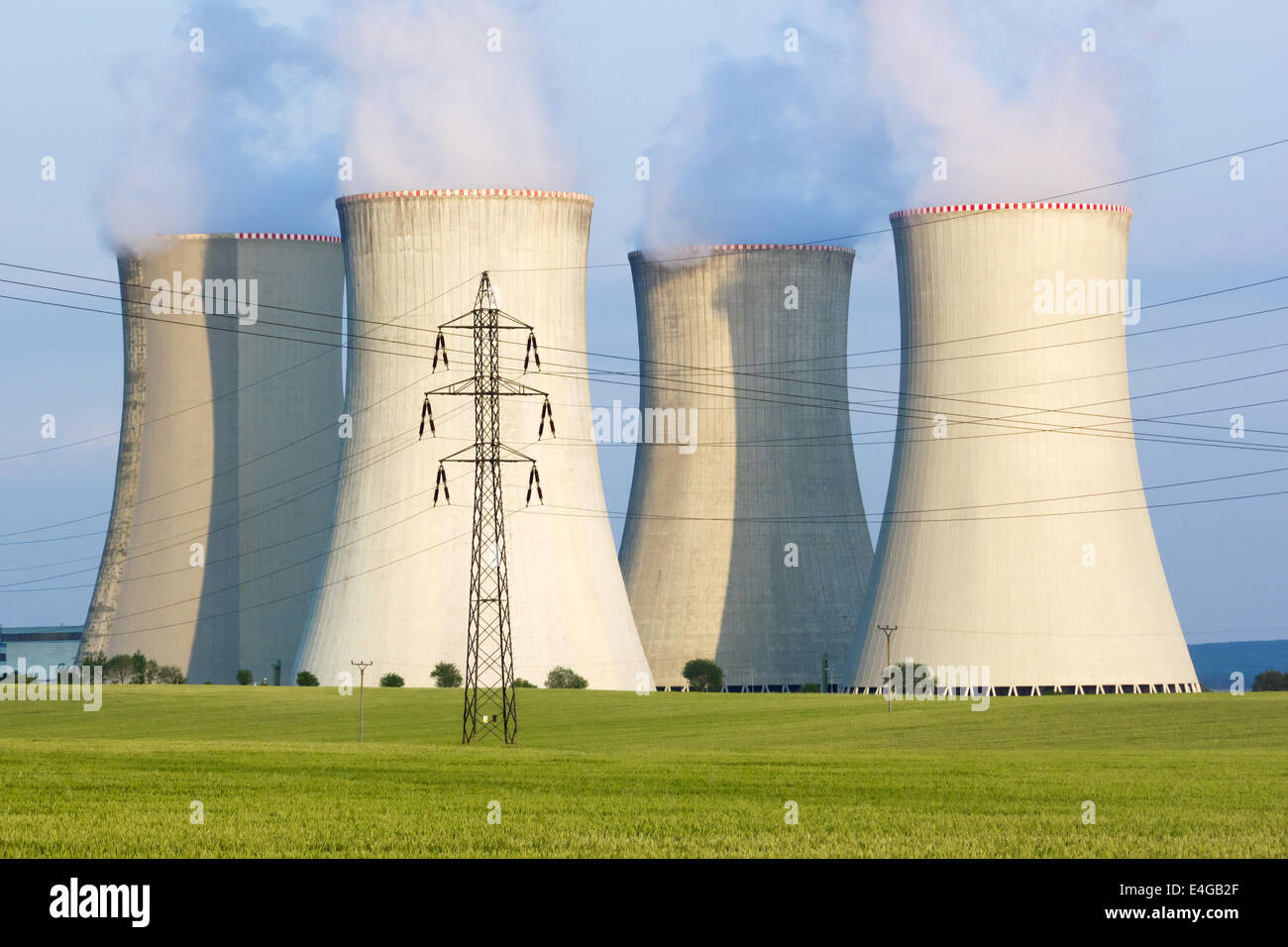

2025 Q3 Utility Sector Report: Structural Differentiation & Shift to High Dividend Investment Logic

#公用事业 #三季报 #高股息 #火电 #水电 #核电 #新能源发电 #水务 #固废处理 #红利策略 #2025Q3

混合

A股市场

2025年11月19日

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

SH600795

--

SH600795

--

SH600900

--

SH600900

--

SZ003816

--

SZ003816

--

01816.HK

--

01816.HK

--

Reddit Factors

- Thermal power profits rebounded significantly due to falling coal prices, with low valuation (Reddit).

- Hydropower performance was stable but valuation was high; nuclear power had clear growth potential focusing on future installed capacity increments (Reddit).

- New energy generation was under pressure due to market-oriented electricity price declines; water and solid waste treatment sectors saw significant cash flow improvements (Reddit).

- The sector’s investment logic shifted to high dividends and stable cash flow, with dividend potential becoming a key consideration (Reddit).

Research Findings

- Structural Differentiation: Thermal power outperformed (dividend growth 91% YoY in H1 2025), hydropower stable (Yangtze Power SH600900 Q3 net profit +0.6%), nuclear under pressure (CGN Power 01816.HK Q3 net profit -14.1%), new energy growth slowed (policy & absorption constraints).

- Dividend Shift: Utility sector became core for dividend strategies (second largest in dividend index after banks), with thermal power companies like Guodian Power SH600795 committing ≥60% dividend payout for 2025-2027.

- Cash Flow & Institutional Allocation: Thermal power H1 2025 operating cash flow increased by 29.4% YoY; AI infrastructure drove power demand, supporting cash flow improvement for power enterprises.

Synthesis

- Alignment: Both Reddit and research confirmed the shift to high dividends and structural differentiation.

- Impact: Low interest rates amplified the appeal of utility high dividends; AI-driven demand provided long-term support for power sectors.

Risks & Opportunities

- Risks: Nuclear cost pressures, new energy absorption issues, regulatory changes.

- Opportunities: Thermal power’s dividend growth, hydropower stability, AI-related power demand growth.

Citations

相关阅读推荐

暂无推荐文章

基于这条新闻提问,进行深度分析...

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

SH600795

--

SH600795

--

SH600900

--

SH600900

--

SZ003816

--

SZ003816

--

01816.HK

--

01816.HK

--