Fed's Quantitative Tightening End: Market Impact and AI Bubble Analysis

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Reddit discussions reveal mixed perspectives on the Fed’s QT termination:

- Defensive Policy Move: User Rainyfriedtofu explains ending QT is defensive to avoid liquidity stress, not a pivot to easing, noting Treasury cash pile and shutdown accelerate liquidity drain[0]

- Trading Strategies: UrStockDaddy suggests trading SPXL and shorting USD, though other users question timing and implementation[0]

- Policy Distinction: Digfortreasure emphasizes ending QT doesn’t imply QE, with consensus viewing it as a stopgap rather than expansionary policy[0]

- Consumer Impact: PugsAndHugs95 warns additional liquidity may not help consumers if wages stagnate while asset prices remain high, potentially risking subprime loans in auto/housing sectors[0]

- AI Bubble Comparison: Charming_Catch1982 contrasts current AI bubble with dot-com era, citing profitable companies like Palantir with real infrastructure[0]

- Risk Prevention: 95Daphne compares the move to preventing a 2019-style repo accident, suggesting possible “not QE, QE” if incidents occur[0]

Research indicates the Fed’s QT reversal stems from mounting liquidity concerns:

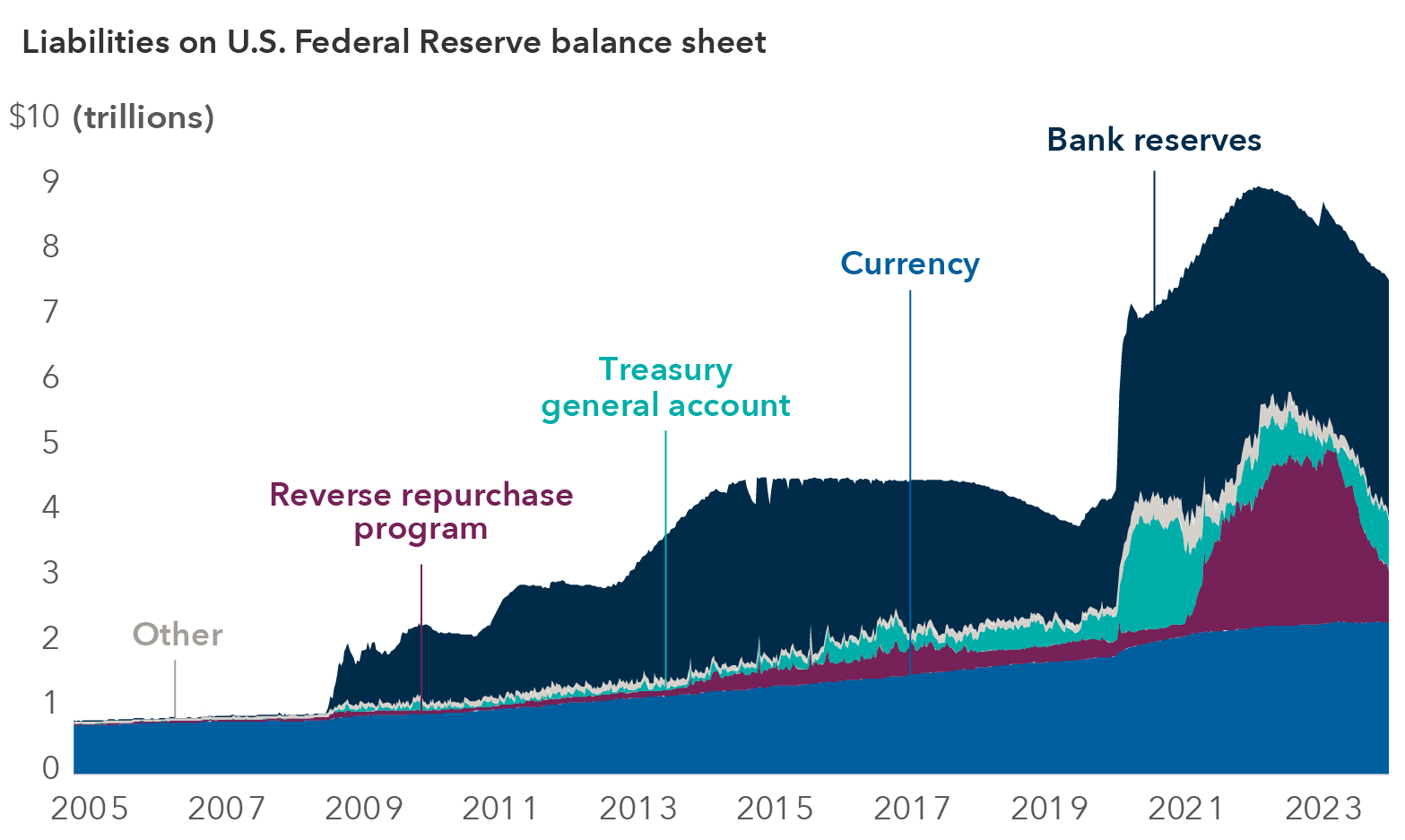

- Policy Pivot: Fed abruptly ended 3-year QT program in late 2025 due to liquidity strains and market stability concerns, prioritizing market stability over inflation control[3][4]

- Inflation Trade-off: The policy reversal includes rate cuts despite 3.0% inflation, potentially undermining inflation control efforts[3][8]

- Liquidity Injection: Ending QT will inject significant liquidity into financial system, putting downward pressure on longer-term interest rates[3][4]

- AI Valuations: AI sector has reached extraordinary valuations, with OpenAI valued at over $300 billion by early 2025[3]

- Market Timeline: Liquidity improvements could stabilize by early 2026, potentially reigniting risk appetite across markets[3]

- Policy Uncertainty: Divergence within Fed creates uncertainty about future easing pace and inflation trajectory[3][8]

Reddit and research sources align on viewing the QT end as primarily defensive rather than expansionary. Both perspectives acknowledge liquidity concerns as the primary driver, though Reddit users express more skepticism about consumer benefits. The AI bubble discussion reveals nuanced views - while research highlights extraordinary valuations, Reddit users note fundamental differences from the dot-com bubble with current AI companies showing real profitability and infrastructure.

Key contradictions emerge around inflation impact: research emphasizes the 3.0% inflation challenge, while Reddit discussions focus more on distributional effects and wage stagnation concerns.

- Risk Assets: Increased liquidity could boost equity markets, particularly growth sectors including AI[3][4]

- Fixed Income: Downward pressure on longer-term rates may benefit bond investors[3]

- Currency Plays: USD weakness potential creates forex trading opportunities[0]

- Inflation Acceleration: Policy pivot risks reigniting inflation despite current 3.0% levels[3][8]

- Market Distortions: Liquidity injection could exacerbate asset price bubbles, particularly in AI sector[3][4]

- Consumer Stress: Wage stagnation combined with high asset prices may strain household finances[0]

- Policy Uncertainty: Fed divergence creates unpredictable policy environment[3][8]

Investors should consider defensive positioning while monitoring liquidity flows. The QT termination favors risk assets but requires careful timing given inflation risks. AI sector exposure warrants selective approach based on fundamentals rather than momentum alone. Currency hedging against USD weakness may provide additional portfolio protection.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。