Data Center Stock Analysis: Separating Sustainable AI Infrastructure from Speculative Plays

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Reddit investors are actively debating the merits of four key data center/AI infrastructure stocks, seeking to separate durable businesses from speculative AI plays:

- IRENemerges as a Reddit favorite, with users Extra_Indication7523 and catlovr1129 highlighting its secured cheap energy contracts and multi-year competitive lead in the transition from Bitcoin mining to AI cloud services [citation:1].

- NBISreceives strong support for its management team and GPU ownership model, positioning it as a pure AI cloud infrastructure play with major Microsoft partnership [citation:1].

- APLDgenerates mixed sentiment - while 15xorbust maintains a large position citing its hyperscaler pipeline, PrettyLittleRosey views it as riskier and less profitable than NBIS/IREN [citation:1].

- WULFis noted for potential upside from Fluidstack expansion and Google backing, with projected additional $190M revenue [citation:1].

- Redditors warn against CRWVdue to high debt and dilution risks, andBITFfor heavy Bitcoin correlation [citation:1].

- Alternative strategies suggested include broader exposure through hyperscale ETFs or direct Nvidia/AMD investments, while some dismiss ex-miners as “risky wrappers around Nvidia debt” [citation:1].

Fundamental analysis reveals distinct business models and risk profiles among the data center contenders:

- NBISoperates as a pure AI cloud infrastructure provider with massive growth trajectory and Microsoft partnership [citation:2]

- IRENleverages renewable energy infrastructure for Bitcoin-to-AI transition [citation:3]

- CIFRpivots from crypto mining to AI HPC workloads with Google partnership [citation:4]

- APLDspecializes in building/operating AI data centers with CoreWeave leasing agreements [citation:5]

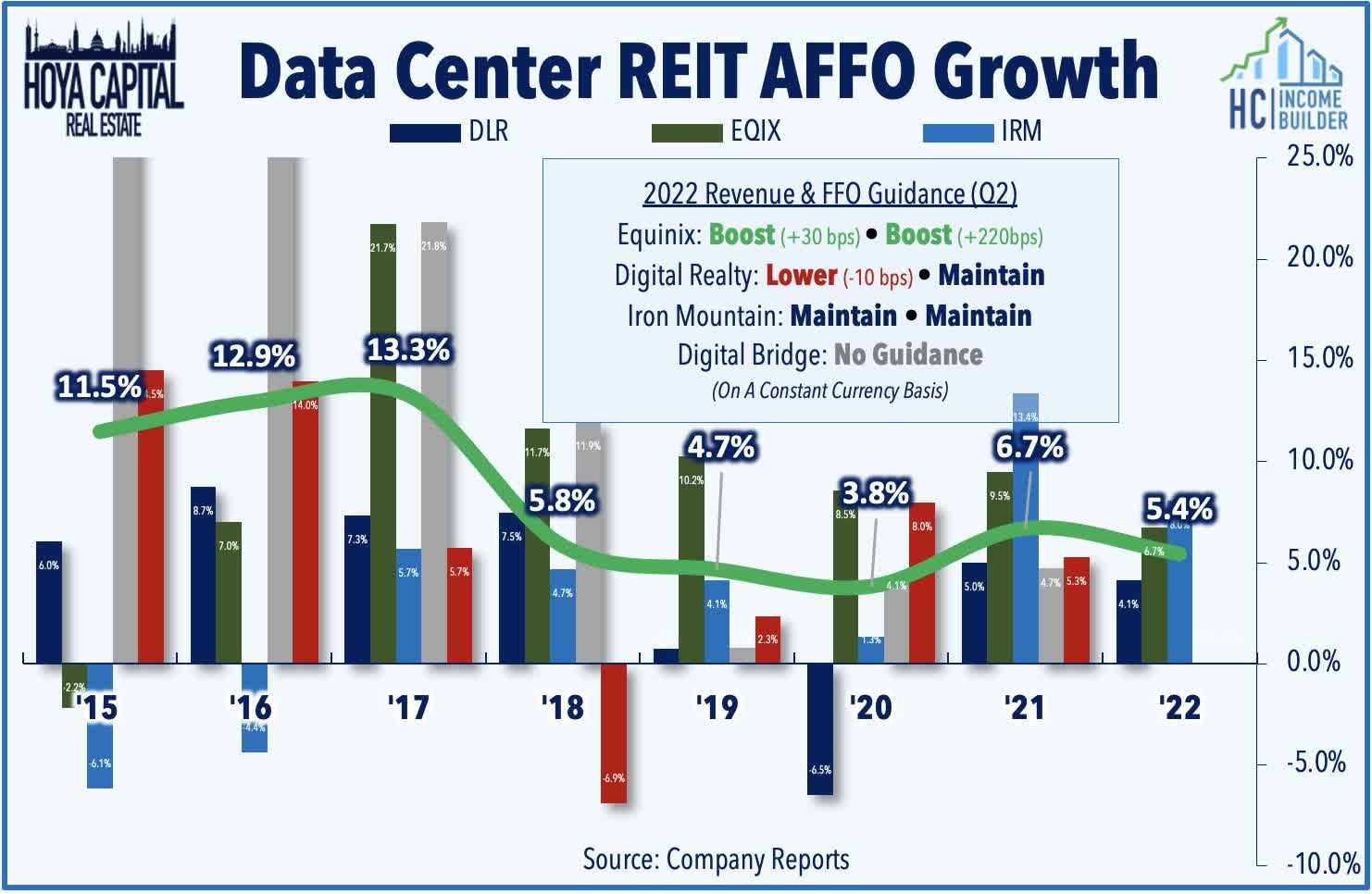

- REIT-specific metrics (FFO, AFFO, payout ratios) are essential for sustainable data center investments [citation:10]

- Long-term lease contracts with high renewal rates indicate durable revenue streams [citation:10]

- Customer concentration risk assessment is crucial - hyperscale dependency creates volatility [citation:10]

- Power availability constraints will become critical differentiators by 2027 [citation:10]

- Same-store growth and recurring revenue provide stability indicators [citation:10]

Both Reddit sentiment and research analysis converge on

Reddit shows more optimism about

- Power Infrastructure Advantage: Companies with secured cheap energy (IREN) or renewable capabilities will outperform as power constraints intensify

- Contract Quality Matters: Long-term leases with high renewal rates (CoreWeave agreements for APLD) provide revenue stability

- Balance Sheet Strength: Critical for weathering AI demand cycles and financing expansion

- Diversification Benefit: Companies avoiding single-customer dependency reduce volatility risk

- Power Availability Constraints: Grid limitations and energy costs could cap growth by 2027 [citation:10]

- AI Demand Volatility: Overexposure to AI hype cycles could create significant drawdowns

- Customer Concentration: Dependency on hyperscale clients creates revenue volatility

- Debt Burdens: High leverage from infrastructure investments could strain balance sheets

- First-Mover Advantage: Companies securing power contracts and locations early will benefit from scarcity

- AI Infrastructure Gap: Growing demand for specialized AI computing capacity creates sustained growth

- Renewable Energy Integration: Companies combining AI with clean energy positioning gain ESG and cost advantages

- Consolidation Potential: Weaker players may become acquisition targets for established data center operators

Based on the convergence of Reddit sentiment and fundamental analysis,

Investors should prioritize companies with:

- Secured power infrastructure and energy advantages

- Strong balance sheets and manageable debt levels

- Diversified customer bases with long-term contracts

- Proven operational execution in infrastructure management

Avoid companies with high customer concentration, excessive leverage, or those primarily serving as “Nvidia debt wrappers” without differentiated infrastructure advantages.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。