Google's Ironwood TPU Challenges Nvidia but Doesn't Threaten Dominance: Analysis

#AI Chips #Google TPU #Nvidia GPU #AI Infrastructure #CUDA Ecosystem #Supply Chain #Investment Opportunities

混合

A股市场

2025年11月24日

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

NVDA

--

NVDA

--

GOOG

--

GOOG

--

LITE

--

LITE

--

研究视角

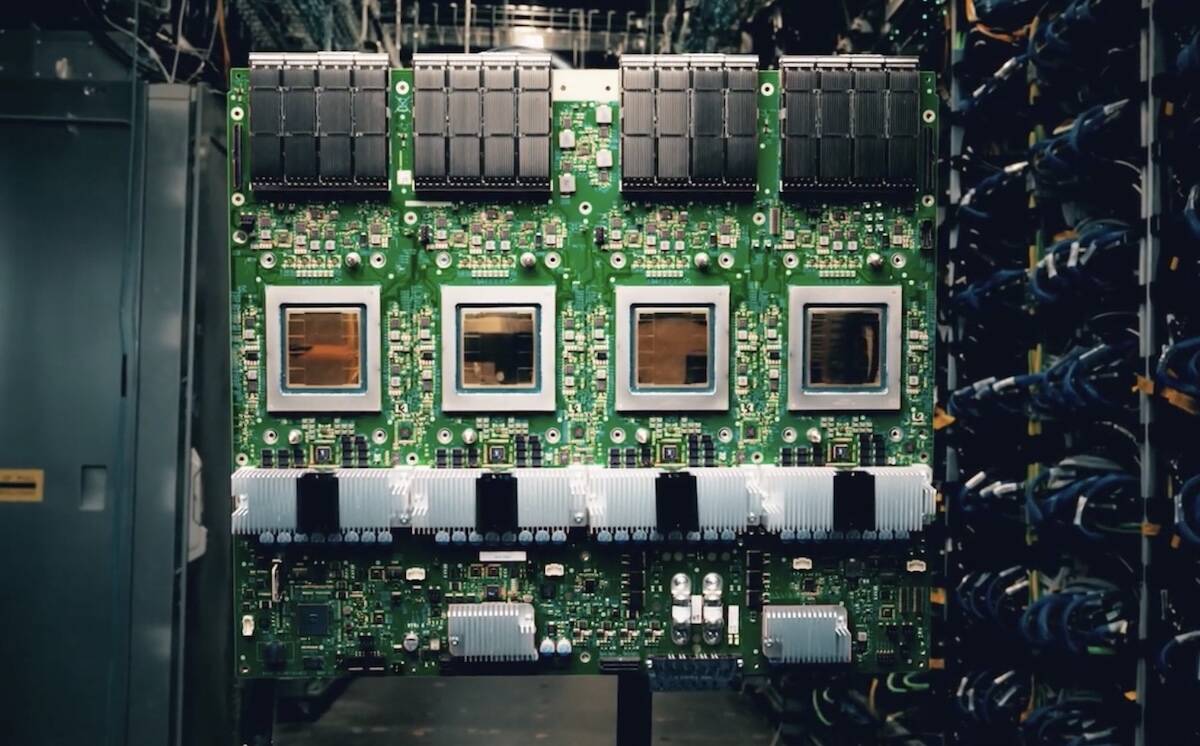

据谷歌最强AI芯片Ironwood即将登场:挑战英伟达: Google’s Ironwood TPU v7 delivers 4614 TFLOPS (FP8) per chip and 42.5 Exaflops per cluster, matching Nvidia B200 performance, with 20-30% total cost savings for inference.

据云巨头自研芯片竞赛升级 谷歌Ironwood挑战英伟达GPU统治: Nvidia holds ~80% AI chip market share (94% in training) via CUDA ecosystem (4M developers) and $500B backlog until 2026.

社交媒体视角

Reddit用户: Google’s TPU+OCS architecture has infrastructure advantages but relies on Nvidia GPUs for flexibility; Anthropic’s 1M TPU order validates demand.

雪球用户 (强大的谷歌,不等于颠覆NV的一些思考): Google’s Ironwood can’t颠覆 Nvidia—TPU lacks CUDA support and global supply chain; recommends LITE (光芯片), 旭创 (光模块), and NAND flash.

综合分析

Both research and social media align on Ironwood’s niche potential but Nvidia’s short-term dominance. Nvidia’s CUDA moat and supply chain remain strong, while Ironwood excels in cost-efficient inference. Investment opportunities lie in AI infrastructure (optical modules, NAND, energy storage) and Nvidia’s core business.

相关阅读推荐

暂无推荐文章

基于这条新闻提问,进行深度分析...

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

NVDA

--

NVDA

--

GOOG

--

GOOG

--

LITE

--

LITE

--