Google TPU vs. NVIDIA GPU: Competitive Dynamics and Investment Implications

#AI Chips #Google TPU #NVIDIA GPU #CUDA Ecosystem #AI Supply Chain #Investment Analysis

混合

A股市场

2025年11月24日

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

NVDA

--

NVDA

--

GOOGL

--

GOOGL

--

LITE

--

LITE

--

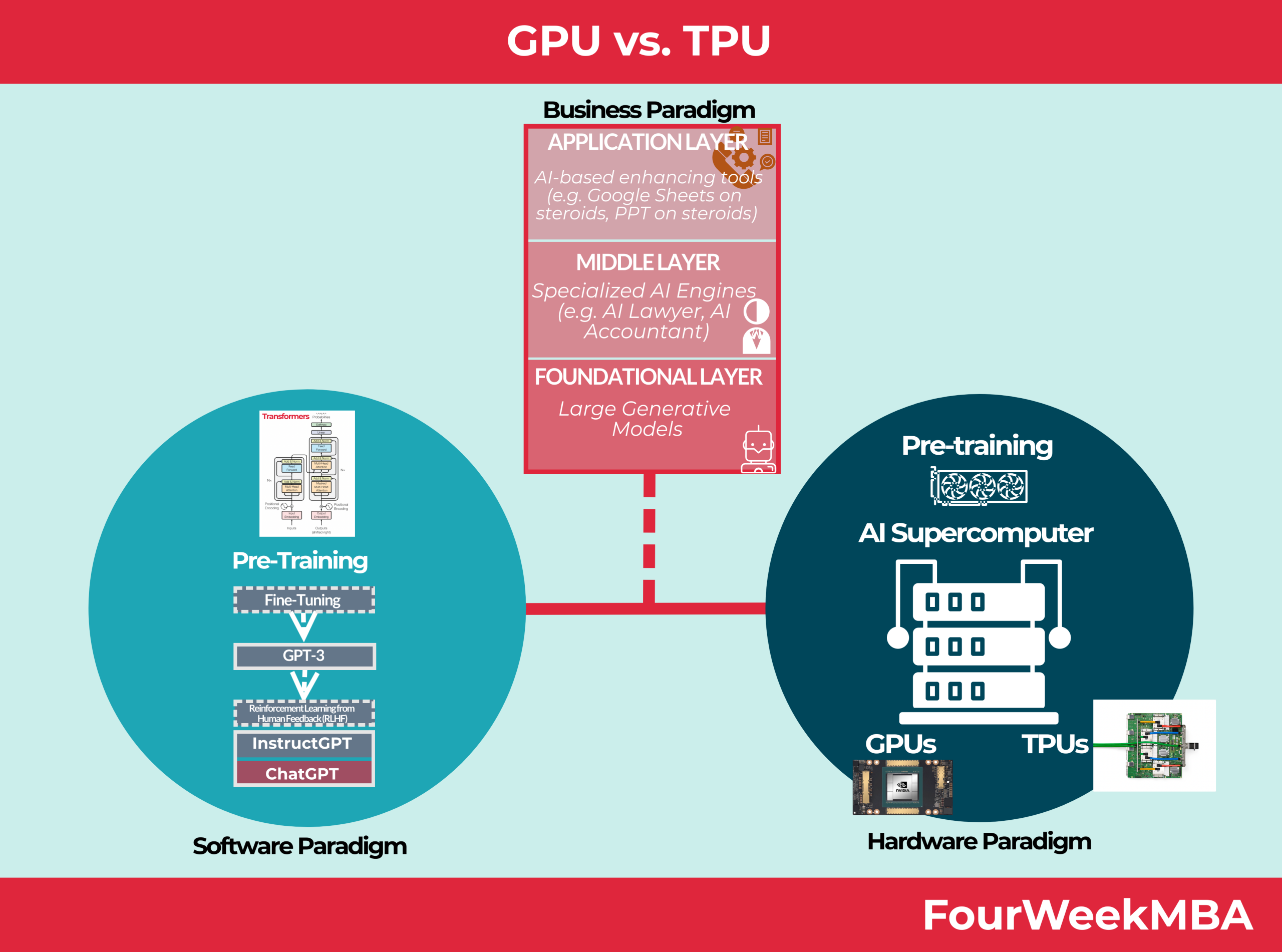

Google TPU vs. NVIDIA GPU: Competitive Dynamics and Investment Implications

Research Perspective

- According to The Silicon Arms Race: An Architectural and Strategic Analysis of AI Accelerators, NVIDIA’s GPU dominates the AI chip market with ~80% share, driven by its CUDA ecosystem and technical leadership in Blackwell architecture.

- Research from Google Cloud TPU Performance Guide highlights TPU’s superior energy efficiency in large-scale AI workloads via JAX/XLA integration.

- A Sina Finance report notes NVIDIA’s 5000亿美元 backlog and strategic shift to AI factory services, while Google targets 1000x performance improvement in 4-5 years.

Social Media Perspective

- 雪球用户 argues Google’s TPU has technical advantages but lacks NVIDIA’s CUDA ecosystem and global supply chain, so it won’t颠覆 NVDA.

- Reddit discussions point to investment opportunities in AI supply chains like Lumentum (LITE) and energy infrastructure due to power bottlenecks.

Comprehensive Analysis

NVIDIA maintains market leadership via CUDA and massive backlogs, but Google’s TPU is gaining traction in cloud-scale AI. Supply chain winners include optical component makers (LITE) and storage providers. Energy infrastructure and storage are critical due to increasing power demands from AI chips.

相关阅读推荐

暂无推荐文章

基于这条新闻提问,进行深度分析...

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

NVDA

--

NVDA

--

GOOGL

--

GOOGL

--

LITE

--

LITE

--