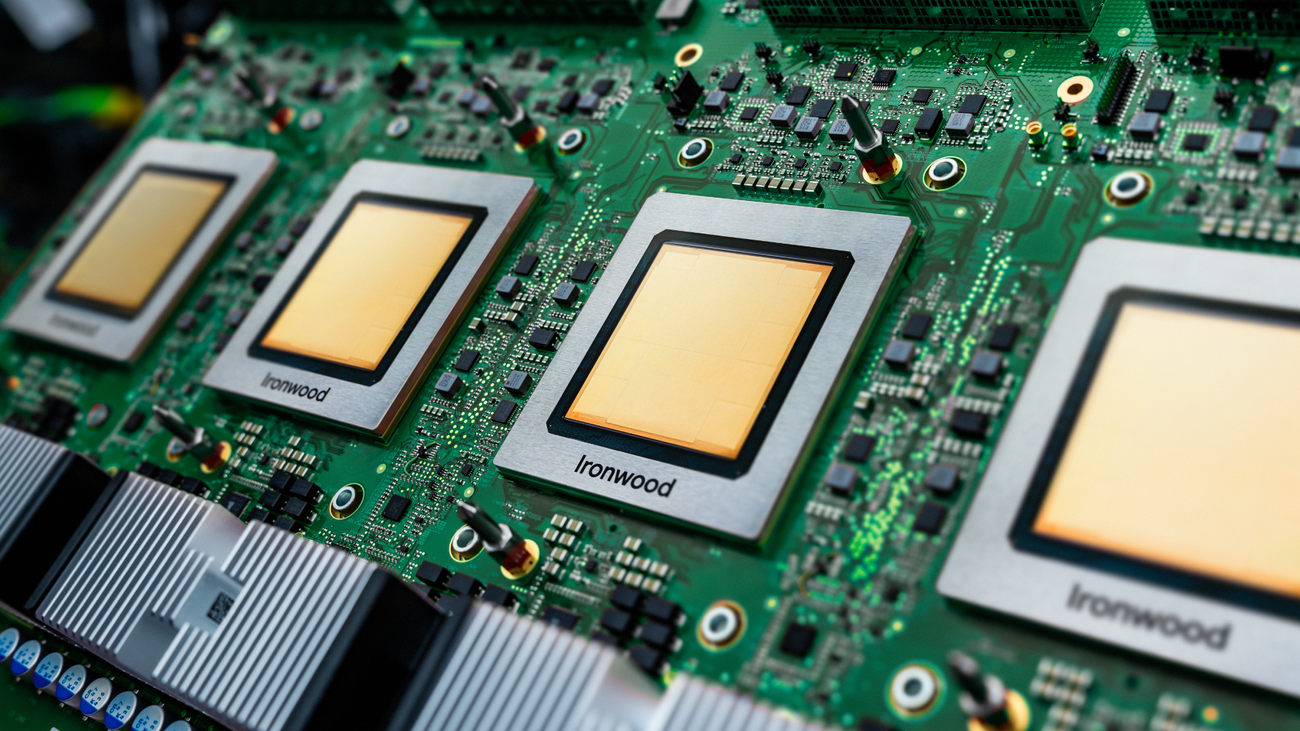

Google TPU's Rise vs NVIDIA's Dominance: AI Chip Market Dynamics 2025

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

-据腾讯新闻:NVIDIA controls ~80% of the AI chip market via its CUDA ecosystem with over 4M developers, maintaining dominance despite Google’s TPU advances.

-据知乎专栏:Google’s TPU v7 Ironwood delivers 4614 TFLOPS FP8 performance, 2x energy efficiency over predecessors, and supports 9216-chip pods for 42.5 ExaFLOPS cluster算力.

-据36氪:Anthropic signs a 100M TPU deal with Google, reducing its NVIDIA GPU dependency from 75% to <40% and saving $2B annually.

-据TradingView (Reuters):Tech giants are shifting to ASICs, with ASICs projected to capture 45% of AI chip market share by 2027.

-雪球用户:Google’s TPU is technically strong but not颠覆性 to NVIDIA due to CUDA’s ecosystem lock-in and NVIDIA’s global supply chain优势.

-Reddit用户:Supply chain opportunities exist in光模块 (Lumentum, LITE) and energy infrastructure to address AI’s power bottlenecks.

Google’s TPU advances and Anthropic deal signal growing competition, but NVIDIA retains leadership via CUDA and global reach. The industry faces dual trends: ASIC adoption for efficiency and urgent need for energy infrastructure. Investors should consider NVIDIA (NVDA) for its ecosystem moat, Google (GOOG) for its vertical integration, and Lumentum (LITE) for supply chain exposure.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。