Google's TPU Advances vs Nvidia's Dominance: Competitive Dynamics and Investment Implications

#AI Chip Race #Google TPU #Nvidia GPU #CUDA Ecosystem #Investment Analysis #Supply Chain #Meta #Anthropic #Energy Infrastructure

混合

A股市场

2025年11月26日

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

NVDA

--

NVDA

--

GOOGL

--

GOOGL

--

META

--

META

--

LITE

--

LITE

--

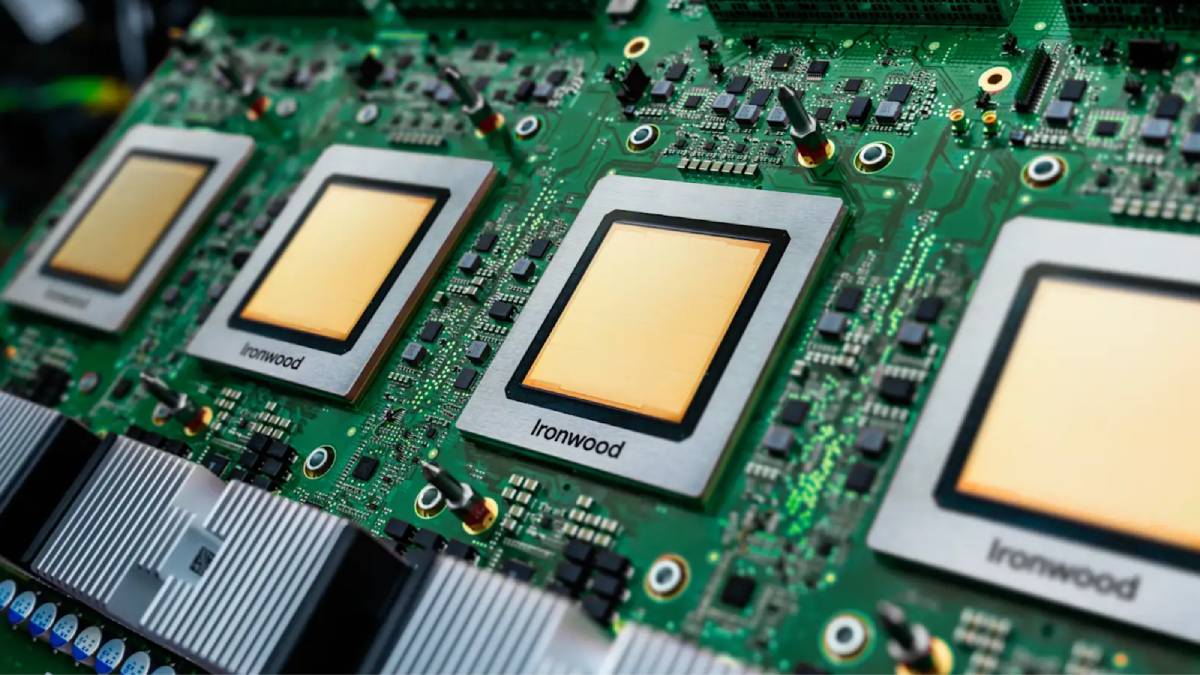

Google’s TPU Advances vs Nvidia’s Dominance: Competitive Dynamics and Investment Implications

Research Findings

- Google’s Ironwood TPU: The 7th-gen TPU delivers significant performance improvements, targeting Nvidia’s dominance in AI workloads [3].

- Meta Partnership Talks: Meta is negotiating to use Google’s chips, signaling potential for broader non-Nvidia chip adoption [4].

- Nvidia Market Share: Nvidia holds ~92% of data center GPU market, supported by CUDA ecosystem [1,5].

- Anthropic TPU Deal: Anthropic signed for up to 1M Google TPUs, underscoring alternative compute demand [6].

Social Media Perspectives (雪球帖子)

- Users note Google’s TPU+OCS architecture has advantages but still relies on Nvidia GPUs for flexibility [11].

- AI chip race is long-term; supply chain and energy infrastructure are critical enablers [11].

Investment Insights

- Supply Chain: Lumentum (LITE) benefits from AI chip demand [11].

- Storage: NAND flash sees growing AI-driven demand [11].

- Energy: Power bottlenecks create opportunities in energy/storage [11].

Competitive Landscape

- Google: TPU reduces CUDA dependency but lacks third-party developer support [1, 10].

- Nvidia: CUDA ecosystem and chip-as-a-service (CaaS) model strengthen market moat [5,9].

相关阅读推荐

暂无推荐文章

基于这条新闻提问,进行深度分析...

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

NVDA

--

NVDA

--

GOOGL

--

GOOGL

--

META

--

META

--

LITE

--

LITE

--