Full-Time Trading: Psychological Costs and Industry Mental Health Crisis

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

This analysis is based on a Reddit post [Event source] published on November 7, 2025, where a full-time trader shared their experience after over a year in the profession. The individual achieved unexpected financial success but suffered severe consequences including health issues, sleepless nights, near-alcoholism, and persistent imposter syndrome. This personal account aligns with broader research indicating systemic mental health challenges within the trading industry.

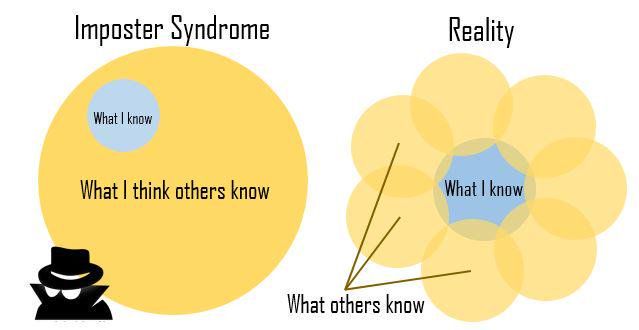

The trader’s experience reflects a well-documented pattern where financial success does not translate to psychological well-being. Research shows that imposter syndrome, defined as “self-doubt of intellect, skills, or accomplishments among high-achieving individuals” who “cannot internalize their success,” is particularly prevalent in trading where success can feel arbitrary rather than skill-based [2]. The trader’s inability to internalize their financial achievements demonstrates that “no amount of experience, money, success, or praise can eliminate it” [6].

The physical manifestations described mirror documented health impacts of trading stress, including “increased heart rate, muscle tension, headaches, digestive issues” and mental effects such as “decreased concentration, memory lapses, anxiety attacks and disrupted sleep patterns” [3]. The trader’s near-alcoholism represents a common maladaptive coping mechanism, with historical precedents like legendary trader Jesse Livermore who “despite achieving immense wealth, battled alcoholism and depression throughout his life” [7].

- Talent Retention Crisis: With 40% of traders knowing colleagues who left due to mental health issues [1], the industry faces significant talent sustainability challenges

- Regulatory Scrutiny: Documented health impacts, including increased emergency department visits during market stress [4], may lead to regulatory consideration of trader mental health as systemic risk

- Performance Degradation: Research indicates that “trading requires constant attention to the markets during trading hours and making rapid decisions under stress so it’s not for the faint of heart” [10], suggesting chronic stress may impair decision-making quality

- Support System Development: The trader’s gradual development of “healthier mindset” suggests potential for sustainable trading practices with proper psychological support [Event source]

- Industry Leadership: Firms implementing comprehensive mental health programs may gain competitive advantage in talent acquisition and retention

- Preventive Interventions: Early identification of stress symptoms and imposter syndrome could prevent more severe consequences like the alcoholism issues described

The Reddit trader’s experience occurred during November 2025, likely during a period of significant market volatility which typically exacerbates trading stress [9]. Active traders “skew male (≈sixty-one percent), primarily aged 25 to 34 (thirty-four percent)” [4], suggesting the poster likely falls within this demographic.

Research on “Stock Market and the Psychological Health of Investors” shows that “investors’ psychological health significantly worsens when their portfolios decline, especially in prolonged market downturns” [9]. However, this case suggests that even during periods of success, psychological toll persists due to the inherent stress of rapid decision-making under pressure.

The industry is gradually recognizing these challenges, with growing emphasis on “mental health awareness, education and training” [1]. However, many traders still suffer “in silence” [1], highlighting the need for more proactive support systems and cultural change within trading organizations.

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。