Exxon Mobil (XOM): Geopolitical Risk Analysis and Investment Implications

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Based on my comprehensive analysis of the available data, I will now provide a detailed assessment of how US-Venezuela geopolitical tensions may affect Exxon Mobil’s investment strategy and valuation.

Exxon Mobil Corporation faces a strategic crossroads in Venezuela, balancing immense resource potential against significant legal, political, and sanctions-related risks. The company’s recent public statements at the January 2026 White House meeting reveal a carefully calibrated approach that prioritizes governance reforms and risk mitigation over rapid capital deployment, suggesting the market should expect measured, conditional engagement rather than immediate large-scale investment [1][2].

The geopolitical dynamics between the United States and Venezuela have entered an unprecedented phase following the capture of President Nicolás Maduro in late 2025, which the administration has framed as part of the “Donroe Doctrine” demonstrating renewed US influence in Latin America [3]. Key developments include:

| Event | Date | Implication |

|---|---|---|

| Maduro’s capture | Late 2025 | Power vacuum, transitional uncertainty |

| Trump’s “$100 billion” proposal | January 2026 | Industry surprised by the figure; no industry consensus [1] |

| White House executive meeting | January 9, 2026 | Oil CEOs addressed but made no commitments |

| Executive order on Venezuelan assets | January 11, 2026 | Protection of oil revenue from judicial seizure [4] |

The Trump administration has seized tankers carrying Venezuelan oil and announced plans to control sales of 30-50 million barrels of previously sanctioned crude “indefinitely” [4]. Energy Secretary Chris Wright has indicated the US government will sell Venezuelan oil on an ongoing basis, with sanctions selectively rolled back to enable transport and import of oilfield equipment [5].

Exxon Mobil’s CEO Darren Woods delivered a notably blunt assessment at the White House meeting on January 9, 2026, explicitly characterizing Venezuela’s current investment climate as

- Risk Management Signaling: By explicitly stating conditions are unacceptable, Woods establishes a defensive posture against potential criticism if Exxon does not proceed aggressively

- Negotiation Leverage: Publicly articulating conditions creates a framework for future negotiations with both the US administration and any post-Maduro Venezuelan government

- Investor Confidence: Demonstrating rigorous capital discipline reassures shareholders about Exxon Mobil’s commitment to returns over geopolitical opportunism

Exxon Mobil has outlined five non-negotiable prerequisites for Venezuelan engagement:

| Condition | Details |

|---|---|

Legal Framework Reform |

Overhaul of hydrocarbon laws requiring 60% taxes on oil proceeds |

Joint Venture Terms |

Modification of requirements for majority-government-controlled partnerships |

Investment Protections |

Durable protections against asset seizure and political interference |

Security Guarantees |

Formal commitments against crime and theft affecting operations |

Judicial Reform |

Functional, independent legal system for dispute resolution |

Woods explicitly stated: “If we look at the legal and commercial constructs and frameworks in place today, in Venezuela today, it’s uninvestable, and so significant changes have to be made to those commercial frameworks, the legal system. There has to be durable investment protections” [1].

Exxon Mobil’s caution is grounded in bitter experience. The company was forced out of Venezuela in 2007 when the Chávez regime nationalized its assets, a traumatic event that shaped subsequent corporate governance philosophy [2][3]. This historical trauma informs the company’s stated “win-win-win” investment model, which requires decades-long stability—precisely what Venezuela currently lacks.

Exxon Mobil’s 2025 Global Outlook emphasizes capital allocation toward stable, predictable environments where legal certainty supports long-term returns [3]. Current priorities include:

| Asset/Region | Strategic Priority | Rationale |

|---|---|---|

Permian Basin |

Highest | Domestic, stable regulatory environment |

Guyana |

Very High | New discovery, favorable terms, political stability |

Global LNG Projects |

High | Long-term demand growth, contractual protections |

Venezuela |

Conditional/Low | Awaiting structural reforms |

This strategic hierarchy suggests Venezuela would receive capital only after demonstrable reform, meaning any potential upside is likely a

Unlike Chevron, which maintains existing operations in Venezuela under specific licenses, Exxon Mobil’s complete exit in 2007 creates a “clean slate” situation [1][2]. This positioning provides flexibility but also means the company would need to rebuild operational presence entirely, requiring:

- New drilling equipment and infrastructure

- Local workforce training and management

- Supply chain development

- Regulatory approvals from scratch

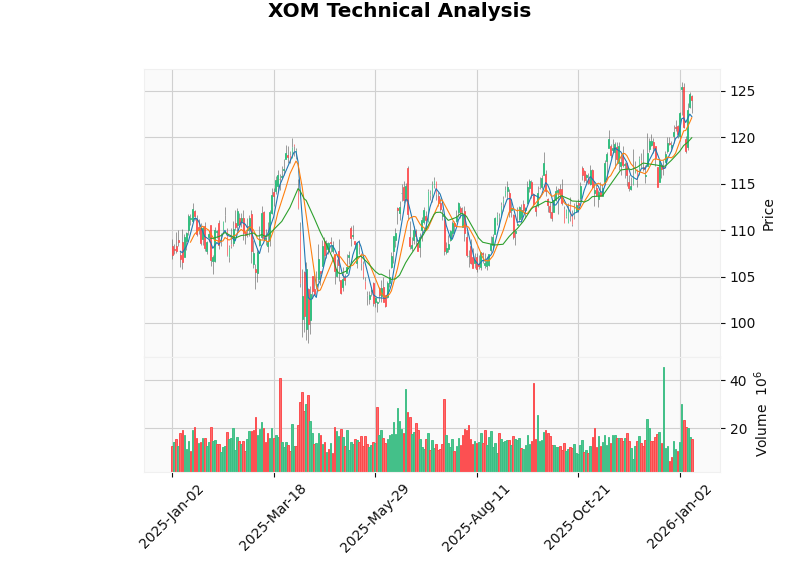

Exxon Mobil’s stock (XOM) closed at

| Metric | Value | Industry Context |

|---|---|---|

| Market Cap | $522.87B | Largest US energy company |

| P/E Ratio (TTM) | 17.93x | At historical norms |

| P/B Ratio | 2.06x | Reasonable for integrated majors |

| Beta (vs S&P 500) | 0.36x | Low correlation with broad market |

| 52-Week Range | $97.80 - $125.93 | Near all-time highs |

Our discounted cash flow analysis reveals a significant divergence between market price and fundamental value:

| Scenario | Fair Value | Upside vs. Current |

|---|---|---|

Conservative |

$496.83 | +300.7% |

Base Case |

$637.78 | +414.4% |

Optimistic |

$1,310.06 | +956.6% |

Probability-Weighted |

$814.89 | +557.2% |

The substantial implied upside suggests the market is not currently pricing in Venezuelan investment upside, or alternatively, that current prices already reflect a risk premium for geopolitical exposure through other international operations.

The DCF model incorporates the following assumptions [0]:

| Component | Conservative | Base Case | Optimistic |

|---|---|---|---|

| Revenue Growth | 0.0% | 17.4% | 20.4% |

| EBITDA Margin | 18.8% | 19.8% | 20.8% |

| WACC | ~7.0% | ~6.7% | ~5.8% |

| Terminal Growth | 2.0% | 2.5% | 3.0% |

The wide valuation range reflects uncertainty around oil demand trajectories, carbon transition policies, and geopolitical risk premiums—Venezuela represents just one component of this broader uncertainty.

| Indicator | Value | Signal |

|---|---|---|

| MACD | No cross | Neutral-to-bullish |

| KDJ | K:66.8, D:64.1, J:72.0 | Bullish |

| RSI (14) | Normal range | Neutral |

| Trend | Sideways/No Clear Trend |

Neutral |

| Support Level | $119.94 | Technical floor |

| Resistance Level | $125.26 | Technical ceiling |

| Beta | 0.36 | Low market correlation |

The sideways trend with no clear buy/sell signals suggests the market is in a holding pattern, awaiting either earnings catalysts (next report: January 30, 2026) or geopolitical developments that could clarify the Venezuela outlook [0].

| Firm | Rating | Target | Most Recent Action |

|---|---|---|---|

Consensus |

Hold |

$142.00 |

+14.5% upside potential |

| Piper Sandler | Overweight | — | Maintained January 8, 2026 |

| Bernstein | Outperform | — | Maintained January 5, 2026 |

| TD Cowen | Buy | — | Maintained December 12, 2025 |

| Mizuho | Neutral | — | Maintained December 12, 2025 |

| Freedom Capital Markets | Sell | — | Downgraded January 6, 2026 |

The analyst community appears balanced, with no significant bullish thesis emerging around Venezuela potential—the cautious consensus suggests professional expectations are aligned with Exxon Mobil’s stated strategy of waiting for structural reforms [0].

| Risk | Probability | Impact | Mitigation |

|---|---|---|---|

Escalating sanctions affecting broader operations |

Medium | High | Diversified geographic footprint |

Asset seizure risk in any new venture |

Medium | Very High | Explicitly refused to invest without protections |

Regulatory uncertainty post-Maduro |

High | High | Waiting for stability before committing |

Competitive disadvantage vs. Chevron |

Low | Medium | First-mover advantage not proven valuable |

| Scenario | Probability | Trigger | Potential Impact |

|---|---|---|---|

Successful reforms in Venezuela |

Low | Democratic transition, legal reforms | Access to 300+ billion barrels of reserves |

Strategic partnership with administration |

Medium | National security designation | Favorable operating terms |

Regional stabilization |

Medium | Broader Latin American stability | Reduced risk premium on all international assets |

The Venezuela situation exemplifies Exxon Mobil’s core investment philosophy:

- 5-Year Total Return: +158.95% [0]

- Conservative accountingwith high depreciation ratios suggesting earnings quality [0]

- Moderate debt riskprofile [0]

-

Venezuela represents optionality, not guidance: Any future investment would require years of stability and reform, making this a 5-10 year consideration at earliest

-

Current valuation is not dependent on Venezuela: The DCF analysis shows substantial upside using existing asset portfolio alone, suggesting Venezuelan exposure is not baked into current prices

-

Management credibility is strong: CEO Woods’ public statements demonstrate alignment with shareholder interests—prioritizing returns over size or geopolitical positioning

-

Technical posture is neutral: The stock trades near the top of its 52-week range with no clear directional bias, suggesting a consolidation phase ahead of the January 30 earnings report

-

Sector context matters: The Energy Select Sector SPDR (XLE) has underperformed the S&P 500 in 2025, with geopolitical tensions creating both risks and potential opportunities across the sector [6]

| Date | Event | Relevance |

|---|---|---|

| January 30, 2026 | Q4 FY2025 Earnings | EPS estimate: $1.65; Revenue: $77.98B |

| Q1 2026 | Venezuela transitional developments | Could clarify reform trajectory |

| 2026 H1 | US sanctions policy evolution | Determines operating envelope |

Exxon Mobil’s approach to Venezuela reflects sophisticated risk management rather than disengagement. The company’s explicit articulation of investment prerequisites—legal reform, security guarantees, and durable protections—creates a framework for potential future engagement while maintaining credibility with both the current administration and long-term investors.

The

For current and prospective shareholders, the Venezuela situation underscores Exxon Mobil’s commitment to capital discipline—a characteristic that has historically translated into superior long-term returns despite occasional criticism for missing short-term opportunities.

[1] CNN - “Trump meets with US execs about plans” (https://www.cnn.com/world/live-news/trump-venezuela-01-09-26)

[2] Politico - “Trump ‘inclined’ to keep ExxonMobil out of Venezuela after CEO response” (https://www.politico.com/news/2026/01/11/trump-inclined-to-keep-exxonmobil-out-of-venezuela-after-ceo-response-at-white-house-meeting-00721688)

[3] AInvest - “ExxonMobil’s Strategic Dilemma in Venezuela and Its Implications for Energy Sector Investors” (https://www.ainvest.com/news/exxonmobil-strategic-dilemma-venezuela-implications-energy-sector-investors-2601/)

[4] Fortune - “Trump threatens to keep ‘too cute’ Exxon out of Venezuela” (https://fortune.com/2026/01/12/trump-threatens-keep-too-cute-exxon-out-of-venezuela/)

[5] Holland & Knight - “Venezuela: Navigating a New Era of Uncertainty” (https://www.hklaw.com/en/insights/publications/2026/01/venezuela-navigating-a-new-era-of-uncertainty)

[6] Seeking Alpha - “Energy Stocks: Winners And Losers At The Start Of 2026” (https://seekingalpha.com/article/4858679-energy-stocks-winners-and-losers-at-the-start-of-2026)

[7] Energy Musings - “Energy Musings: January 12, 2026” (https://energymusings.substack.com/p/energy-musings-january-12-2026)

- Market data and financial metrics: Real-time quote and company overview APIs [0]

- Technical analysis: FMP technical indicators [0]

- DCF valuation: Discounted cash flow analysis [0]

- Sector performance: Energy Select Sector SPDR ETF data [0]

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。