AI Spending Risks Impact on Optical Networking Stocks: Ciena Case Study

解锁更多功能

登录后即可使用AI智能分析、深度投研报告等高级功能

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。

相关个股

Based on comprehensive data analysis, I will now provide a detailed examination of how rising AI spending risks may impact valuations of optical networking and infrastructure stocks, with a focus on Ciena Corporation (CIEN).

Bank of America Securities recently downgraded Ciena Corporation from

- Extreme Valuation Levels: Ciena trades at a P/E ratio of approximately286.6x, representing substantial earnings multiples that leave little margin for error [2]

- Peak Margin Risk: The company may have reached cyclical margin peaks, with limited upside potential

- Order/Backlog Deterioration Risk: Potential for slower order trends and declining backlog levels

- Spending Rationalization: Risk that network providers may delay or reduce capital expenditure as they await demand ramp-up [2]

Despite these concerns, BofA acknowledged that deployment plans among key cloud and neocloud leaders remain intact, suggesting continued underlying demand for optical networking equipment [2].

Ciena has delivered

| Performance Metric | Value |

|---|---|

| 1-Year Return | +173.30% |

| 6-Month Return | +185.20% |

| 3-Month Return | +40.00% |

| Current Price | $241.79 |

| 52-Week Range | $49.21 - $261.13 |

| Market Cap | $34.11 billion |

| Metric | Value | Assessment |

|---|---|---|

| P/E Ratio (TTM) | 278-286x |

Extremely elevated |

| P/B Ratio | 12.57x |

High relative to historical norms |

| P/S Ratio | 7.17x |

Premium valuation |

| EV/OCF | 43.02x |

Steep enterprise value multiple |

The consensus price target of

The optical networking sector’s fortunes are inextricably linked to hyperscaler capital expenditure patterns. Current data reveals a nuanced picture:

| Year | Projected CapEx | Year-over-Year Growth |

|---|---|---|

| 2024 | ~$200 billion | Base year |

| 2025 | $300-350 billion [3][4] |

~50-75% |

| 2026 | $400+ billion [4] |

Growth rate slowing to ~25% |

According to Goldman Sachs Research, while consensus estimates have consistently underestimated AI-related capital expenditure, the

- Amazon (AWS): On pace to exceed$100 billionin CapEx for 2025 [3]

- Microsoft: Raised 2025 CapEx outlook substantially

- Meta: Guides$66-72 billionfor 2025, potentially doubling year-over-year [3]

- Google: Lifted 2025 forecast by $10 billion to approximately$85 billion[3]

The optical networking and communications market is projected to grow from

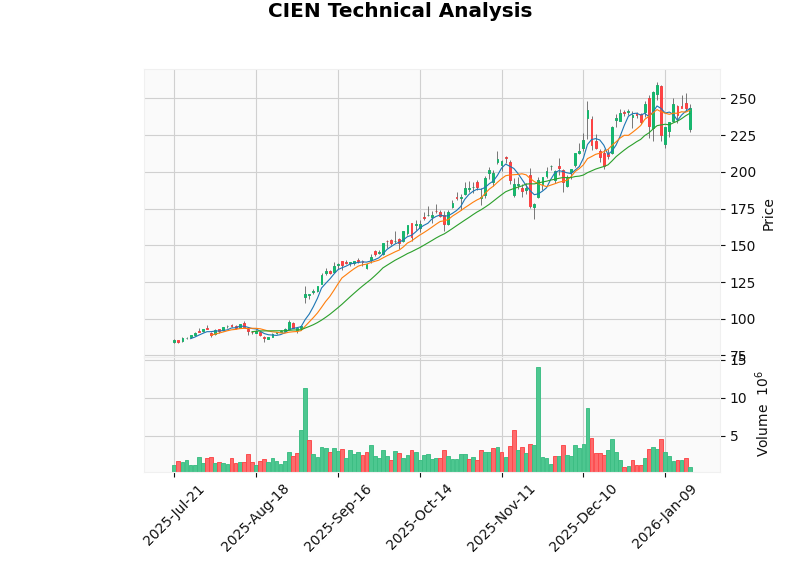

Technical indicators reveal a stock in consolidation mode with mixed signals:

- Overall Assessment: Sideways/no clear trend

- Trading Range: $236.03 (support) to $250.93 (resistance)

- Beta: 1.14 relative to S&P 500, indicating above-average volatility

| Indicator | Value | Signal |

|---|---|---|

| MACD | No cross | Bearish |

| KDJ | K:58.4, D:56.7, J:61.6 | Bullish |

| RSI (14) | Normal range | Neutral |

The chart above illustrates Ciena’s recent price action, showing the stock trading near the upper end of its recent range after a substantial rally. The bearish MACD signal combined with neutral RSI suggests caution among technical traders [6].

Ciena’s fundamental financial profile presents a

- Low Debt Risk Classification: The company maintains conservative leverage levels [6]

- Strong Liquidity: Current ratio of 2.73 and quick ratio of 2.09 indicate robust short-term financial health [1]

- Positive Free Cash Flow: Latest FCF of approximately $665 million supports ongoing operations and shareholder returns [6]

- Neutral Accounting Practices: Company maintains balanced accounting without persistent extremes [6]

- EPS: $0.91 actual vs. $0.78 estimate (+16.67% surprise) [1]

- Revenue: $1.35 billion actual vs. $1.29 billion estimate (+4.72% surprise) [1]

- Full-Year Revenue Growth: 18.79% YoY [2]

| Segment | Revenue | % of Total |

|---|---|---|

| Networking Platforms | $941.35M | 77.2% |

| Global Services | $160.26M | 13.1% |

| Software & Services | $117.76M | 9.7% |

The company’s

- Valuation Risk: The extreme P/E multiple of ~286x prices in perfection and leaves no margin for disappointment

- Cyclical Exposure: Optical networking is highly cyclical and dependent on telecom/hyperscaler capital expenditure cycles

- Customer Concentration: Heavy reliance on major cloud providers creates execution risk if any key customer reduces orders

- Margin Peak: Operating margin of 6.52% and net profit margin of 2.59% may have peaked [1]

- Growth Deceleration: Expected slowdown in hyperscaler CapEx growth from 75% to 25% represents a meaningful headwind [4]

- Continued AI infrastructure buildout exceeding expectations

- New product cycle adoption (WaveLogic platforms, Blue Planet software)

- Share repurchase program (completed $361.46 million buyback by December 2025) [7]

- Potential for revenue outperformance driven by data center interconnect demand

- Hyperscaler CapEx slowdown faster than anticipated

- Order deferrals or cancellations from major customers

- Competitive pressure from Cisco (CSCO), Infinera (INFN), and other optical networking vendors

- General rotation away from AI infrastructure stocks [4]

Ciena has significantly outperformed the broader technology sector and market indices:

| Index/Stock | 3-Month Return |

|---|---|

| Ciena (CIEN) | +40.00% |

| S&P 500 | -0.08% |

| NASDAQ Composite | -1.16% |

| Russell 2000 | +4.88% |

| Communication Equipment Sector | Mixed |

The technology sector has shown modest gains (+0.25%), while Ciena’s outperformance reflects its positioning as a key beneficiary of AI infrastructure buildout [8].

The intersection of extreme valuation and emerging AI spending concerns creates a

- Bull Case: Continued AI infrastructure buildout, market share gains, operating leverage improvement

- Bear Case: Valuation compression, customer concentration risk, CapEx deceleration, margin peak

Given the current risk-reward profile following the Bank of America downgrade, a

[1] Company Overview and Financial Data - Retrieved from Financial Database (2026-01-20)

[2] Investing.com - “Ciena stock rating downgraded to Neutral from Buy by BofA Securities” (https://www.investing.com/news/analyst-ratings/ciena-stock-rating-downgraded-to-neutral-from-buy-by-bofa-securities-93CH-4454659)

[3] Fusion Worldwide - “How Hyperscaler Spending Influences Semiconductor Supply Chains” (https://www.fusionww.com/insights/resources/the-cost-of-ai-how-hyperscaler-spending-is-impacting-semiconductor-supply)

[4] Goldman Sachs - “Why AI Companies May Invest More than $500 Billion in 2026” (https://www.goldmansachs.com/insights/articles/why-ai-companies-may-invest-more-than-500-billion-in-2026)

[5] Mordor Intelligence - Optical Networking and Communications Market Analysis (https://www.mordorintelligence.com)

[6] Technical and Financial Analysis - Retrieved from Financial Database (2026-01-20)

[7] Yahoo Finance - “Ciena (CIEN) Is Down 6.3% After AI-Focused Q4 Beat Highlights” (https://finance.yahoo.com/news/ciena-cien-down-6-3-190947586.html)

[8] Sector Performance Data - Retrieved from Financial Database (2026-01-20)

数据基于历史,不代表未来趋势;仅供投资者参考,不构成投资建议

关于我们:Ginlix AI 是由真实数据驱动的 AI 投资助手,将先进的人工智能与专业金融数据库相结合,提供可验证的、基于事实的答案。请使用下方的聊天框提出任何金融问题。